Current liquidity ratio of the largest Russian manufacturers of medical appliances and equipment

Information agency Credinform presents a ranking of the largest Russian manufacturers of medical appliances and equipment. Companies with the highest volume of revenue (TOP-10) were selected for this ranking according to the data from the Statistical Register for the latest available periods (2016 and 2015). The enterprises were ranked by current liquidity ratio in 2015 (Table 1). The analysis was based on data from the Information and Analytical system Globas.

Current liquidity ratio (х) is calculated as current assets to short-term liabilities of the company. The recommended value is from 1.0 to 2.0. The value of the indicator less than 1.0 indicates the excess of current liabilities over current working capital. Thus, the lower interval limit is determined by the need to ensure the adequacy of working capital for the full repayment of short-term liabilities. Otherwise, the enterprise faces bankruptcy. However, a significant excess of short-term funds over liabilities may indicate a violation of the capital structure and non-rational or inefficient investment of funds.

Taking into account the actual situation both in economy in general and in sectors, the experts of the Information Agency Credinform have developed and implemented in the Information and Analytical System Globas the calculation of practical values of financial ratios that can be recognized as normal for a particular industry. The practical value of current liquidity ratio for manufacturers of medical appliances and equipment in 2016 was from 1,03 to 8,91.

For the most complete and objective view of the financial condition of the enterprise it is necessary to pay attention to the complex of ratios and financial indicators of the company.

| Name, INN, region | Revenue, mln RUB | Net profit, mln RUB | Current liquidity ratio (x) | Solvency index Globas | |||

| 2015 | 2016 | 2015 | 2016 | 2015 | 2016 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| LLC NEUROSOFT INN 3729002450 Ivanovo region |

519,6 | 758,7 | 151,2 | 182,3 | 29,54 | 48,41 | 167 Superior |

| JSC KRONT-M INN 5047004056 Moscow region |

456,3 | 652,6 | 24,6 | 111,3 | 13,40 | 13,32 | 170 Superior |

| JSC YELATMA INSTRUMENT-MAKING ENTERPRISE INN 6204001412 Ryazan region |

298,2 | 3 202,5 | 652,5 | 531,5 | 5,82 | 8,32 | 179 High |

| JSC THERMO FISHER SCIENTIFIC INN 7805023194 Saint-Petersburg |

881,4 | 1 091,6 | 49,7 | 113,2 | 2,37 | 4,18 | 162 Superior |

| LLC S.P.GELPIK INN 7728220318 Moscow |

751,9 | 835,9 | 130,7 | 128,7 | 3,72 | 3,83 | 145 Superior |

| JSC NIPK ELECTRON INN 7827012767 Saint-Petersburg |

2 312,4 | 1 232,9 | 85,6 | 0,5 | 3,43 | 3,10 | 210 Strong |

| LLC MIASS PLANT FOR MEDICAL EGUIPMENT PRODUCTION INN 7415058730 Chelyabinsk region |

1 239,3 | 1 022,2 | 10,1 | 2,8 | 2,93 | 1,92 | 217 Strong |

| LLC ASK-ROENTGEN INN 7804068234 Saint-Petersburg |

1 062,2 | 1 236,7 | 136,2 | 211,8 | 1,24 | 1,57 | 191 High |

| LLC SEVKAVRENTGEN-D INN 0703006616 The Kabardino-Balkar Republic |

994,6 | 923,9 | 42,7 | 1,5 | 1,08 | 1,20 | 271 Medium |

| LLC TRIVES INN 7803043491 Saint-Petersburg |

676,0 | 726,0 | 5,4 | 14,6 | 1,00 | 0,96 | 208 Strong |

| Total for the group of companies TOP-10 | 9 191,9 | 11 682,9 | 1 288,8 | 1 298,4 | |||

| Average for the group of companies TOP-10 | 919,2 | 1 168,3 | 128,9 | 129,8 | 6,45 | 8,68 | |

| Industry average value | 66,7 | 59,3 | 4,6 | 4,9 | 1,88 | 1,78 | |

The average value of current liquidity ratio of TOP-10 companies in 2016 is higher than practical and average values. Five companies of the TOP-10 have increased indicators of revenue and net profit compared to the previous period. Other companies have decreased their indicators (marked with red filling in columns 3 and 5 of Table 1).

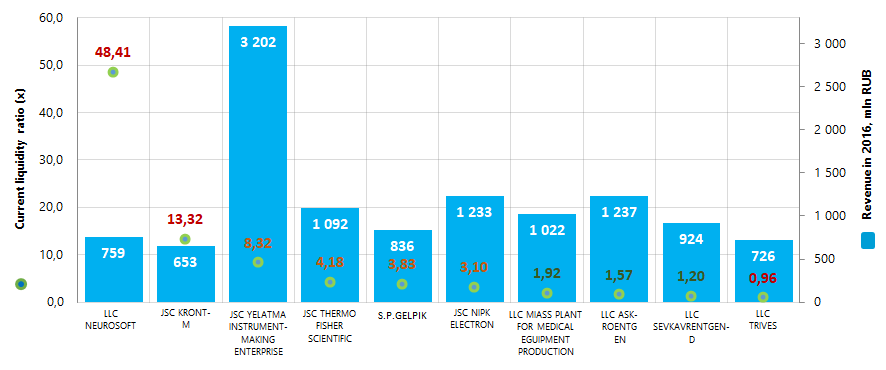

Picture 1. Current liquidity ratio and revenue of the largest Russian manufacturers of medical appliances and equipment (TOP-10)

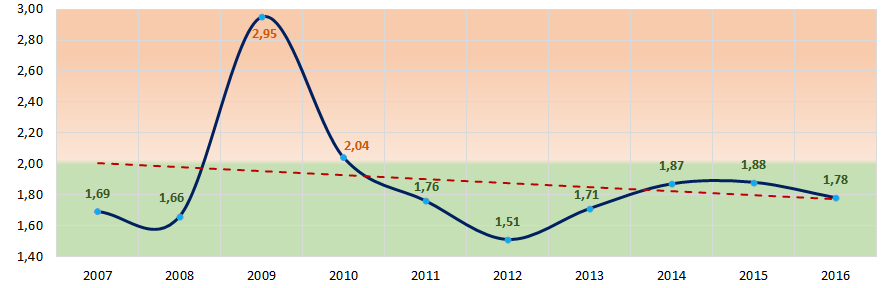

Picture 1. Current liquidity ratio and revenue of the largest Russian manufacturers of medical appliances and equipment (TOP-10)In general, the average sectoral indicators of current liquidity ratio for the last 10 years were within the interval of recommended values and above practical values of 2016, however, with decreasing tendency (Picture 2).

Picture 2. Change of average sectoral values of current liquidity ratio of the largest Russian manufacturers of medical appliances and equipment in 2007 – 2016

Picture 2. Change of average sectoral values of current liquidity ratio of the largest Russian manufacturers of medical appliances and equipment in 2007 – 2016All companies of the TOP-10 croup have got from superior to medium solvency index Globas, that shows their ability to repay their debt obligations in time and fully.

Asset turnover of the largest Russian hunting farms

Information agency Credinform has prepared a ranking of the largest Russian hunting farms. The companies with the largest volume of annual revenue (TOP-10) have been selected for the ranking, according to the data from the Statistical Register for the latest available accounting periods (2016 and 2015). Then they have been ranked by asset turnover ratio (Table 1). The analysis was based on the data from the Information and Analytical system Globas.

Asset turnover is a ratio of sales revenue to average total assets for the period. It is one of the activity ratios and it indicates resource efficiency regardless of sources. This ratio shows the number of profit-bearing complete production and distribution cycles per annum.

A calculation of practical values of financial ratios, which might be considered as normal for a certain industry, has been developed and implemented in the Information and Analytical system Globas by the experts of the Information Agency Credinform, having taken into account the current situation in the economy as a whole and in the industries. The practical value of asset turnover ratio for hunting farms amounted from 0,16 in 2016.

The whole set of financial indicators and ratios is to be considered to get the fullest and fairest opinion about the company’s financial standing.

| Name, INN, region | Revenue, mln RUB | Revenue, mln RUB | Asset turnover, times | Solvency index Globas | |||

| 2015 | 2016 | 2015 | 2016 | 2015 | 2016 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| KUR-VOSTOK-URMI LLC INN 2720022770 Khabarovsk territory |

51,3 | 69,1 | 1,9 | 1,2 | 3,18 | 3,18 | 222 Strong |

| BURAN LLC INN 2461021038 Krasnoyarsk territory |

0,0 | 77,6 | 0,0 | 1,8 | 0,02 | 3,37 | 256 Medium |

| HUNTING FARM PROMYSLOVIK LLC INN 2526004474 Primorye territory |

67,9 | 79,0 | 49,9 | 54,4 | 3,22 | 3,19 | 166 Superior |

| HUNTING STATE OWNED FARM KRASNOYARSKY NJSC INN 2464002065 Krasnoyarsk territory |

40,3 | 40,3 | 3,3 | 6,2 | 1,17 | 1,04 | 196 High |

| DUBRAVA LLC INN 3436017022 Volgograd region |

13,2 | 40,6 | 0,2 | 15,3 | 0,38 | 0,82 | 273 Medium |

| ZAPADPROMSTROY LLC INN 6714023406 Smolensk region |

125,3 | 97,6 | 0,0 | 0,1 | 2,99 | 0,80 | 254 Medium |

| MEDVED LLC INN 2922008024 Arkhangelsk region |

185,0 | 73,0 | 0,4 | 41,8 | 1,09 | 0,49 | 300 Adequate |

| HUNTING FARM OZERNOE LLC INN 4012000186 Kaluga region |

51,9 | 64,1 | 3,1 | -3,5 | 0,32 | 0,44 | 289 Medium |

| FINANCIAL AND AGROINDUSTRIAL CONCERN SAKHABULT JSC INN 1435178584 Republic of Sakha (Yakutia) |

250,4 | 259,3 | 1,3 | 8,0 | 0,40 | 0,44 | 202 Strong |

| GREENWOOD NJSC INN 6726008963 Smolensk region |

39,7 | 45,1 | 0,9 | 6,1 | 0,12 | 0,16 | 313 Adequate |

| Total for TOP-10 companies | 824,9 | 845,6 | 61,0 | 61,0 | |||

| Average for TOP-10 companies | 82,5 | 82,5 | 6,1 | 13,2 | 1,29 | 1,48 | |

| Industry average value | 1,9 | 1,2 | -0,2 | -0,5 | 0,33 | 0,16 | |

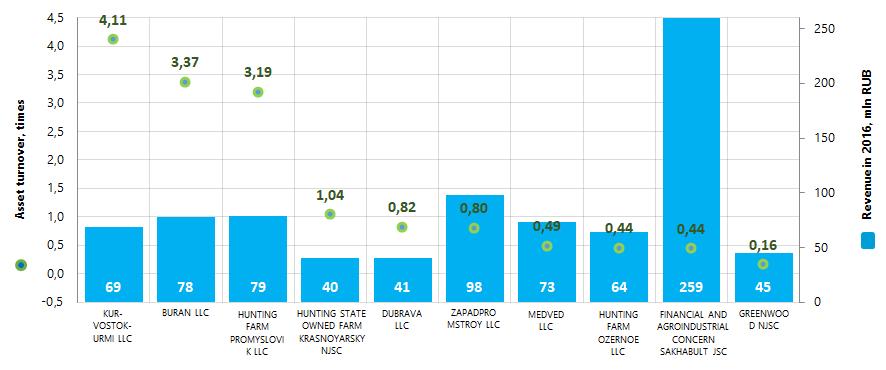

The average value of asset turnover ratio within TOP-10 companies is higher than practical and industry average values (green color in columns 6 and 7 of Table 1 and Picture 1). Five of TOP-10 companies have higher revenue and net profit compared to the prior period. The rest of the companies have a decrease in revenue or profit, or have loss (red color in columns 3 and 5 of Table 1).

Picture 1. Asset turnover ratio and revenue of the largest Russian hunting farms (TOP-10)

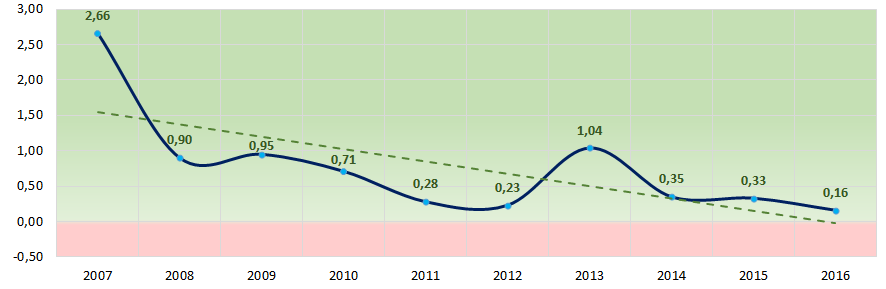

Picture 1. Asset turnover ratio and revenue of the largest Russian hunting farms (TOP-10)Industry average values of asset turnover ratio within the last 10 years were higher than the 2016 practical value. However, they follow a downward trend (Picture 2). This may indicate a certain downturn in the sector.

Picture 2. Change of industry average values of asset turnover ratio of the largest Russian hunting farms in 2007-2016

Picture 2. Change of industry average values of asset turnover ratio of the largest Russian hunting farms in 2007-2016Eight of TOP-10 companies have got from superior to medium solvency index Globas, which indicates their ability to meet debt obligations timely and in full.

MEDVED LLC has got an adequate solvency index Globas, due to the company being a defendant in debt collection arbitration proceedings and untimely fulfillment of obligations. Index development trends are stable.

GREENWOOD NJSC has also got an adequate solvency index Globas due to reorganization of the company and in view of the company being a defendant in debt collection arbitration proceedings. Index development trends are stable.