The upcoming 2015 will be a year of challenges and difficult decisions

The year of 2014, which was rich in events and has set new challenges for the country, is drawing to a close. Russia has entered an unfavorable stage of the economic cycle, which will be influenced in the medium term by economic sanctions, falling of oil prices, devaluation and acceleration of inflation.

Negative processes in the economy have resulted in a perceptible slowdown in the consumption growth of the population, proving by the reduction in retail trade turnover from 3.6% in I quarter to 1.8% in the II quarter this year. A raise of key rate by Central Bank to 9.5% in the future can significantly chill the activity in the domestic borrowing market. Tense geopolitical situation makes the leading investors nervous. Currently serious infrastructure solutions are required from the state, which is now more relevant than ever.

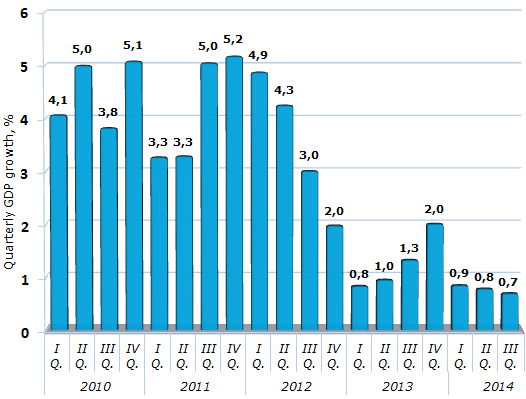

All this affects the key macroeconomic indicators - GDP growth, which is slowing down for three consecutive quarters and absolutely does not correspond to the potential capabilities and needs of the country for the development of existing and new industries, creating jobs in the service sector.

Figure 1. Quarterly GDP growth rate of the corresponding period of the previous year,%

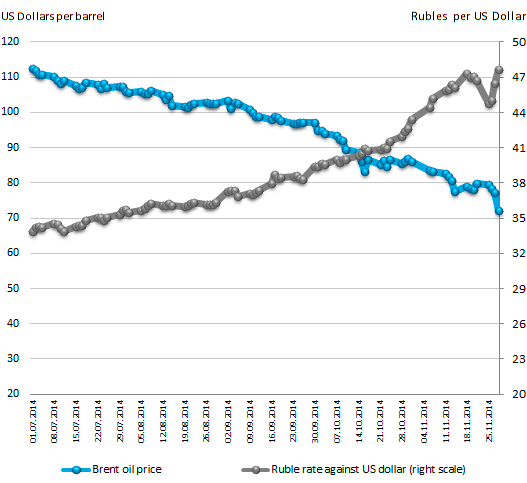

Figure 2. Dynamics of prices for Brent oil and the Russian ruble against the US dollar

Against the background of the rapid devaluation of the national currency, the historic decision of the Bank of Russia to cancel the currency basket corridor and regular foreign exchange intervention from November 10, 2014 has gone almost unnoticed. Floating exchange rate determined by market forces - is an important step towards full convertibility of the ruble, means of international payments and reserves.

The falling ruble is under enormous pressure of market participants due to lower of oil prices.

On the one hand, a weak ruble compensates losses of the budget from foregone export revenues; on the other hand – companies, attracting loans in the foreign market, will feel the sting of extra costs for loans service increased in price. Large list of products purchased abroad also increased in price. All this will lead to the acceleration of inflation and the deterioration of the growth dynamics of the population’s real wages and pensions.

However, despite the current geopolitical turbulence, a healthy optimism should be kept. The upcoming 2015 will be a year of challenges and difficult decisions that finally define new growth points and ways to diversify the economy.

Crisis bailout plan will help us

The Government of the Russian Federation in response to complicated macro economic conditions has developed the crisis bailout plan, which was announced on the 28th January 2015. Sanctions, deterioration of the pricing environment on the commodity markets, devaluation of the ruble, accelerated inflation and the slowing of the GDP growth, push the Government to decrease expenses for business and population, provide sustainable economic development and social stability support.

According to the crisis bailout plan, the expenses on the majority items of the 2015 federal budget will be cut down by 10%. Within the following three years the State expenditure should be reduced at least by 5% per year in order to reach the budget balance by 2017. It is supposed that the reduction of the expenses will be provided first of all by the elimination of the inefficient costs. For example, expenses on the operation of the government authority will be cut.

According to the plan, the fulfillment of the social obligations is promised to be provided, that will require additional budget allocations. Besides, it is agreed not to reduce the costs on provision of defense capability, supporting of agriculture and fulfillment of international obligations. The realization of new investment projects will be put off and the released resources will be concentrated on the completing of the unfinished projects.

In accordance with the plan, the State support programs in Russia will be extended on wider range of enterprises of small and medium business, than it is allowed by the current rules. This will happen due to the dual increase in the extreme value of the annual revenue from the sales of goods and services. The extreme value is a criterion for reference of the enterprise to the category of micro, small and medium enterprise. The increasing in the extreme value of annual revenue will allow to transfer about 8 000 enterprises to the category of small business; now they are formally considered as medium. In particular, because of that more companies will be able to participate in the public procurement.

Besides, as it is said in the government crisis bailout plan, the right to reduce rates for the taxation in the form of unified imputed income tax for a certain types of activity from 15% to 7,5% was acquired. Territorial entities of the Russian Federation will also be able to reduce the income tax from 6% to 1% for the enterprises, applying the simplified system of the taxation, and the right to reduce twofold the maximum amount of the potential annual income of the individual entrepreneur from 1 mln. RUB. to 500 000 RUB.