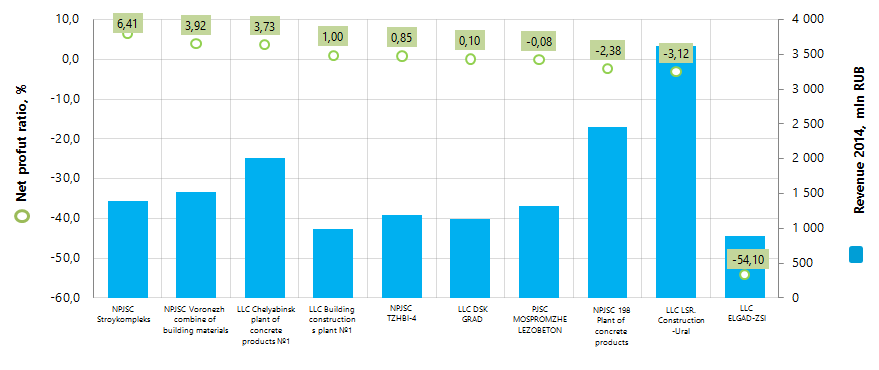

The largest Russian manufacturers of concrete products by the net profit ratio

Information agency Credinform prepared a ranking of the largest Russian manufacturers of concrete products by the net profit ratio.

Companies with the highest volume of revenue (Top-10) were selected for this ranking according to the data from the Statistical Register for the latest available period (for the year 2014). The enterprises were ranked by the net profit ratio decrease (Table 1).

Net profit ratio (%) is net profit (loss)-to-revenue. This ratio shows the level of the company’s profit from sales.

There is no standard value for this ratio. It is recommended to compare the companies in the industry or the ratio dynamics by the specified company. The negative value indicates the net loss. The higher is the value, the higher is the efficiency of the company.

For the most comprehensive and fair information on the company’s position, it is necessary to take into account not only the values of financial ratios, but also the total of financial and non-financial data.

| Name, INN, region | Net profit (loss) 2014, mln RUB | Turnover 2014, mln RUB | Revenue 2014 to 2013, % | Net profit ratio 2013, % | Net profit ratio 2014, % | Solvency index Globas-i |

|---|---|---|---|---|---|---|

| NPJSC Stroykompleks INN 3801053916 Irkutsk region |

89,0 | 1 388,0 | 95 | 0,75 | 6,41 | 199 The highest |

| NPJSC Voronezh combine of building materials INN 3665002959 Voronezh region |

59,4 | 1 516,9 | 100 | 3,93 | 3,92 | 171 The highest |

| LLC Chelyabinsk plant of concrete products №1 INN 7447188267 Chelyabinsk region |

74,9 | 2 009,0 | 119 | 4,25 | 3,73 | 199 The highest |

| LLC Building constructions plant №1 INN 5528211231 Omsk region |

9,9 | 995,3 | 1 164 | 2,04 | 1,00 | 178 The highest |

| NPJSC TZHBI-4 INN 6903008805 Tver region |

10,0 | 1 184,6 | 115 | 7,17 | 0,85 | 187 The highest |

| LLC DSK GRAD INN 5032261283 Moscow region |

1,1 | 1 131,1 | 332 | 0,24 | 0,10 | 260 High |

| PJSC MOSPROMZHELEZOBETON INN 7718013513 Moscow |

-1,1 | 1 325,5 | 70 | -1,41 | -0,08 | 218 High |

| NPJSC 198 Plant of concrete products ИНН 5028002208 Moscow region |

-58,6 | 2 460,8 | 94 | 5,87 | -2,38 | 188 The highest |

| LLC LSR. Construction-Ural ИНН 6670345033 Sverdlovsk region |

-112,7 | 3 612,7 | 87 | 5,17 | -3,12 | 201 High |

| LLC ELGAD-ZSI ИНН 5022047202 Moscow region |

-478,6 | 884,6 | 130 | -39,34 | -54,10 | 257 High |

LLC LSR. Construction-Ural, the leader by revenue for 2014, is the next to last in the table. The share of this company in the total volume of the Top-10 companies’ revenue is 22%. In comparison to the previous period, net profit of LLC LSR. Construction-Ural, as well as of other 5 of the Top-10 companies, has reduced. Moreover, the enterprise closed the year of 2014 with the loss, that is why the net profit ratio value is negative.

The highest net profit value of 6,41% belongs to NPJSC Stroykompleks. This company and another three of the Top-10 have reduced their revenue in 2014 compared to 2013.

Only two companies in the top of the ranking have positive dynamics of the net profit ratio value. The average value for the Top-10 for 2014 is negative -4,37% with a trend to reduction compared to the previous year. The value for that period was also negative, but amounted to -1,13%. At the same time, the average value of the Top-10 companies’ net profit ratio for 2014 is positive 1,75%.

All companies have got high and the highest solvency index Globas-i, indicating their ability to timely and fully fulfill the liabilities.

Total volume of revenue of the Top-10 companies for 2014 amounted to 16,5 mln RUB, that is by 7% higher than in 2013. The growth of revenue of the Top-10 companies for the same period was 13%, however the reduction of net profit by 51% is observed.

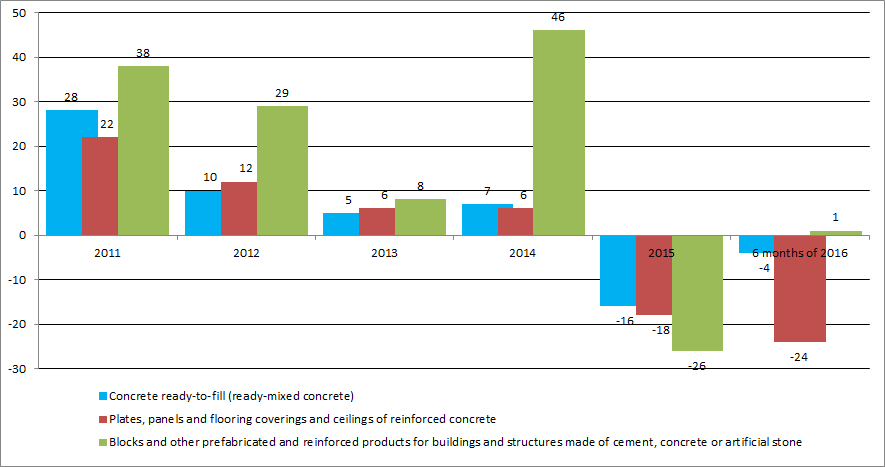

At the background of the economic situation in the country, the industry of concrete products manufacturing is in tough situation following the reduction in concrete production according to the results of 2015. This is confirmed by the data of the Federal state statistics service (Table 2) and estimated data based on them (Picture 2).

| 2010 г. | 2011 г. | 2012 г. | 2013 г. | 2014 г. | 2015 г. | 6 months of 2016 | |

|---|---|---|---|---|---|---|---|

| Concrete ready-to-fill (ready-mixed concrete) | 19 232,3 | 24 678,5 | 27 107,8 | 28 345,6 | 30 290,9 | 25 548,0 | 11 287,8 |

| Plates, panels and flooring coverings and ceilings of reinforced concrete | 5 901,2 | 7 175,3 | 8 025,9 | 8 538,4 | 9 040,9 | 7 369,3 | 2 902,9 |

| Blocks and other prefabricated and reinforced products for buildings and structures made of cement, concrete or artificial stone | 683,6 | 944,3 | 1 220,2 | 1 314,9 | 1 926,1 | 1 420,4 | 640,8 |

Manufacturing by all three types of products reached maximum values in 2014.

Manufacture in 2015 decreased, but according to the results of the first half-year, there are healthy signs of decrease in reduction of blocks manufacturing and even its slight growth.

In the sector of concrete products manufacturing there is no evident concentration of companies in any region of the country. According to the data of the Information and analytical system Globas-i, 100 companies largest in term of revenue for 2014 are registered in 46 regions. Most of them are registered in the following regions (Top-12 of regions):

| Region | Number of enterprises |

|---|---|

| Moscow region | 9 |

| Krasnodar territory | 6 |

| Republic of Bashkortostan | 5 |

| Republic of Tatarstan | 4 |

| Ryazan region | 4 |

| Sverdlovsk region | 4 |

| Altai territory | 3 |

| Moscow | 3 |

| Penza region | 3 |

| Perm territory | 3 |

| Smolensk region | 3 |

| Chelyabinsk region | 3 |

Problems of the financial market turn out to be more serious

Essential component of the state economy is financial market, the basis for that represents banking sector. At the same time, lately, non-banking financial sector is becoming more significant – firstly at global markets and, consequently, in Russia. Taking into account that the Central Bank of the RF as megaregulator tries to pay attention to all sectors of the financial market, the XXV jubilee banking congress held from June 29 to July 1, was named financial.

On the congress the head of the CB of the RF admitted that problems of the banking sector compared to the beginning of the recovery program of the banking system are much more substantial. Among them – facts of owners` business crediting instead of investment in good/sound projects and banks involvement in shady transactions through transit schemes, as a result, money return to the owners of banks or for fictitious capital increase of the credit organizations.

Breach of specified requirements by banks results in the fact that their licenses are suspended by the CB of the RF. Since 2013 amount of credit organizations with suspended licenses is more than 200, on some estimation, it is close to 300. This year suspending rate of unsustainable banks is 7-8 organizations per month, according to the megaregulator, work on detection and liquidation of unfair credit organizations is not finished.

Further development of the financial market will come on the background of external calls: long-term fall in average oil prices, low growth rate of the global economy, its delay in China, influence of brexit on the Russian financial system and economy in general, realization of structural reforms and monetary policy by central banks.

Certainly, the situation at the financial market does not satisfy anybody: the Government – because it leads to the slowdown of economic growth; the CB of the RF – because of growing distrust in credit organizations and financial market in general; and business – because of risks to lose funds in banks with suspended activities. Under current conditions the megaregulator is going to take some measures aimed to recover financial market sectors, among them:

- to limit amount of credits by the special normative standard Н25 for associated with bank bodies in order to prevent from crediting of owners` business;

- to raise minimal amount of bank equity capital to 1 bln RUB (currently 300 mln RUB), gradual raise of requirements will start with the beginning of 2018;

- to 0,75 percentage point increase normative standard of legal reserve requirement;

- to define criteria of credit organizations falling into the category of regional banks - raise of bank equity capital does not concern them, they will operate according to simplified regulation, will be limited by the credit projects rate and will not be able to carry out trans-border operations;

- to change drastically the resolution procedure: according to practice, it is cheaper to save bank than to pay to its depositors;

- to create the state fund, that will have access to capital of unsustainable banks, to take for resolution to the special governmental managing company, and to sell them after rehabilitation procedures by auction that helps full-rate return to the market.

However, banking risks still exist and during the investigation force to investigate bank, that contractor keeps an account in. Information and analytical system Globas-i provides all the necessary information on investigating bank, after analyzing data, generates the financial stability index of a bank, that helps to observe cooperation risks and realize the degree of influence on the contractor`s activity.