Solvency ratio of the largest Russian companies engaged in processing and conservation of fish, crustaceans and mollusks

Information agency Credinform has prepared a ranking of the largest Russian companies engaged in processing and conservation of fish, crustaceans and mollusks. The largest enterprises (TOP-10) in terms of annual revenue were selected according to the data from the Statistical Register for the available periods (from 2014 to 2016). Then the companies were ranged by solvency ratio (Table 1). The analysis was based on the data from the Information and Analytical system Globas.

Solvency ratio (x) is calculated as a ratio of shareholders’ equity to total assets and shows the dependence of the company on external loans. The recommended value of the ratio is >0,5. The ratio value less than minimum limit signifies about strong dependence on external sources of funds; such dependence may lead to liquidity crisis, unstable financial position in case of economic downturn.

The calculation of practical values of financial indicators, which might be considered as normal for a certain industry, has been developed and implemented in the Information and Analytical system Globas by the experts of the Information Agency Credinform, taking into account the actual situation of the economy as a whole and the industries.

In 2016 the practical value of solvency ratio for companies engaged in processing and conservation of fish, crustaceans and mollusks is from 0,01 to 0,83.

For the most full and fair opinion about the company’s financial position the whole set of financial indicators and ratios should be taken into account.

| Name, INN, region | Revenue, mln RUB | Net profit, mln RUB | Solvency ratio (x) | Solvency index Globas | |||

| 2015 | 2016 | 2015 | 2016 | 2015 | 2016 | ||

| USTKAMCHATRYBA CO., LTD INN 4109002780 Kamchatka Krai |

1 503 1 503 |

2 132 2 132 |

689 689 |

987 987 |

0,87 0,87 |

0,93 0,93 |

174 Superior |

| NAO KURILSKII RYBAK INN 6511000178 Sakhalin region |

4 463 4 463 |

5 279 5 279 |

1 734 1 734 |

1 601 1 601 |

0,93 0,93 |

0,90 0,90 |

155 Superior |

| PAO OZERNOVSKII RKZ #55 INN 4108003484 Kamchatka Krai |

3 337 3 337 |

3 532 3 532 |

1 214 1 214 |

1 400 1 400 |

0,62 0,62 |

0,76 0,76 |

158 Superior |

| NAO SEVERO-KURILSKAYA BAZA SEINERNOGO FLOTA INN 6515000242 Sakhalin region |

2 355 2 355 |

2 744 2 744 |

278 278 |

703 703 |

0,17 0,17 |

0,55 0,55 |

141 Superior |

| Federal state unitary enterprise ARKHANGELSKOE of the Federal Service for the Execution of Sanctions INN 3621005430 Saint-Peterburg In process of reorganization in the form of transformation, 21.05.2018 |

2 082 2 082 |

3 343 3 343 |

104 104 |

235 235 |

0,40 0,40 |

0,47 0,47 |

229 Strong |

| LLC Vichunai RUS INN 3911008930 Kaliningrad region |

6 991 6 991 |

8 716 8 716 |

259 259 |

244 244 |

0,25 0,25 |

0,28 0,28 |

199 High |

| PAO MERIDIAN INN 7713016180 Moscow |

8 006 8 006 |

7 635 7 635 |

683 683 |

323 323 |

0,34 0,34 |

0,24 0,24 |

206 Strong |

| PAO RYBOOBRABATYVAYUSHCHII KOMBINAT #1 INN 7805024462 Saint-Peterburg |

4 984 4 984 |

5 842 5 842 |

69 69 |

80 80 |

0,19 0,19 |

0,19 0,19 |

184 High |

| NAO RUSSIAN SEA INN 5031033020 Moscow region |

7 460 7 460 |

8 801 8 801 |

-842 -842 |

1 467 1 467 |

-0,54 -0,54 |

-0,18 -0,18 |

226 Strong |

| NAO BALTIC COAST INN 7826059025 Leningrad region Process of being wound up, 03.05.2017 |

10 065 10 065 |

6 376 6 376 |

-232 -232 |

-1 674 -1 674 |

0,09 0,09 |

-0,31 -0,31 |

600 Insufficient |

| Total for TOP-10 companies |  53 261 53 261 |

56 417 56 417 |

5 971 5 971 |

7 381 7 381 |

|||

| Average value for TOP-10 companies |  5 326 5 326 |

5 642 5 642 |

597 597 |

738 738 |

0,33 0,33 |

0,38 0,38 |

|

| Average industry value |  82 82 |

102 102 |

5 5 |

7 7 |

0,24 0,24 |

0,21 0,21 |

|

— growth of indicator in comparison with prior period,

— growth of indicator in comparison with prior period,  — decline of indicator in comparison with prior period.

— decline of indicator in comparison with prior period.

Average value of solvency ratio for TOP-10 companies is lower than recommended value and higher than average industry value.

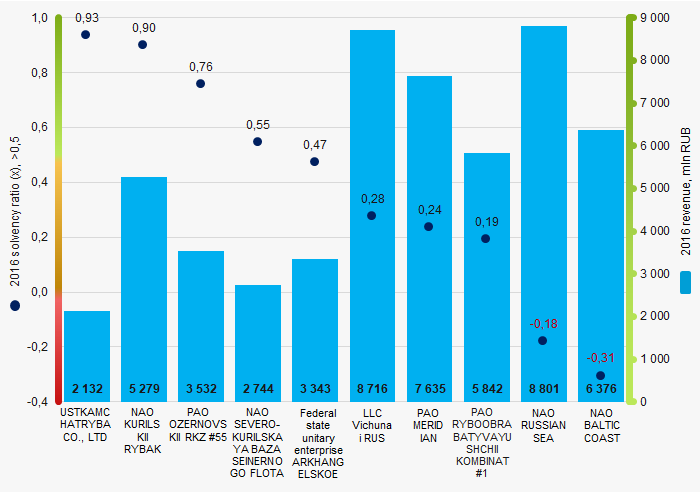

Picture 1. Solvency ratio and revenue of the largest Russian companies engaged in processing and conservation of fish, crustaceans and mollusks (ТОP-10)

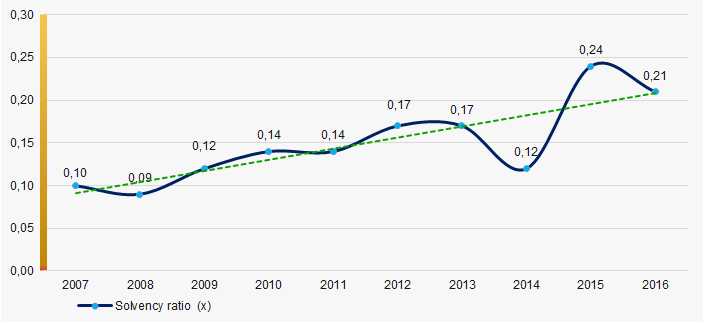

Picture 1. Solvency ratio and revenue of the largest Russian companies engaged in processing and conservation of fish, crustaceans and mollusks (ТОP-10)For the last 10 years, the average values of solvency ratio showed the increasing tendency (Picture 2).

Picture 2. Change in average industry values of solvency ratio of the largest Russian companies engaged in processing and conservation of fish, crustaceans and mollusks in 2007 — 2016

Picture 2. Change in average industry values of solvency ratio of the largest Russian companies engaged in processing and conservation of fish, crustaceans and mollusks in 2007 — 2016Trends in the activity of the largest companies of real sector of economy of the Republic of Bashkortostan

Information agency Credinform Credinform has observed trends in the activity of the largest companies of real sector of economy of the Republic of Bashkortostan.

Enterprises with the largest volume of annual revenue (TOP-10 and TOP-1000), were selected for the analysis, according to the data from the Statistical Register for the latest available periods (for 2014-2016). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Net assets — indicator, reflecting the real value of company’s property, is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The indicator of net assets is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

| № in TOP-1000 | Name, INN, main type of activity | Net assets value, mln RUB | Solvency index Globas | ||

| 2014 | 2015 | 2016 | |||

| 1. | PJSOC Bashneft INN 274051582 Crude oil mining |

126 720 |  164 332 164 332 |

176 336 176 336 |

208 Strong |

| 2. | AO TRANSNEFT – URAL INN 0278039018 Transportation of oil and oil products by pipeline |

93 660 |  101 303 101 303 |

115 205 115 205 |

188 High |

| 3. | LLC BGK INN 0277077282 Production of electric power by heat power plants, including activities on working ability of electric power plants |

30 161 |  31 186 31 186 |

35 303 35 303 |

145 Superior |

| 4. | LLC GAZPROM NEFTEKHIM SALAVAT INN 0266048970 Manufacture of oil products |

4 009 |  -4 619 -4 619 |

31 913 31 913 |

276 Medium |

| 5. | AO UCHALINSKII GOK INN 0270007455 Mining and preparation of copper ore |

24 233 |  27 534 27 534 |

30 564 30 564 |

193 High |

| 996. | JSC Housing Authority of Ordzhonikidze district INN 0277101778 Management of housing maintenance on a fee or a negotiable basis |

-544 |  -592 -592 |

-539 -539 |

307 Adequate |

| 997. | JSC BASHKORTOSTAN SUBURBAN PASSENGER COMPANY INN 0278168302 Passenger suburban transportation by railway transport in controlled sector |

-1 063 |  -878 -878 |

-861 -861 |

285 Medium |

| 998. | LLC BPK named after M.GAFURI INN 0263012454 Poultry breeding In bankruptcy proceeding |

89 |  -3 057 -3 057 |

-891 -891 |

550 Insufficient |

| 999. | LLC ALFA-SOYUZ INN 0278083465 Lease and management of own or rented uninhabited immovable property |

-602 |  -1 273 -1 273 |

-1 674 -1 674 |

307 Adequate |

| 1000. | LLC GLAVBASHSTROI INN 0245957140 Manufacture of concrete products for construction activities |

-1 932 |  -2 226 -2 226 |

-2 487 -2 487 |

352 Adequate |

— growth of the indicator to the previous period,

— growth of the indicator to the previous period,  — decline of the indicator to the previous period.

— decline of the indicator to the previous period.

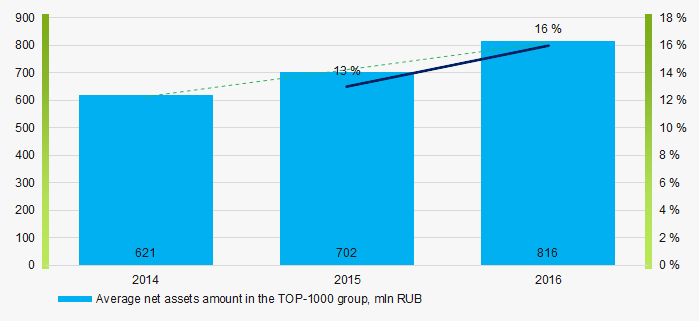

Picture 1. Change in TOP-1000 average indicators of the net asset amount in 2014 — 2016

Picture 1. Change in TOP-1000 average indicators of the net asset amount in 2014 — 2016Sales revenue

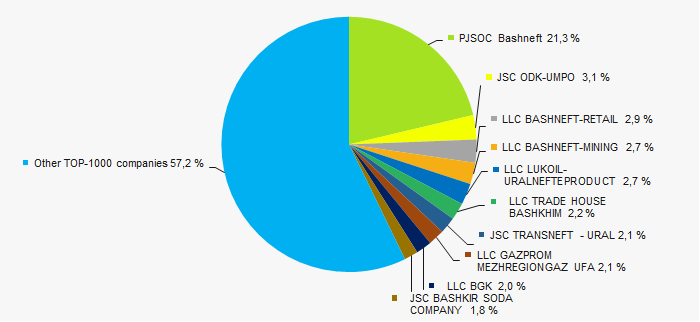

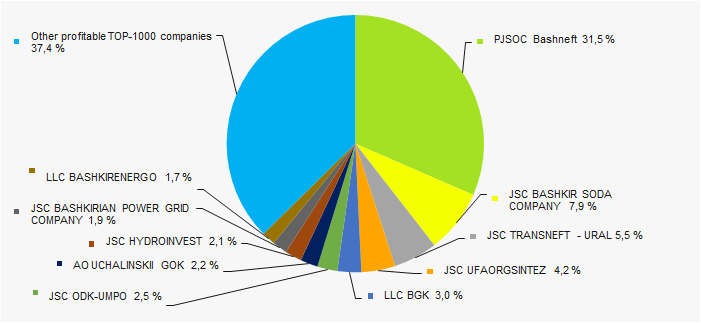

The revenue of 10 leaders of the industry made 43% of the total revenue of TOP-1000 companies in 2016. It demonstrates concentration of large companies in the Republic of Bashkortostan (Picture 2).

Picture 2. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 companies for 2016

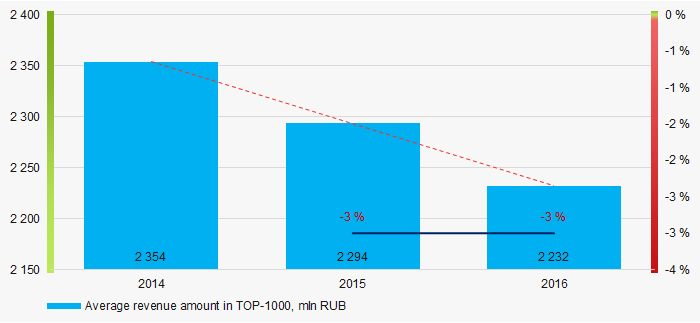

Picture 2. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 companies for 2016In general, a decreasing tendency in volume revenue is observed (Picture 3).

Picture 3. Change in the average revenue of TOP-1000 companies in 2014 — 2016

Picture 3. Change in the average revenue of TOP-1000 companies in 2014 — 2016Profit and losses

The profit volume of 10 leading enterprises in 2016 made 63% of the total profit of TOP-1000 companies (Picture 4).

Picture 4. Share of participation of TOP-10 companies in the total volume of profit of TOP-1000 companies for 2016

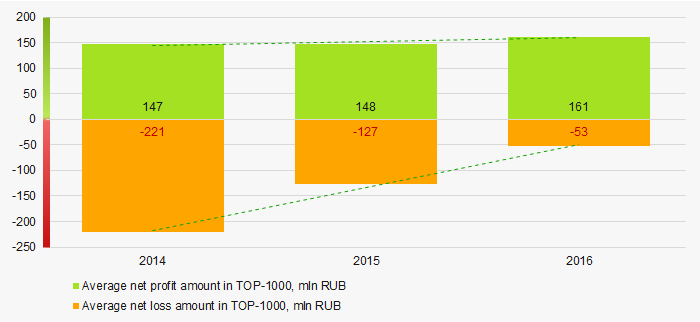

Picture 4. Share of participation of TOP-10 companies in the total volume of profit of TOP-1000 companies for 2016Over a three-year period, the average values of profit indicators of TOP-1000 companies tend to increase. However, the average value of net loss decreases (Picture 5).

Picture 5. Change in the average indicators of profit and loss of TOP-1000 companies in 2014 — 2016

Picture 5. Change in the average indicators of profit and loss of TOP-1000 companies in 2014 — 2016Key financial ratios

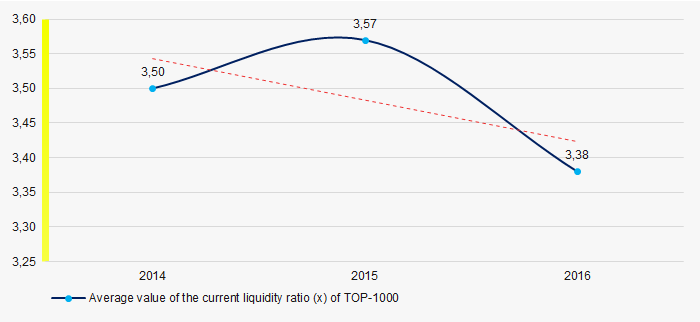

The current liquidity ratio (the relation of the amount of current assets to short-term liabilities) shows the sufficiency of company’s funds for repayment of its short-term liabilities.

Over the three-year period the average indicators of the current liquidity ratio were above the range of recommended values — from 1,0 up to 2,0 (Picture 6). In general, the ratio indicator tends to decrease.

Picture 6. Change in the industry values of the current liquidity ratio of TOP-1000 companies in 2014 — 2016

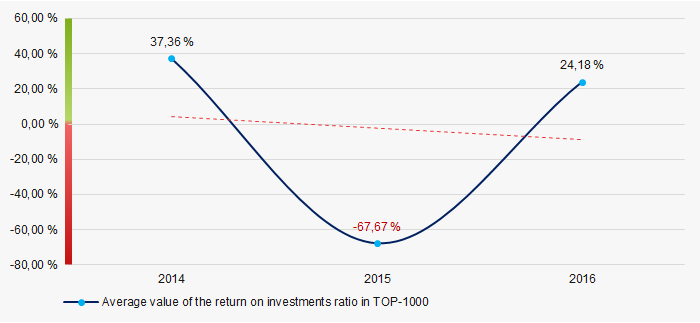

Picture 6. Change in the industry values of the current liquidity ratio of TOP-1000 companies in 2014 — 2016The return on investment ratio is calculated as the relation of net profit to the sum of own capital and long-term liabilities and demonstrates the return on the equity involved in the commercial activity of own capital and the long-term borrowed funds of an organization.

Decreasing tendency in the indicators of the return on investment ratio has been observed for three years (Picture 7).

Picture 7. Change in the average values of the return on investment ratio of TOP-1000 companies in 2014 — 2016

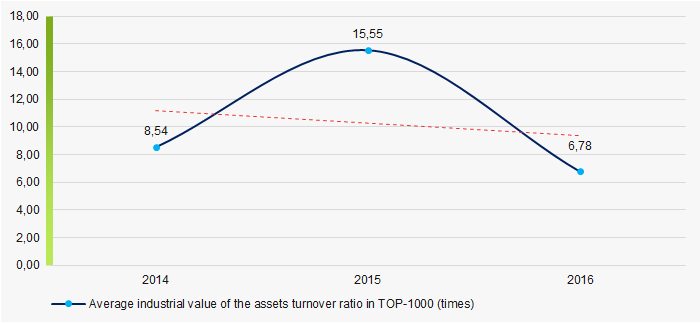

Picture 7. Change in the average values of the return on investment ratio of TOP-1000 companies in 2014 — 2016Asset turnover ratio is calculated as the relation of sales revenue to the average value of total assets for a period and characterizes the efficiency of use of all available resources, regardless of the sources of their attraction. The ratio shows how many times a year a complete cycle of production and circulation is made, yielding profit.

This business activity ratio showed a tendency to decrease for a three-year period (Picture 8).

Picture 8. Change in the average values of the assets turnover ratio of TOP-1000 companies in 2014 — 2016

Picture 8. Change in the average values of the assets turnover ratio of TOP-1000 companies in 2014 — 2016Production structure

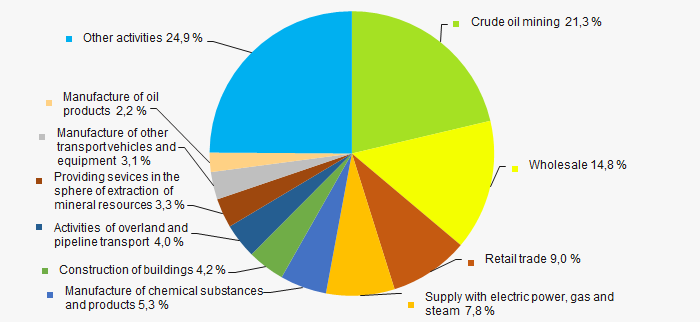

The largest share in the total revenue of TOP-1000 is owned by companies, specializing in crude oil mining (Picture 9).

Picture 9. Distribution of companies by types of output in the total revenue of TOP-1000, %

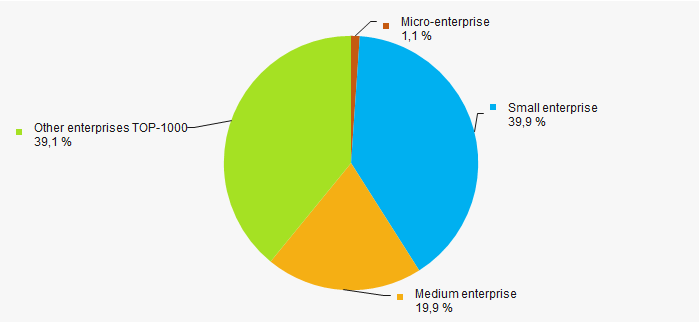

Picture 9. Distribution of companies by types of output in the total revenue of TOP-1000, %61% of TOP-1000 companies are registered in the Register of small and medium enterprises of the Federal Tax Service of the RF (Picture 10).

Picture 10. Shares of small and medium enterprises in TOP-1000 companies, %

Picture 10. Shares of small and medium enterprises in TOP-1000 companies, %Financial position score

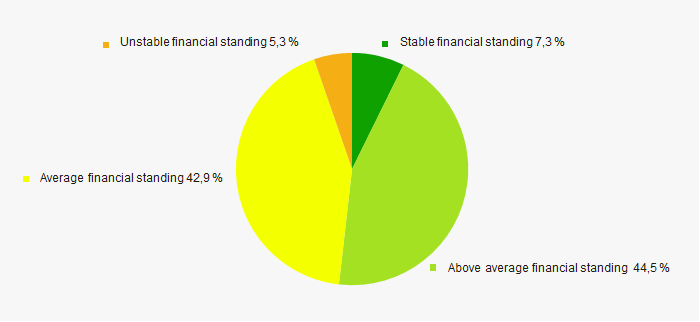

An assessment of the financial position of TOP-1000 companies shows that the largest number is in a stable financial position and above the average (Picture 11).

Picture 11. Distribution of TOP-1000 companies by financial position score

Picture 11. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

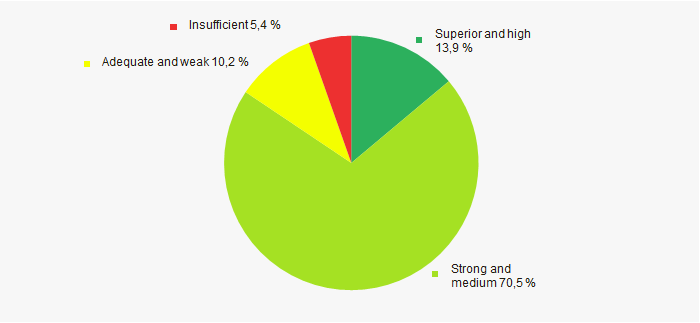

Most of TOP-1000 companies have got from Superior to Medium Solvency index Globas, that points to their ability to repay their debts in time and fully (Picture 12).

Picture 12. Distribution of TOP-1000 companies by Solvency index Globas

Picture 12. Distribution of TOP-1000 companies by Solvency index GlobasConclusion

Comprehensive assessment of the activity of largest companies of real sector of economy of the Republic of Bashkortostan, taking into account the main indexes, financial indicators and ratios, demonstrates the presence of favorable trends. However, among disturbing factors are decreasing indicators of revenue volume and key financial ratios.