The largest companies of Russia: not by oil alone

As a rule, prosperity of the country's economy is judged by the largest enterprises. However, sometimes the results of famous domestic brands’ activity do not demonstrate all complexity of inland economic processes. The economy of Germany, for instance, is firmly associated with BMW and Mercedes, Volkswagen and others, but its GDP is mainly formed by small and medium business. At the same time, it is possible to judge the general level of the country's technological development and its main specialization in the international market by leading enterprises.

The main engines of the Russian economy, both by revenue and net profit, are enterprises of fuel and energy complex (FEC). Exporting oil and gas to Europe and Asia, domestic oil holdings are crucial for world cooperation that still gears economic growth of Russia to resources supply and global prices dynamics.

That is why it is pleasant that not only mineral companies are included in the list of the largest enterprises promoting the growth of the country’s economy.

Largest companies of Russia by annual revenue

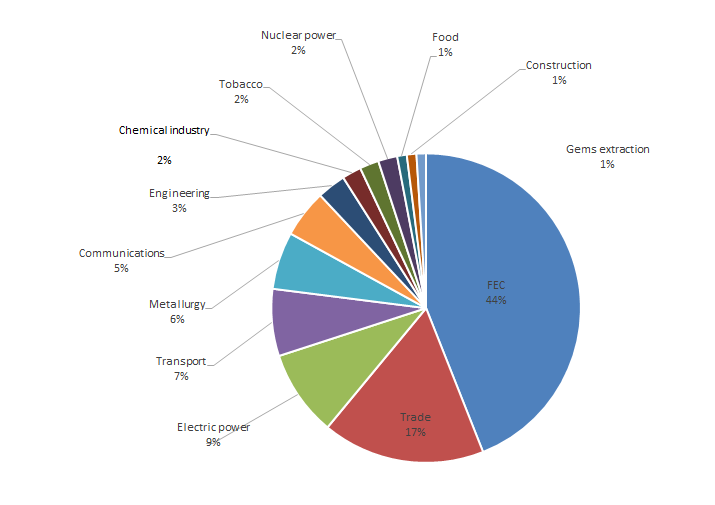

Following the analyses of the largest companies of Russia by turnover, the share of FEC enterprises in total revenue of Top-100 reduced from 54% in 2015 to 44% in 2016 (see picture 1). However, the sector still dominates in the economy of the country. Nowadays the companies of the following business begin to make substantial contribution to the GDP: retailers increased their share from 14,1% in 2015 to 17% in 2016, electric power – from 4,1% to 9% and transport – from 5,6% to 7%. Reduction of total share of oil and gas enterprises in the rating indicates the positive trend of national economy diversification. At the current dynamics, the significant reduction of dependence of Russia on FEC should be expected. According to the Ministry of Finance, revenue from oil and gas sales in 2016 amounted to 36% of budget receipts. In 2014, the share of oil and gas revenue was 51%.

Picture 1. Distribution of revenue of Top-100 companies of Russia by the sectors of economy

Picture 1. Distribution of revenue of Top-100 companies of Russia by the sectors of economy GAZPROM, ROSNEFT and RZD remain the largest businesses in Russia (see table 1). However, the highest revenue increase rate for Top-10 companies was demonstrated by TRADE HOUSE PEREKRESTOK: its turnover during the year increased by 16,8%, up to 848,3 bln RUB, and the company rose from 9 to 8 position in the rating.

Table 1. Top-10 of the Russian companies with the highest revenue

| Rating | Sector | Company | Turnover 2016, bln RUB | |

| 1 | - | FEC | GAZPROM | 3934,5 |

| 2 | - | FEC | OC ROSNEFT | 3930,1 |

| 3 | - | Transport | RZD | 1577,5 |

| 4 | - | FEC | GAZPROM NEFT | 1233,8 |

| 5 | - | Trade | TANDER (Magnit) | 1175,2 |

| 6 | - | FEC | SURGUTNEFTEGAZ | 992,5 |

| 7 | - | FEC | GAZPROM MEZHREGIONGAZ | 884,8 |

| 8 |  +1 +1 |

Trade | TRADE HOUSE PEREKRESTOK | 848,3 |

| 9 |  -1 -1 |

FEC | TRANSNEFT | 803,1 |

| 10 |  +1 +1 |

Trade | TRADE COMPANY MEGAPOLIS | 624,1 |

Table 2 contains companies with the highest revenue increase rate in 2016. Among them are ALROSA, GAZPROMNEFT-TSENTR and AGROTORG. ORENBURGNEFT, VERKHNECHONSKNEFTEGAZ and URALKALI had the highest rate of reduction of turnover for 2016. Significant decrease in revenue is due to downgrade of demand-supply situation in the commodity markets of petrochemical products.

Table 2. Russian companies with the highest rate of increase and decrease in revenue

| Rating | Sector | Sector | Turnover 2016, bln RUB | |

| 14 |  +33 +33 |

Trade | AGROTORG | 481,7 |

| 32 |  +48 +48 |

FEC | GAZPROMNEFT-TSENTR | 288,1 |

| 47 |  +16 +16 |

Gems | Gems | 249,5 |

| 76 |  -27 -27 |

FEC | FEC | 199,3 |

| 121 |  -48 -48 |

Chemical industry | URALKALI | 131,3 |

| 127 |  -67 -67 |

FEC | VERKHNECHONSKNEFTEGAZ | 128,5 |

Companies with the highest net profit

Another indicator for company size assessment and leaders identification is net profit.

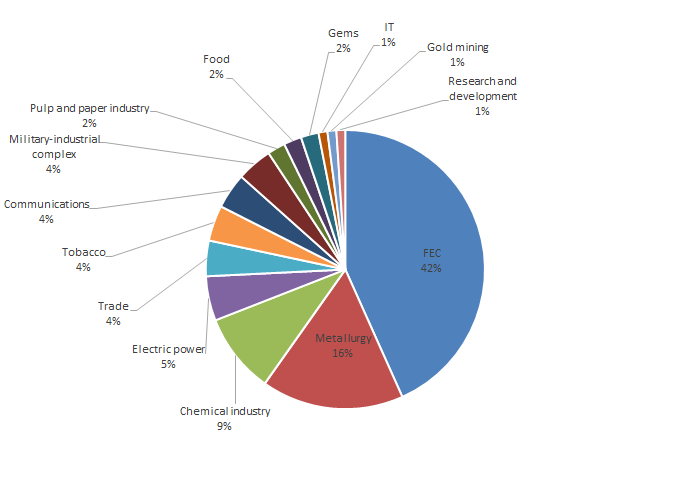

Today the bulk of net profit is still with FEC companies. At the same time, growth in number of companies of other sectors is observed. For example, metallurgy enterprises have almost double increased net profit share in Top-100 compared to 2015 (see picture 2).

Picture 2. Distribution of net profit of Top-100 companies of Russia by the sectors of economy

Picture 2. Distribution of net profit of Top-100 companies of Russia by the sectors of economy Rating of the most profitable business of Russia has changed significantly in comparison with 2015 (see table 3). GAZPROM with net profit of 411,4 bln RUB heads the list.

The second profitable company is LUKOIL with 182,5 bln RUB.

Then follows POLYUS KRASNOYARSK, gold mining company with comprehensive financial result of 150,8 bln RUB. At the year-end, the company had three-fold increase in net profit and implemented new investment-attractive “Natalka deposit” project.

Through revaluation of exchange rate difference and devaluation of rouble to foreign currency, diamond-mining company ALROSA demonstrated the growth of figure in seven times and became fourth in the rating.

By means of military and industrial products sales, ROSTEC corporation with net profit of 124,7 bln RUB is the 6th. It should be noted that Russia is the second to the USA in term of armament export in the global market. According to the data for 2016, the country’s share is 23% of total world arms exports.

GAZPROM NEFT rose on 58 positions and demonstrated the highest net profit growth rate in almost 8 times for 2016. This result is mainly connected with the opening of the “Prirazlomnaya” oil production platform in the Barents Sea.

GAZPROM NEFT rose on 58 positions and demonstrated the highest net profit growth rate in almost 8 times for 2016. This result is mainly connected with the opening of the “Prirazlomnaya” oil production platform in the Barents Sea.

Table 3. Top-10 of the Russian companies with the highest net profit

| Rating | Sector | Company | Company | |

| 1 |  +1 +1 |

FEC | GAZPROM | 411,4 |

| 2 |  +1 +1 |

FEC | LUKOIL | 182,5 |

| 3 |  +28 +28 |

Gold mining | POLYUS KRASNOYARSK | 150,8 |

| 4 |  +50 +50 |

Gems | ALROSA | 148,6 |

| 5 |  +4 +4 |

FEC | NOVATEK | 147,9 |

| 6 |  +12 +12 |

Research and development | ROSTEC | 124,7 |

| 7 |  -3 -3 |

Metallurgy | MMC NORILSK NICKEL | 122,7 |

| 8 |  +58 +58 |

FEC | GAZPROM NEFT | 122,4 |

| 9 |  +54 +54 |

Electric power | FGC UES | 106,0 |

| 10 |  -2 -2 |

FEC | TATNEFT | 104,8 |

SURGUTNEFTEGAZ, used to be the first in the rating in 2015, deserves special mention. The company is no longer among the most profitable enterprises due to losses of 104,8 bln RUB in 2016. This was caused by loss in exchange rate difference: the company hold foreign currency for the account and sustained significant financial losses in 2016 on the background of the rouble strengthening.

Planned decrease of FEC share in the Russian economy is taking place: companies of IT (Yandex), telecommunications industry (MTS), pharmacy (R-Pharm) and other sectors appear in the lead.

At the current trend, dependence on oil and gas income and falling oil prices will not so critically influence all sectors; economy will continue to diversify and processing industry, construction and trade will become new drivers of growth.

Small business will become the foundation of the Russian economy

Small business will account for over 30% of the turnover of all Russian companies in a few years. This forecast was followed by an analysis of the financial accounts of all Russian companies for 2016.

Since the beginning of market reforms in Russia, the economists speaks about the important role of small business in the balanced development of the domestic economy and exemplify the countries of the West where the contribution of small companies in the GDP generation reaches 50% or more. After all, in Europe the tradition of small business has been continuously existed for more than one hundred years, whereas the history of domestic private enterprises is much more complicated.

Today in Russia, measures are being taken at the legislative level to support entrepreneurial activity and expand private initiative: exemption from inspections, tax holidays for newly established companies, simplified reporting forms, access to participation in state procurement. However, there are problems connected primarily with a high level of fiscal burden and excessive administrative regulation, which hinders the development of small business and affects the structure of the Russian business.

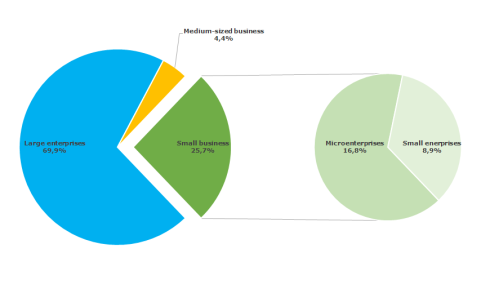

The structure of the Russian economy is well illustrated by the financial accounts for the full circle of companies for the last reporting year 2016, which is available in the Information and Analytical system Globas since September. Large business enterprises still play the leading role and accumulate almost 70% of the total revenue from sales of goods, products, services. The share of medium-sized companies accounts for 4,4% of annual turnover. The share of small business is 25,7% of revenues, 16,8% of which accounts for microenterprises and 8.9% for small organizations (see Picture 1).

Criteria for being qualified as micro, small and medium-sized business are determined by decisions of the Government of Russia. Nowadays, an organization with annual income of up to 120 mln RUB and the number of employees not exceeding 15 people is declared as a micro-, up to 800 mln RUB and 100 employees as small, up to 2 billion rubles and 250 employees as medium-sized enterprise. Other structures belong to large business.

Picture 1. Distribution of the Russian companies by categories according to financial accounts for 2016,% of total revenue

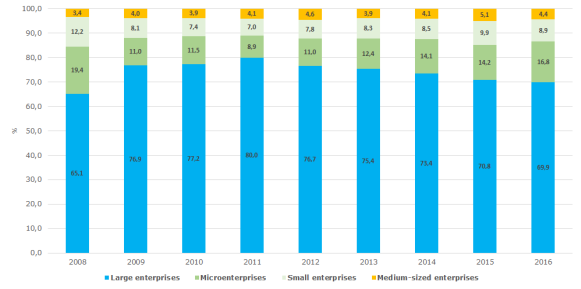

Picture 1. Distribution of the Russian companies by categories according to financial accounts for 2016,% of total revenuePicture 2 shows the dynamics of change in the share of various categories in generation of total revenues from sales of goods, products, services from 2008, when the contribution of small business reached 35%. After the crisis of 2009, large corporations had increased their share until 2011. Since 2012, the share of large business has been gradually declining due to the resumed growth of micro and small enterprises. If the current trends continue, small businesses can give over 30% of turnover of all Russian companies in a few years.

Picture 2. Dynamics of the contribution (share) of enterprises of various categories in generation of revenues from sales of goods, products, services,% of total revenue

Picture 2. Dynamics of the contribution (share) of enterprises of various categories in generation of revenues from sales of goods, products, services,% of total revenueThe development of small forms of entrepreneurship meets the needs of all spheres of the Russian economy and trends of world economic processes. Being a purely market structure, small business is able to provide freedom of entrepreneurial choice and stimulate the effective organization of production. Small business is one of the most flexible sectors of the economy, in which innovative approach and relatively high growth rates are combined with relatively low expenditures for establishment of an enterprise.