On current and long-range plans of the Russian economy development

The beginning of the year is permanently accompanied with the Government activity on reconsideration or development of the current or long-range plans. 2017 is no exception. The so-called “Crisis bailout plan” fell under major changes. The plan introduces the events the funding allocation of which is to amount to 107,5 billion RUB. What is more it is referred to extrabudgetary funds to be found. As a comparison, financial component of the 2016 crisis bailout plan amounted to 750 billion RUB, of 2015 – 2,3 trillion RUB. The 2017 plan in a greater degree represents a plan for support of individual industries.

For this purpose 17,4 billion RUB are to be allocated for capitalization support of the Industry Development Fund. It is planned to finance at the expense of the Fund no less than 50 projects aimed at development of import phase-out and Russian manufacturing industry. The market launch of the new engineering equipment, improvement of capacity utilization of the Russian enterprises, as well as fulfilment of scientific and technical potential held by the manufacturers are to be guaranteed by 3 billion RUB under the subprogram «Production development of manufacturing equipment».

The major part of measures represents the allocation of funds for subsidization of the Russian engineering enterprises for various industries: automobile, transport, agricultural, road-building, utility, food and light. The main part of planned funds (62,3 billion RUB) are aimed at the support of automobile industry, in particular: subsidies for car manufacturers are to amount to 17,5 billion RUB, which will make it possible to provide additional manufacture of 250 vehicles and to preserve workplaces.

In the agriculture it is expected to allocate 13,7 billion RUB for subsidization of agricultural machinery manufacturers. In the transport engineering the subsidies (5,4 billion RUB) are to be given to the buyers of locomotives and carriages on recovery of several expenses arising from its purchase. In the road-building and utility machine building the subsidization volume of road-building and utility machinery leasing will amount to 2,5 billion RUB. 2,2 billion RUB will be allocated in order to support the light industry. The subsidization amount of car and equipment manufacturers for food and processing industries is to reach 1 billion RUB.

At the moment the Government of the RF by the order of the President of the RF develops an integrated action plan of the government till 2025. The plan should include proposals of structural and institutional reforms. Structural and institutional reforms should take place upon following courses:

- lifting of quantitative and qualitative restrictions in the field of human capital;

- dealing with problems of poverty and social disparity;

- increase of investment activity;

- creation of innovations;

- international cooperation and growth of export component;

- reduction of transaction costs in the economy;

- dealing with problem of the black economy high share in the country;

As a whole the action plan of the Government of the RF is focused on increase in the rate of economic growth in Russia. It should be prepared in May 2017. The Prime Minister of the RF took ownership of the plan development. According to him, the Russian economy should have the priority worldwide average growth rates and become the smart economy and the economy of possibilities as a result of implementing of the action plan till 2025.

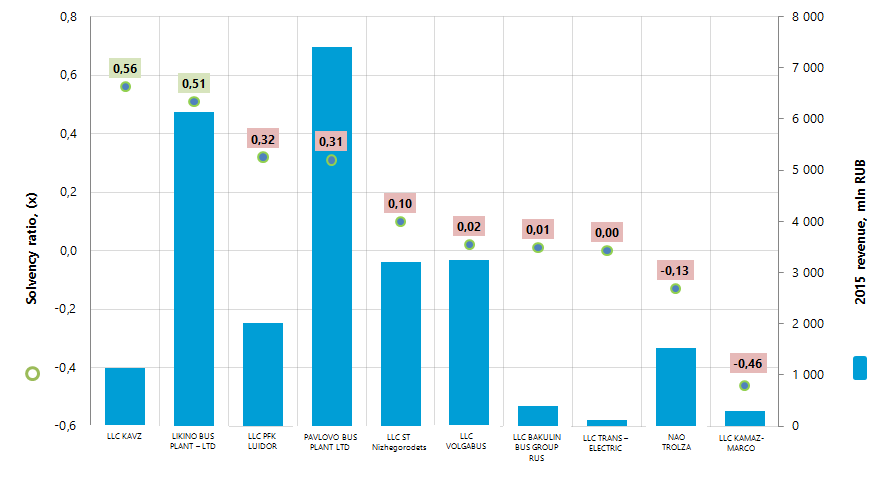

The largest Russian manufacturers of buses and trolley buses by solvency ratio

Information Agency Credinform has prepared the ranking of the largest Russian manufacturers of buses and trolley buses. The largest enterprises of the industry (TOP-10) in terms of annual revenue were selected according to the data from the Statistical Register for the latest available periods (2015 and 2014). Then the companies were ranged by solvency ratio (Table 1).

Solvency ratio (х) is calculated as a ratio of equity capital to total balance. The ratio shows the company’s dependence from external borrowings. The recommended value of the ratio is >0,5.

The ratio value less than minimum limit signifies about strong dependence from external sources of funds; such dependence may lead to liquidity crisis, unstable financial position in case of contraction in business conditions.

The calculation of practical values of financial indicators, which might be considered as normal for a certain industry, has been developed and implemented in the Information and Analytical system Globas-i® by the experts of Information Agency Credinform, taking into account the actual situation of the economy as a whole and the industries. The practical value of solvency ratio for bus and trolley bus manufacturers is from 0 to 0,58.

For the most full and fair opinion about the company’s financial position not only the compliance with standard values, but the whole set of financial indicators and ratios should be taken into account.

| Name, INN, region | 2015 net profit, mln RUB | 2015 revenue, mln RUB | 2015/2014 revenue, +/- % | Solvency ratio, (х) | Solvency index Globas-i® |

|---|---|---|---|---|---|

| LLC KAVZ INN 4501103580 Kurgan region |

-18,77 | 1 128,68 | -2,63 | 0,56 | 299 High |

| LIKINO BUS PLANT – LTD INN 5034019312 Moscow region |

-184,92 | 6 137,70 | -29,12 | 0,51 | 291 High |

| LLC PFK LUIDOR INN 5257065753 Nizhny Novgorod Region |

43,05 | 2 017,47 | -10,92 | 0,32 | 259 High |

| PAVLOVO BUS PLANT LTD INN 5252015220 Nizhny Novgorod Region |

141,30 | 7 399,84 | -10,48 | 0,31 | 237 High |

| LLC ST Nizhegorodets INN 5259062324 Nizhny Novgorod Region |

38,17 | 3 204,39 | -48,19 | 0,10 | 288 High |

| LLC VOLGABUS INN 3435107555 Volgograd region |

24,23 | 3 240,18 | -5,31 | 0,02 | 292 High |

| LLC BAKULIN BUS GROUP RUS INN 3435308935 Volgograd region |

0,70 | 387,39 | 282,76 | 0,01 | 293 High |

| LLC TRANS – ELECTRIC INN 3525297406 Vologda region |

0,01 | 113,91 | 36,19 | 0,00 | 309 Satisfactory |

| NAO TROLZA INN 6449972323 Saratov region |

-349,46 | 1 530,41 | 33,92 | -0,13 | 331 Satisfactory |

| LLC KAMAZ-MARCO INN 1650238806 Republic of Tatarstan |

-49,37 | 294,61 | 30,18 | -0,46 | 344 Satisfactory |

| Total for TOP-10 group of companies | -355,05 | 25 454,58 | -19,22* | 0,12* | |

| Total for TOP-24 group of companies ** | -371,38 | 26 394,66 | -16,81* | 0,05* |

*) - Average value within group of companies

**) All companies, which provided 2015 financial statements to the Federal State Statistics Service

In 2015 the average value of solvency ratio within TOP-10 group of companies is higher than average value within TOP-24 group of companies with industry average value of 0,15. Meanwhile only two companies, which take first two places of the ranking, have the ratio within recommended and practical values.

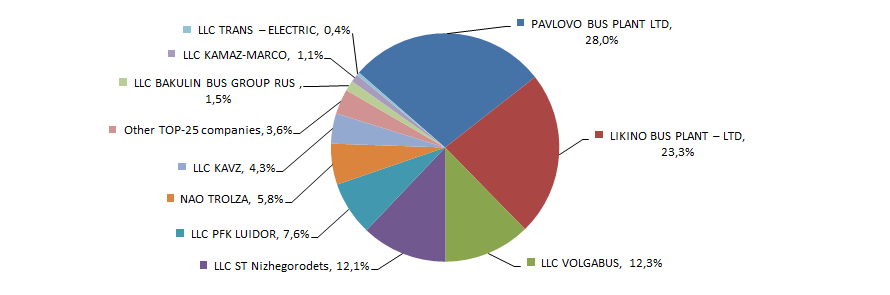

Total revenue of 10 largest companies amounted to 96% from TOP-24 total revenue. This fact testifies the high level of monopolization within industry. Thus, the share of the largest company by 2015 total revenue - PAVLOVO BUS PLANT LTD in TOP-24 total revenue amounted to 28% (Picture 2).

7 companies from TOP-10 list have high solvency index Globas-i®, this fact shows the ability of the companies to meet their obligations in time and fully.

3 out of 10 participants have satisfactory solvency index Globas-i®. Thus, LLC TRANS – ELECTRIC, NAO TROLZA and LLC KAMAZ-MARCO acted as a defendant in debt collection arbitration proceedings. Besides, NAO TROLZA as well as LLC KAMAZ-MARCO has unclosed enforcement orders and loss in balance sheet ratio structure. The forecast for companies’ index development is stable.

In 2015 among TOP-10 participants only LLC BAKULIN BUS GROUP RUS increased its net profit and revenue in comparison with previous period. Other companies (red color in Table 1) have loss or decrease in revenue or net profit.

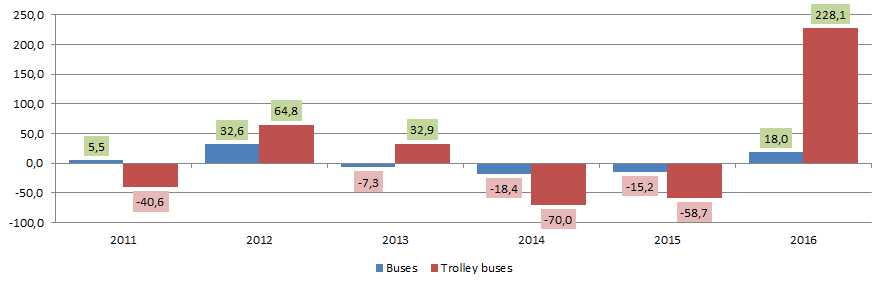

Within 2013-2015 the bus and trolley bus manufacturers’ ratios in natural terms were characterized by decrease in output volumes; this testifies the data from the Federal State Statistics Service (Table 2).

| Types of products | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

|---|---|---|---|---|---|---|---|

| Buses | 40 784 | 43 051 | 57 077 | 52 926 | 43 208 | 36 655 | 43 241 |

| Trolley buses | 397 | 236 | 389 | 517 | 155 | 64 | 210 |

*) Red color in table 2 shows decline in production, green color shows the growth.

Increase in production, especially in production of trolleybuses, is marked in 2016; the growth is quite understandable, taking into account the volume of output (Picture 3).

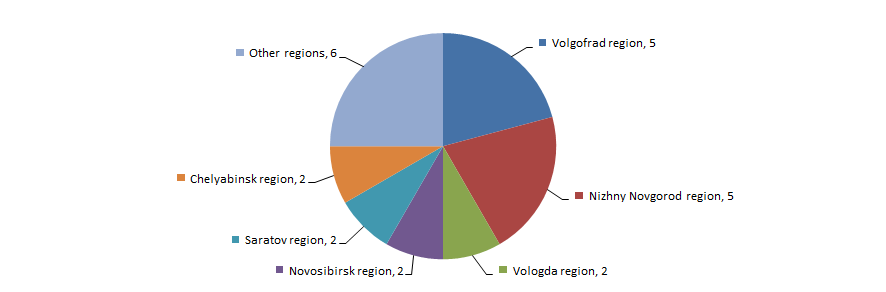

Manufacturers of buses and trolley buses are unequally distributed across the country and are basically concentrated in industrialized regions with developed infrastructure of automotive manufacture. This fact is confirmed by data from the Information and Analytical system Globas-i, according to which 24 largest companies of the industry in terms of 2015 revenue are registered in 12 Russian regions (Picture 4).