Investigative Committee of Russia will gain the right to cause proceedings in the sphere of tax violation

A bill is passing the reading in the State Duma, which vests the Investigative Committee of Russia (ICR) a right to open by itself a criminal case for violation of the tax legislation.

The mechanism of action of amendments will be as follows: by receipt of materials of pre-investigation check an investigator directs to the tax authority during three days a copy of materials with preliminary calculation of the number of arrears in respect of taxes and levies. The tax administration submits its conclusion by not later than 15 days. If it doesn’t happen, the investigative bodies make decision on the institution of proceeding or refusal to initiate it at their discretion.

According to the opinion of the Head of ICR – Aleksandr Bastrykin, the suggested scheme will allow to use operational-investigative means by breaking of complicated schemes of tax fraud, and the Federal Tax Service has no such opportunities.

The initiative has been met in the business environment with a mixed reception. So that, the Russian Union of Industrialists and Entrepreneurs is worried about that the threat of institution of criminal proceedings will be a form of pressure against entrepreneurs. The operative rule assumes that business will be able to challenge at arbitration courts the actions of taxmen already after payment of tax arrears and refund of a part of paid money in case the suit will be won. And in the suggested scheme an active repentance means that a person has admitted his/her guilt without a right to continue proceedings in arbitration court.

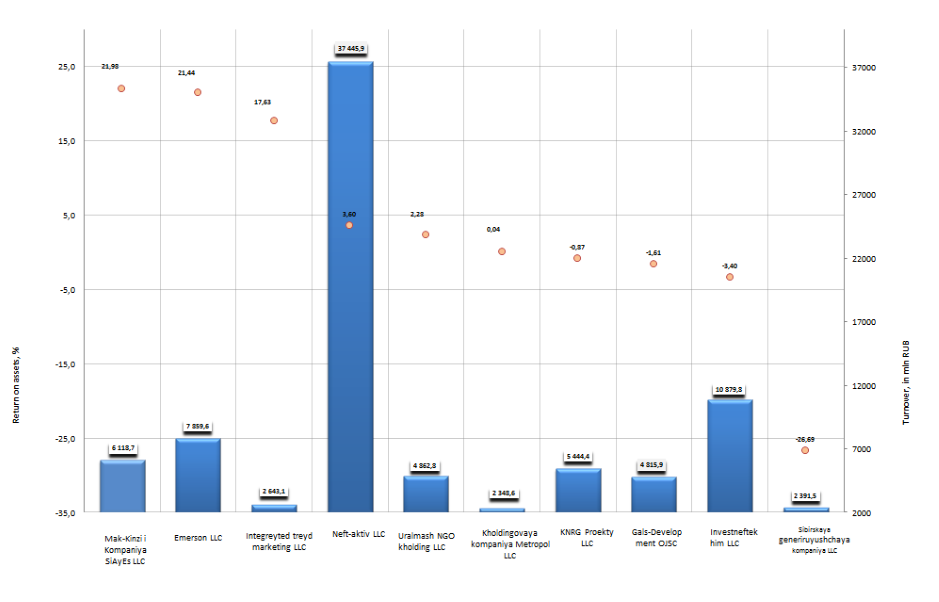

Return on assets of enterprises engaged in consultation on questions of commercial activity and management

Information agency Credinform offers to get acquainted with the ranking of enterprises engaged in consultation on questions of commercial activity and management. The companies with the highest volume of revenue involved in this activity were selected by the experts according to the data from the Statistical Register for the latest available period (for the year 2013). Then, the first 10 enterprises selected by turnover were ranked by decrease in return on assets.

Return on assets is a financial indicator, which characterizes the benefit from the use of all assets of an organization. This ratio is calculated as the relation of net profit and interests payable to company’s total assets value and shows, how many monetary units of net profit were earned by each unit of total assets.

There are no recommended or specified values prescribed for profitability ratios, because their values vary strongly depending on the branch.

| № | Name, INN | Region | Turnover for 2013, in mln RUB | Return on assets, % | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | Mak-Kinzi i Kompaniya SiAyEs LLC INN 7710708760 |

Moscow | 6119 | 21,98 | 298 (high) |

| 2 | Emerson LLC INN 7705130530 |

Moscow | 7860 | 21,44 | 284 (high) |

| 3 | Integreyted treyd marketing LLC INN 7715565611 |

Moscow | 2643 | 17,63 | 273 (high) |

| 4 | Neft-aktiv LLC INN 7725594298 |

Moscow | 37 446 | 3,6 | 279 (high) |

| 5 | Uralmash neftegazovoe INN 7707727918 |

Moscow | 4863 | 2,28 | 367 (unsatisfactory) |

| 6 | Kholdingovaya kompaniya Metropol LLC INN 7706632798 |

Moscow | 2349 | 0,04 | 311 (unsatisfactory) |

| 7 | Kaspiyskaya energiya Proekty LLC INN 3015057870 |

Astrakhan region | 5444 | -0,87 | 286 (high) |

| 8 | Gals-Development OJSC INN 7706032060 |

Moscow | 4816 | -1,61 | 263 (high) |

| 9 | Investneftekhim LLC INN 1655077599 |

Republic of Tatarstan | 10 880 | -3,4 | 328 (satisfactory) |

| 10 | Sibirskaya generiruyushchaya kompaniya LLC INN 7709832989 |

Moscow | 2391 | -26,69 | 334 (satisfactory) |

The first three enterprises of the ranking are as follows: Mak-Kinzi i Kompaniya SiAyEs LLC (return on assets value is 21,98%), Emerson LLC (21,44%) and Integreyted treyd marketing LLC (17,63%). The return on assets values of these companies is above 17%, what is a good result for the representatives of services sector. Moreover, all the first three enterprises got a high solvency index GLOBAS-i®, what testifies that these organizations can pay off their debts in time and fully.

Diagram. Return on assets of Russian enterprises engaged in consultation on questions of commercial activity and management, TOP-10

The return on assets value of companies Kaspiyskaya energiya Proekty LLC (-0,87%), Gals-Development OJSC (-1,61%), Investneftekhim LLC (-3,4%) and Sibirskaya generiruyushchaya kompaniya LLC (-26,69%) is below zero, because the enterprises have losses following the results of the accounting period.

The return on assets value for capital-intensive industries is, as a rule, lower than for companies of services sector, which don’t need large financial investments and investments in current assets. However, the results obtained within this ranking demonstrate not the most favorable picture: only three companies of the TOP-10 list showed a worthy result. However, it should be remembered, that for comprehensive and objective assessment of an enterprise it is necessary to consider the combination of financial and non-financial indicators.