Legislation amendments

The Federal Law No. 143-FZ dated 26.05.2021 amended the Federal Law "On State Registration of Legal Entities and Individual Entrepreneurs" and the Article 80 of the Fundamental Principles of Legislation of the Russian Federation on the Notariate.

In particular, the requirement for notarial attestation of powers of attorney while submitting documents for the state registration through the applicant's representatives (including couriers) is excluded.

According to the new rules set to come into force from August 25, 2021, the notaries who certified the authenticity of signatures on applications for state registration of legal entities or individual entrepreneurs are required to send independently the necessary information to the registration authorities in electronic form with a strengthened qualified signature.

All available data on more than 7 thousand notaries and notary chambers (including inactive) is available in the Information and Analytical system Globas.

TOP 1000 of construction companies in Moscow

Information agency Credinform represents a review of activity trends among construction companies in Moscow.

The largest companies with the highest annual revenue (TOP 1000) were selected for the ranking, according to the data from the Statistical Register and the Federal Tax Service for the latest available periods (2016 – 2020). The selection and analysis of companies were based on the data of the Information and Analytical system Globas.

Net assets are total assets less total liabilities. This indicator reflects the real value of the property of an enterprise. When the company’s debt exceeds the value of its property, the indicator is considered negative (insufficiency of property).

The largest company in term of net assets is STATE ENTERPRISE OF THE CITY OF MOSCOW DEPARTMENT OF CIVIL CONSTRUCTION, INN 7719272800, construction of residential and non-residential buildings. In 2020, net assets value of the company exceeded 103 billion RUB.

The lowest net assets value among TOP 1000 belonged to FSUE MAIN MILITARY CONSTRUCTION DEPARTMENT NO. 14, INN 5047054473, construction of residential and non-residential buildings. In 2020, insufficiency of property of the enterprise was indicated in negative value of -65 billion RUB.

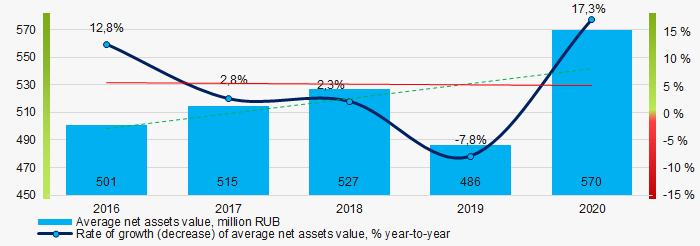

Covering the five-year period, the average net assets values of TOP 100 have a trend to increase with the decreasing growth rate (Picture 1).

Picture 1. Change in industry average net assets value in 2016 – 2020

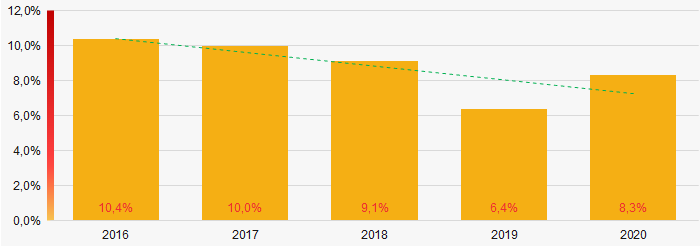

Picture 1. Change in industry average net assets value in 2016 – 2020Over the past five years, the share of companies with insufficient property had a positive trend to decrease (Picture 2).

Picture 2. Shares of TOP 1000 companies with negative net assets value in 2016-2020

Picture 2. Shares of TOP 1000 companies with negative net assets value in 2016-2020Sales revenue

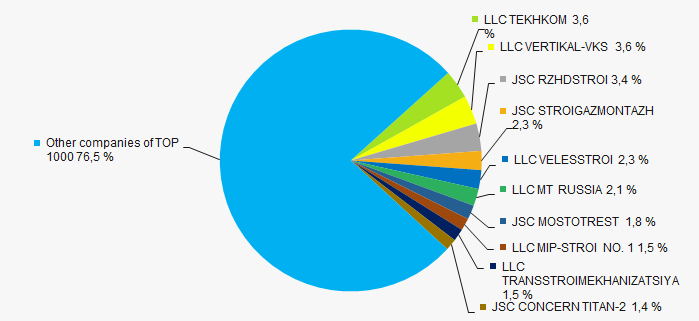

In 2020, the revenue volume of ten largest companies was near 24% of total TOP 1000 revenue (Picture 3). This is indicative of a high level of completion in construction.

Picture 3. The share of TOP 10 companies in total 2020 revenue of TOP 1000

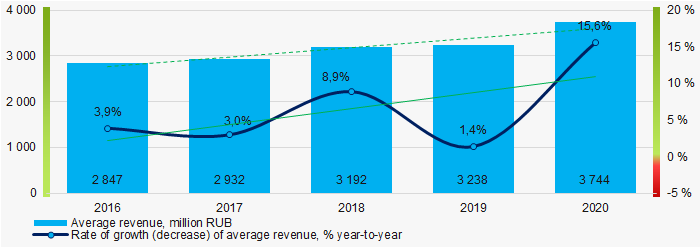

Picture 3. The share of TOP 10 companies in total 2020 revenue of TOP 1000 In general, there is a trend to increase in revenue and growth rate (Picture 4).

Picture 4. Change in industry average net profit in 2016 – 2020

Picture 4. Change in industry average net profit in 2016 – 2020Profit and loss

In 2020, the largest organization in term of net profit is LLC TEKHKOM, INN 7721784675, electrical, sanitary and other construction and installation works. The company’s profit almost amounted to 50 billion RUB.

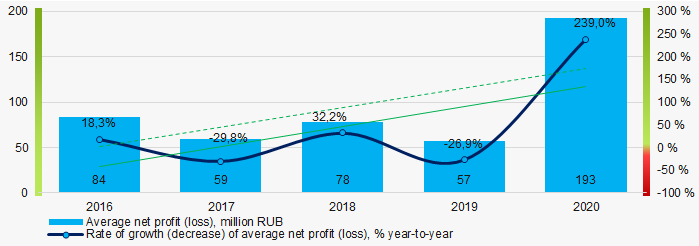

Covering the five-year period, there is a trend to increase in average net profit and growth rate (Picture 5).

Picture 5. Change in industry average net profit (loss) values in 2016 – 2020

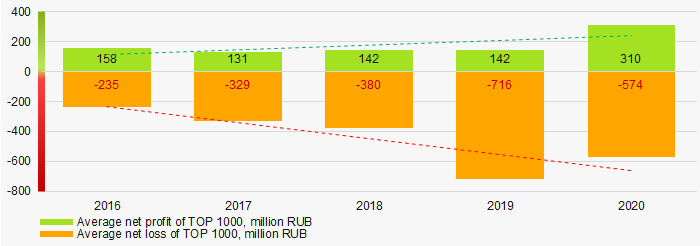

Picture 5. Change in industry average net profit (loss) values in 2016 – 2020For the five-year period, the average net profit values of TOP 1000 have the increasing trend with the increasing net loss (Picture 6).

Picture 6. Change in average net profit and net loss of ТОP in 2016 - 2020

Picture 6. Change in average net profit and net loss of ТОP in 2016 - 2020Key financial ratios

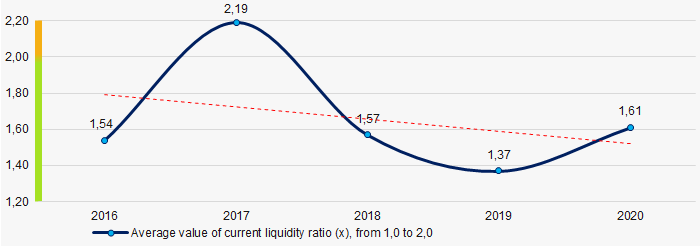

Covering the five-year period, the average values of the current liquidity ratio were within the recommended one - from 1,0 to 2,0 with a trend to decrease (Picture 7).

Current liquidity ratio (current assets to short-term liabilities) shows the sufficiency of company’s assets to repay on short-term liabilities.

Picture 7. Change in industry average values of current liquidity ratio in 2016 – 2020

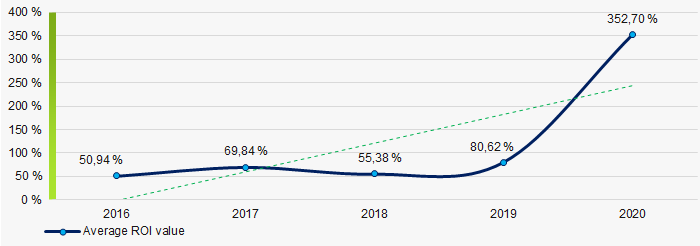

Picture 7. Change in industry average values of current liquidity ratio in 2016 – 2020 Covering the five-year period, the average values of ROI ratio кhad a trend to increase (Picture 8).

ROI ratio is calculated as net profit to sum of shareholders equity and long-term liabilities, and shows the return of equity involved in commercial activities and long-term borrowed funds.

Picture 8. Change in industry average values of ROI ratio in 2016 - 2020

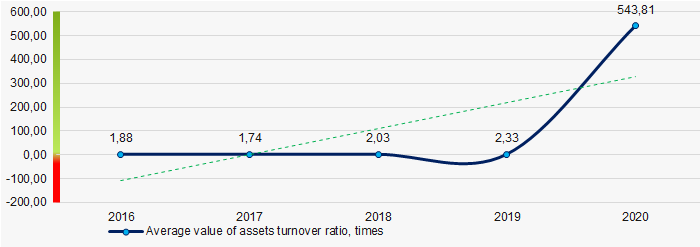

Picture 8. Change in industry average values of ROI ratio in 2016 - 2020Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

Covering the five-year period, business activity ratio demonstrated the increasing trend (Picture 9).

Picture 9. Change in average values of assets turnover ratio in 2016 – 2020

Picture 9. Change in average values of assets turnover ratio in 2016 – 2020Small business

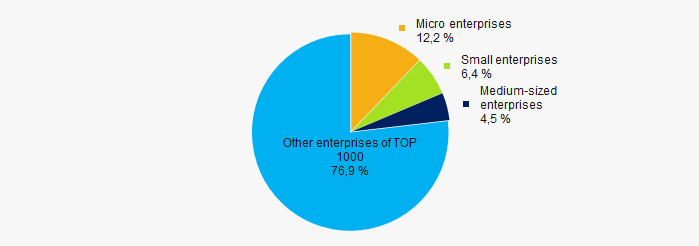

60% of companies of TOP 1000 are registered in the Register of small and medium-sized enterprises of the Federal Tax Service of the Russian Federation. In 2020, their share in total revenue of TOP 1000 is 23%, more than the average country values in 2018-2019 (Picture 10).

Picture 10. Shares of small and medium-sized enterprises in TOP 1000

Picture 10. Shares of small and medium-sized enterprises in TOP 1000Financial position score

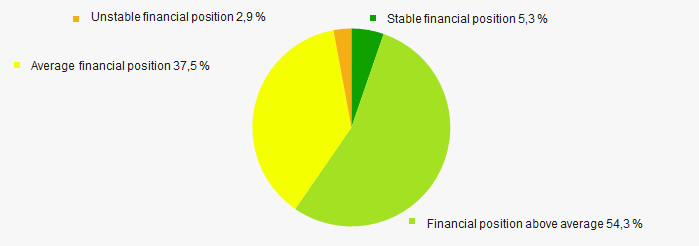

Assessment of the financial position of TOP 1000 companies shows that the financial position of the majority of them is above average (Picture 11).

Picture 11. Distribution of TOP 1000 companies by financial position score

Picture 11. Distribution of TOP 1000 companies by financial position scoreSolvency index Globas

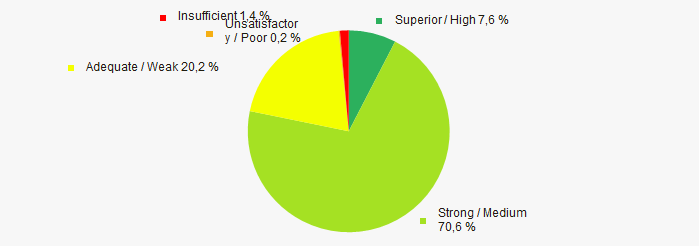

Most of TOP 1000 companies got Superior / High and Strong / Medium indexes Globas. This fact shows their limited ability to meet their obligations fully (Picture 12).

Picture 12. Distribution of TOP 1000 companies by solvency index Globas

Picture 12. Distribution of TOP 1000 companies by solvency index GlobasConclusion

Complex assessment of activity of construction companies of Moscow, taking into account the main indexes, financial ratios and indicators, demonstrates the prevalence of positive trends in 2016 - 2020 (Table 1).

| Trends and evaluation factors | Relative share of factors, % |

| Dynamics of the average net assets value |  10 10 |

| Rate of growth (decrease) in the average size of net assets |  -10 -10 |

| Increase (decrease) in the share of enterprises with negative values of net assets |  10 10 |

| Level of competition / monopolization |  10 10 |

| Dynamics of the average revenue |  10 10 |

| Rate of growth (decrease) in the average size of revenue |  10 10 |

| Dynamics of the average profit (loss) |  10 10 |

| Rate of growth (decrease) in the average profit (loss) |  10 10 |

| Growth / decline in average values of companies’ net profit |  10 10 |

| Growth / decline in average values of companies’ net loss |  -10 -10 |

| Increase / decrease in average values of total liquidity ratio |  -5 -5 |

| Increase / decrease in average values of return on investment ratio |  10 10 |

| Increase / decrease in average values of asset turnover ratio, times |  10 10 |

| Share of small and medium-sized businesses in terms of revenue being more than 20% |  10 10 |

| Financial position (the largest share) |  10 10 |

| Solvency index Globas (the largest share) |  10 10 |

| Average value of relative share of factors |  6,6 6,6 |

positive trend (factor),

positive trend (factor),  negative trend (factor)

negative trend (factor)