Foreign loans in software engineering

Information agency Credinform represents the ranking of the largest Russian software developers. The companies with the largest volume of annual revenue (TOP-10) were selected for the ranking, according to the data from the Statistical Register for the latest available periods (for 2015 - 2017). Then they were ranked by solvency ratio (Table 1). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Solvency ratio (х) is calculated as the relation of the amount of equity to balance sum and characterizes company's dependence on foreign loans. Recommended value is: >0,5.

The ratio value below the minimum means a strong dependence on external sources of financing, that by deterioration in market environment may lead to a liquidity crisis and an unstable financial situation of a company.

The experts of the Information agency Credinform, taking into account the actual situation both in the economy as a whole and in the sectors, has developed and implemented in the Information and Analytical system Globas the calculation of practical values of financial ratios that can be recognized as normal for a particular industry. For software developers the practical value of solvency ratio made from 0,04 up to 0,94 in 2017.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention to all combination of indicators and financial ratios.

| Name, INN, region | Revenue, billion RUB | Net profit (loss), billion RUB | Solvency ratio (x), >0,5 | Solvency index Globas | |||

| 2016 | 2017 | 2016 | 2017 | 2016 | 2017 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| YANDEX LLC INN 7736207543 Moscow |

71,69 71,69 |

86,06 86,06 |

12,14 12,14 |

19,01 19,01 |

36,45 36,45 |

0,87 0,87 |

178 High |

| KASPERSKY LAB NJSC INN 7713140469 Moscow |

17,72 17,72 |

19,72 19,72 |

1,24 1,24 |

0,09 0,09 |

0,75 0,75 |

0,68 0,68 |

187 High |

| SKB KONTUR JSC INN 6663003127 Sverdlovsk region |

8,20 8,20 |

10,18 10,18 |

1,03 1,03 |

0,90 0,90 |

0,70 0,70 |

0,62 0,62 |

179 High |

| YANDEX.TAXI LLC INN 7704340310 Moscow |

2,82 2,82 |

9,02 9,02 |

-0,74 -0,74 |

-5,76 -5,76 |

0,78 0,78 |

0,57 0,57 |

314 Adequate |

| MICROSOFT RUS LLC INN 7743528989 Moscow |

9,89 9,89 |

9,25 9,25 |

0,54 0,54 |

1,16 1,16 |

0,37 0,37 |

0,50 0,50 |

189 High |

| NEFTEAVTOMATIKA JSC INN 0278005403 Republic of Bashkortostan |

6,75 6,75 |

8,42 8,42 |

0,41 0,41 |

1,14 1,14 |

0,29 0,29 |

0,33 0,33 |

185 High |

| SBERBANK – TECHNOLOGIES NJSC INN 7736632467 Moscow |

20,34 20,34 |

30,32 30,32 |

0,23 0,23 |

0,15 0,15 |

0,28 0,28 |

0,30 0,30 |

256 Medium |

| RT-INVEST TRANSPORT SYSTEMS LLC INN 7704869777 Moscow |

10,82 10,82 |

10,99 10,99 |

3,09 3,09 |

2,14 2,14 |

0,09 0,09 |

0,09 0,09 |

249 Strong |

| FORS - DEVELOPMENT CENTER LLC INN 7702270040 Moscow |

4,65 4,65 |

6,75 6,75 |

0,13 0,13 |

0,24 0,24 |

0,04 0,04 |

0,08 0,08 |

179 High |

| RVO GROUP LLC INN 7702531291 Moscow |

4,65 4,65 |

6,75 6,75 |

0,13 0,13 |

0,24 0,24 |

-0,04 -0,04 |

0,01 0,01 |

235 Strong |

| Total by TOP-10 companies |  154,15 154,15 |

198,61 198,61 |

18,08 18,08 |

19,10 19,10 |

|||

| Average value by TOP-10 companies |  15,42 15,42 |

19,86 19,86 |

1,81 1,81 |

1,91 1,91 |

0,41 0,41 |

0,41 0,41 |

|

| Industry average value |  0,04 0,04 |

0,04 0,04 |

0,004 0,004 |

0,004 0,004 |

0,45 0,45 |

0,64 0,64 |

|

improvement of the indicator to the previous period,

improvement of the indicator to the previous period,  decline in the indicator to the previous period.

decline in the indicator to the previous period.

The average value of the solvency ratio of TOP-10 enterprises is below industry average and recommended values. Seven companies improved results in 2017.

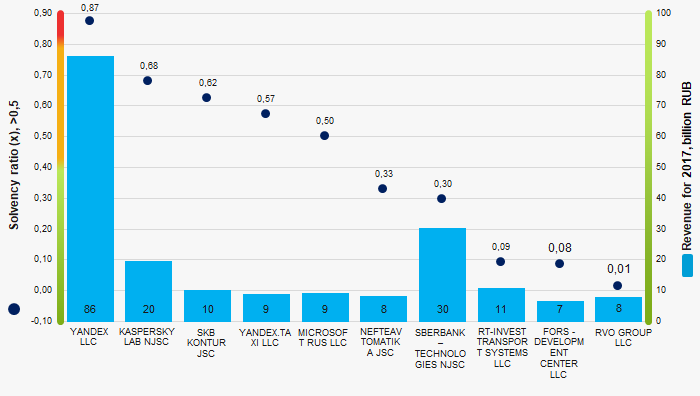

Picture 1. Solvency ratio and revenue of the largest Russian software developers (TOP-10)

Picture 1. Solvency ratio and revenue of the largest Russian software developers (TOP-10)The industry average indicators of the solvency ratio tend to decrease over the course of 10 years (Picture 2).

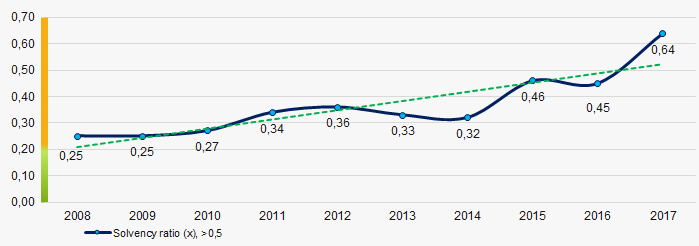

Picture 2. Change in industry average values of the solvency ratio of Russian software developers in 2008 – 2017

Picture 2. Change in industry average values of the solvency ratio of Russian software developers in 2008 – 2017Activity trends of Udmurtia companies

Information agency Credinform has observed trends in the activity of the largest companies of the real sector of economy in The Republic of Udmurtia the Republic of Udmurtia.

Enterprises with the largest volume of annual revenue (TOP-1000), were selected for the analysis, according to the data from the Statistical Register for the latest available periods (for 2013-2017). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Net assets is an indicator, reflecting the real value of company's property, is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The indicator of net assets is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

The largest company of the Udmurtia Republic in terms of net assets amount is JSC Belkamneft named after А.А. Volkov INN 0264015786. In 2017 net assets of the company amounted to 57,5 billion RUB.

had the smallest amount of net assets in the TOP-1000 group LLC Udmurtia public utilities. INN 1833037470. Insufficiency of property of the company was expressed in negative value - 3,5 billion RUB.

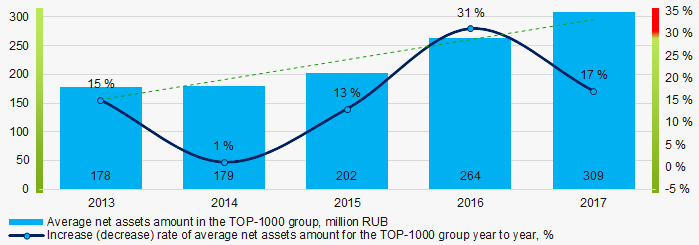

For a five-year period average amount of net assets of TOP-1000 companies has increasing tendency (Picture 1).

Picture 1. Change in TOP-1000 average indicators of the net asset amount in 2013 – 2017

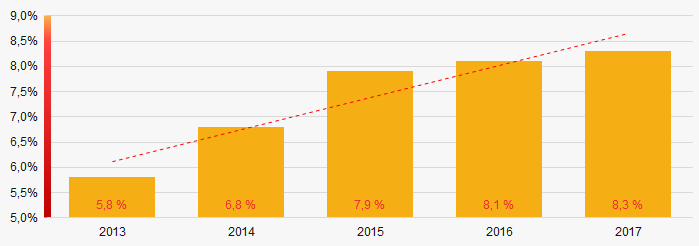

Picture 1. Change in TOP-1000 average indicators of the net asset amount in 2013 – 2017Share of companies with insufficiency of property in the TOP-1000 has increasing trend for the last five years (Picture 2).

Picture 2. Shares of companies with negative values of net assets in TOP-1000 companies

Picture 2. Shares of companies with negative values of net assets in TOP-1000 companiesSales revenue

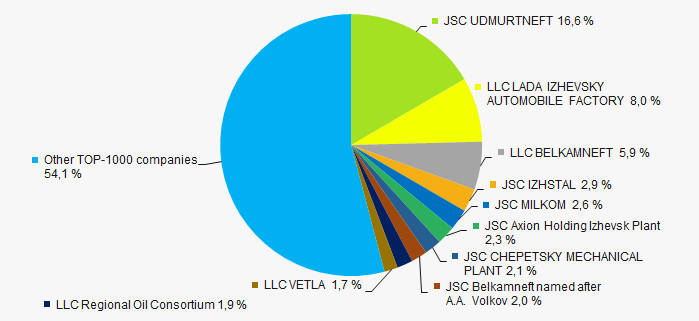

The revenue volume of 10 leaders of the industry made 46% of the total revenue of TOP-1000 companies in 2017(Picture 3). It demonstrates high level of productive concentration in the Republic of Udmurtia.

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 companies for 2017

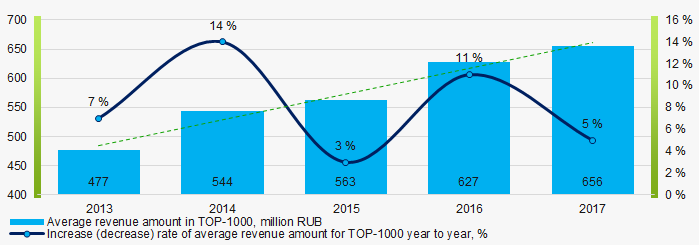

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 companies for 2017In general, an increasing tendency in revenue volume is observed (Picture 4).

Picture 4. Change in the average revenue of TOP-1000 companies in 2013 – 2017

Picture 4. Change in the average revenue of TOP-1000 companies in 2013 – 2017Profit and losses

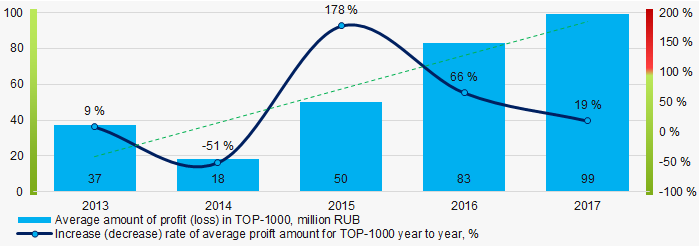

The largest company of the Republic of Udmurtia in terms of net profit amount is JSC Belkamneft named after А.А. Volkov INN 0264015786. Net profit of the company amounted to 50,7 billion RUB for 2017.

In general, an increasing tendency in average profit amount for TOP-1000 is observed (Picture 6).

Picture 5. Change in the average indicators of profit and loss of TOP-1000 companies in 2013 – 2017

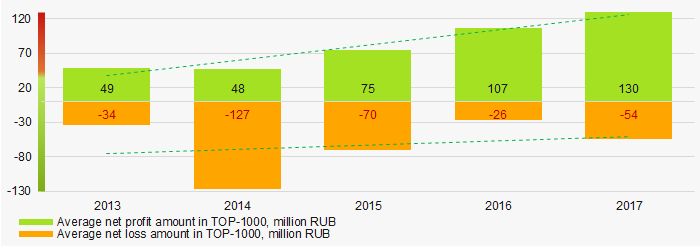

Picture 5. Change in the average indicators of profit and loss of TOP-1000 companies in 2013 – 2017Over a five-year period, the average values of net profit indicators of TOP-1000 companies tend to increase. Besides, the average value of net loss decreases (Picture 6).

Picture 6. Change in the average indicators of net profit and loss of TOP-1000 companies in 2013 – 2017

Picture 6. Change in the average indicators of net profit and loss of TOP-1000 companies in 2013 – 2017Key financial ratios

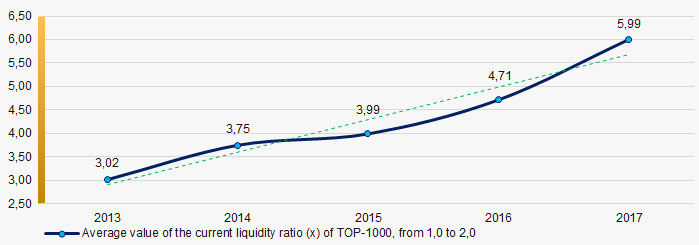

Over the five-year period the average indicators of the current liquidity ratio of TOP-1000 were above the range of recommended values – from 1,0 up to 2,0 with increasing tendency (Picture 7).

The current liquidity ratio (the relation of the amount of current assets to short-term liabilities) shows the sufficiency of company’s funds for repayment of its short-term liabilities.

Picture 7. Change in the average values of the current liquidity ratio of TOP-1000 companies in 2013 – 2017

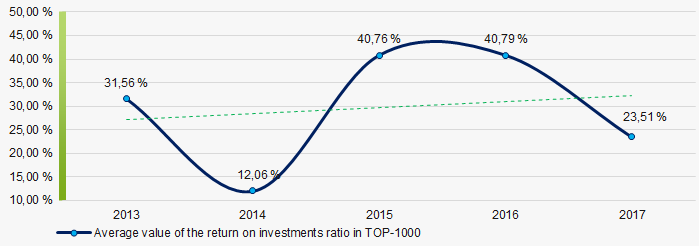

Picture 7. Change in the average values of the current liquidity ratio of TOP-1000 companies in 2013 – 2017Sufficiently high level of average values of the indicators of the return on investment ratio with increasing tendency has been observed for five years (Picture 8).

The ratio is calculated as the relation of net profit to the sum of own capital and long-term liabilities and demonstrates the return on the equity involved in the commercial activity of own capital and the long-term borrowed funds of an organization.

Picture 8. Change in the average values of the return on investment ratio of TOP-1000 companies in 2013 – 2017

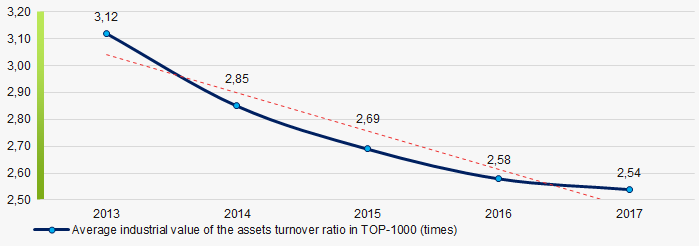

Picture 8. Change in the average values of the return on investment ratio of TOP-1000 companies in 2013 – 2017Asset turnover ratio is calculated as the relation of sales revenue to the average value of total assets for a period and characterizes the efficiency of use of all available resources, regardless of the sources of their attraction. The ratio shows how many times a year a complete cycle of production and circulation is made, yielding profit.

This business activity ratio showed a tendency to decrease for a five-year period (Picture 9).

Picture 9. Change in the average values of the assets turnover ratio of TOP-1000 companies in 2013 – 2017

Picture 9. Change in the average values of the assets turnover ratio of TOP-1000 companies in 2013 – 2017Small business

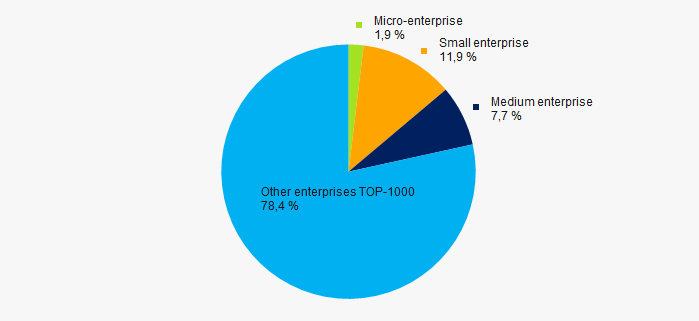

80% of the TOP-1000 companies are registered in the Register of small and medium enterprises of the Federal Tax Service of the RF. Besides, share of revenue in the total volume of TOP-1000 is 21,6%, that almost equal to the average indicator countrywide (Picture 10).

Picture 10. Shares of small and medium enterprises in TOP-1000 companies

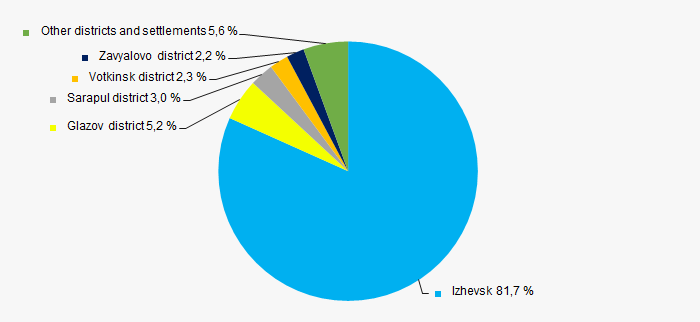

Picture 10. Shares of small and medium enterprises in TOP-1000 companiesMain regions of activity TOP-1000 enterprises are registered in 26 districts and settlements of the Udmurtia Republic and are unequally distributed. Almost 82% of the largest companies in terms of revenue volume are concentrated in the center of the Republic – Izhevsk city (Picture 11).

Picture 11. Distribution of TOP-1000 companies by districts of the Republic of Udmurtia

Picture 11. Distribution of TOP-1000 companies by districts of the Republic of Udmurtia Financial position score

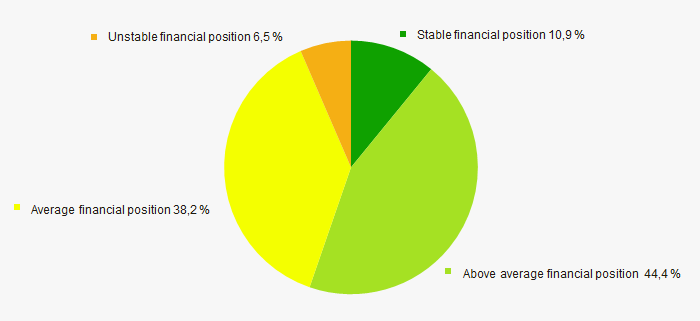

An assessment of the financial position of TOP-1000 companies shows that the largest number is in stable and an above the average financial position. (Picture 12).

Picture 12. Distribution of TOP-1000 companies by financial position score

Picture 12. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

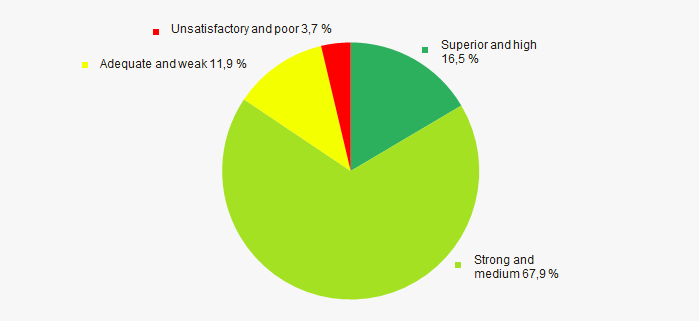

Most of TOP-1000 companies have got from Medium to Superior Solvency index Globas, that points to their ability to repay their debts in time and fully (Picture 13).

Picture 13. Distribution of TOP-1000 companies by solvency index Globas

Picture 13. Distribution of TOP-1000 companies by solvency index GlobasIndustrial production index

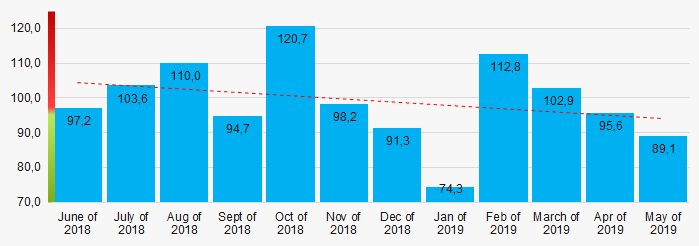

According to the data from the Federal State Statistics Service, during 12 months of 2018-2019 decreasing tendency is observed for the industrial production index of the enterprises of The Republic of Udmurtia (Picture 14). Besides, the average indicator of index from month to month amounted to 99,2%.

Picture 14. Industrial production index of manufacture of the enterprises of the Republic of Udmurtia in 2018-2019, month to month (%)

Picture 14. Industrial production index of manufacture of the enterprises of the Republic of Udmurtia in 2018-2019, month to month (%) According to the same data, share of the enterprises of the Republic of Udmurtia in revenue volume from sale of goods, products, works services countrywide for 2018 was 0,503%, and for the first quarter of 2019 – 0,504%.

Conclusion

Comprehensive assessment of the activity of largest real economy enterprises of the Republic of Udmurtia, taking into account the main indexes, financial indicators and ratios, demonstrates the presence of favorable trends (Table 1).

| Trends and assessment factors for TOP-1000 | Share of factor, % |

| Rate of increase (decrease) of average amount of net assets |  10 10 |

| Increase / decrease of share of companies with negative values of net assets |  -10 -10 |

| Level of capital concentration |  -10 -10 |

| Increase (decrease) rate of average revenue amount |  10 10 |

| Increase (decrease) rate of average net profit (loss) amount |  10 10 |

| Increase / decrease of average net profit amount of TOP-1000 companies |  10 10 |

| Increase / decrease of average net loss amount of TOP-1000 companies |  10 10 |

| Increase / decrease of average industrial values of the current liquidity ratio |  5 5 |

| Increase / decrease of average industrial values of the return on investments ratio |  10 10 |

| Increase / decrease of average industrial values of the assets turnover ratio, times |  -10 -10 |

| Share of small and medium enterprises in the industry in terms of revenue volume more than 22% |  5 5 |

| Regional concentration |  -10 -10 |

| Financial position (major share) |  10 10 |

| Solvency index Globas (major share) |  10 10 |

| Industrial production index |  -10 -10 |

| Average value of factors |  2,7 2,7 |

positive trend (factor),

positive trend (factor),  negative trend (factor).

negative trend (factor).