Electric equipment manufacturers in Samara

Performance evaluation of liabilities to assets ratio of the largest electric equipment and electronics manufacturers in Samara in 2020 indicates the extra debt load of the enterprises and it can worsen stability of their financial position.

Information agency Credinform selected for this ranking companies with the largest volume of annual revenue according to the data from the Statistical Register and the Federal Tax Service for the latest available periods (2018 - 2020). These companies manufacture computers, peripheral units, communication tools and similar electronic products, and also applications that produce, split and use electric power (TOP 10 and TOP 100). They were ranked by liabilities to assets ratio (Table 1).The selection and analysis were based on the data of the Information and Analytical system Globas.

Liabilities to assets ratio shows the share of assets financed by loans. The standard value for this ratio is from 0.2 to 0.5

Sales revenue and net profit show the scale of the company and the efficiency of its business, and the liabilities to assets ratio indicates the risk of insolvency of the company.

Exceeding the upper standard value indicates excessive debt load, which can stimulate development, but negatively affects the stability of the financial position. If the value is below the standard value, this may indicate a conservative strategy of financial management and excessive caution in attracting new borrowed funds.

For the most complete and objective view of the financial condition of the enterprise, it is necessary to pay attention to the complex of indicators and financial ratios of the company.

| Name, INN, type of activity | Revenue, million RUB. | Net profit (loss), million RUB. | Liabilities to assets ratio (x), from 0,2 to 0,5 | Solvency index Globas | |||

| 2019 | 2020 | 2019 | 2020 | 2019 | 2020 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| OOO PK ELEKTRUM INN 6315597656 Manufacture of electricity distribution and control apparatus |

1 871,8 1 871,8 |

1 315,2 1 315,2 |

-0,8 -0,8 |

14,1 14,1 |

0,99 0,99 |

0,95 0,95 |

260 Medium |

| OOO EKKA INN 6314042860 Manufacture of other electrical equipment |

285,5 285,5 |

397,9 397,9 |

17,6 17,6 |

10,3 10,3 |

0,89 0,89 |

0,87 0,87 |

265 Medium |

| AO GK ELECTROSHIELD - TM SAMARA INN 6313009980 Manufacture of electric motors, generators and transformers, except repair |

10 861,8 10 861,8 |

1 234,9 1 234,9 |

-1 671,2 -1 671,2 |

-538,6 -538,6 |

0,78 0,78 |

0,61 0,61 |

289 Medium |

| AO NPTS INFOTRANS INN 6311012176 Manufacture of other devices, sensors, equipment and tools for measuring, control and testing |

1 833,3 1 833,3 |

1 792,2 1 792,2 |

222,2 222,2 |

165,4 165,4 |

0,59 0,59 |

0,49 0,49 |

152 Superior |

| CZ EMI INN 6318100022 Manufacture of wiring devices |

1 187,1 1 187,1 |

1 252,6 1 252,6 |

76,3 76,3 |

110,1 110,1 |

0,49 0,49 |

0,48 0,48 |

180 High |

| OOO NVF SMS INN 6315506610 Manufacture of automatic regulating or controlling instruments and apparatus |

931,5 931,5 |

1 583,4 1 583,4 |

10,1 10,1 |

7,7 7,7 |

0,57 0,57 |

0,48 0,48 |

194 High |

| OOO NTF BACS INN 6311007747 Manufacture of instruments and appliances for measuring, testing and navigation |

1 836,3 1 836,3 |

932,5 932,5 |

536,1 536,1 |

131,8 131,8 |

0,53 0,53 |

0,46 0,46 |

219 Strong |

| JOINT STOCK COMPANY SAMARA CABLE COMPANY INN 6318101450 Manufacture of other wires and cables for electronic and electric equipment |

5 868,6 5 868,6 |

5 538,8 5 538,8 |

182,0 182,0 |

223,4 223,4 |

0,44 0,44 |

0,40 0,40 |

174 Superior |

| LIMITED LIABILITY COMPANY METROLOGY AND AUTOMATION INN 6330013048 Manufacture of instruments and appliances for measuring, testing and navigation |

549,3 549,3 |

399,2 399,2 |

28,3 28,3 |

5,3 5,3 |

0,29 0,29 |

0,32 0,32 |

248 Strong |

| OOO BITAS INN 6318149028 Manufacture of instruments and appliances for measuring, testing and navigation |

305,6 305,6 |

404,4 404,4 |

27,9 27,9 |

48,3 48,3 |

0,15 0,15 |

0,11 0,11 |

192 High |

| Average value for TOP 10 companies |  2 553,1 2 553,1 |

1 485,1 1 485,1 |

-57,1 -57,1 |

17,8 17,8 |

0,57 0,57 |

0,52 0,52 |

|

| Average value for TOP 100 companies |  308,6 308,6 |

293,4 293,4 |

-3,1 -3,1 |

3,6 3,6 |

0,65 0,65 |

0,83 0,83 |

|

improvement compared to prior period,

improvement compared to prior period,  decline compared to prior period

decline compared to prior period

Indicators of six companies show liabilities to assets ratio within the standard value. However, average values of TOP 10 and Top 100 in 2020 is above the standard value.

Moreover, in 2020 three companies of TOP 10 increased the revenue and five companies gained the net profit. The revenue of TOP 10 fell at average 42% and TOP 100 at 5%. The average net profit of TOP 10 and TOP 100 increased more than 2 times.

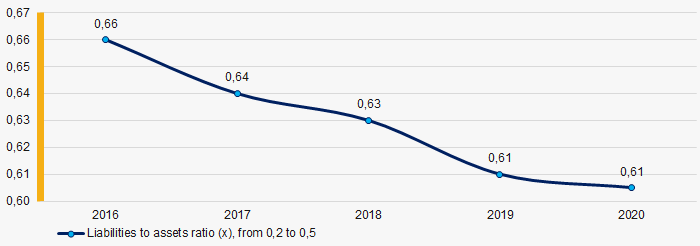

In general, during last 5 years, the average industry values of liabilities to assets ratio were constantly decreasing toward reaching the interval of the standard value. (Picture 1).

Picture 1. Change in the industry average values of the liabilities to assets ratio of the electric equipment and electronics manufacturers in 2016 – 2020.

Picture 1. Change in the industry average values of the liabilities to assets ratio of the electric equipment and electronics manufacturers in 2016 – 2020.Legislation amendments

August 25, 2021 came in force the Federal Law No. 143-FZ dated 26.05.2021. We reported about the enactment in our notice dated 24.06.2021.

This Law amended the Federal Law "On State Registration of Legal Entities and Individual Entrepreneurs" and the Article 80 of the Fundamental Principles of Legislation of the Russian Federation on the Notaries.

According to the new rules the notaries who certified the authenticity of signatures on applications for state registration of legal entities or individual entrepreneurs are required to send independently on the same day the necessary information to the registration authorities in electronic form with a strengthened qualified signature.

Moreover location of the applicants or availability of a personal strengthened qualified signature does not matter.

These rules do not apply to certain types of legal entities whose registration requires special procedure by legislation.

The users of the Information and Analytical system Globas have access to the full, relevant and up-to-date information about more than 7 thousand notaries and notary chambers (including inactive).