Net profit of the largest manufacturers of dairy products in Russia

Information agency Credinform prepared the ranking of the largest manufacturers of milk, cheese and other dairy products in Russia.

The TOP-10 companies with the highest volume of revenue were selected for the ranking (according to the data from the Statistical Register for the latest available period - for the year 2014); dynamic of the profit related to the previous period, the value of net profit were rated (look at the table 1).

Net profit is undistributed profit (uncovered loss) of the reported period, remained after paying the profit tax and other obligatory payments to the budgets of all levels. Index may be considered as total financial result of enterprise activity.

Net profit may be used for investments into production process, organizing capital reserves, growth of working capital.

Assuming that main aim of the enterprise activity is profit-making, presence of net loss is the evidence of wrong financial strategy, errors of management, changes in external environment.

Fixing of net profit during some years can make future existence of the firm questionable, leading to its bankruptcy.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention not only to average values of profit in the industry, but also to all available combination of financial data.

| № | Brand/name | Region | Revenue, mlnRUB, 2014 | Revenue increase, % | Net profit, mln RUB, 2014 | GLOBAS-i® index of insolvency |

|---|---|---|---|---|---|---|

| 1 | Open Joint-stock company Wimm-Bill-Dann INN 7713085659 |

Moscow | 84 178,4 | 13,1 | 2318,0 | 230 high |

| 2 | Joint-stock company Danone Russia INN 7714626332 |

Moscow | 40 905,0 | 1,9 | 2247,0 | 266 high |

| 3 | LLCHochland Russland INN 5040048921 |

Moscow region | 11 574,1 | 33,8 | 539,6 | 170 The highest |

| 4 | Open Joint-stock company Dairy Plant Voronezh INN 3662009586 |

Voronezh region | 11 145,2 | 26,0 | 363,2 | 196 The highest |

| 5 | Open Joint-stock company Milkom INN 1834100340 |

The Udmurt Republic | 10 732,1 | 111,6 | 750,7 | 178 The highest |

| 6 | LLC Management Company Prosto Moloko INN 1660183627 |

The Republic of Tatarstan | 10 038,5 | 97,7 | 63,6 | 268 high |

| 7 | LLC Campina INN 5045021970 |

Moscow region | 9594,0 | 1,4 | -416,3 | 264 high |

| 8 | Close Joint-stock company Korenovsky Milk Processing company INN 2335013799 |

Krasnodar territory | 9103,6 | 32,4 | 382,7 | 194 The highest |

| 9 | Open Joint-stock company Ostankino Dairy Plant INN 7715087436 |

Moscow | 7139,8 | 12,0 | 218,2 | 199 The highest |

| 10 | Joint-stock company Lactalis Vostok INN 7716128854 |

Moscow region | 6877,2 | -16,8 | 286,6 | 213 high |

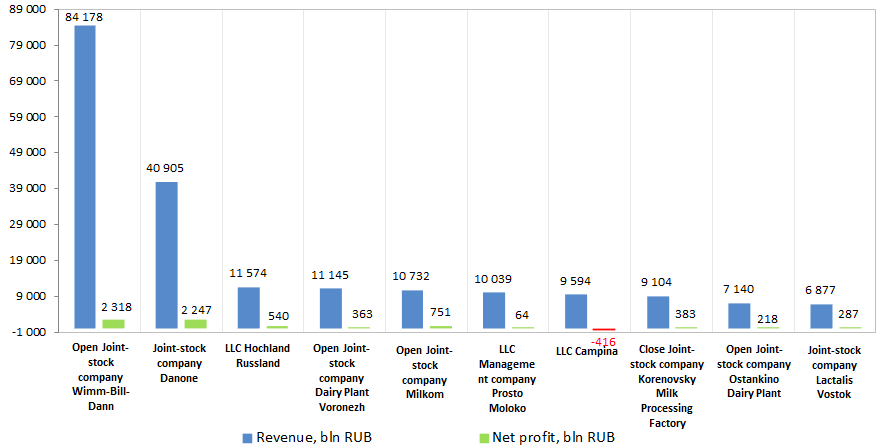

Net profit (loss) of the largest manufacturers of dairy products (Top-10) varies from

-416,3 mln RUB (LLC Campina) to 2318 mln RUB (Open joint-stock company Wimm-Bill-Dann).

Picture 1. Revenue and net profit of the largest manufacturers of milk products (Top-10)

Annual revenue of top-10 companies list according to the last annual financial report (2014) was 201,3 bln RUB, that is 16,2% higher than total index of the same manufacturers of the previous period.

The largest turnover increase (111,6%) shows manufacturer from the Udmurt Republic - Open Joint-stock company Milkom. The company was based on the subholding «Milk processing» and performs wholesale and direct sales of own products throughout Russia. «Milkom» company realizes products of the four largest milk processing companies of the Udmurt Republic: «Izhmoloko», «Sarapul-moloko», «Glazov-moloko», «Kezsky cheese factory». The company is also a distributor of LLC «Savushkin product», LLC «Yastro». Today the industry suplies market with more than 170 000 tons of dairy products per year. Today the range of products counts more than 500 brands that are produced under several registered trademarks.

It worth mentioning the long-standing leaders of the industry: Open joint-stock company Wimm-Bill-Dann and Joint-stock company Danone Russia – the largest companies, according both to the annual turnover and net profit on the dairy products market.

- Business history of «Wimm-Bill-Dann» starts in 1992. In 1993 «Wimm-Bill-Dann» began jogurts producing. That time this kind of dairy products was not well known and just began gaining popularity among the consumers. In 2002 «Wimm-Bill-Dann» is the first Russian food company, placed shares at New York Stock Exchange (NYSE). First placement of shares brought 200 bln USD to the company. On February 2011 the company, the largest manufacturer of juices and dairy products in Russia, joints the PepsiCo family. After buyng «Wimm-Bill-Dann» PepsiCo became the largest enterprise on food and drinks in Russia. Brends of output products became well known: «Agusha», «Domik v Derevne», «Chudo», «Veseliy Molochnik», «J7», «Mazhitel», «Immunel», «Lamber», « Essentuki », «BIO MAX» and others.

- In 1992 Danone is one of the first western companies appearing at the Russian market. In 1995 the first Danone plant began working. At the end of 2010 Danone jointed its dairy products business to the Unimilk company. Unimilk has its history since 2002. For several years of existence the company united about 30 milk processing plants of childhood nutrition. Investments volume of Danone since the moment of the beginning of activity in Russia reached 2 bln USD. There are 18 plants of the group, that products are manufactured under such brends as Danone, «Activia», Actimel, «Rastishka», «Danissimo», «Prostokvashino», «Bio Balance», «Actual», «Smeshariki», «Tyoma» and others.

All participants of the Top-10 largest manufacturers of dairy products ranking have got the highest and high solvency index. This obstacle shows ability of the companies to pay debt obligations in time and in full extent to debt creditors, risk of non-perfomance is minimal.

Taxation of controlled foreign companies

Information agency Credinform has often covered the subject of deoffshorization of the Russian economy. In connection with the adoption of a number of legislative acts in 2014-2015 it will be useful to revert to this actual topic and describe briefly the adopted laws.

The Federal Law №376-FZ of November 24, 2014 «On Amendments to Parts I and II of the Tax Code of the Russian Federation (regarding the taxation of profits of controlled foreign companies and profits of foreign companies)». This law has obliged the organizations registered in foreign countries, which profit exceeds 10 mln RUB, to pay income tax to the Russian budget. In case of nonpayment or understatement of tax by hiding a part of income, significant fines are prescribed, which will take effect from the tax period for 2018. Also, the criteria are specified to determine a controlled foreign company and a foreign structure with no corporate status, for which it is necessary to pay taxes on the territory of Russia. The law has obliged Russian citizens to report their participation in foreign companies to tax authorities.

The Federal Law №150-FZ of June 8, 2015 «On Amendments to Parts I and II of the Tax Code of the Russian Federation and the Article 3 of the Federal Law «On Amendments to Parts I and II of the Tax Code of the Russian Federation (regarding the taxation of profits of controlled foreign companies and profits of foreign companies)». This law has introduced the concept of controlled foreign company and controlling person. Controlled foreign company is recognized as a foreign organization, that is not registered in Russia, but controlled by a person, who is a Russian tax resident. Controlling person is recognized as a Russian citizen or a legal entity, whose share in a foreign company is 25% or more. If a person together with marriage partners and minor children owns a half of foreign business, this share is dropped to 10%.

It is introduced the concept of "place of real management" of a foreign company. If the company is managed from Russia and by Russian tax resident, it is determined the mechanism of profit taxation of this organization.

The profit of a controlled foreign company is exempt from tax, if the organization is a non-profit one or it is established in accordance with the law of a state-member of the Eurasian Economic Union.

The law prescribes that by voluntary declaration of foreign assets, an owner–natural person is exempt from tax payment by re-registration of property from nominee to its own name. The effect of this so-called "capital amnesty" is determined until December 31, 2015 by the Federal Law №140-FZ of June 8, 2015 «On the voluntary declaration of assets and bank accounts (deposits) by individuals and on amendments to certain legislative acts of the Russian Federation». Since July 1, 2015, the Federal Tax Service has been taking special declarations, the submission of which is prescribed by this law.

At the present time, for the development of a legal base on deoffshorization the Federal Tax Service (FTS) has prepared the draft of the Order, which declares the "List of states and territories, which do not ensure the exchange of information for tax purposes with the Russian Federation." The list includes 119 countries, which are not considered as traditional offshore companies, with which there is an agreement on the exchange of tax information, however, its quality is not satisfactory for the Russian part. Among them are the tax jurisdictions, for example, Austria, Great Britain, Israel, Switzerland and Estonia.

Earlier, the «List of states and territories, that provide preferential tax treatment of taxation and (or) do not require the disclosure of information by financial operations (offshore zones)» has included only 40 offshore. The list was approved by the order №108N of the Ministry of Finance of the Russian Federation from November 13, 2007.

If foreign structures of Russian companies, which accumulate profit transferred from Russia in the form of passive income, operate in the countries, that are got shortlisted in the list of the FTS, then natural and legal persons-members of these structures are obliged to pay the tax of 13% or 20%, respectively, from the retained earnings to the Russian budget.

According to experts, in the case of the adoption of this List of restrictions for Russian organizations, in particular of banking and insurance sector, as well as mining companies, they may be deprived of the opportunity to receive a benefit on the effective income tax rate, at which a controlled foreign company pays tax abroad. These rules apply to profit earned already in 2015.

In general, the adopted innovations are focused on reducing of a number of companies, which are registered in countries with lower tax rates, that can significantly affect the increase in tax revenues to the Russian budget.

To review on-line the information about foreign companies, including enterprises with Russian participation, as well as to get to know special features of the disclosure of corporate information in all countries of the world, you can by making a subscription to the information and analytical system Globas-i®.