TOP-10 Russian manufacturers of bread and bakery products in terms of revenue for 2018

Information agency Credinform presents ranking of Russian manufacturers of bread and bakery products. Experts of the agency, using Information and Analytical system Globas, have selected TOP-10 manufacturers of bakery products in terms of revenue for 2018, analyzed tax payments of every enterprise to the budget of Russia and defined characteristics of the market.

Bread is one of the oldest food products in the world. For Russians bread has always been essential element. It has great history and is connected with plenty of traditions and memories. During the Leningrad Blockade it helped to save many lives. Although, in terms of ingredients it hardly resembled familiar food product

Before the transition to postindustrial society hard and menial labor prevailed in Russia, and bread was the only available product for workers to recover strength and be sated without burdening a budget.

Bread is a good of first priority, and its` production is one of the most important industries in any country.

According to the data of the Information and Analytical system Globas, TOP-10 companies take only 11,2% of the market in terms of comprehensive annual revenue, that amounted to 345,8 billion RUB, following the results of 2018.

Remarkably, revenue of companies is distributed equally, and industrial concentration is moderate, new manufacturers often appear at the market. TOP-60 companies take only 38,5% of the industry.

| № | Manufacturer name | Revenue for 2018, billion RUB | Tax payments for 2018, billion RUB | |

| 1 | KARAVAI Saint Petersburg |

6473,0 | -6,5% | 558,4 |

| 2 | BKK Kolomenskiy Moscow |

6367,8 | +32,0% | 431,8 |

| 3 | LIMAK Lipetsk |

5873,2 | -2,0% | 457,9 |

| 4 | PERVYI KHLEBOKOMBINAT Chelyabinsk |

4149,6 | -0,4% | 564,9 |

| 5 | THE GROUP OF COMPANIES DARNITSA Saint Petersburg |

3947,6 | -0,3% | 74,7 |

| 6 | CONFECTIONARY AND BREAD FACTORY CHERIOMUSHKI Moscow |

3497,7 | +5,8% | 314,4 |

| 7 | Lantmannen Unibake Egoryevsk (Moscow region) |

3291,7 | +30,0% | 159,4 |

| 8 | SMAK Ekaterinburg |

2952,9 | +9,2% | 213,2 |

| 9 | VOLZHSKY PEKAR Tver |

2791,5 | -6,1% | 265,4 |

| 10 | KHLEBOZAVOD №28 Moscow |

2357,3 | +13,0% | 100,1 |

The largest Russian manufacturer of bread and bakery products is KARAVAI (6,4 billion RUB), located in Saint Petersburg, share of its`s production is 1,9 % of the total revenue in the industry. Amount of tax payments of the company to the budget of Russia amounted to more than 550 million RUB in 2018. For one year revenue has decreased on 6,5%, and industrial volume on 2%.

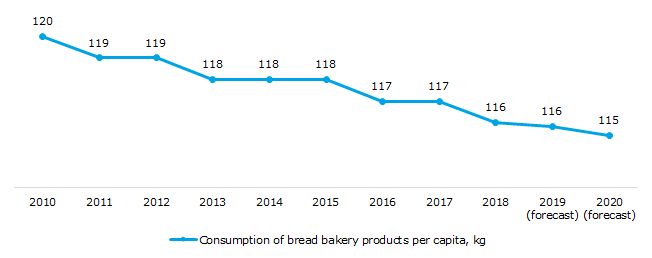

Decrease in revenue of the majority of Russian manufacturers is related to reduction of bread products consumption (Picture 1). Since 2010-2018 consumption has decreased on 3,3%, and following the results of 2019 and 2020, continuation of the existing trend should be expected. Decrease in consuming of bakery products among Russians is connected with pursuance of healthy lifestyle and switch to dietetic, light, healthy nutrition. Ration is also becoming more diversified: bread is replaced with other available food products.

Picture 1. Dynamics of bread and bakery consumption (on a per capita basis) in 2010-2020, kg

Picture 1. Dynamics of bread and bakery consumption (on a per capita basis) in 2010-2020, kgSource: Unified Interdepartmental Statistical Information System, calculation by Credinform

However, part of the top group demonstrate increase in revenue on 5, 9 and even 30%.

With the help of the instrument of the Information and Analytical system Globas – Сompany's position in the industry, the reason for increase in revenue of Moscow bread-baking factories was figured out. The point is that companies started leaving the market for various reasons. Amount of liquidations has increased on 26,5%. Vacant shares of the market are distributed between large manufacturers of bread and bakery products, thereby promoting increase offtake of products and sales.

Therefore, bakery and confectionary factories Kolomenskoe (2-nd place; 6,4 billion RUB), Cheriomushki (6-th place; 3,5 billion RUB) and Khlebozavod №28 (10-th place; 2,4 billion RUB) demonstrate revenue growth, on the back of general reduction of consumption.

Lantmannen Unibake company takes seventh place in the ranking (3,3 billion RUB). Revenue of the enterprise has increased on 30,0% for a year. Growth of an indicator is mainly connected with the uniqueness of the sold product range. The company produces burger, hot-dog and sandwich rolls, for cafes and fast food restaurants. These products are of great demand among Russian people, as it is fast, cheap and tasty.

Bread-baking manufacture is one of the most important industry of Russia not only because of good of first priority production, but also in terms of amount of tax payments to the state budget. 3,1 billion RUB as taxation of the TOP-10 manufacturers of bread-baking products was entered to the Treasury of the RF in 2018.

Results of the ranking have shown that bread-baking industry still remains vitally important for the country, in spite of general decrease in bakery products consumption among the population. In general, bread and bakery products manufacturing industry is one of the most well-balanced in the economy. Shares of companies are equally distributed between the market participants and new manufacturers appear.

Profit level of construction companies

Information agency Credinform has prepared a ranking of the largest Russian companies engaged in specialized building activity. The largest enterprises (TOP-10) in terms of annual revenue were selected according to the data from the Statistical Register for the available periods (2016-2018). Then the companies were ranged by net profit ratio (Table 1). The analysis was based on the data from the Information and Analytical system Globas.

Net profit ratio (%) is calculated as a ratio of net profit (loss) to sales revenue. The ratio reflects the company’s level of sales profit.

The ratio doesn’t have the standard value. It is recommended to compare the companies within the industry or the dynamics of a ratio for a certain company. The negative value of the ratio indicates about net loss. The higher is the ratio value, the better the company operates.

For the most full and fair opinion about the company’s financial position the whole set of financial indicators and ratios should be taken into account.

| Name, INN, region | Revenue, million RUB | Net profit (loss), million RUB | Net profit ratio, % | Solvency index Globas | |||

| 2017 | 2018 | 2017 | 2018 | 2017 | 2018 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| KORPORATSIYA AKTSIONERNOI KOMPANII ELEKTROSEVKAVMONTAZH INN 2312065504 Krasnodar region |

14876 14876 |

24767 24767 |

1112 1112 |

1872 1872 |

7,48 7,48 |

7,56 7,56 |

176 High |

| MODERN MINING TECHNOLOGIES LLC INN 4205185423 Kemerovo Region - Kuzbass |

12956 12956 |

17510 17510 |

250 250 |

485 485 |

1,93 1,93 |

2,77 2,77 |

214 Strong |

| LSR. STROITELSTVO-SZ LLC INN 7802862265 St. Petersburg |

17772 17772 |

16363 16363 |

720 720 |

438 438 |

4,05 4,05 |

2,68 2,68 |

228 Strong |

| SPETSSTROISERVIS LLC INN 1644040406 Republic of Tatarstan |

15581 15581 |

14762 14762 |

279 279 |

315 315 |

1,79 1,79 |

2,13 2,13 |

204 Strong |

| ESTA KONSTRUCTION LLC INN 7704615959 Moscow |

19367 19367 |

17358 17358 |

174 174 |

284 284 |

0,90 0,90 |

1,64 1,64 |

242 Strong |

| JSC TRUST KOKSOKHIMMONTAZH INN 7705098679 Moscow |

28914 28914 |

27533 27533 |

342 342 |

349 349 |

1,18 1,18 |

1,27 1,27 |

180 High |

| JSC RZDSTROY INN 7708587205 Moscow |

119886 119886 |

107482 107482 |

303 303 |

378 378 |

0,25 0,25 |

0,35 0,35 |

245 Strong |

| ZAPOLYARNAYA STROITELNAYA KOMPANIYA LLC INN 2457061775 Krasnoyarsk region |

22777 22777 |

14012 14012 |

-988 -988 |

-249 -249 |

-4,34 -4,34 |

-1,78 -1,78 |

272 Medium |

| LLC SPECIALIZED CONSTRUCTION COMPANY GAZREGION INN 7729657870 Moscow |

31801 31801 |

26017 26017 |

502 502 |

-481 -481 |

1,58 1,58 |

-1,85 -1,85 |

326 Adequate |

| LLC BRYANSKAGROSTROY INN 3250521869 Bryansk region |

12997 12997 |

19926 19926 |

1 1 |

-562 -562 |

0,01 0,01 |

-2,82 -2,82 |

313 Adequate |

| Average value for TOP-10 companies |  29693 29693 |

28573 28573 |

269 269 |

283 283 |

1,48 1,48 |

1,20 1,20 |

|

| Average industry value |  32 32 |

32 32 |

0,51 0,51 |

0,67 0,67 |

1,60 1,60 |

2,12 2,12 |

|

growth of indicator in comparison with prior period,

growth of indicator in comparison with prior period,  decline of indicator in comparison with prior period

decline of indicator in comparison with prior period

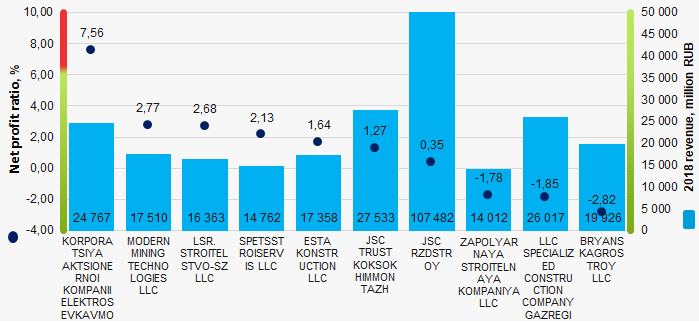

In 2018, the average value of net profit ratio for TOP-10 companies is lower than average industry value: seven companies improved the results.

Picture 1. Net profit ratio and revenue of the largest Russian companies engaged in specialized building activity (ТОP-10)

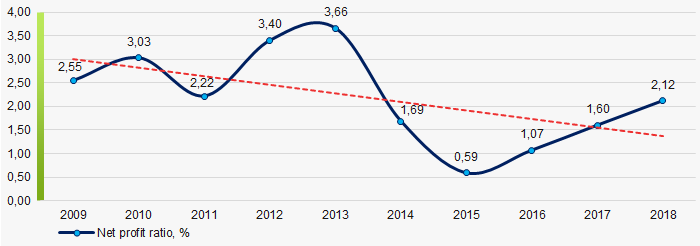

Picture 1. Net profit ratio and revenue of the largest Russian companies engaged in specialized building activity (ТОP-10)Within 10 years, the average industry indicators of the net profit ratio showed the decreasing tendency. (Picture 2).

Picture 2. Change in average industry values of the net profit ratio of Russian companies engaged in specialized building activity in 2009 – 2018

Picture 2. Change in average industry values of the net profit ratio of Russian companies engaged in specialized building activity in 2009 – 2018