Is it necessary to review bank, while checking the counterparty?

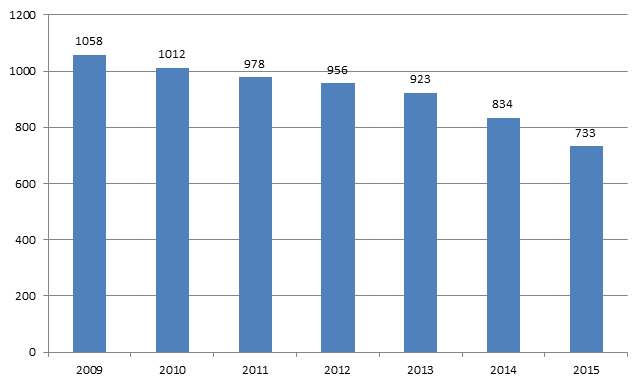

Over the last few years the number of active credit institutions (banks and non-bank credit institutions) has reduced from 1058 in 2009 to 733 in 2015. The increase trend of liquidated organizations became especially noticeable after 2013: 89 companies were liquidated in 2014, 101 companies – in 2015; in most cases the reason of liquidation is revocation of a license.

Diagram 1. Active credit institutions (banks and non-bank credit institutions) with the right to carry out banking operations (as of the end of the year)

- Among the reasons of revocation of credit institutions’ banking licenses are:

- non-execution of the Federal Laws and the Bank of Russia statutory enactments, regulating banking activity;

- numerous violation of requirements, established by articles 6 and 7 of the Federal Law № 115-FZ «On countering the legislation of illegal earnings (money laundering) and the financing of terrorism»

- inability to satisfy requirements of creditors under monetary obligations within 14 days from the date of their satisfaction;

- decrease in own funds (capital) below the minimum value of authorized capital (as of the date of state registration of the credit institution);

- ascertainment of the facts of substantial unreliability in reporting data;

- capital adequacy ratio (standard value Н1.0) is lower than 2% etc.

Among main reasons of license’s revocation are: money laundering, loss of capital and swindling. Frequent cases of identifying of unreliable banks confirm the necessity to check the bank, which holds the counterparty’s accounts, while it’s reviewing. If worse comes to worst, in case of bank’s liquidation the counterparty may completely lose its money funds. This case will lead to failure of contractual obligations and may cause the significant damage to a business.

Information and analytical system Globas-i® may check the counterparty’s bank, in particular: license availability, participation in S.W.I.F.T. and deposit insurance systems; to estimate the development of branch network; to compare bank’s indicators with mandatory standards, established by the Central Bank of Russia; to review the cash flows, assets value, cases of nonfulfillment of obligations, participation as a defendant in arbitration cases, negative information.

Based on the analysis of available information, Globas-i® System generates «Financial stability index of a credit institution». This is an independent assessment of the reliability and financial stability of a credit institution; it takes into account key performance indicators, regulatory compliance, established by the Central Bank of Russia, and quality indicators.

Introduction of responsibility for Russian and foreign legal entities for bribery of public officials abroad

In March 2016 the Federal law of Russian Federation as of 09.03.2016 №64-FZ “Concerning the Introduction of Amendments to Code of the Russian Federation on Administrative Violations” came into force.

The amendments refer to the clauses concerning illegal gratification on behalf of the legal entity. The dispositions of the statute are now practiced in cases when the transfer or promise of money and valuables took place abroad. The responsibility occurs if these actions were stacked against interests of Russia as well as in cases contemplated by the international treaty of Russia if the violator wasn’t brought to criminal or administrative responsibility in the foreign country.

The lawbreakers might be fined under administrative procedures. The penalties amount to:

- in case of small bribery (less than 1 million RUB) – up to three-fold amount of remuneration but no fewer than 1 million RUB;

- in case of major bribery (from 1 to 20 million RUB) – up to thirty-fold amount of remuneration but no fewer than 20 million RUB;

- in case of grand bribery (more than 20 million RUB) – up to hundred-fold amount of remuneration but no fewer than 100 million RUB;

The fine sanctions are as well extended to foreign legal entities.

The law introduces the administrative responsibility for violation of contracts concluded on unorganized tenders such as: repurchase agreements, contracts being derivative financial instruments or other contracts provided by the statutory acts of the Central Bank of Russia or federal laws. The responsibility is also contemplated for filing of incomplete or unreliable information, violation of procedure and terms of filing of such information on aforementioned contracts or general agreement to repository or the Bank of Russia. The violation is punishable by an administrative fine for public officials ranging from 20 to 30 th RUB, and for legal entities – from 300 to 500 th RUB.

The administrative responsibility of repositories is significantly strengthened. This is relevant to such actions as improper refusal or avoidance of making entry on the aforementioned agreements; making of such entry without causes contemplated by federal laws or statutory acts of the Central Bank of Russia; non-fulfilment or improper fulfilment of the duty to file information from the list of agreements, including to the Central Bank of Russia; illegal acquisition, use or disclosure of information or data from the list of agreements. Such violations are fraught with fines – for public officials ranging from 30 to 50 th RUB, for legal entities – from 700 th to 1 million RUB.