Top-10 basketball clubs of the VTB United League

The Information agency Credinform presents a ranking of the basketball clubs of the VTB United League by total assets. Using the Information and Analytical System Globas, the experts of the Agency selected Top-10 of basketball teams with the largest amount of assets. To get the total value of the assets of the club, its annual budget was taken into account. The experts also identified the most valuable players.

VTB United League is a basketball tournament created by VTB Bank and the Russian basketball federation in 2008. It unites the clubs from Russia, Kazakhstan, Belarus, Poland and Estonia and is the official FIBA1 tournament. It has the status of the championship of Russia.JSC Bank VTB is the primary sponsor.

VTB United League is the most prestigious and first in the division of professional basketball in Russia. The major trophy is the League Cup, played in the play-offs2. The predecessor of the VTB League was the Russian Basketball Championship, which was held from 1992 to 2008. Due to the constantly emerging problems with financing, most professional clubs began to go bankrupt, the championship participants and audience became less, and the popularization of basketball fell. Under the prevailing negative trend, it was decided to expand the boundaries of the competitions held; foreign clubs were invited, and the Russian Basketball Championship was held under the auspices of the VTB United League.

As in hockey, the value of a player is determined by his contract, i.e. the amount that a sports organization spends on paying a salary to a player while he plays for a club.

Transitions of players between clubs are possible only with the full consent of the players, moreover, the receiving party fully redeems the salary contract from the previous club. The financial conditions for each basketball player are individual and depend on many factors, so the procedure of such a transition is very difficult. Most often, the transition to other teams is carried out in the status of a free agent, i.e. at the moment when the contract expired and all obligations of the player to the club are fully fulfilled. Unlike hockey, in basketball most contracts are signed for one season. If the club is satisfied with the player, he is given the right to extend the employment contract, with the possibility of revising various conditions. Therefore, having 5-6 clubs per career is normal for most basketball players.

Another feature of the championship is that foreign clubs can not become champions of Russia in the regular competition. They can win the league only through the playoffs, winning the cup. If the first place in the regular championship will be taken by a foreign representative, the winner will be the domestic team with the highest points among Russian teams.

| Rank | Name | Balance sheet assets, million RUB | Club’s budget/Salary project, million RUB | Total assets value, million RUB | The most valuable player | |

| 1 | PBC CSKA Moscow |

800,0 | 2685,0 | 1551,5 | 3485,8 | Nando de Colo (157, 5 million RUB per year) |

| 2 | BC UNICS Kazan |

359,9 | 897,2 | 438,0 | 1257,1 | Jamar Smith (40 million RUB per year*3) |

| 3 | PBC Lokomotiv-Kuban Krasnodar |

333,3 | 1129,0 | 642,8 | 1462,3 | Dmitry Kulagin (126 million RUB per year) |

| 4 | BC Khimki Khimki (Moscow region) |

227,3 | 1676,0 | 811,1 | 1903,3 | Alexei Shved (189 million RUB per year) |

| 5 | BC Zenit Saint Petersburg |

115,6 | 854,7 | 437,6 | 970,3 | Sergey Karasev (94,5 million RUB per year) |

| 6 | BC Parma Perm Perm |

39,0 | 217,9 | 44,0 | 256,9 | Rashard Kelly (4,4 million RUB per year *) |

| 7 | BC Yenisei Krasnpyarsk |

15,9 | 269,7 | 192,4 | 285,6 | D'Angelo Harrison (12,8 million RUB per year *) |

| 8 | BC Avtodor Saratov |

9,8 | 169,7 | 120,3 | 179,5 | Perrin Buford (8 million RUB per year *) |

| 9 | BSK Samara Samara |

9,6 | - | - | 9,6 | Vladimir Pichkurov (data is not disclosed) |

| 10 | BC Nizhniy Novgorod Nizhniy Novgorod |

Data not disclosed | 424,4 | 135,0 | 424,4 | Vladimir Dragichevich (9,6 million RUB per year *) |

PBC CSKA with the highest balance sheet assets (800 million rubles) and the budget (2,7 billion RUB) is the first in the ranking. CSKA is the most titled club in the history of domestic and world basketball: it won trophies in championships of the USSR-era, as well as Russian and European ones.

In Russia, PBC CSKA is the absolute champion and the second to no one:

- 10 out of 11 times became the winner of the VTB United League;

- 26 out of 28 became the champion of Russia;

- 24-time USSR champion;

- 8-time Euroleague winner4

CSKA Basketball Club has the strongest and most valuable team in the entire league. However, at the end of the season 2018/19, having won another victory in the Euroleague and in the domestic championship, a number of leaders left the team. In the season 2019/2020, the reshaped team will play.

The second is BC UNICS from Kazan. The volume of the balance sheet assets of the club is almost 2,5 times less than the sum of balance assets (359,9 million RUB) than of the Top leader. The team from Tatarstan is inferior to Moscow not only by the sum of balance sheet assets, but also by all other indicators. Throughout the history of BC UNICS, the club have never become the Champion of Russia and the winner of the VTB United League: 8 times it has been a step from the championship, and 11 times took the third place. However, the Kazan club has an international trophy: in the season 2010/11 the team won the European Cup5. The most valuable player of BC UNICS is Jamar Smith (40 million RUB per year). The American played in many European clubs, has a large number of individual awards and achievements based on the results of his performance in the VTB United League.

PBC Lokomotiv-Kuban is ranked the third. Like the BC UNICS team, Lokomotiv-Kuban has never won domestic championships: once it won the second place and 5 times - the third. But in the season 2012/13, the Krasnodar team won an international trophy - the European Cup. In terms of the budget for the season, the club from Krasnodar has almost no equal (1,1 billion RUB). The most valuable player is Dmitry Kulagin (126 million RUB per year), a multiple champion in other teams, the winner of the Euroleague in the season 2015/16 in the PBC CSKA.

BC Khimki in the season 2010/11 became the champion of the VTB United League, which allowed the club to be ranked the second team in in terms of trophies. Russia. In addition, the club is a two-time winner of the European Cup and won the second place in the Russian championships for 16 times. The most valuable player of the team is Alexei Shved (189 million RUB per year). The Russian played in the NBA6for 3 seasons. He is the multiple winner of the Russian championships, Honored Master of Sports of Russia, winner of the Euroleague, bronze medalist of the Olympic Games in London (2012) and European Championship (2011), and the member of the NBA rising stars competition (2013).

The fifth is the club from St. Petersburg. BC Zenit was formed in 2014. Over the five years of its existence, the team has achieved quite good results: 3-time bronze medalist of the VTB United League, regular participant in the play-offs, finalist of the Russian Basketball Championship. The most valuable player in the team is Sergey Karasev (94,5 million RUB per year). He played in the NBA for 3 seasons and helped the Russian team win bronze medals at the Olympic Games in London (2012).

The balance sheet assets of basketball clubs from the second part of the table do not exceed the total balance sheet assets of the team from Saint Petersburg. BC Parma, BC Yenisei, BC Avtodor, BSK Samara and BC Nizhniy Novgorod did not achieve success in the Russian championship, and performances in the play-offs often ended in the first stage. Such unsatisfactory results can be explained by the lack of funding: major sponsors do not invest in the development of regional clubs, as there is a risk not to make a profit.

It is noteworthy that BSK Samara is not a member of the VTB United League. The club seeks to get into it, therefore there is no data on the budget. As soon as the Samara team expands the capacity of its basketball court to 3 thousand people, the management of the VTB United League will satisfy the request to join the top division.

Unlike football and hockey, 7 basketball teams from the Top-10 are privately owned. The owners of BC Khimki, PBC Lokomotiv-Kuban, BC UNICS, BSK Samara, BC Nizhniy Novgorod, BC Parma and BC Avtodor are individuals. They own clubs directly or through various commercial funds. The largest private metallurgical company of Russia - JSC MMC Norilsk Nickel can be considered as the main private beneficiary of PSC CSKA.

The ultimate owners of the team from Saint Petersburg are the state structures owning the basketball team through the largest corporation. BC Zenit is controlled by the Russian government through JSC Gazprom.

BC Yenisei is a non-profit organization.

The results of the ranking showed that teams with good funding are making progress in basketball. The greater the budget of the club for the season, the greater success awaits them. The first 5 teams from the Top have a serious financial support from the sponsors, and the rest of the teams have to manage with their own funds, so it is impossible to achieve great results at this level of competition.

1 FIBA is the organization uniting all national basketball federations and defining the main directions of the world basketball development.

2 Play-off - a series of elimination games (up to 3 wins).

3 * Contract details are not disclosed; the contract value is calculated approximately based on the total amount of the salary project and the number of players.

4 European basketball tournament among professional men's clubs from member countries of FIBA Europe.

5 The European Cup is the second-largest European basketball tournament among professional men's basketball clubs after Euroleague

6 NBA - National Basketball Association, men's professional basketball league of North America, the most famous and popular basketball world league

Profit level of fuel wholesale

Information agency Credinform represents the ranking of the largest wholesalers of motor fuel, including aviation gasoline. The enterprises with the largest volume of annual revenue (TOP-10) were selected for the ranking, according to the data from the Statistical Register for the latest available periods (for 2015 – 2017). Then they were ranked by the net profit ratio (Table 1). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Net profit ratio (%) is calculated as a relation of net profit (loss) to sales revenue and characterizes the level of sales profit.

There is no normative value for the indicator. It is recommended to compare enterprises of one industry, or change of the ratio in the course of time of a certain company. A negative value of the ratio indicates a net loss. A high value shows an efficient operation of an enterprise.

The experts of the Information agency Credinform, taking into account the actual situation both in the economy as a whole and in the sectors, has developed and implemented in the Information and Analytical systemGlobas the calculation of practical values of financial ratios that can be recognized as normal for a particular industry. For wholesalers of motor fuel the practical value of the net profit ratio made from 1,59 % in 2017.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention to all combination of indicators and financial ratios.

| Name, INN, region | Sales revenue, billion rubles | Net profit (loss), billion rubles | Net profit ratio, % | Solvency index Globas | |||

| 2016 | 2017 | 2016 | 2017 | 2016 | 2017 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| RN-AERO LLC INN 7705843041 Moscow |

75,48 75,48 |

97,73 97,73 |

20,52 20,52 |

14,38 14,38 |

20,30 20,30 |

15,18 15,18 |

241 Strong |

| RN-SMAZOCHNYE MATERIALY LLC INN 6227007682 Ryazan region |

28,69 28,69 |

43,13 43,13 |

1,27 1,27 |

4,85 4,85 |

17,49 17,49 |

11,24 11,24 |

153 Superior |

| KOMPANIYA ADAMAS NJSC INN 7704747779 Moscow |

39,03 39,03 |

43,61 43,61 |

-0,35 -0,35 |

1,71 1,71 |

3,66 3,66 |

3,92 3,92 |

239 Strong |

| GAZENERGOSET ST. PETERSBURG LLC INN 1515919573 Saint-Petersburg |

17,99 17,99 |

31,73 31,73 |

-0,14 -0,14 |

0,86 0,86 |

1,74 1,74 |

2,72 2,72 |

192 High |

| GAZPROMNEFT-REGIONAL SALES LLC INN 4703105075 Saint-Petersburg |

486,96 486,96 |

572,81 572,81 |

20,18 20,18 |

8,96 8,96 |

3,10 3,10 |

1,56 1,56 |

241 Strong |

| TATNEFT-AZS CENTER LLC INN 1644040195 Republic of Tatarstan |

39,07 39,07 |

45,37 45,37 |

0,42 0,42 |

0,44 0,44 |

1,94 1,94 |

0,98 0,98 |

178 High |

| NC ROSNEFT – KUBANNEFTEPRODUCT PJSC INN 2309003018 Krasnodar territory |

37,04 37,04 |

38,45 38,45 |

0,59 0,59 |

0,36 0,36 |

1,86 1,86 |

0,95 0,95 |

277 Medium |

| PTK-TERMINAL LLC INN 7806055343 Saint-Petersburg |

25,02 25,02 |

25,05 25,05 |

0,22 0,22 |

0,07 0,07 |

0,50 0,50 |

0,26 0,26 |

238 Strong |

| RN-VOSTOKNEFTEPRODUKT LLC INN 2723049957 Khabarovsk territory |

50,89 50,89 |

55,58 55,58 |

0,43 0,43 |

0,08 0,08 |

1,93 1,93 |

0,14 0,14 |

254 Medium |

| FORTEINVEST NJSC INN 7707743204 Moscow |

100,13 100,13 |

134,14 134,14 |

-9,82 -9,82 |

-1,42 -1,42 |

-3,19 -3,19 |

-1,06 -1,06 |

297 Medium |

| Total by TOP-10 companies |  900,31 900,31 |

1084,60 1084,60 |

33,33 33,33 |

30,28 30,28 |

|||

| Average value by TOP-10 companies |  90,03 90,03 |

108,46 108,46 |

3,33 3,33 |

3,03 3,03 |

4,93 4,93 |

3,59 3,59 |

|

| Industry average value |  0,64 0,64 |

0,72 0,72 |

0,014 0,014 |

0,011 0,011 |

2,17 2,17 |

1,59 1,59 |

|

improvement of the indicator to the previous period,

improvement of the indicator to the previous period,  decline in the indicator to the previous period.

decline in the indicator to the previous period.

The average value of the net profit ratio of TOP-10 enterprises is above the industry average and practical values. Three companies improved their results in 2017.

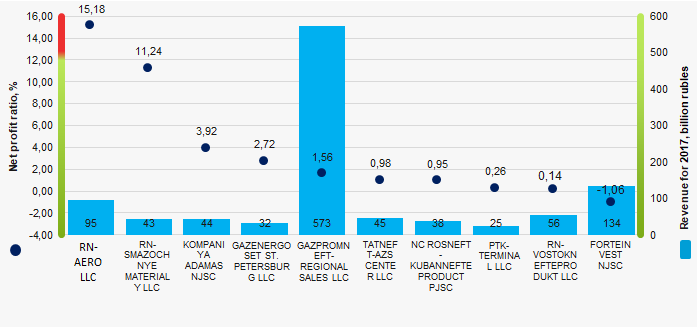

Picture 1. Net profit ratio and revenue of the largest Russian wholesalers of motor fuel (TOP-10)

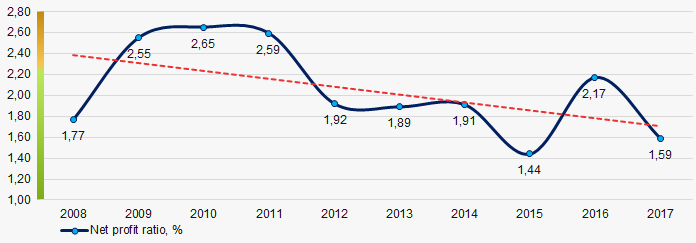

Picture 1. Net profit ratio and revenue of the largest Russian wholesalers of motor fuel (TOP-10)For ten years, the industry average indicators of the net profit ratio tend to decrease. (Picture 2).

Picture 2. Change in industry average values of the net profit ratio of Russian wholesalers of motor fuel in 2008 – 2017

Picture 2. Change in industry average values of the net profit ratio of Russian wholesalers of motor fuel in 2008 – 2017