Trends in Ekaterinburg economy in time of crisis

Information agency Credinform has prepared a review of activity trends of the largest companies of Ekaterinburg real economy sector during the financial crisis of 2008-2009.

The largest companies (ТОP-1000) in terms of annual revenue were selected according to the data from the Statistical Register for the latest available periods (2006 - 2011). The analysis was based on data of the Information and Analytical system Globas.

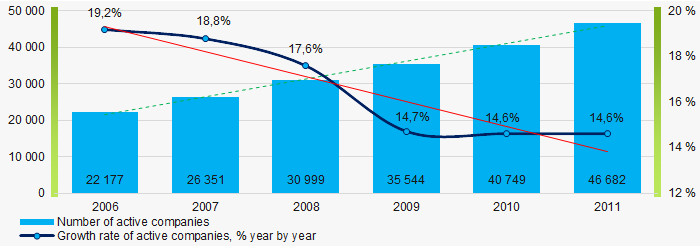

Number of active companies

Within 2006 - 2011 the number of active companies was growing, however during the acute phase of crisis, the growth rate was decreasing.

Picture 1. Dynamics of active companies in 2006 – 2011

Picture 1. Dynamics of active companies in 2006 – 2011Net assets is a ratio reflecting the real value of company's property. It is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The ratio is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

The largest company in terms of net assets was JSC Enel Russia, INN 6671156423. In 2011 net assets of the company amounted to almost 58 billion RUB. In 2019 the indicator amounted to 49 billion RUB.

The smallest size of net assets in TOP-1000 had JSC THE SVERDLOVSK SUBURBAN COMPANY, INN 6659122795. The lack of property of the company in 2011 was expressed in negative terms -1,4 billion RUB and – 2,9 billion RUB in 2019.

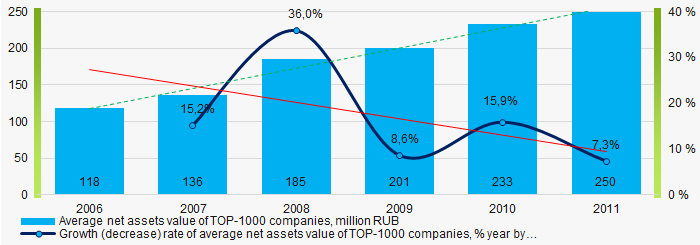

Within 2006-2011, the average values of TOP-1000 net assets showed the growing tendency, however the growth rate was decreasing during the acute phase of crisis in the beginning of recovery. (Picture 2).

Picture 2. Change in average net assets value of ТОP-1000 companies in 2006– 2011

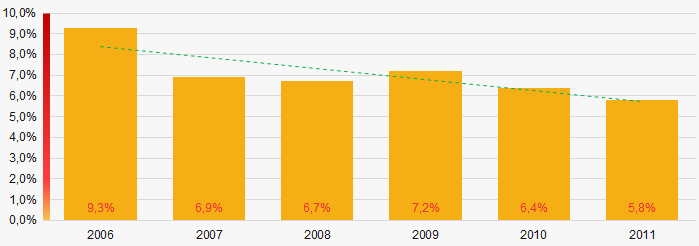

Picture 2. Change in average net assets value of ТОP-1000 companies in 2006– 2011In general, within 2006 - 2011, the share of ТОP-1000 enterprises with lack of property was decreasing (Picture 3).

Picture 3. The share of enterprises with negative net assets value in ТОP-1000 in 2006 – 2011

Picture 3. The share of enterprises with negative net assets value in ТОP-1000 in 2006 – 2011 Sales revenue

The largest company by sales revenue was also JSC Enel Russia, INN 6671156423. In 2011 the indicator amounted to almost 61 billion RUB and almost 74 billion RUB in 2019.

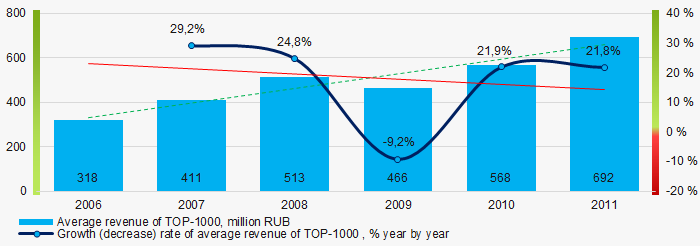

In general, the growing trend in sales revenue with decreasing growth rate was observed (Picture 4).

Picture 4. Change in average revenue of TOP-1000 in 2006 – 2011

Picture 4. Change in average revenue of TOP-1000 in 2006 – 2011Profit and loss

The largest company in terms of net profit was also JSC Enel Russia, INN 6671156423. In 2011, the company’s profit amounted to more than 3 billion RUB, in 2019 a loss of 12 billion RUB was recorded.

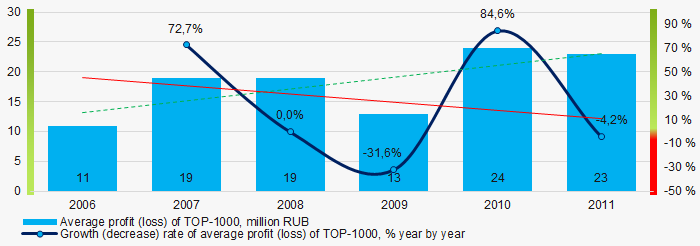

Within 2006 – 2011, the average profit values of TOP-1000 showed the growing tendency with decrease during the acute phase of crisis (Picture 5).

Picture 5. Change in average profit (loss) of TOP-1000 in 2006 – 2011

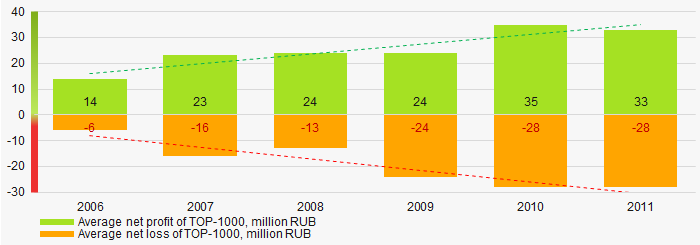

Picture 5. Change in average profit (loss) of TOP-1000 in 2006 – 2011 In 2006 – 2011 the average net profit values of ТОP-1000 showed the growing tendency, along with this the average net loss was increasing, especially in the beginning of recovery (Picture 6).

Picture 6. Change in average net profit/loss of ТОP-1000 in 2006 – 2011

Picture 6. Change in average net profit/loss of ТОP-1000 in 2006 – 2011Main financial ratios

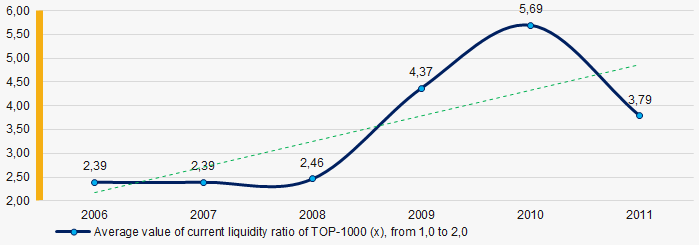

In 2006 – 2011 the average values of the current liquidity ratio were higher than the recommended values - from 1,0 to 2,0, with growing trend in the beginning of recovery (Picture 7).

The current liquidity ratio (ratio of total working capital to short-term liabilities) shows the sufficiency of company’s assets to meet short-term obligations.

Picture 7. Change in average values of current liquidity ratio of TOP-1000 companies in 2006 – 2011

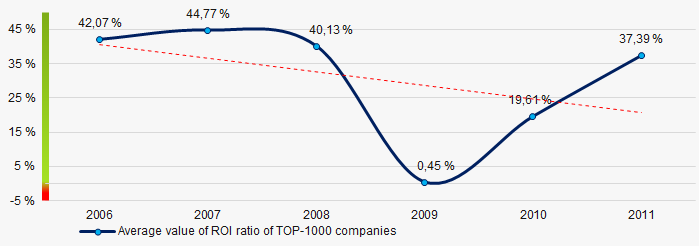

Picture 7. Change in average values of current liquidity ratio of TOP-1000 companies in 2006 – 2011Within 2006 - 2011 the decreasing trend of the average values of ROI ratio with significant downward trend in 2009 was observed (Picture 8).

The ROI ratio is calculated as a ratio of net profit to sum of stockholder equity and long-term liabilities and shows the return from equity involved in commercial activities and long-term borrowed funds.

Picture 8. Change in average values of ROI ratio in 2006 – 2011

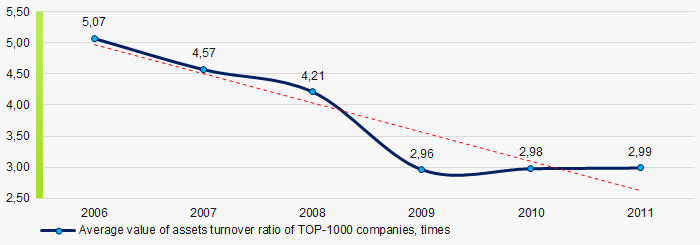

Picture 8. Change in average values of ROI ratio in 2006 – 2011 Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

In 2006 – 2011 this business activity ratio demonstrated the decreasing trend (Picture 9).

Picture 9. Change in average values of assets turnover ratio of TOP-1000 companies in 2006 – 2011

Picture 9. Change in average values of assets turnover ratio of TOP-1000 companies in 2006 – 2011Small businesses

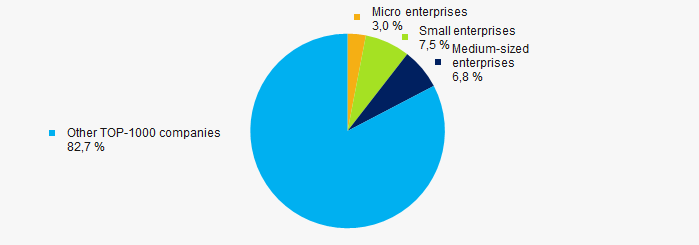

75% of ТОP-1000 companies are registered in the Unified register of small and medium-sized enterprises of the Russian Federal Tax Service. Herein, in 2011 their share in TOP-1000 total revenue amounted to 17% (Picture 10).

Picture 10. Revenue of small and medium-sized enterprises in 2011

Picture 10. Revenue of small and medium-sized enterprises in 2011Financial position score

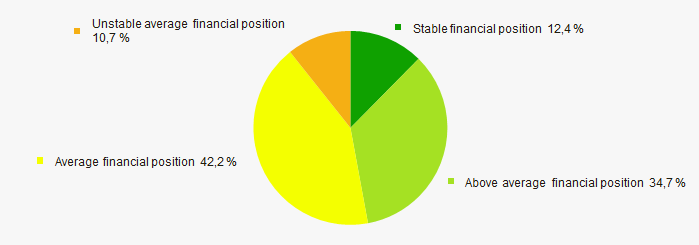

An assessment of the financial position of TOP-1000 companies shows that in 2020 the largest part has the average financial position (Picture 11).

Picture 11. Distribution of TOP-1000 companies by financial position score in 2020

Picture 11. Distribution of TOP-1000 companies by financial position score in 2020Solvency index Globas

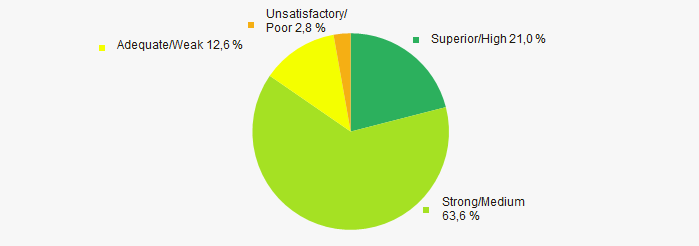

In 2020 the most of TOP-1000 companies got superior/high or strong/medium Solvency index Globas, this fact shows the ability of the companies to meet their obligations in time and fully (Picture 12).

Picture 12. Distribution of TOP-1000 companies by Solvency index Globas in 2020

Picture 12. Distribution of TOP-1000 companies by Solvency index Globas in 2020Conclusion

A complex assessment of activity of the largest Russian companies of Ekaterinburg real economy sector, taking into account the main indexes, financial ratios and indicators, demonstrates the balance of positive and negative trends within 2006-2011 (Table 1).

| Trends and assessment factors | Relative share, % | Possible forecast |

| Dynamics of active companies |  10 10 |

|

| Growth rate of active companies |  -10 -10 |

During the acute phase of crisis, the number of active companies may decrease |

| Dynamics of average net assets value |  10 10 |

|

| Growth/drawdown rate of average net assets value |  -10 -10 |

During the acute phase of crisis, the growth rate of average net assets may decrease |

| Increase / decrease in the share of enterprises with negative net assets |  10 10 |

|

| Dynamics of average revenue |  10 10 |

|

| Growth/drawdown rate of average revenue |  -10 -10 |

During the acute phase of crisis, the growth rate of revenue may decrease |

| Dynamics of average profit |  10 10 |

|

| Growth/drawdown rate of average net profit (loss) |  -10 -10 |

During the acute phase of crisis the growth rate of average profit may decrease |

| Increase / decrease in average net profit of companies |  10 10 |

|

| Increase / decrease in average net loss of companies |  -10 -10 |

In time of crisis and its recovery the net loss may increase |

| Increase / decrease in average values of current liquidity ratio |  5 5 |

|

| Increase / decrease in average values of ROI ratio |  -10 -10 |

In time of crisis, the ROI ratio may decrease |

| Increase / decrease in average values of assets turnover ratio, times |  -10 -10 |

In time of crisis, the business activity is declining and during the recovery - is slowly growing |

| Share of small and medium-sized businesses by revenue more than 20% |  -10 -10 |

|

| Financial position (the largest share) |  5 5 |

|

| Solvency index Globas (the largest share) |  10 10 |

|

| Average value of factors |  0,0 0,0 |

favorable trend (factor),

favorable trend (factor),  unfavorable trend (factor).

unfavorable trend (factor).

Denunciation of double taxation agreements

As of August 3rd, 2020 the Ministry of Finance of the Russian Federation announced the withdrawal from the Double Taxation Agreement with the Republic of Cyprus.

The Ministries of Finance of Luxembourg, Malta and the Netherlands also received the letters about the introduction of amendments to the reciprocal agreements.

The amendments were made in the framework of implementation of instruction of the President of Russia on increase of income tax rates from dividends and interests, which are withdrawn to the rest of the world accounts. This measure is meant to help to recover the damages from the economic crisis and pandemic, closing the door of large capital outflow from Russia.

As a reminder, the tax rate on dividends in the current agreement with Cyprus might be reduced to 5% or 10%, on interests – to 0%. Standard tax rate in Russia is higher: on dividends equals to 15%, on interests – to 20%.

The Ministry of Finance of Russia proposed to increase the income tax rate on dividends and interests arriving from the Russian companies to parent companies, registered in low-tax jurisdictions, to 15% starting from January 1st, 2021.

Luxembourg and Malta accepted the Russian proposal to reconsider the terms of the agreement. The Netherlands’ decision is still expected, but is likely to be positive.

Cyprus is the hardest-hit party being the most popular jurisdiction of the Russian business. According to the Ministry of Russia, more than 1,9 trillion RUB or 27 billion USD were withdrawn to Cyprus in 2019. This sum surpasses the Cyprus GDP, which amounted to 24,5 billion USD in 2019..

Cyprus disagrees with the Russian plans and sets forwards its own suggestions, as the decrease of the budget revenue might become significant. The results of the negotiations will become available after the regular meeting on the August 11th.

After the introduction of amendments, it will be unprofitable to use low-tax jurisdictions for the tax avoidance. The repatriation of the Russian holdings should be first of all expected to the regions with the special treatment - the Far East and Kaliningrad.

It is possible to monitor the changes of shareholders and beneficiaries in the Russian companies, as well as to get the information on affiliated international companies in the Globas.