TOP 10 natural gas producers

During the energy crisis in Europe, Russia is increasing its foreign gas supplies. Eight of the ten leading gas producing companies in the country are included in Gazprom Group. Analysis of the solvency ratio shows, on average, a low dependence of TOP 10 enterprises on external loans in 2020, with declining revenues and growing profits.

Information agency Credinform has selected for this ranking in Globas the largest Russian producers of natural gas and condensate. Companies with the largest volume of annual revenue (TOP 10) were selected for the ranking, according to the data from the Statistical Register and the Federal Tax Service for the latest available periods (2018 - 2020). They were ranked by solvency ratio (Table 1).

Solvency ratio (х) is calculated by dividing total equity by total assets. Shows the dependence of the company on external loans. The recommended value is >0,5.

The value of the ratio below the minimum one indicates a strong dependence on external sources of funds, which, if the market conditions deteriorate, can lead to a liquidity crisis and an unstable financial position of the company.

For the most complete and objective view of the financial condition of the enterprise, it is necessary to pay attention to the complex of indicators and financial ratios of the company.

| Name, INN, region | Revenue, million RUB | Net profit (loss), million RUB | Solvency ratio (x), >0,5 | Solvency index Globas | |||

| 2019 | 2020 | 2019 | 2020 | 2019 | 2020 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| JSC GAZPROM DOBYCHA TOMSK INN 7019035722 Tomsk region |

42 540 42 540 |

32 891 32 891 |

5 375 5 375 |

4 423 4 423 |

0,67 0,67 |

0,73 0,73 |

253 Medium |

| LLC GAZPROM DOBYCHA ORENBURG INN 5610058025 Orenburg region |

88 019 88 019 |

73 041 73 041 |

1 267 1 267 |

-309 -309 |

0,69 0,69 |

0,68 0,68 |

272 Medium |

| LLC GAZPROM DOBYCHA NOYABRSK INN 8905026850 Yamal-Nenets autonomous district |

62 531 62 531 |

81 025 81 025 |

1 283 1 283 |

4 367 4 367 |

0,22 0,22 |

0,62 0,62 |

237 Strong |

| LLC NOVATEK-YURKHAROVNEFTEGAZ INN 8903021599 Yamal-Nenets autonomous district |

171 960 171 960 |

137 716 137 716 |

4 239 4 239 |

1 930 1 930 |

0,63 0,63 |

0,61 0,61 |

256 Medium |

| JSC SEVERNEFTEGAZPROM INN 8912001990 Yamal-Nenets autonomous district |

51 742 51 742 |

44 073 44 073 |

4 408 4 408 |

5 950 5 950 |

0,68 0,68 |

0,54 0,54 |

157 Superior |

| LLC NOVATEK-TERKOSALENEFTEGAZ INN 8911020768 Yamal-Nenets autonomous district |

113 459 113 459 |

111 813 111 813 |

11 683 11 683 |

7 683 7 683 |

0,57 0,57 |

0,52 0,52 |

203 Strong |

| LLC GAZPROM DOBYCHA URENGOI INN 8904034784 Yamal-Nenets autonomous district |

303 918 303 918 |

270 016 270 016 |

16 322 16 322 |

15 816 15 816 |

0,52 0,52 |

0,49 0,49 |

191 High |

| LLC GAZPROM DOBYCHA NADYM INN 8903019871 Yamal-Nenets autonomous district |

209 533 209 533 |

211 011 211 011 |

2 390 2 390 |

4 777 4 777 |

0,30 0,30 |

0,41 0,41 |

217 Strong |

| LLC GAZPROM DOBYCHA YAMBURG INN 8904034777 Yamal-Nenets autonomous district |

333 793 333 793 |

277 478 277 478 |

1 700 1 700 |

9 021 9 021 |

0,33 0,33 |

0,40 0,40 |

202 Strong |

| LLC GAZPROM DOBYCHA ASTRAKHAN INN 3006006420 Astrakhan region |

94 612 94 612 |

78 928 78 928 |

982 982 |

237 237 |

0,37 0,37 |

0,35 0,35 |

281 Medium |

| Average value for TOP 10 |  147 211 147 211 |

131 799 131 799 |

4 965 4 965 |

5 390 5 390 |

0,50 0,50 |

0,54 0,54 |

|

| Industry average value (oil and gas extraction) |  15 939 15 939 |

10 749 10 749 |

2 421 2 421 |

1 798 1 798 |

0,65 0,65 |

0,66 0,66 |

|

growth of indicator to the previous period,

growth of indicator to the previous period,  fall of indicator to the previous period

fall of indicator to the previous period

The average 2020 value of solvency ratio of TOP 10 was above the industry average one. Six of TOP 10 companies had decrease in 2020, while in 2019 the decrease was recorded for four companies.

Two of ten companies gained revenue and four ones gained net profit in 2020.

The decrease in average revenue was 10%, and there was 33% fall of the industry average value.

The average profit of TOP 10 have increased almost 9%. However, on average in the industry, the decrease was recorded by almost 26%.

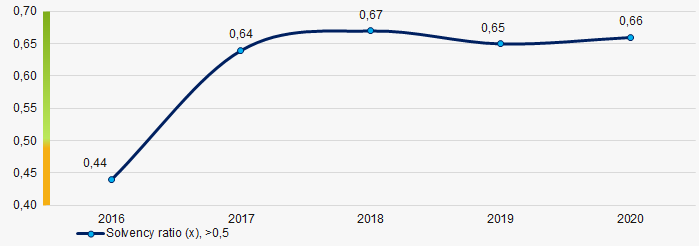

The industry average values of solvency ratio have raised for three periods during the past 5 years. The highest value was recorded in 2018 and the lowest one was in 2016 (Picture 1).

Picture 1. Change in the average values of solvency ratio of natural gas producers in 2016 - 2020

Picture 1. Change in the average values of solvency ratio of natural gas producers in 2016 - 2020TOP 1000 of the companies in Samara

Among the largest companies in Samara in 2016 – 2020 prevail positive activity trends. The most important are decline in net loss and decrease in share of companies with insufficient property, high values of return on investment ratio. Among negative trends there is decline in companies’ average net profit.

For the activity trends analysis among the largest companies in Samara information agency Credinform selected the largest companies of the city (TOP 1000) with the highest annual revenue according to the data from the Statistical Register and the Federal Tax Service for the latest available periods (2016 – 2020). The selection and analysis of companies were based on the data of the Information and Analytical system Globas.

Net assets are total assets less total liabilities. This indicator reflects the real value of the property of an enterprise. When the company’s debt exceeds the value of its property, the indicator is considered negative (insufficiency of property).

The largest company in term of net assets is LIMITED LIABILITY COMPANY RUSSIAN INNOVATION FUEL AND ENERGY COMPANY, INN 6317130144, extraction of petroleum. In 2020 net assets value of the company exceeded 338 billion RUB.

The lowest net assets value among TOP 1000 belonged to JOINT STOCK COMPANY SAMARA BEARING PLANT, INN 6318100431, manufacture of ball and rolling bearings, it was declared as insolvent (bankrupt) and bankruptcy proceedings were opened 24.04.2018. Insufficient property figured out negative value – 2.3 billion RUB.

Covering the five-year period, the average net assets values of TOP 100 have a trend to increase with the decreasing growth rate (Picture 1).

Picture 1. Change in average net assets values in 2016 – 2020

Picture 1. Change in average net assets values in 2016 – 2020Over the past five years, the share of companies with insufficient property had a positive trend to decrease (Picture 2).

Picture 2. Shares of TOP 1000 companies with negative net assets value in 2016-2020

Picture 2. Shares of TOP 1000 companies with negative net assets value in 2016-2020Sales revenue

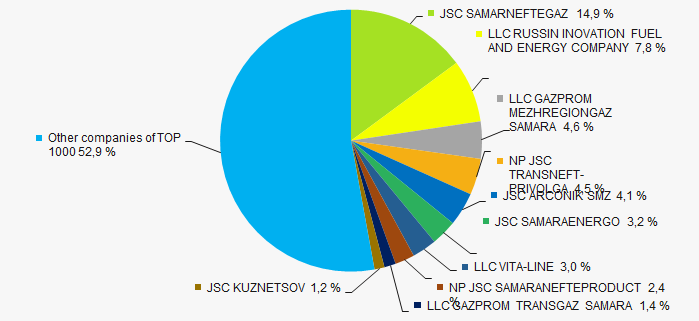

In 2020, the revenue volume of the ten largest companies was about 47% of total TOP 1000 revenue (Picture 3). This is indicative of a relatively high level of capital concentration among companies in Samara.

Picture 3. The share of TOP 10 companies in total 2020 revenue of TOP 1000

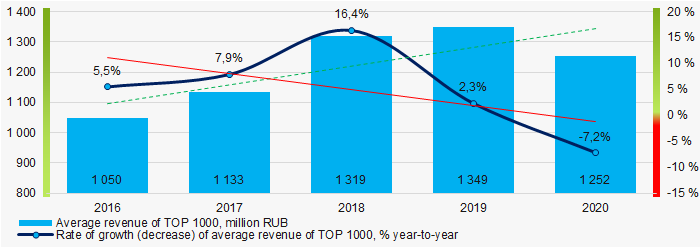

Picture 3. The share of TOP 10 companies in total 2020 revenue of TOP 1000In general, there is a trend to increase in revenue with the decreasing growth rate (Picture 4).

Picture 4. Change in average revenue in 2016 – 2020

Picture 4. Change in average revenue in 2016 – 2020Profit and loss

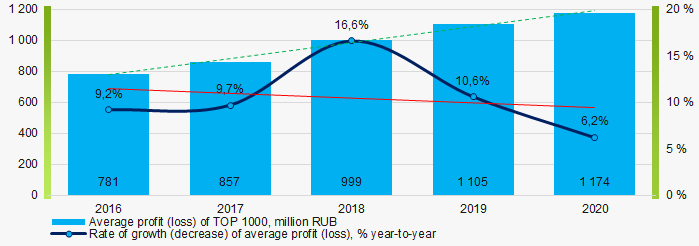

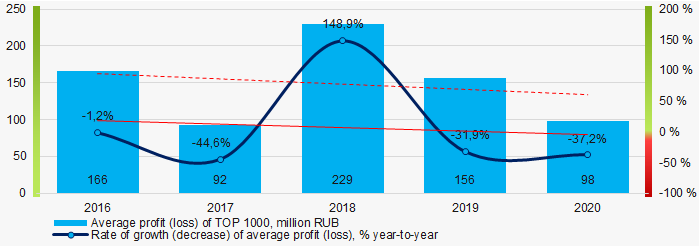

In 2020, the largest organization in term of profit was JOINT STOCK COMPANY SAMARANEFTEGAS, INN 6315229162, extraction of petroleum. The company’s profit almost exceeded 34 billion RUB. Covering the five-year period, there is a trend to decrease in average net profit and growth rate (Picture 5).

Picture 5. Change in average profit (loss) values of TOP 1000 in 2016 – 2020

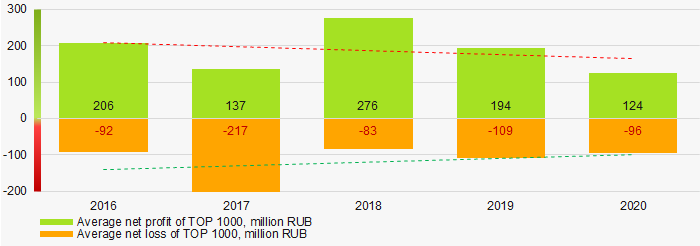

Picture 5. Change in average profit (loss) values of TOP 1000 in 2016 – 2020For the five-year period, the average profit of TOP 1000 have the decreasing trend with the increasing net loss (Picture 6).

Picture 6. Change in average net profit and net loss of ТОP 1000 in 2016 - 2020

Picture 6. Change in average net profit and net loss of ТОP 1000 in 2016 - 2020Key financial ratios

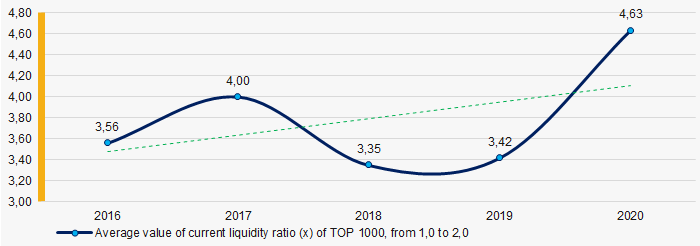

Covering the five-year period, the average values of the current liquidity ratio were above the recommended one - from 1,0 to 2,0 with a trend to increase (Picture 7).

Current liquidity ratio (current assets to short-term liabilities) shows the sufficiency of company’s assets to repay on short-term liabilities.

Picture 7. Change in industry average values of current liquidity ratio of TOP 1000 in 2016 – 2020

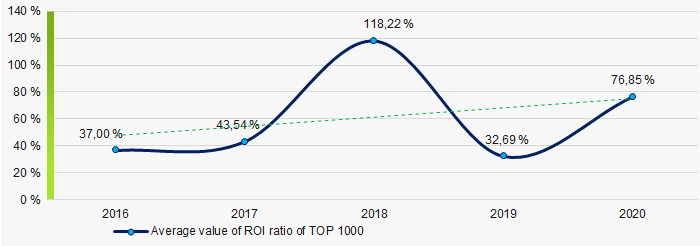

Picture 7. Change in industry average values of current liquidity ratio of TOP 1000 in 2016 – 2020Covering the five-year period, the average values of ROI ratio had a trend to increase (Picture 8).

ROI ratio is calculated as net profit to sum of shareholders equity and long-term liabilities, and shows the return of equity involved in commercial activities and long-term borrowed funds.

Picture 8. Change in industry average values of ROI ratio of TOP 1000 in 2016 - 2020

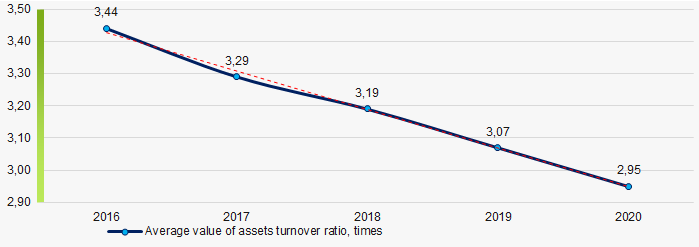

Picture 8. Change in industry average values of ROI ratio of TOP 1000 in 2016 - 2020Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

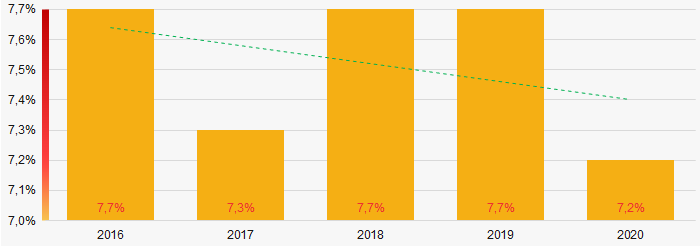

Covering the five-year period, business activity ratio demonstrated the decreasing trend (Picture 9).

Picture 9. Change in average values of assets turnover ratio of TOP 1000 in 2016 – 2020

Picture 9. Change in average values of assets turnover ratio of TOP 1000 in 2016 – 2020Small business

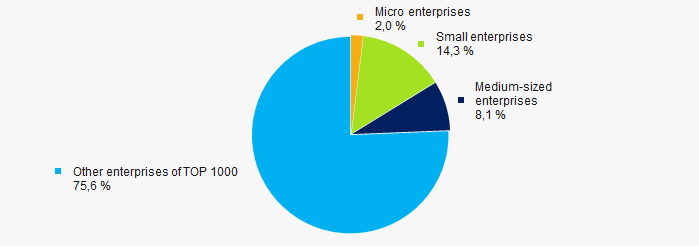

84% of companies of TOP 1000 are registered in the Register of small and medium-sized enterprises of the Federal Tax Service of the Russian Federation. In 2020, their share in total revenue of TOP 1000 is 24.4%, higher than the average country values in 2018-2019 (Picture 10).

Picture 10. Shares of small and medium-sized enterprises in TOP 1000

Picture 10. Shares of small and medium-sized enterprises in TOP 1000Financial position score

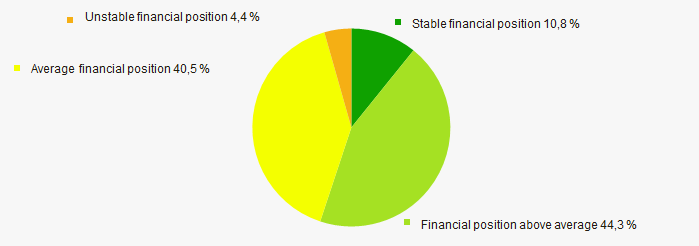

Assessment of the financial position of TOP 1000 companies shows that the financial position of the majority of them is above average (Picture 11).

Picture 11. Distribution of TOP 1000 companies by financial position score

Picture 11. Distribution of TOP 1000 companies by financial position scoreSolvency index Globas

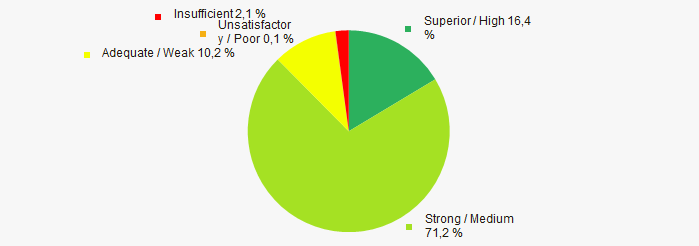

Most of TOP 1000 companies got Superior / High indexes Globas. This fact shows their ability to meet their obligations on time and in full (Picture 12).

Picture 12. Distribution of TOP 1000 companies by solvency index Globas

Picture 12. Distribution of TOP 1000 companies by solvency index GlobasConclusion

Complex assessment of activity of the largest companies in Samara, taking into account the main indexes, financial ratios and indicators, demonstrates the prevalence of positive trends in their activities in 2016 - 2020 (Table 1).

| Trends and evaluation factors | Relative share of factors, % |

| Dynamics of the average net assets value |  10 10 |

| Rate of growth (decrease) in the average size of net assets |  -10 -10 |

| Increase (decrease) in the share of enterprises with negative values of net assets |  10 10 |

| Level of competition / monopolization |  -10 -10 |

| Dynamics of the average revenue |  10 10 |

| Rate of growth (decrease) in the average size of revenue |  -10 -10 |

| Dynamics of the average profit (loss) |  -10 -10 |

| Rate of growth (decrease) in the average profit (loss) |  -10 -10 |

| Growth / decline in average values of companies’ net profit |  -10 -10 |

| Growth / decline in average values of companies’ net loss |  10 10 |

| Increase / decrease in average values of total liquidity ratio |  5 5 |

| Increase / decrease in average values of return on investment ratio |  10 10 |

| Increase / decrease in average values of asset turnover ratio, times |  -10 -10 |

| Share of small and medium-sized businesses in terms of revenue being more than 20% |  10 10 |

| Financial position (the largest share) |  10 10 |

| Solvency index Globas (the largest share) |  10 10 |

| Average value of relative share of factors |  0,9 0,9 |

positive trend (factor),

positive trend (factor),  negative trend (factor)

negative trend (factor)