Changes to the antimonopoly legislation will come into force in January 2016

Less than 4 years passed since the enactment of the so-called “third antimonopoly package”. The antimonopoly practice for the previous period showed the necessity of its future development.

By the Federal law of the Russian Federation as of October 5th, 2015 №275-FZ “On introducing amendments to the Federal Law “On Protection of Competition” and certain legislative acts of the Russian Federation” the following “forth antimonopoly package” will be put into force since January 5th, 2016.

In the Federal law as of July 26th, 2006 №135-FZ “On Protection of Competition” the changes were made in 19 articles, 3 articles were supplemented, 1 chapter and 13 new articles were initiated. The changes were made as well to Article 7 of the Federal law as of August 17th, 1995 №147- FZ “Concerning Natural Monopolies” and to Article 2 of the Federal law as July 13th, 2015 №250- FZ “On introducing amendments to the Federal law “On Protection of Competition” and certain legislative acts of the Russian Federation”. In the Code of the Administrative Offences of the Russian Federation the changes were made in the 9 articles, 1 new article was supplemented and 1 article was recognized void.

All the above-mentioned refer to scale changes in the antimonopoly legislation.

Firstly, at the moment all the cases of the unfair competition such as using of else’s trademark, advertising of “the best product in the market” not being confirmed by the researches are clearly designated. Previously it was considered as a violation as well; however it wasn’t embodied in the documents.

Secondly, the joint venture agreements between enterprises using primarily for reduction of goods and services cost were given the legal status. Formerly the companies ought to pay a penalty amounting to 15 percent of the revenue for this.

Thirdly, the Federal Antimonopoly Service (FAS) was imposed the duty of prejudicial settlement of the issues related to claims against companies. It is enshrined in the law by the term “preliminary conclusion procedure”. Entrepreneurs for their part were entitled the right of prejudicial appeal decision of the FAS territorial administrations in its central office.

The amendments on responsibility for violation of antimonopoly law by the state government bodies are very important. In the first place it refers to the fact when the officers lobby the interests of one company and restrict the access to the market of the others. At present the Federal Antimonopoly Service is eligible for caution of the state official of various levels. The ceiling value of the penal sanctions for the official is raised from 30 to 50 th RUB. Moreover, the authority was entitled the right to restrict the creation of new state or municipal enterprises in the established markets.

According to experts, the adopted amendments give a clear understanding of an unfair competition. On the one hand, the changes are aimed at reducing the administrative pressure upon business, on the other - at raising responsibility of the state authorities for the antimonopoly law compliance.

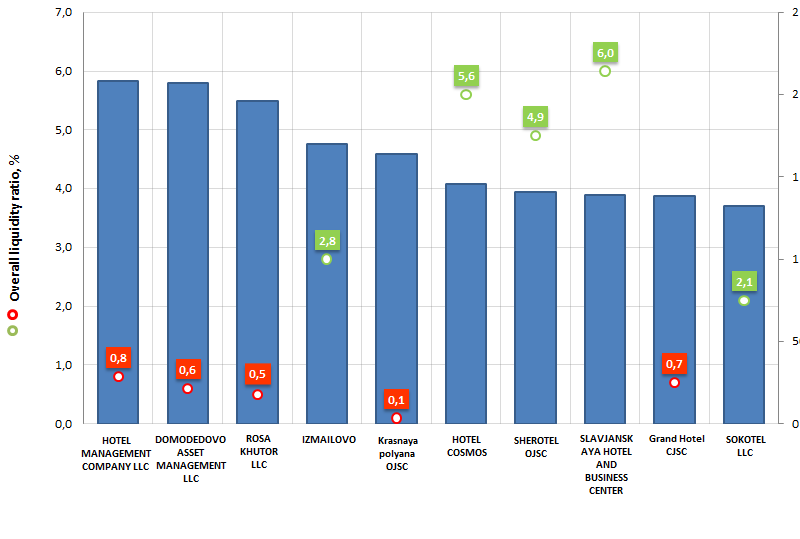

Overall liquidity ratio of Russian hotel complexes

Information Agency Credinform has prepared the ranking of the largest Russian hotel chains.

Top-10 enterprises in terms of revenue were selected according to the data from the Statistical Register for the latest available period (for the year 2014). The enterprises were ranked by decrease in annual revenue; besides, revenue trend data relative to previous period, overall liquidity ratio and solvency index GLOBAS-i® is also represented (see table 1).

Overall liquidity ratio - characterizes the ability of the company to secure short-term obligations by the most easily realizable part of assets – working capital. The recommended value is from 1,0 to 2,0.

Ratio value equal 1 assumes equality of the current assets and liabilities. Excessively high values may testify about unsatisfactory assets management, loss of liquidity taking into account the time factor. The value below 1 testifies about financial risk, connected with inability to fulfill current liabilities regularly.

For the most full and fair opinion about the company’s financial situation, not only the average values of the indicators should be taken into account, but also the whole set of financial indicators and ratios.

| № | Name | Region | Revenue, mln RUB, 2014 | Revenue growth,% | Overall liquidity ratio, % | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|---|

| 1 | LLC HOTEL MANAGEMENT COMPANY INN 7710578737 |

Moscow | 2 081,2 | -13,4 | 0,8 below normal |

300 satisfactory |

| 2 | DOMODEDOVO ASSET MANAGEMENT (Airhotel) INN 5009096987 |

Moscow Region | 2 070,2 | 7,3 | 0,6 below normal |

322 satisfactory |

| 3 | SKI RESORT DEVELOPMENT COMPANY ROSA KHUTOR , LLC INN 7702347870 |

Moscow | 1 959,7 | 76,3 | 0,5 below normal |

280 high |

| 4 | TOURIST HOTEL COMPLEX "IZMAILOVO" INN 7719017101 |

Moscow | 1 698,5 | -3,1 | 2,8 above normal |

161 the highest |

| 5 | OJSC Krasnaya polyana INN 2320102816 |

Krasnodar Region | 1 641,6 | 920,9 | 0,1 below normal |

306 satisfactory |

| 6 | HOTEL COSMOS INN 7717016198 |

Moscow | 1 456,6 | -5,8 | 5,6 above normal |

184 the highest |

| 7 | OJSC SHEROTEL INN 7712014856 |

Moscow Region | 1 405,4 | 5,4 | 4,9 above normal |

249 high |

| 8 | SLAVJANSKAYA HOTEL AND BUSINESS CENTER (Radisson Slavyanskaya Hotel) INN 7730001183 |

Moscow | 1 387,3 | -3,8 | 6,0 above normal |

197 the highest |

| 9 | CJSC Grand Hotel (Marriott Grand Hotel) INN 7707172215 |

Moscow | 1 381,7 | -12,5 | 0,7 below normal |

259 high |

| 10 | LLC SOKOTEL (Sokos Hotel) INN 7841338200 |

Saint-Petersburg | 1 324,2 | -2,3 | 2,1 above normal |

273 high |

Overall liquidity ratio of the largest Russian hotel chains does not fit the recommended standard values (both for lower and upper boarder). In the first case it is the excess of current liabilities over assets; that may lead the company to financial crisis because of inability to fulfill liabilities. In the second case it is the irrational structure of capital, as if not to put it in requisition, the risk of loss of a certain percentage of liquidity is growing up.

Picture 1. Revenue and overall liquidity ratio of the largest Russian hotel chains (Top-10)

According to the latest financial statements (2014), the revenue of the largest Russian hotel chains (Top-10), amounted to 16,4 bln RUB, that is 12,3% higher than total sum in 2013.

The development of hotel business in Russian is significantly changing. The growth of USD and EUR rate influences on the amount of hotel visitors. The owners are forced to reduce the price of the rooms in order to attract the tourists.

The foreign policy of Russia and the impact of foreign mass media are negatively influence on travel activity level in Saint-Petersburg, Moscow and other Russian cities. The image of «aggressive country» decreased the popularity level of excursions across the country. On average, the price of a hotel room decreased by 8%. The hotels are forced to change its rent conditions in connection with decrease in business activity among Russian regions.

The growth rate influenced people’s choice. Now people choose cheaper hotels with service level not worse, than in expensive hotels; however, as a rule, such hotels are located farther from the center. Infrastructure level is also lower than lux rooms in the city center. According to the experts, today the 70% fill rate is the great indicator for hotel business owners.