Credit protection of the largest Russian manufacturers of mineral water

Information agency Credinform prepared a ranking of the largest Russian manufacturers of mineral water.

The TOP-10 list of enterprises was drawn up for the ranking on the annual volume of revenue for the latest available accounting period available in the Statistical Register (for the year 2014); following data were calculated: the dynamics of revenue related to the previous period and credit protection ratio (s. Table 1).

Credit protection ratio (x) is the relation of pre-tax earnings and interest on loans to the amount of interest due. It characterizes the degree of protection of creditors against non-payment of interests for a granted credit and shows how many times during the reporting period a company earned money to pay the interests on loans. The recommended value is: > 1.

Thus, if the ratio is less than 1, it testifies that a company has no possibility to repay all credit obligations simultaneously. This, in its turn, may lead to financial instability of business in today's difficult economic conditions, especially during the fall in effective demand of the population.

If there is no value of the considered indicator – there are no borrowings in the report of an enterprise, and, consequently, no interests payable to creditors. This in itself can be a positive factor, but it requires access to the capital market for a successful business, market retention, introduction of innovation solutions. Therefore, the task of financial management is the observance of a reasonable balance between development and its financial well-being.

For getting of more comprehensive and fair picture of financial standing of an enterprise it is necessary to pay attention not only to average indicator values in industry, but also to all presented combination of financial indicators and ratios of a company.

| № | Name | Region | Revenue for 2014, in ths RUB | Revenue, dynamics 2014 - 2013, %% | Credit protection ratio | Solvency index GLOBAS -i® |

|---|---|---|---|---|---|---|

| 1 | PK LIDER LLC INN 5027073220 |

Moscow region | 1 662 090 | 136 | 10,73 | 170 the highest |

| 2 | EDELVEIS L LLC INN 4807003494 |

Lipetsk region | 965 784 | 145 | 3,03 | 224 high |

| 3 | AKVALAIN CJSC NJSC INN 0901039797 |

Karachay-Cherkess Republic | 590 798 | 134 | 2,74 | 239 high |

| 4 | FONTE AKVA LLC INN 5007039750 |

Moscow region | 1 098 284 | 86 | 1,84 | 287 high |

| 5 | KOMPANIYA CHISTAYA VODA LLC INN 5408155063 |

Sverdlovsk region | 634 167 | 81 | 1,70 | 213 high |

| 6 | NARZAN OJSC PJSC INN 2628008703 |

Stavropol Territory | 1 877 356 | 104 | 1,41 | 238 high |

| 7 | FIRMA MERKURY LLC INN 0901006512 |

Karachay-Cherkess Republic | 2 073 999 | 109 | 1,39 | 211 high |

| 8 | KAVMINVODY JSC NJSC INN 2630016660 |

Stavropol Territory | 841 976 | 110 | 168 the highest | |

| 9 | ZAVOD MINERALNYKH VOD OKTYABR-A LLC INN 2618012997 |

Stavropol Territory | 586 137 | 547 | 223 high | |

| 10 | VISMA CJSC NJSC INN 0901015958 |

Karachay-Cherkess Republic | 996 857 | 83 | 0,48 | 288 high |

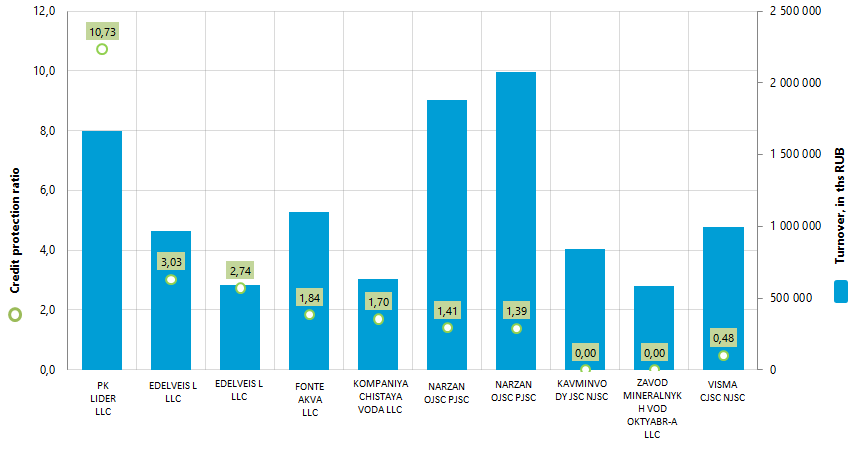

The value of the credit protection ratio of the largest Russian manufacturers of mineral water (TOP-10) ranges from 10,3 (PK LIDER LLC) to 0,48 (VISMA CJSC NJSC). There are no indicator values by AVMINVODY JSC NJSC and ZAVOD MINERALNYKH VOD OKTYABR-A LLC.

Picture 1. Revenue and credit protection ratio of the largest Russian manufacturers of mineral water (TOP-10)

The annual revenue of the companies from the Top-10 list amounted to 11,3 bln RUB at year-end 2014, that is by 11% higher than the total figure of the same producers for 2013. Three enterprises from Top-10 reduced the amount of revenue in 2014 in regard to 2013. At the same time, ZAVOD MINERALNYKH VOD OKTYABR-A LLC demonstrated a quite impressive dynamics of the revenue with its increasing by more than 5 times in 2014 in regard to 2013.

The industry average value of the credit protection ratio in 2013 was 2,08, and in 2014 had already a negative value – 0,73. Thus, in 2014 all TOP-10 enterprises had the value of this indicator above the industry average. Only VISMA NJSC CJSC had the ratio value less than 1 in 2014.

All participants of the TOP-10 list got high and the highest solvency index GLOBAS-i®. It testifies that all enterprises can pay off their debts in time and fully, while risk of default is minimal.

Russia and the OPEC must influence world oil price

The analysis of the current oil prices indicates that from January, 4 to February, 19 of 2016 the world price of, for example, Brent oil has exceeded 30 US dollars per barrel and varied from 30 to 38 USD. In the period of 15 - 21 January, the price was lower than 30 USD and shown minimal value of 27,88 USD since 2004. In general, the average Brent oil price amounted to 32,41 US dollars per barrel. Price dynamics is represented in the table 1.

| date | 04.01.16 | 05.01.16 | 06.01.16 | 07.01.16 | 11.01.16 | 12.01.16 | 13.01.16 | 14.01.16 | 15.01.16 |

| average price | 37,22 | 36,42 | 34,23 | 33,75 | 33,55 | 30,86 | 30,31 | 31,03 | 28,94 |

| date | 18.01.16 | 19.01.16 | 20.01.16 | 21.01.16 | 22.01.16 | 22.01.16 | 25.01.16 | 26.01.16 | 27.01.16 |

| average price | 28,55 | 28,76 | 27,88 | 29,25 | 32,18 | 30,50 | 30,50 | 31,80 | 33,10 |

| date | 28.01.16 | 29.01.16 | 01.02.16 | 02.02.16 | 03.02.16 | 04.02.16 | 05.02.16 | 08.02.16 | 09.02.16 |

| average price | 33,89 | 34,74 | 34,24 | 32,72 | 35,04 | 34,46 | 34,06 | 32,88 | 30,32 |

| date | 10.02.16 | 11.02.16 | 12.02.16 | 14.02.16 | 15.02.16 | 16.02.16 | 17.02.16 | 18.02.16 | 19.02.16 |

| average price | 30,84 | 30,06 | 33,36 | 32,89 | 33,39 | 32,18 | 34,50 | 34,28 | 33,10 |

Current situation with the world oil price is absolutely unacceptable due to its non-allowance to form the debt-neutral budget of manufacturing countries. This budget plays a key role in economic development and performance of social obligations. Oil industry in general is also under the negative influence of the situation. For example, the 2016 budget of Russia was calculated with 3% deficit of the GDP at expected year-average oil price of 50 US dollars per barrel. Moreover, today the prices of 20, 30, 40 USD are taken into account. Kazakhstan has set 40, Azerbaijan – 50, Angola – 48 and Nigeria - 38 US dollars per barrel.

Traditional oil extraction in the North America barely holds an acceptable level, but reduction of drilling rigs for shale gas extraction indicates crises in this sector. 95% of Venezuela budget depends on oil earnings. Oil barrel should cost not less than 77 US dollars to ensure profitability of Mexico’s energy projects. Bolivia, Columbia, Ecuador, Trinidad and Tobago also fully feel the drop in raw material and energy prices. For the lossless budget of Saudi Arabia, oil must cost 98,3 US dollar per barrel; for Oman and Bahrein the price is 96,8 and 89,8 USD respectively.

Today many analysts agree that realistic oil price have to be not less than 50 US dollars per barrel. At the same time, the experts in the oil sector speak about 60-80 USD. No prize for guessing that high oil production and superfluous market offer against decrease in consumption apply strong pressure to the world oil price. In order not to give up the competition, major oil market players do not reduce production and sales volumes, but on the contrary, constantly increasing them. This lock-up situation continues for more than a year and has led to the world oil price started to break through the threshold of 30 US dollars per barrel.

In the current conditions, changes in oil prices will depend on ability of major market players (Russia and the OPEC members are among them) come to an agreement. Today countries negotiate not about reduction in oil extraction, but about “freezing” the extraction on achieved volumes. In the current February, Russia, Saudi Arabia, Qatar and Venezuela agreed to fix volumes on the level of January 2016 after other countries’ support.

Currently, Kuwait, Iraq, Iran and Nigeria have endorsed the agreement on keeping the extraction on the level of January 2016. As is noted in the OPEC, European Union, Russia and China are engaged in dialogue, as well as Mexico and Norway are engaged in negotiations. The USA was also invited for negotiations concerning freezing of the oil extraction level. According to the experts, these measures may adjust the world oil prices.

Supplementary information:

13 countries are included in the OPEC: Algeria, Angola, Venezuela, Indonesia, Iraq, Iran, Qatar, Kuwait, Libya, Nigeria, United Arab Emirates, Saudi Arabia, and Ecuador.