Cereals trading trends

Information agency Credinform represents an overview of activity trends of the largest Russian wholesalers of cereals.

Trading companies with the largest volume of annual revenue (TOP-50) were selected for the analysis, according to the data from the Statistical Register for the latest available periods (for 2013 - 2018). The analysis was made on the basis of the data of the Information and Analytical system Globas.

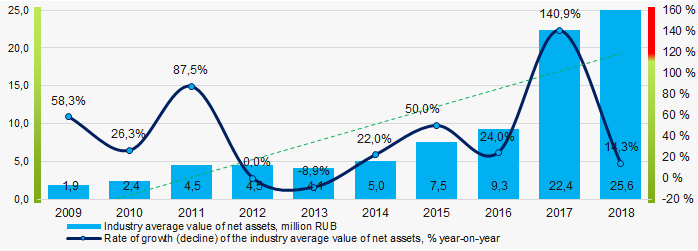

Net assets value is an indicator, reflecting the real value of company’s property, is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The indicator of net assets is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

The largest enterprise of the industry in terms of net assets is OPTOVO-ROZNICHNAYA TORGOVAYA I PROIZVODSTVENNAYA FIRMA KUBANYOPTPRODTORG NJSC, INN 2312018180, Krasnodar territory. Its net assets amounted to more than 4 billion rubles in 2018.

The smallest amount of net assets in the TOP-50 list was hold by RICHLINE LLC, INN 7718791016, Moscow. The insufficiency of property of this company in 2018 was expressed as a negative value of -1 billion rubles.

The industry average values of net assets tend to increase over the ten-year period (Picture 1).

Picture 1. Change in the industry average indicators of the net asset value in 2009 – 2018

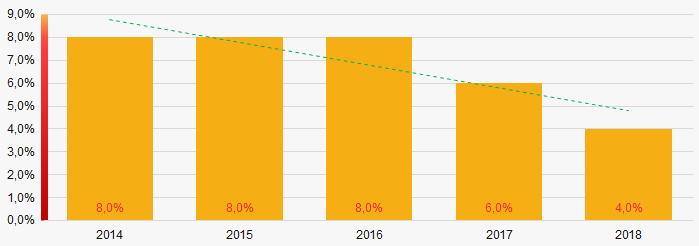

Picture 1. Change in the industry average indicators of the net asset value in 2009 – 2018The shares of TOP-50 enterprises with insufficiency of assets have a tendency to decrease in the last five years (Picture 2).

Picture 2. Shares of enterprises with negative values of net assets in TOP-50

Picture 2. Shares of enterprises with negative values of net assets in TOP-50Sales revenue

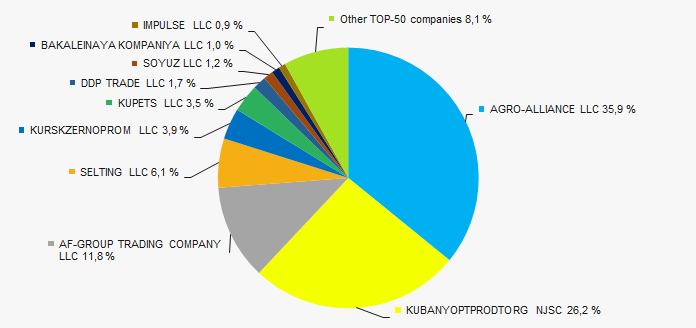

The revenue volume of 10 leading companies of the industry made almost 92% of the total revenue of TOP-50 in 2018 (Picture 3). It points to a high level of monopolization in the industry.

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-50 enterprises for 2018

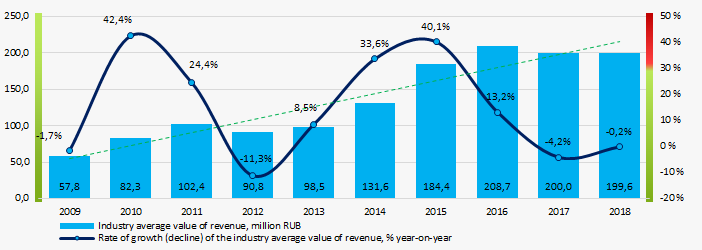

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-50 enterprises for 2018In general, there is a tendency to increase in the revenue volumes (Picture 4).

Picture 4. Change in the industry average revenue in 2009 – 2018

Picture 4. Change in the industry average revenue in 2009 – 2018Profit and losses

The largest company of the industry in terms of net profit value is also OPTOVO-ROZNICHNAYA TORGOVAYA I PROIZVODSTVENNAYA FIRMA KUBANYOPTPRODTORG NJSC, INN 2312018180, Krasnodar territory. The company's profit amounted to 177 million rubles in 2018.

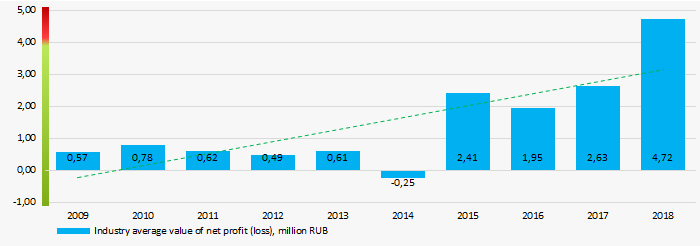

Over a ten-year period, the indicators of industry average profit have a tendency to increase (Picture 5).

Picture 5. Change in the industry average indicators of profit (loss) in 2009 – 2018

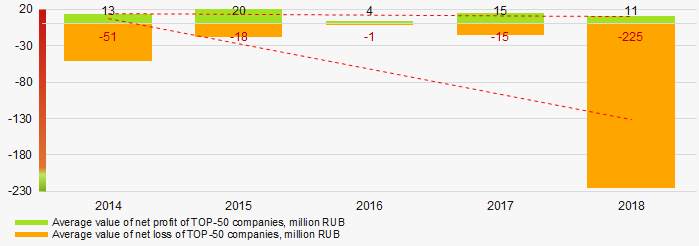

Picture 5. Change in the industry average indicators of profit (loss) in 2009 – 2018Average values of net profit’s indicators of TOP-50 enterprises have a tendency to decrease over a five-year period, at the same time the average value of net loss increases. (Picture 6).

Picture 6. Change in the industry average indicators of net profit and net loss of TOP-50 companies in 2014 – 2018

Picture 6. Change in the industry average indicators of net profit and net loss of TOP-50 companies in 2014 – 2018 Key financial ratios

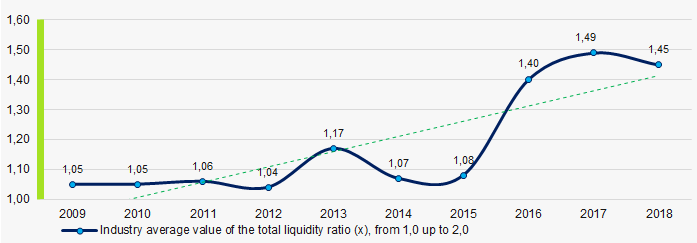

Over the ten-year period the industry average indicators of the total liquidity were within the range of recommended values - from 1,0 up to 2,0, with a tendency to increase. (Picture 7).

The total liquidity ratio (the relation of the amount of current assets to short-term liabilities) shows the sufficiency of company’s funds for repayment of its short-term liabilities.

Picture 7. Change in the industry average values of the total liquidity ratio in 2009 – 2018

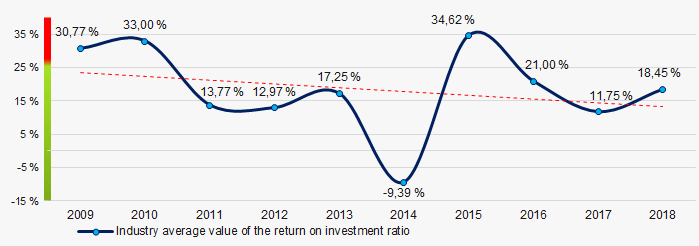

Picture 7. Change in the industry average values of the total liquidity ratio in 2009 – 2018The industry average values of the return on investment ratio trend to decrease for ten years. (Picture 8).

The ratio is calculated as the relation of net profit to the sum of own capital and long-term liabilities and demonstrates the return on the equity involved in the commercial activity and the long-term borrowed funds of an organization.

Picture 8. Change in the industry average values of the return on investment ratio in 2009 – 2018

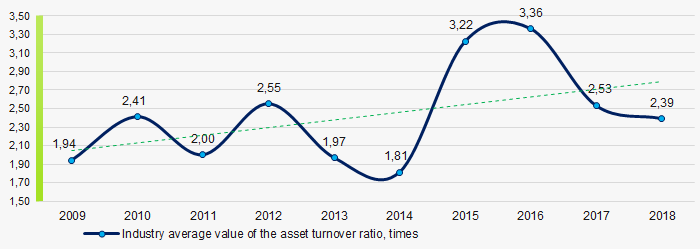

Picture 8. Change in the industry average values of the return on investment ratio in 2009 – 2018Asset turnover ratio is calculated as the relation of sales proceeds to the average value of total assets for a period and characterizes the efficiency of use of all available resources, regardless of the sources of their attraction. The ratio shows how many times a year a complete cycle of production and circulation is made, yielding profit.

Over a ten-year period, indicators of this ratio of business activity showed an upward trend (Picture 9).

Picture 9. Change in the industry average values of the asset turnover ratio in 2009 – 2018

Picture 9. Change in the industry average values of the asset turnover ratio in 2009 – 2018 Small business

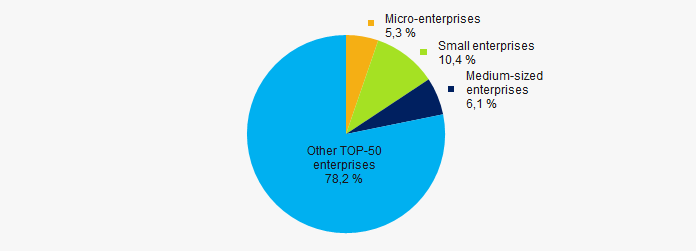

88% of TOP-50 companies are registered in the Register of small and medium-sized enterprises of the Federal Tax Service of the RF. At the same time, their share in the total revenue of TOP-50 enterprises mounts to almost 22%, that is higher than the national average one (Picture 10).

Picture 10. Shares of proceeds of small and medium-sized enterprises in TOP-50 companies

Picture 10. Shares of proceeds of small and medium-sized enterprises in TOP-50 companiesMain regions of activity

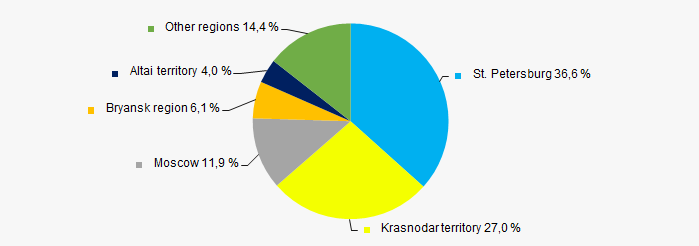

The TOP-50 companies are registered in 22 regions and distributed unequal across Russia. More than 75% of the largest enterprises in terms of revenue are concentrated in St. Petersburg, Krasnodar territory and Moscow (Picture 11).

Picture 11. Distribution of the revenue of TOP-50 companies by Russian regions

Picture 11. Distribution of the revenue of TOP-50 companies by Russian regionsFinancial position score

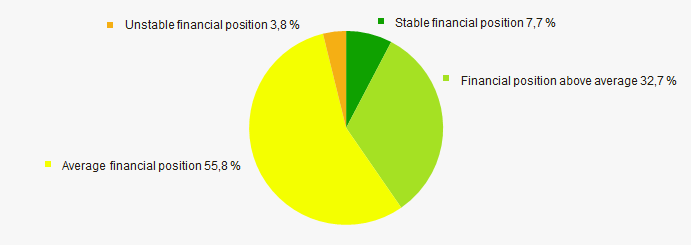

An assessment of the financial position of TOP-50 companies shows that most of them are in average financial position. (Picture 12).

Picture 12. Distribution of TOP-50 companies by financial position score

Picture 12. Distribution of TOP-50 companies by financial position scoreSolvency index Globas

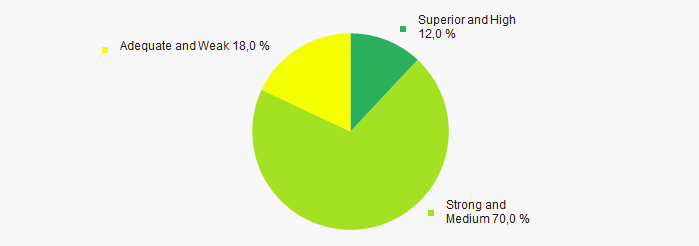

The most of TOP-50 enterprises got Superior/High or Strong/Medium Solvency index Globas, that points to their ability to pay off their debts in time and fully (Picture 13).

Picture 13. Distribution of TOP-50 companies by solvency index Globas

Picture 13. Distribution of TOP-50 companies by solvency index GlobasAccording to the Federal State Statistics Service, the share of enterprises of the industry in the total revenue volume from the ale of goods, products, works, services made 0,023% countrywide for 2019, that is higher than the indicator for 2018, which amounted to 0,02%.

Conclusion

A comprehensive assessment of activity of the largest Russian wholesalers of cereals, taking into account the main indices, financial indicators and ratios, points to the prevalence of positive trends (Table 1).

| Trends and evaluation factors | Specific share of factor, % |

| Rate of growth (decline) in the average size of net assets |  10 10 |

| Increase / decrease in the share of enterprises with negative values of net assets |  10 10 |

| Level of competition / monopolization |  -10 -10 |

| Rate of growth (decline) in the average size of revenue |  10 10 |

| Rate of growth (decline) in the average size of profit (loss) |  10 10 |

| Growth / decline in average values of net profit of TOP-50 companies |  -10 -10 |

| Growth / decline in average values of net loss of TOP-50 companies |  -10 -10 |

| Increase / decrease in average values of total liquidity ratio |  10 10 |

| Increase / decrease in average values of return on investment ratio |  -10 -10 |

| Increase / decrease in average values of asset turnover ratio, times |  10 10 |

| Share of small and medium-sized enterprises in terms of revenue being more than 21% |  10 10 |

| Regional concentration |  -10 -10 |

| Financial position (the largest share) |  5 5 |

| Solvency index Globas (the largest share) |  10 10 |

| Dynamics of the share of proceeds of the industry in the total revenue of the RF |  10 10 |

| Average value of the specific share of factors |  3,0 3,0 |

positive trend (factor),

positive trend (factor),  negative trend (factor).

negative trend (factor).

Profitability of sales in cereals trade.

Information agency Credinform has prepared a ranking of the largest Russian companies engaged in wholesale trade of cereals. The largest enterprises (TOP-10) in terms of annual revenue were selected according to the data from the Statistical Register for the available periods (2016-2018). Then the companies were ranged by profitability of sales (Table 1). The analysis was based on the data from the Information and Analytical system Globas.

Profitability of sales (%) is the share of operating profit in the sales volume of the company. The ratio characterizes the efficiency of the industrial and commercial activity and shows the company’s funds, which remained after covering the cost of production, interest and tax payments.

The rage of ratio’s values within companies of the same industry is defined by the differences in competitive strategies and product lines.

For the most full and fair opinion about the company’s financial position the whole set of financial indicators and ratios should be taken into account.

| Name, INN, region | Revenue, million RUB | Net profit (loss), million RUB | Profitability of sales, % | Solvency index Globas | |||

| 2017 | 2018 | 2017 | 2018 | 2017 | 2018 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| IMPULS LLC INN 5407048460 Novosibirsk region |

484,49 484,49 |

262,90 262,90 |

35,78 35,78 |

41,98 41,98 |

10,36 10,36 |

14,16 14,16 |

192 High |

| AF-GROUP TRADING COMPANY LLC INN 7734623403 Moscow |

3754,23 3754,23 |

3598,11 3598,11 |

86,35 86,35 |

68,17 68,17 |

7,42 7,42 |

4,64 4,64 |

240 Strong |

| AGRO-ALLIANCE LTD INN 7814413641 Saint-Petersburg |

11464,57 11464,57 |

10950,40 10950,40 |

203,01 203,01 |

73,53 73,53 |

3,95 3,95 |

3,52 3,52 |

261 Medium |

| SELTING LLC INN 3235013772 Bryansk region |

1679,76 1679,76 |

1864,34 1864,34 |

54,57 54,57 |

29,85 29,85 |

5,83 5,83 |

3,34 3,34 |

221 Strong |

| KUPETS LLC INN 2289006988 Altai region |

546,10 546,10 |

1057,87 1057,87 |

2,44 2,44 |

10,91 10,91 |

-2,40 -2,40 |

1,95 1,95 |

256 Medium |

| NAO KUBANYOPTPRODTORG INN 2312018180 Krasnodar region |

8335,47 8335,47 |

7987,74 7987,74 |

182,84 182,84 |

176,51 176,51 |

1,76 1,76 |

1,34 1,34 |

228 Strong |

| DDP TRADE LLC INN 2540180383 Primorsky Krai |

378,30 378,30 |

506,81 506,81 |

10,10 10,10 |

23,24 23,24 |

3,94 3,94 |

1,08 1,08 |

245 Strong |

| SOYUZ LLC INN 5406521885 Novosibirsk region |

292,00 292,00 |

361,96 361,96 |

1,41 1,41 |

1,69 1,69 |

0,49 0,49 |

0,56 0,56 |

198 High |

| ОBAKALEINAYA KOMPANIYA LLC INN 2723087134 Khabarovsk region |

222,87 222,87 |

306,08 306,08 |

-5,61 -5,61 |

0,62 0,62 |

-2,50 -2,50 |

0,24 0,24 |

246 Strong |

| KURSKZERNOPROM LLC INN 4627003174 Belgorod region |

1377,93 1377,93 |

1179,72 1179,72 |

-84,24 -84,24 |

3,29 3,29 |

-11,76 -11,76 |

-3,53 -3,53 |

273 Medium |

| Average value for TOP-10 companies |  2853,57 2853,57 |

2807,60 2807,60 |

48,67 48,67 |

42,98 42,98 |

1,71 1,71 |

2,73 2,73 |

|

| Average industry value |  200,03 200,03 |

199,56 199,56 |

2,63 2,63 |

4,72 4,72 |

3,38 3,38 |

4,20 4,20 |

|

growth of indicator in comparison with prior period,

growth of indicator in comparison with prior period,  decline of indicator in comparison with prior period

decline of indicator in comparison with prior period

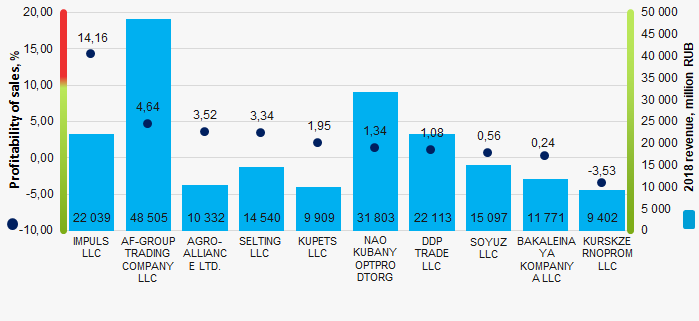

In 2018, the average value of profitability of sales for TOP-10 companies is lower than average industry value: seven companies improved the results.

Picture 1. Profitability of sales and revenue of the largest Russian companies engaged in wholesale trade of cereals (ТОP-10)

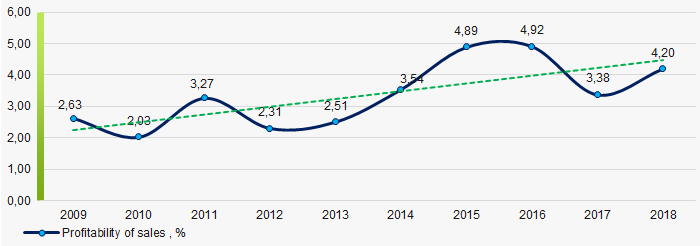

Picture 1. Profitability of sales and revenue of the largest Russian companies engaged in wholesale trade of cereals (ТОP-10)Within 10 years, the average industry indicators of profitability of sales showed the growing tendency. (Picture 2).

Picture 2. Change in average industry values of profitability of sales of Russian companies engaged in wholesale trade of cereals in 2009 – 2018

Picture 2. Change in average industry values of profitability of sales of Russian companies engaged in wholesale trade of cereals in 2009 – 2018