Personal credit score is now calculated and provided to data subjects

The Federal Law No. 327-FZ as of 03.08.2018 «On the amendments to the Federal Law «On credit histories» came into effect on January 31, 2019. According to the adopted amendments, a personal credit score is now assigned to Russian consumers.

The credit score is based on a credit history and is calculated automatically. The score depends particularly on such variables as: overdue credits, debt burden level, number of requests on credit history check, credit history age etc. A higher score raises the chances to get a positive credit decision.

According to the data provided by one of the leading Russian credit history bureau, Unified Credit Bureau, 78% of Russian consumers are assigned with a higher credit score, 9% – with a poor one. Russian consumers can request their credit histories and from now on also their personal credit scores in credit history bureaus.

The Regulator – Bank of Russia – has developed and launched in autumn 2018 a new public service within the Unified Public Services Portal enabling consumers to find out which credit bureau is keeping their credit histories (more details you can find in the article of December 3, 2018 «Available data on credit bureaus». To make an inquiry passport data and personal insurance account number are required. The Bank of Russia sends within 1 working day to the user’s account the name, address, phone number of the related credit history bureau. To obtain the credit history itself the consumer have to apply to the credit history bureau making a visit or online.

According to the law changes, each Russian individual is now authorized to request two free credit history reports annually. Previously only one report was provided free of charge. Our readers can learn about «Ways of receiving information from a counterparty’s credit history» from the publication of December 5, 2017. According to the State Register of Credit History Bureaus on the beginning of February 2019, 13 credit bureaus are registered and operating in Russia. Each credit bureau uses its own methodology of credit score calculation but the Regulator has been discussing the implementation of an unified methodology in future. Information about these bureaus is available by subscription to the Information and Analytical system Globas.

TOP-10 companies in terms of net assets value

Information Agency Credinform presents a ranking of net assets value of the largest real economy sector companies of 10 most populated regions of Russia. The companies with the largest volume of annual revenue (TOP-10 and TOP-1000) were selected for the ranking, according to the data from the Statistical Register for the latest available periods (2012 - 2017). Then they were ranked by net assets value (Table 1). The analysis is based on data of the Information and Analytical system Globas.

Net assets is calculated as the difference between balance sheet assets of the enterprise and its debt obligations plus deferred income. There are no recommenmded values for this indicator. It reflects the real value of company's property.

Analysis of the net assets development helps to estimate financial state of the enterprise, solvency and risk level of bankruptcy.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention to all combination of indicators and financial ratios.

| № in TOP-1000 group, name, INN, region, activity type |

Sales revenue, billion RUB | Net profit (loss), billion RUB | Net assets value, billion RUB | Solvency index Globas | |||

| 2016 | 2017 | 2016 | 2017 | 2016 | 2017 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 1 JSC GAZPROM INN 7736050003 Moscow Wholesale of solid, liquid and gas fuel and similar products |

3934,5 3934,5 |

4313,0 4313,0 |

411,4 411,4 |

100,3 100,3 |

10414,0 10414,0 |

10324,2 10324,2 |

158 Superior |

| 2 JSC SURGUTNEFTEGAS INN 8602060555 Khanty-Mansiysk Autonomous district – Yugra (Tyumen region) Crude oil mining |

992,5 992,5 |

1144,4 1144,4 |

-104,8 -104,8 |

149,7 149,7 |

3353,5 3353,5 |

3486,5 3486,5 |

185 High |

| 3 LLC GAZPROM MEZHREGIONGAZ INN 5003021311 Saint-Petersburg Wholesale of solid, liquid and gas fuel and similar products |

884,8 884,8 |

882,0 882,0 |

-31,4 -31,4 |

-16,2 -16,2 |

575,7 575,7 |

658,3 658,3 |

224 Strong |

| 4 JSC Tatneft INN 1644003838 The Republic of Tatarstan Crude oil and associated petroleum gas mining |

486,2 486,2 |

581,5 581,5 |

104,8 104,8 |

100,0 100,0 |

624,5 624,5 |

606,2 606,2 |

158 Superior |

| 5 JSC Bashneft petroleum company INN 0274051582 The Republic of Bashkortostan Crude oil mining |

475,5 475,5 |

558,6 558,6 |

43,3 43,3 |

129,3 129,3 |

176,3 176,3 |

279,3 279,3 |

199 High |

| 6 JSC MAGNITOGORSK IRON & STEEL WORKS INN 7414003633 Chelyabinsk region Manufacture of iron, steel and ferroalloys |

339,1 339,1 |

392,8 392,8 |

68,0 68,0 |

67,3 67,3 |

201,1 201,1 |

232,5 232,5 |

130 Superior |

| 7 JSC EVRAZ NIZHNY TAGIL METALLURGICAL PLANT INN 6623000680 Sverdlovsk region Manufacture of iron, steel and ferroalloys |

111,9 111,9 |

144,7 144,7 |

14,3 14,3 |

55,9 55,9 |

175,1 175,1 |

200,6 200,6 |

137 Superior |

| 8 JSC CHERNOMORTRANSNEFT INN 2315072242 Krasnodar territory Transportation of oil and oil products by pipelines |

53,0 53,0 |

52,8 52,8 |

25,3 25,3 |

9,0 9,0 |

125,5 125,5 |

136,9 136,9 |

147 Superior |

| 9 JSC T Plus INN 6315376946 Moscow region Electric power producing |

216,7 216,7 |

222,7 222,7 |

0,3 0,3 |

3,1 3,1 |

145,6 145,6 |

129,0 129,0 |

201 Strong |

| 10 ROSTOV HELICOPTER PRODUCTION COMPLEX ROSTVERTOL INN 6161021690 Rostov region Manufacture of helicopters, airplanes and other aircraft vehicles |

84,3 84,3 |

99,1 99,1 |

18,6 18,6 |

16,7 16,7 |

34,8 34,8 |

39,1 39,1 |

167 Superior |

| Total by TOP-10 companies |  7578,6 7578,6 |

8391,6 8391,6 |

549,9 549,9 |

615,3 615,3 |

15825,9 15825,9 |

16119,6 16119,6 |

|

| Average value by TOP-10 companies |  757,9 757,9 |

839,2 839,2 |

55,0 55,0 |

61,5 61,5 |

1582,6 1582,6 |

1612,0 1612,0 |

|

| Industry average value by TOP-1000 companies |  83,6 83,6 |

104,3 104,3 |

3,9 3,9 |

3,6 3,6 |

45,4 45,4 |

47,1 47,1 |

|

| 991 JSC SHIPBUILDING PLANT SEVERNAYA VERF INN 7805034277 Saint-Petersburg Construction of ships, vessels and other floating structures |

13,6 13,6 |

19,2 19,2 |

-1,8 -1,8 |

-1,7 -1,7 |

1,2 1,2 |

-0,7 -0,7 |

271 Medium |

| 992 LLC BASHNEFT-STROY INN 0271006454 The Republic of Bashkortostan Providing other services in the sphere of oil and natural gas mining |

5,8 5,8 |

2,4 2,4 |

-0,1 -0,1 |

-0,8 -0,8 |

-0,3 -0,3 |

-1,1 -1,1 |

335 Adequate |

| 993 PALMALI CO. LTD INN 6164087026 Rostov region Sea cargo transport activities Process of being wound up since 21.11.2018 |

4,2 4,2 |

2,8 2,8 |

0,2 0,2 |

-1,9 -1,9 |

-2,9 -2,9 |

-4,7 -4,7 |

600 Insufficient |

| 994 JSC Krasnaya polyana INN 2320102816 Krasnodar territory Activities of hotels and other places for part-time residence |

3,6 3,6 |

4,8 4,8 |

-5,5 -5,5 |

-1,2 -1,2 |

-4,2 -4,2 |

-5,4 -5,4 |

275 Strong |

| 995 LLC REGION-INVEST INN 7733753865 Moscow Investments in securities |

26,8 26,8 |

127,1 127,1 |

-5,5 -5,5 |

-5,1 -5,1 |

-5,5 -5,5 |

-10,6 -10,6 |

365 Adequate |

| 996 LLC CHELYABINSK TRAKTOR PLANT-URALTRAC LIMITED INN 7452027843 Chelyabinsk region Manufacture of machines and equipment for extraction of minerals and construction |

6,9 6,9 |

7,1 7,1 |

-0,1 -0,1 |

-1,2 -1,2 |

-8,0 -8,0 |

-10,6 -10,6 |

307 Adequate |

| 997 JSC CROCUS INTERNATIONAL INN 7728115183 Moscow region Lease and management of own or rented inhabited real estate |

34,7 34,7 |

35,8 35,8 |

8,2 8,2 |

-8,1 -8,1 |

-11,8 -11,8 |

-19,9 -19,9 |

260 Strong |

| 998 LLC UMMC-STEEL CORPORATION INN 6606021264 Sverdlovsk region Manufacture of sorted hot-rolled steel and wire |

7,3 7,3 |

9,4 9,4 |

-0,9 -0,9 |

-0,8 -0,8 |

-21,7 -21,7 |

-22,4 -22,4 |

313 Adequate |

| 999 LLC AGRO - LIGA INN 1650195013 The Republic of Tatarstan Sale of automotive components, parts and accessories |

19,6 19,6 |

9,7 9,7 |

-35,5 -35,5 |

-1,2 -1,2 |

-35,5 -35,5 |

-36,9 -36,9 |

340 Adequate |

| 1000 JSC YAMAL LNG INN 7709602713 Yamalo-Nenets Autonomous district (Tyumen region) Liquation and benefication of natural gas for further transportation |

10,6 10,6 |

13,8 13,8 |

136,2 136,2 |

-68,4 -68,4 |

-25,8 -25,8 |

-94,1 -94,1 |

245 Strong |

— growth of indicator to the previous period,

— growth of indicator to the previous period,  — decrease of indicator to the previous period.

— decrease of indicator to the previous period.

The average indicator of the net assets value of TOP-10 companies is significantly above the average value of the TOP-1000. In 2017 seven companies out of the TOP-10 have improved their indicators compared to the previous period.

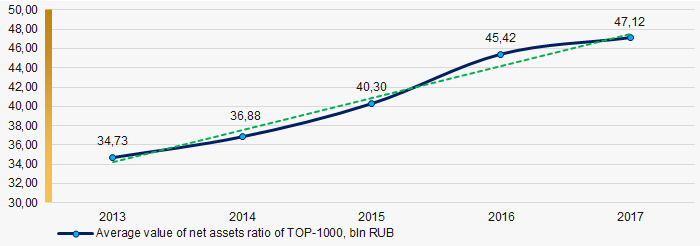

Over a five-year period an increasing tendency in the average values of the net assets ratio in TOP-1000 has been observed. (Picture 2).

Picture 1. Change of average values of the net assets ratio of TOP-1000 in 2013 – 2017

Picture 1. Change of average values of the net assets ratio of TOP-1000 in 2013 – 2017