Accounts receivable turnover of enterprises, supporting the activity of maritime transport

Information agency Credinform prepared a ranking of enterprises, supporting the activity of maritime transport of Russia, on accounts receivable turnover.

The companies with the highest volume of revenue were selected for this ranking according to the data from the Statistical Register for the latest available period (for the year 2012). These enterprises were ranked by increase in accounts receivable turnover in days.

Accounts receivable turnover (days) is the relation of average accounts receivable for the period to sales revenue. This is the indicator of the speed of the repayment by an organization of its debts to suppliers and contractors. This ratio shows, how many times a year an enterprise has discharged the average amount of its accounts receivable. Consequently, the less is the ratio value, the soonest a company pays up current debts, what exercises a salutary influence over its solvency taken as a whole.

There is no specified value prescribed for the mentioned ratio, because it varies strongly depending on the branch, where each concrete enterprise conducts business.

Companies’ activity should be assessed relying on the industry-average indicator.

| № | Name | Region of the registration | Revenue, in mln RUB, for 2012 | Gain (reduction) by the year 2011, % | Accounts receivable turnover, in days | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|---|

| 1 | Sudokhodnaya Kompaniya pavino LLC INN: 2537031053 |

Primorye territory | 6 036,4 | 44,4 | 18 | 220 high |

| 2 | Flot Novorossiyskogo morskogo torgovogo porta OJSC INN: 2315005197 |

Krasnodar territory | 6 413,3 | -17,4 | 19 | 177 the highest |

| 3 | NOVOROSSIYSKY MORSKOI TORGOVY PORT OJSC INN: 2315004404 |

Krasnodar territory | 10 657,7 | 8,1 | 21 | 211 high |

| 4 | PRIMORSKY TORGOVY PORT LLC INN: 4704057515 |

Leningrad region | 6 618,1 | 3,2 | 35 | 205 high |

| 5 | ROSMORPORT FGUP INN: 7702352454 |

Moscow | 15 341,3 | 14,3 | 41 | 246 high |

| 6 | VOSTOCHNAYA STIVIDORNAYA KOMPANIYA LLC INN: 2508064833 |

Primorye territory | 4 479,7 | 35,3 | 44 | 228 high |

| 7 | NIKO LLC INN: 2538001527 |

Primorye territory | 5 286,0 | 4,5 | 59 | 222 high |

| 8 | SUDOKHODNAYA KOMPANIYA VOLZHSKOE PAROKHODSTVO OJSC INN: 5260902190 |

Nizhny Novgorod region | 4 797,9 | 180,4 | 85 | 214 high |

| 9 | MURMANSKOE MORSKOE PAROKHODSTVO OJSC INN: 5190400250 |

Murmansk region | 4 710,4 | -10,2 | 90 | 322 satisfactory |

| 10 | MIDGLEN LODZHISTIKS SAKHALIN LLC INN: 6501166304 |

Sakhalin region | 7 596,3 | -18,9 | 400 | 231 high |

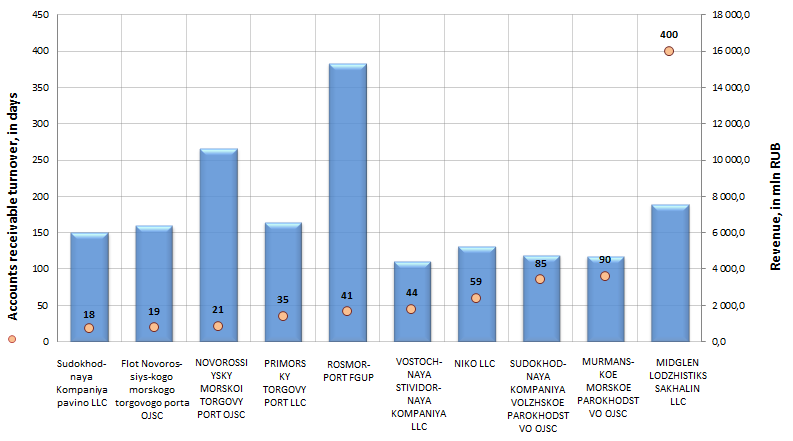

Picture. Accounts receivable turnover and revenue of the largest enterprises, supporting the activity of maritime transport (TOP-10)

The revenue of the largest enterprises, supporting the activity of maritime transport (TOP-10), made 71,9 bln RUB, following the results of the latest published financial statement. The dynamics of the cumulative turnover in annual expression showed moderate growth - 8,4%. Industry leaders accumulate up to 48% of the revenue of all companies of this economy sector.

Except the company MIDGLEN LODZHISTIKS SAKHALIN LLC, where the slowest turnover of accounts receivable is fixed (400 days), other enterprises from TOP-10 discharge debts on average for 46 days.

Following three organizations of the TOP-list showed the turnover period less than one calendar month: SUDOKHODNAYA KOMPANIYA PAVINO LLC (18 days), Flot Novorossiyskogo morskogo torgovogo porta OJSC (19 days), NOVOROSSIYSKY MORSKOI TORGOVY PORT OJSC (21 days).

SUDOKHODNAYA KOMPANIYA PAVINO LLC – carries out bunkering and supply of oil products in Far East region.

Flot Novorossiyskogo morskogo torgovogo porta OJSC - is the largest tow company among similar enterprises, serving vessels at ports. This is the only one self-sufficient commercial organization, providing a full range of harbor services to ship-owners at Novorossiysk Port.

NOVOROSSIYSKY MORSKOI TORGOVY PORT OJSC - is the third port operator of Europe and unchallenged leader on the volume of cargo tonnage in Russian stevedoring market. To the Group belong the biggest two ports of Russia — Novorossiysk port on the Black Sea, Port of Primorsk on the Baltic Sea, as well as port of Baltiysk in Kaliningrad region.

Now therefore, from a creditor's point of view, business connection with organizations mentioned above is least risky, money is refund in minimum terms.

Moreover, all TOP-10 enterprises (except Murmanskoe morskoe parokhodstvo, where the net loss is fixed) got high values of the solvency index GLOBAS -i®, what points to sound enough financial standing of the branch, to investment attractiveness.

See also: Ratio of liabilities and assets of enterprises offering passenger water transportation services

What will be the results of tax burden increase?

The Ministry of Finance of the Russian Federation (MinFin) has enacted a bill of imposing sales tax by regions. The document of the bill was sent for agreement with authorities. By estimate the imposing of this tax will draw more than 650 bln. RUB of extra funds within the first 3 years.

The Ministry suggests setting the maximum tax on the level of 3%. At the same time the sales tax is a regional tax: the decision about its imposing is made at the discretion of the federal subjects and is aimed at solving the problems of regional budgets. It is a reminder that the deficit of regional budgets for the last year was over 600 bln. RUB.

However not all goods and services will be subjects to taxation. For example it is not planned to collect tax from socially important goods like bakery products, dairy products, oils, margarine, eggs, cereals, sugar, salt, potato, medicines, baby and diabetic food, as well as children’s footwear and clothes.

As for services providing, services in the field of Municipal Housing Economy, transport, banks, education, culture and social servicing are exempted from sales tax.

Experts note, that the face of the new law is almost equal to the article of the ten-years-ago Tax Code, excluding tax rate (it was 5% in the previous edition) and tax collection from non-cash accounts. Tax refund became necessary for compensation of the budget’s deficit caused by the increase of expenses for social and military needs, as well as negative economic and political climate.

Vice-prime minister Arkadiy Dvorkovich appeared as advocate of this tax return. However he insisted at replacing VAT with it, reducing the tax burden by that. It should be noted that in the current version of the bill the sales tax imposing will in fact increase VAT.

At the same time the Ministry of Finance and the Ministry of Economic Development were skeptical for the initiative to return the sales tax, since its administration will require large expenditures and will not solve the major problems of the budget. Thus, according to the experts, the greatest benefit from the introduction of this tax should expect regions with the highest effective demand, which are less affected by the budget deficit.

Alexei Ulyukaev, the Economic Development Minister, also adversely commented on the possible increase of the tax burden to supplement the budget in the current economic situation. In his view, to solve the budget deficit must be a more rational approach to the formation of expenditures and income. Reducing primarily dead and costly program, as well as subsidies for unnecessary spending of state companies and natural monopolies.

Despite the fact that the federal government has not yet decided on the timing of administration of the sales tax, retail chains already counting the possible losses. Thus, according to the forecast of retail representatives, additional fiscal burden will doubly increase payments of network. Such a situation will adversely affect the inflation growth and cause many sellers to go into the shadows.

Final decision on the introduction of a new tax has not been made, but the country's leaders have already declared in its favor.