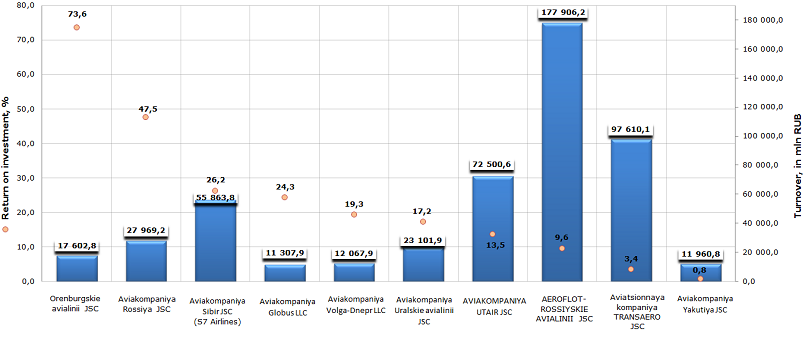

Return on investment of airline companies

Information agency Credinform prepared a ranking of Russian airline companies having the Air Operator Certificate for commercial air transport operations (as of the 10th of January 2014).

The companies with highest volume of revenue were selected for this ranking according to data from the Statistical Register for the latest available period (for the year 2012). Then, the first 10 enterprises selected by turnover were ranked by decrease in return on investment.

Return on investment (%) is the ratio of net profit (loss) of a company to its net asset value. The ratio shows how many monetary units were needed to an enterprise to get one monetary unit of net profit. The higher is the return on investment, the more effective a company has worked with the assets being at its disposal.

There is no recommended and specified value prescribed for profitability ratios, because their values vary depending on economic sphere, where each concrete enterprise operates. Therefore, a company should be assessed first of all relying on industry-average indicators, as well as focusing on other market players.

It should be noted, that the return on investment helps estimate not only the return of invested assets, but also the advisability of borrowing funds at certain interest. Thus the companies should take credits, interest on which is lower than the profitability of investment capital.

| № | Name, INN | Region | Turnover for 2012, in mln RUB | Return on investments, (%) | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | Orenburgskieavialinii JSC INN 5638057840 |

Orenburg region | 17 603 | 73,6 | 226 (high) |

| 2 | AviakompaniyaRossiyaJSC INN 7810814522 |

Saint-Petersburg | 47,5 | 27 969 | 282 (high) |

| 3 | Aviakompaniya Sibir JSC (S7 Airlines) INN 5448100656 |

Novosibirsk region | 55 864 | 26,2 | 206 (high) |

| 4 | Globus LLC INN 5448451904 |

Novosibirsk region | 11 308 | 24,3 | 233 (high) |

| 5 | AVIAKOMPANIYA VOLGA-DNEPR LLC INN 7328510118 |

Ulyanovsk region | 12 068 | 19,3 | 254 (high) |

| 6 | Aviakompaniya Uralskie avialinii JSC INN 6608003013 |

Sverdlovsk Region | 23 102 | 17,2 | 183 (the highest) |

| 7 | AVIAKOMPANIYAUTAIRJSC INN 7204002873 |

Khanty-Mansiysk Autonomous Region - Yugra | 72 501 | 13,5 | 223 (high) |

| 8 | AEROFLOT-ROSSIYSKIE AVIALINII JSC INN 7712040126 |

Moscow | 177 906 | 9,6 | 199 (the highest) |

| 9 | Aviatsionnaya kompaniya TRANSAERO JSC INN 5701000985 |

Saint-Petersburg | 97 610 | 3,4 | 224 (high) |

| 10 | AviakompaniyaYakutiya JSC INN 1435149030 |

the Republic of Sakha (Yakutia) | 11 961 | 0,8 | 232 (high) |

Cumulative turnover of TOP-10 the largest airline companies at year-end 2012 reached 507,9 mln RUB, increased by 22,5% in comparison with the year 2011, that is an positive trend. By that the average value of the analyzed ratio for the largest air carriers of Russia made 23,5% at year-end 2012.

The first place of the ranking list belongs to Orenburgskie avialinii JSC with the return on investment value 73,6%, that is more than a triple higher than the average value for leaders, what testifies to favorable investment climate. It means that the company has more alternatives for borrowing funds and their further use to its own benefit. Besides the enterprise got a high solvency index GLOBAS-i®, that characterizes it as financially stable.

Picture. Ranking «Return on investment (%) and turnover of the largest airline companies of the RF» (TOP-10)

Companies Aviakompaniya Rossiya JSC, Aviakompaniya Sibir JSC (S7 Airlines) and Globus LLC also showed the return on investment value higher than the average value for industry leaders, what testifies to effective use by companies of assets being at their disposal. All three organizations got a high solvency index GLOBAS-i®.

Industry leader by turnover - AEROFLOT-ROSSIYSKIE AVIALINII JSC, is only on the 8th place of the ranking with the return on investment ratio 9,6%. Although, the company got the highest solvency index GLOBAS-i®, that characterizes it as the most attractive for investments. This conclusion confirms once again the rule, that for an objective assessment of a company it is necessary to take comprehensive approach with using of either financial or non-financial indicators.

State companies are obliged to increase purchase rate of the small business

In December 2013 the Prime Minister of the Russian Federation Dmitry Medvedev has enacted the list of decision documents for Russian representatives in the Board of Directors of companies with state participation and which procurement activities fall within the scope of the federal law regulating the state procurement. The approved rules were developed by the Ministry of Economy and Development and extend on all individuals, including state officials and international experts promoting interests of the state in Supervisory Boards of Open Joint-Stock companies with state share of more than 50%.

In accordance with passed amendments, members of Supervisory Boards of state corporations-customers are now obliged not only to outsource the representatives of small and medium businesses for the purchase audit but also to be promotive of their efficient participation in tenders. First of all, customers should return the charge to procurement participants of small and medium businesses for tender security for the period of no more than one week. Secondly, they should sign a contract with the winner of the tender during 20 days. And thirdly, they should pay for contactor’s work within 10 days from the date of signing of all the necessary documents. Besides, the representatives of the small and medium business will be entitled the right to choose between bank guarantee and cash security for the charge payment for tender security.

However, both representatives of state corporations and of the small business are not pleased with current developments. According to experts, the main problem for the moment is non-transparency of the state contracts. Thus, as for calculations of the experts of the National Association of Purchasing Institutes, out of more than 200 tenders with a total cost of 0.5 trillion rubles, a minority may be considered fully transparent. In most of cases the difference between the state contract maximal price and “competitive” offering is less than 1%. Experts see the reason to this in orientation of the tender documentation for the specific supplier. At the same time, 57% of state contacts are concluded with the singular supplier.

The main goal of the proposed developments is to increase the purchase rate that is accounted for by the representatives of the small and medium business. The Prime Minister states that for the moment the specific weight of the small and medium businesses in these purchases amounts to 10%. That doesn’t show its role in country’s economy. In accordance with the orienting points containing in the «roadmap», by 2018 its share in the purchasing structure must be amounted to minimum 25% and direct purchasing share (without any middlemen) must increase from 2 to 10%. According to Dmitry Medvedev, corresponding measures allow to make the purchasing system of the largest companies more transparent.