Activity trends of telecommunications companies

Information Agency Credinform presents a review of activity trends of the largest Russian telecommunications companies.

Telecommunications companies with the largest annual revenue (TOP-10 and TOP-1000) have been selected for the analysis, according to the data from the Statistical Register for the latest available accounting periods (2015 — 2017). The analysis was based on the data from the Information and Analytical system Globas.

Net asset value indicates fair value of corporate assets and is calculated annually as assets on balance less company’s liabilities. Net asset value is negative (insufficiency of property) if liabilities are larger than the property value.

| No. in TOP-1000, Name, INN, region, activity |

Net asset value, billion RUB | Solvency index Globas | ||

| 2015 | 2016 | 2017 | ||

| 1 | 2 | 3 | 4 | 5 |

| 1 PJSC ROSTELECOM INN 7707049388 Saint Petersburg Wired telecommunications activities |

280,38 |  274,83 274,83 |

273,99 273,99 |

247 Medium |

| 2 JSC MEGAFON INN 7812014560 Moscow Wired telecommunications activities |

163,07 |  149,68 149,68 |

128,32 128,32 |

235 Strong |

| 3 Mobile TeleSystems JSC INN 7740000076 Moscow Wireless telecommunications activities In process of reorganization in the form of acquisition of other legal entities since 04.07.2018 |

37,88 |  37,23 37,23 |

114,72 114,72 |

207 Strong |

| 4 PJSC VIMPEL-COMMUNICATIONS INN 7713076301 Moscow Mobile communications services for voice transmission |

119,54 |  108,28 108,28 |

93,27 93,27 |

188 High |

| 5 JSC Moscow City Telephone Network INN 7710016640 Moscow Wired telecommunications activities Cases on declaring the company bankrupt (insolvent) are proceeding |

98,13 |  88,99 88,99 |

82,42 82,42 |

550 Insufficient |

| 996 JSC GlobalStar-Space Telecommunications INN 7717089767 Moscow Satellite telecommunications activities |

-1,45 |  -1,56 -1,56 |

-0,31 -0,31 |

269 Medium |

| 997 Trivon Networks LLC INN 5054086236 Moscow Wired telecommunications activities |

-0,33 |  -0,38 -0,38 |

-0,47 -0,47 |

334 Adequate |

| 998 MIRANDA-MEDIA LLC INN 7702527584 Republic of Crimea Data transmission and access to the Internet services |

-0,44 |  -0,51 -0,51 |

-0,53 -0,53 |

302 Adequate |

| 999 STACK DATA NETWORK LLC INN 7713730490 Moscow Telephone communication services |

-0,09 |  -0,35 -0,35 |

-0,83 -0,83 |

331 Adequate |

| 1000DATAPRO LLC INN 7704825145 Moscow Other wired telecommunications activities |

-2,12 |  -1,88 -1,88 |

-1,96 -1,96 |

339 Adequate |

— growth compared to prior period,

— growth compared to prior period,  — decline compared to prior period.

— decline compared to prior period.

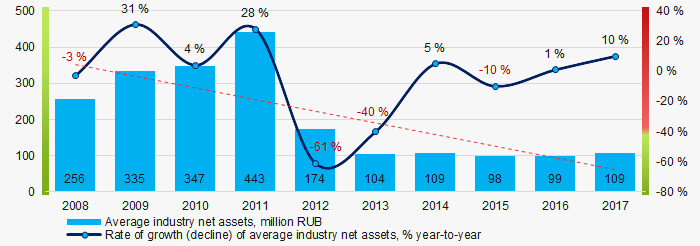

Average net assets of TOP-1000 companies tended to decrease during the last decade (Picture 1).

Picture 1. Change in average net assets of telecommunications companies in 2008 — 2017

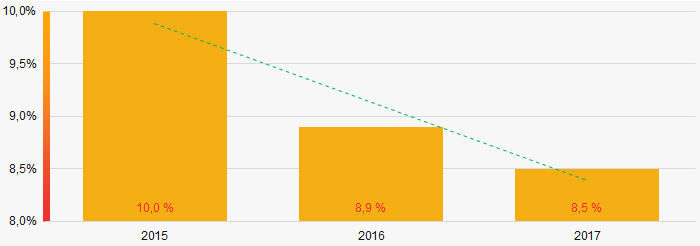

Picture 1. Change in average net assets of telecommunications companies in 2008 — 2017The share of TOP-1000 companies with insufficiency of property tends to decrease within the last 3 years (Picture 2).

Picture 2. Share of TOP-1000 companies with negative value of net assets in 2015-2017

Picture 2. Share of TOP-1000 companies with negative value of net assets in 2015-2017Sales revenue

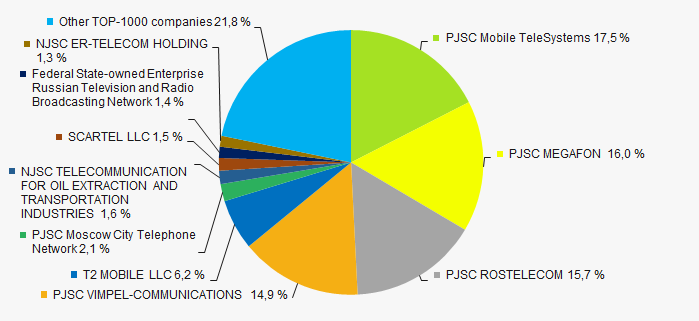

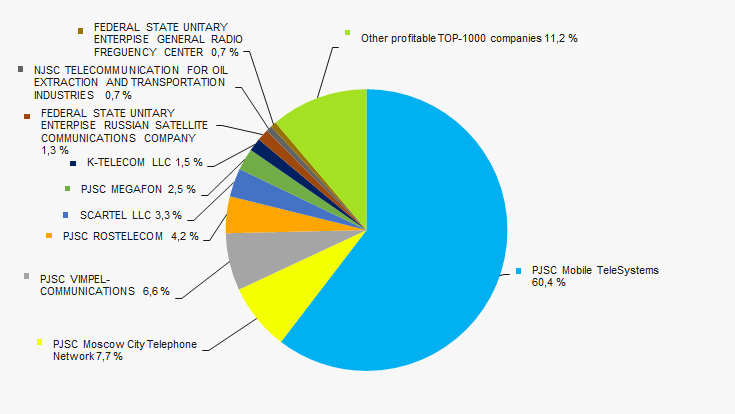

In 2017 sales revenue of 10 industry leaders amounted to 78% of total revenue of TOP-1000 companies (Picture 3). This is an indicator of a high level of monopolization within the industry.

Picture 3. TOP-10 companies by their share in 2017 total revenue of TOP-1000 companies

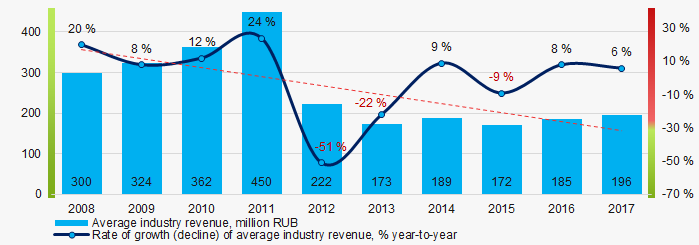

Picture 3. TOP-10 companies by their share in 2017 total revenue of TOP-1000 companiesIn general, average industry revenue tends to decrease during the decade (Picture 4).

Picture 4. Change of average industry revenue of telecommunications companies in 2008 – 2017

Picture 4. Change of average industry revenue of telecommunications companies in 2008 – 2017Profit and loss

In 2017 net profit of 10 industry leaders amounted to 89% of total net profit of TOP-1000 companies (Picture 5).

Picture 5. TOP-10 companies by their share in 2017 total net profit of TOP-1000

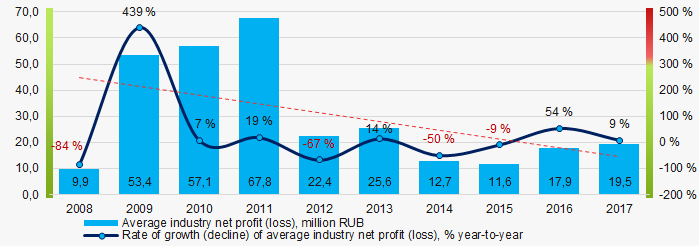

Picture 5. TOP-10 companies by their share in 2017 total net profit of TOP-1000During the last decade average industry net profit tended to decrease (Picture 6).

Picture 6. Change in average industry net profit of telecommunications companies in 2008 — 2017

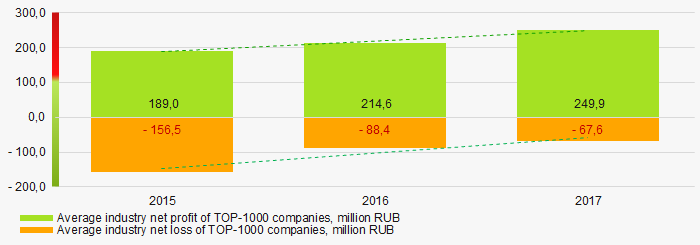

Picture 6. Change in average industry net profit of telecommunications companies in 2008 — 2017During the last 3 years average industry net profit of TOP-1000 companies increased, and the average net loss decreased (Picture 7).

Picture 7. Change in average net profit and loss of TOP-1000 companies in 2015 — 2017

Picture 7. Change in average net profit and loss of TOP-1000 companies in 2015 — 2017Key financial ratios

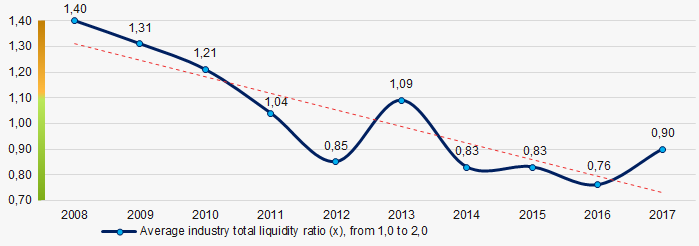

During the last decade average values of total liquidity ratio were below the recommended value — from 1,0 to 2,0, tending to decrease (Picture 8).

Total liquidity ratio (a ratio of current assets to current liabilities) reveals the sufficiency of a company’s funds for meeting its short-term liabilities.

Picture 8. Change in average values of total liquidity ratio of telecommunications companies in 2008 — 2017

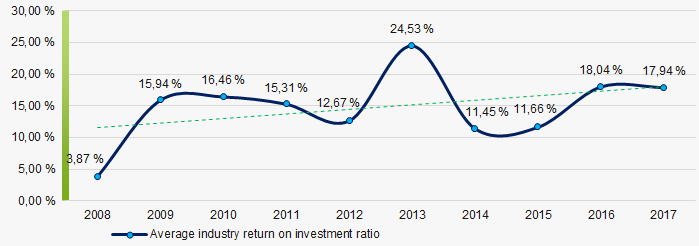

Picture 8. Change in average values of total liquidity ratio of telecommunications companies in 2008 — 2017During the last decade, average industry values of return on investment ratio tended to grow (Picture 9).

It is a ratio of net profit to total equity and noncurrent liabilities, and it demonstrates benefit from equity engaged in business activity and long-term raised funds of the company.

Picture 9. Change in average values of return on investment ratio of telecommunications companies in 2008 — 2017

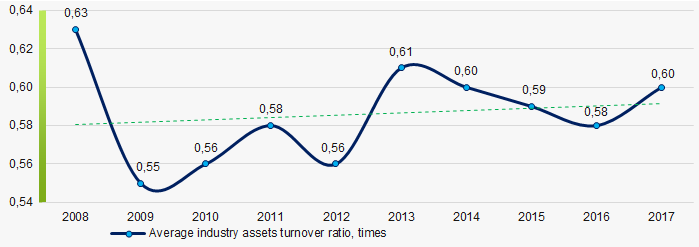

Picture 9. Change in average values of return on investment ratio of telecommunications companies in 2008 — 2017Assets turnover ratio is a ratio of sales revenue to average total assets for the period, and it measures resource efficiency regardless of the sources. The ratio indicates the number of profit-bearing complete production and distribution cycles per annum.

During the decade, this activity ratio tended to increase (Picture 10).

Picture 10. Change in average values of assets turnover ratio of telecommunications companies in 2008 — 2017

Picture 10. Change in average values of assets turnover ratio of telecommunications companies in 2008 — 2017Structure of production and services

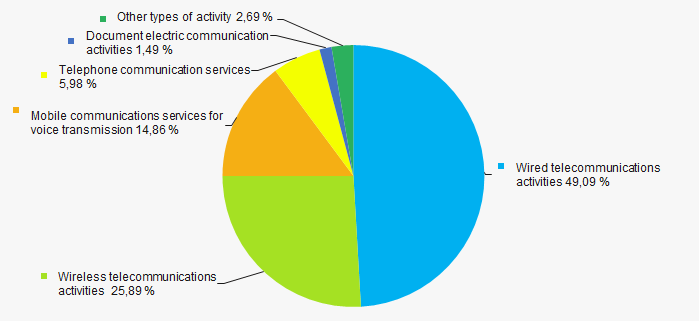

Companies that provide wired telecommunications services have the majority share in the total revenue of TOP-1000 companies (Picture 11).

Picture 11. Types of activity by their share in total revenue of TOP-1000 companies

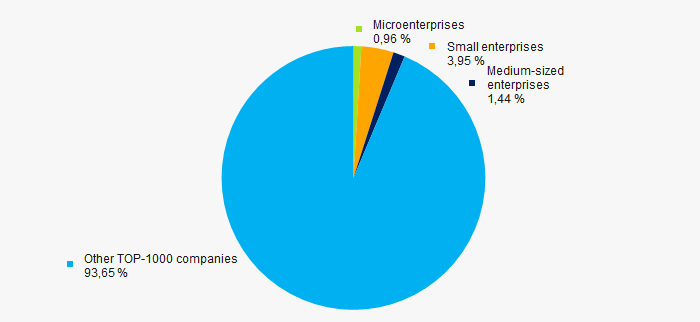

Picture 11. Types of activity by their share in total revenue of TOP-1000 companies 77% of TOP-1000 companies are included in the Register of small and medium-sized businesses of the Federal Tax Service of the Russian Federation. In general, their share in total revenue of TOP-1000 in 2017 amounted to 6% (Picture 12).

Picture 12. Shares of small and medium-sized enterprises in TOP-1000 companies' revenue, %

Picture 12. Shares of small and medium-sized enterprises in TOP-1000 companies' revenue, %Key regions of activity

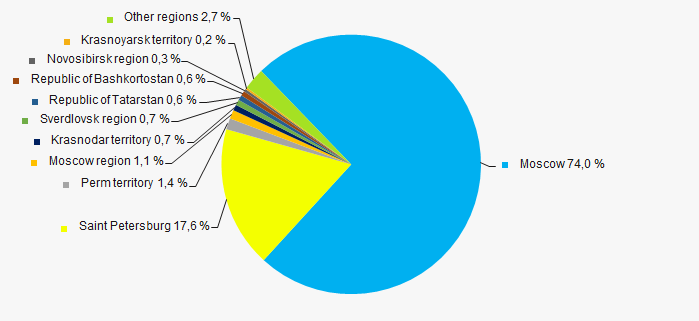

TOP-1000 companies are unevenly located throughout Russian territory and are registered in 79 regions. The largest revenue shares are concentrated in the major cities - Moscow and Saint Petersburg (Picture 13).

Picture 13. Revenue of TOP-1000 companies by Russian regions

Picture 13. Revenue of TOP-1000 companies by Russian regionsFinancial position score

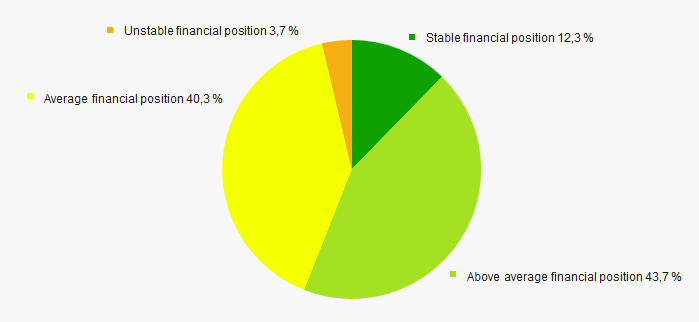

Assessment of financial state of TOP-1000 companies indicates that most of the companies have an above average financial position (Picture 14).

Picture 14. TOP-1000 companies by their financial position score

Picture 14. TOP-1000 companies by their financial position scoreSolvency index Globas

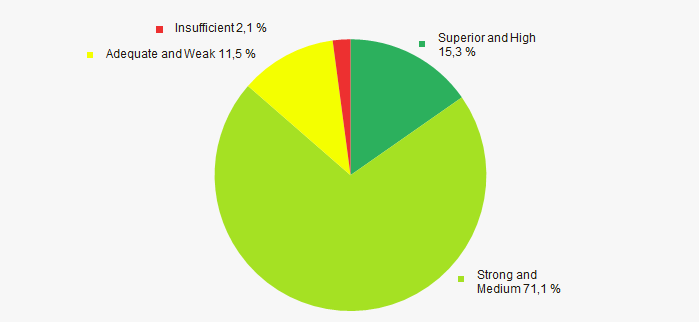

The majority of TOP-1000 companies have got a superior, high, strong or medium Solvency index Globas, that indicates their capability to meet liabilities timely and in full (Picture 15).

Picture 15. TOP-1000 companies by Solvency index Globas

Picture 15. TOP-1000 companies by Solvency index GlobasConclusion

A comprehensive assessment of the largest telecommunications companies, that considers key indexes, financial figures and ratios, is indicative of lack of clearly defined trends within the sector (Table 2).

| Trends and assessment factors | Relative share of the factor, % |

| Rate of growth (decline) of average industry net assets |  -10 -10 |

| Increase/ Decrease of share of companies with negative net assets |  10 10 |

| Rate of growth (decline) of average industry revenue |  -10 -10 |

| Level of competition / monopolization |  -10 -10 |

| Rate of growth (decline) of average industry net profit (loss) |  -10 -10 |

| Increase/ Decrease of average industry net profit of TOP-1000 companies |  10 10 |

| Increase/ Decrease of average industry net loss of TOP-1000 companies |  10 10 |

| Increase/ Decrease of average industry total liquidity ratio |  -10 -10 |

| Increase/ Decrease of average industry return on investment ratio |  10 10 |

| Increase/ Decrease of average industry assets turnover ratio |  10 10 |

| Share of small and medium-sized business within the industry by revenue over 22% |  -10 -10 |

| Regional concentration |  -10 -10 |

| Financial standing (majority share) |  10 10 |

| Solvency index Glogas (majority share) |  10 10 |

| Average factors' value |  0,0 0,0 |

— positive trend (factor),

— positive trend (factor),  — negative trend (factor).

— negative trend (factor).

Tax burden control

A new electronic service with the tax calculator became operational on the official website of the Federal tax service of the Russian Federation. The service allows companies, operating under the general taxation system, to compare the tax burden, including specific payments, with the average industry indicators in the region.

The tax burden is calculated as the ratio of tax paid (less agency fees) to the company's income according to the financial statements (less income from participation in other organizations). The tax burden level may be various and depend on industry, scope of activities and regional characteristics, which may affect the business operations.

The following indicators can be obtained using the tax calculator (%%): total burden (less severance tax and excise duties); total burden (including severance tax and excise duties); profit tax burden; VAT burden; profitability of sales.

The company’s tax burden below the industry average level can be the reason of its inclusion in the field inspection plan.

The tax burden calculator is the part of the electronic service called «Transparent business».

To learn about the position of your company or contractors in the industry is possible by using the service "Analysis of competitive environment" in the Information and Analytical system Globas.