Trends in the field of power supply activity

Information agency Credinform represents an overview in the field of power supply activity.

Enterprises with the largest volume of annual revenue (TOP-10 and TOP-500), trading with electricity, were selected for the analysis, according to the data from the Statistical Register for the latest available periods (for 2015 and 2016). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Sales revenue

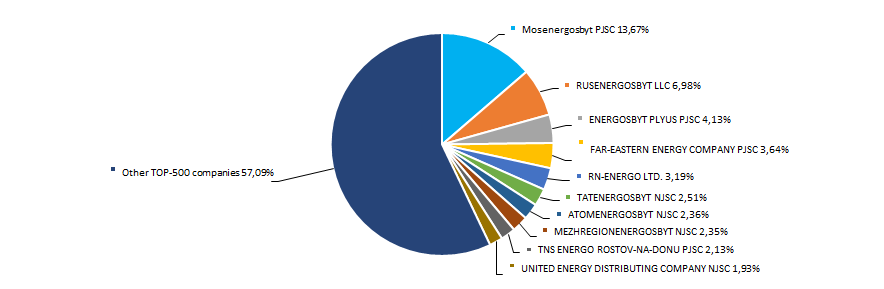

The revenue of 10 industry leaders made 43% of the total revenue of TOP-500 companies in 2016. It points to a relatively high level of monopolization in the industry. Mosenergosbyt PJSC – guaranteeing supplier of electric power in the territory of Moscow and Moscow region – became the largest company in terms of revenue in 2016 (Picture 1).

Picture 1. Shares of participation of TOP-10 companies in the total revenue of TOP-500 companies for 2016

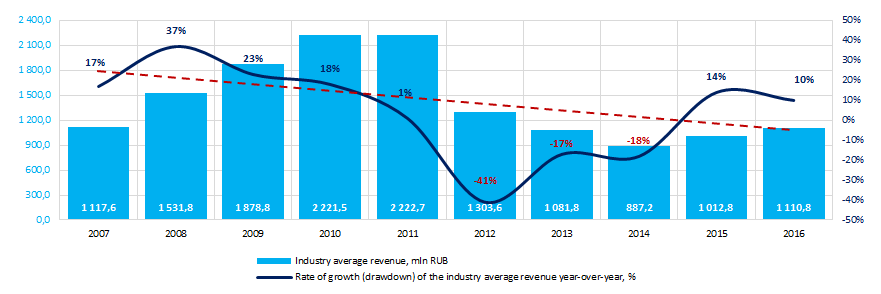

Picture 1. Shares of participation of TOP-10 companies in the total revenue of TOP-500 companies for 2016The best results in the industry in terms of revenue for the ten-year period were achieved in 2011. During the crisis periods in the economy in 2012 – 2014 the industry average indicators decreased. In general, there is a trend towards a decrease in volume revenue (Picture 2).

Picture 2. Change in the industry average revenue of companies in the field of power supply activity in 2007 – 2016

Picture 2. Change in the industry average revenue of companies in the field of power supply activity in 2007 – 2016Profit and losses

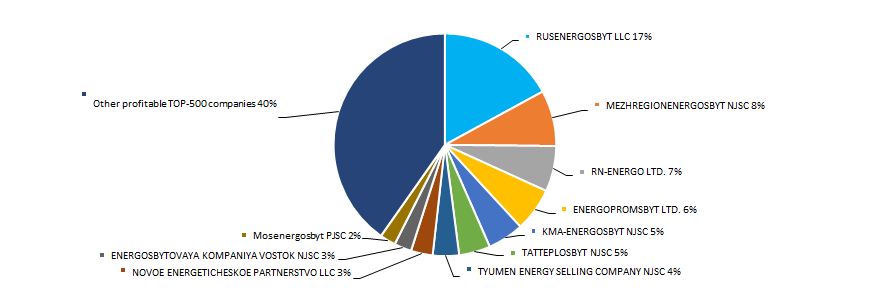

The profit volume of 10 industry leaders in 2016 made 60% of the total profit of TOP-500 companies. The leading position in terms of profit volume in 2016 is taken by RUSENERGOSBYT LLC – one of the largest power supply companies in Russia, delivering electricity to more than 105 000 customers in 60 regions of the country (Picture 3).

Picture 3. Share of participation of TOP-10 companies in the total volume of profit of TOP-500 enterprises for 2016

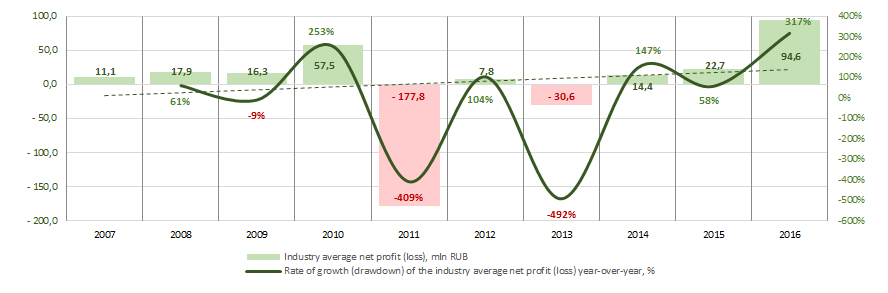

Picture 3. Share of participation of TOP-10 companies in the total volume of profit of TOP-500 enterprises for 2016Industry average indicators of profit of companies of the industry for the ten-year period are not stable. Negative values of the indicator were observed in 2011 and 2013. In general, profit indicators tend to increase. The industry showed the best results in 2016 (Picture 4).

Picture 4. Change in the industry average indicators of profit of companies in the field of power supply activity in 2007 – 2016

Picture 4. Change in the industry average indicators of profit of companies in the field of power supply activity in 2007 – 2016Key financial ratios

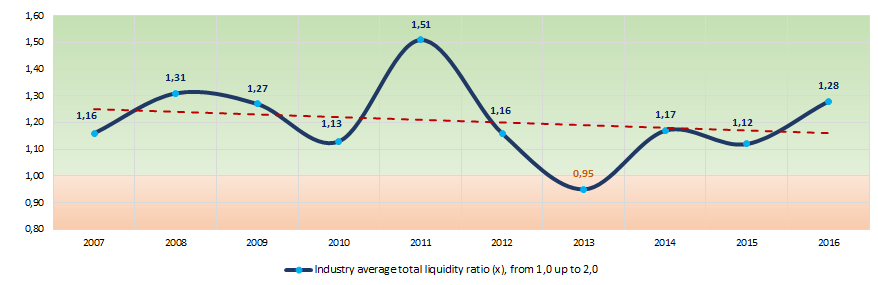

Over the ten-year period the industry average indicators of the total liquidity ratio were in the range of recommended values – from 1,0 up to 2,0, except the year 2013 (Picture 5). In general, the ratio indicator tends to decrease.

The total liquidity ratio (the relation of the amount of current assets to short-term liabilities) shows the sufficiency of company’s funds for repayment of its short-term liabilities.

The experts of the Information agency Credinform, taking into account the actual situation both in the economy as a whole and in the sectors, has developed and implemented in the Information and Analytical system Globas the calculation of practical values of financial ratios that can be recognized as normal for a particular industry. For companies in the field of power supply activity the practical value of the total liquidity ratio made from 0,77 up to 2,46 in 2016.

Picture 5. Change in the average industry values of the total liquidity ratio of companies in the field of power supply activity in 2007 – 2016

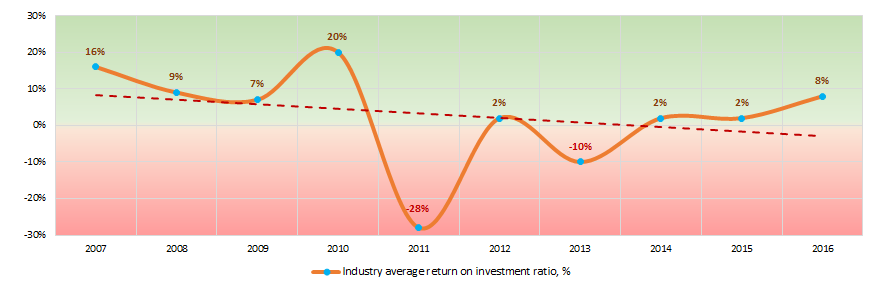

Picture 5. Change in the average industry values of the total liquidity ratio of companies in the field of power supply activity in 2007 – 2016There has been an instability observed in indicators of the return on investment ratio for ten years, with a tendency to decrease. In 2011 and 2013 the indicators decreased to negative values (Picture 6). The ratio is calculated as the relation of net profit to the sum of own capital and long-term liabilities and demonstrates the return on the equity involved in the commercial activity of own capital and the long-term borrowed funds of an organization.

Picture 6. Change in the average industry values of the return on investment ratio of companies in the field of power supply activity in 2007 – 2016

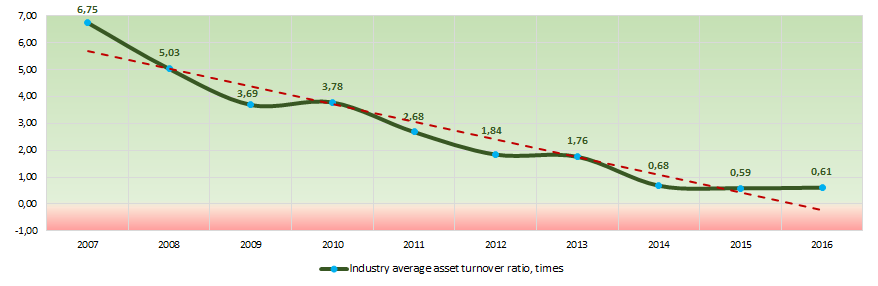

Picture 6. Change in the average industry values of the return on investment ratio of companies in the field of power supply activity in 2007 – 2016Asset turnover ratio is calculated as the relation of sales proceeds to the average value of total assets for a period and characterizes the efficiency of use of all available resources, regardless of the sources of their attraction. The ratio shows how many times a year a complete cycle of production and circulation is made, yielding profit.

As a whole, this activity ratio showed a tendency to decrease over the ten-year period (Picture 7).

Picture 7. Change in the average industry values of the asset turnover ratio of companies in the field of power supply activity in 2007 – 2016

Picture 7. Change in the average industry values of the asset turnover ratio of companies in the field of power supply activity in 2007 – 2016Main regions of activity

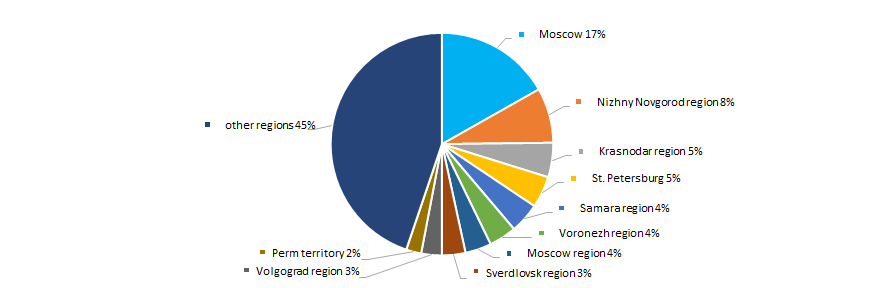

The companies of the industry are unequally distributed across the country. Their largest number is registered in Moscow – the biggest industrial and financial center of the country (Picture 8).

TOP-500 companies are registered in 74 regions of Russia.

Picture 8. Distribution of TOP-500 companies by regions of Russia

Picture 8. Distribution of TOP-500 companies by regions of RussiaFinancial position score

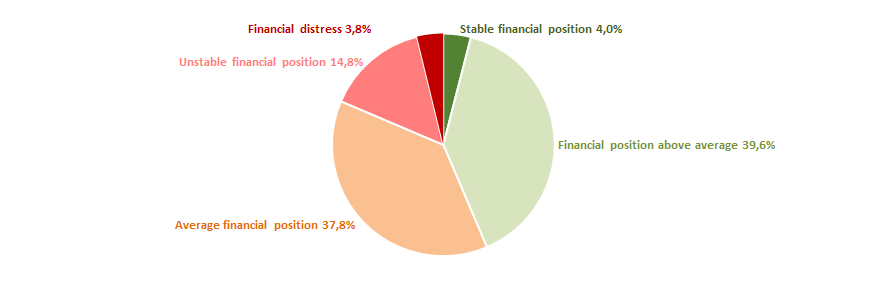

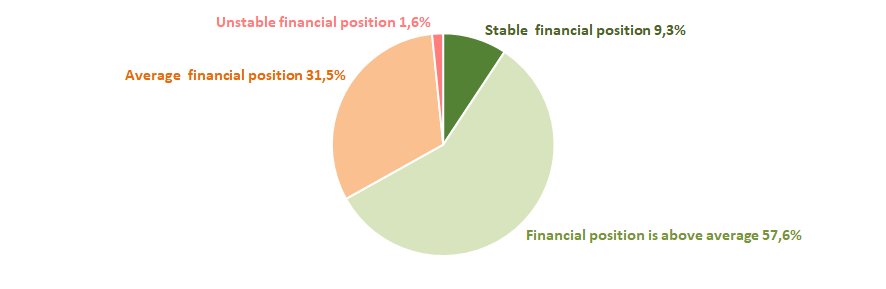

An assessment of the financial position of companies in the industry shows that their the largest number are in a stable financial position and above the average (Picture 9).

Picture 9. Distribution of TOP-500 companies by financial position score

Picture 9. Distribution of TOP-500 companies by financial position scoreLiquidity index

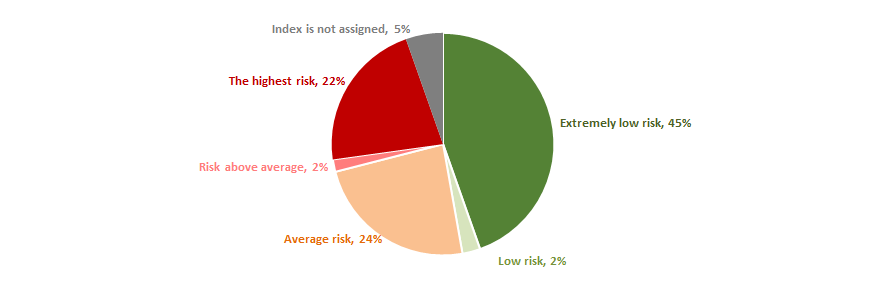

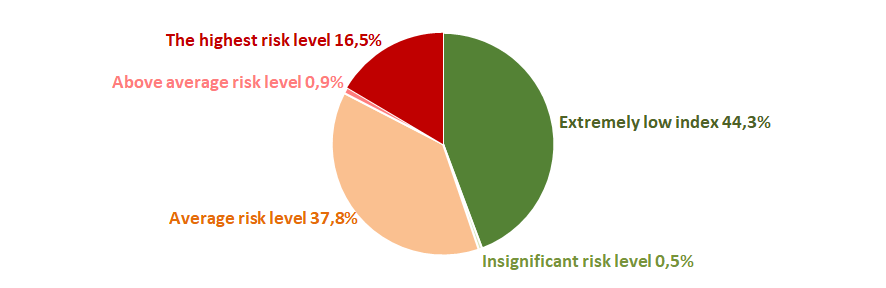

Almost half of companies of the industry show an extremely low bankruptcy risk in the short-term period. However, almost a quarter of companies has the highest and above average level of bankruptcy risk (Picture 10).

Picture 10. Distribution of TOP-500 companies by liquidity index

Picture 10. Distribution of TOP-500 companies by liquidity indexSolvency index Globas

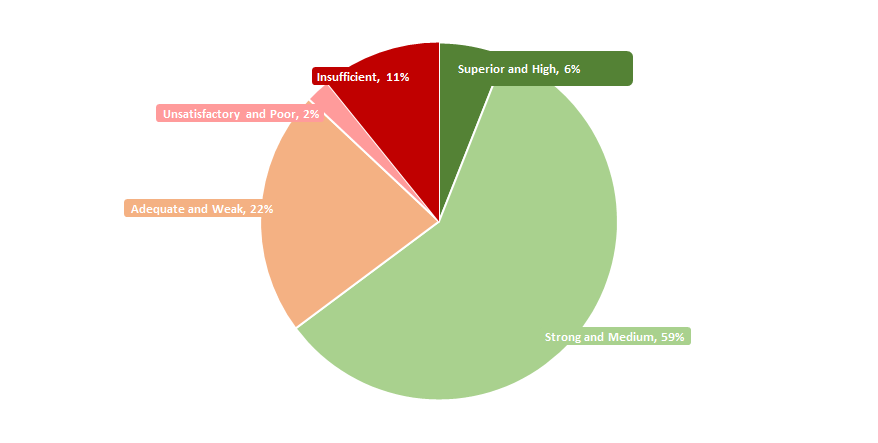

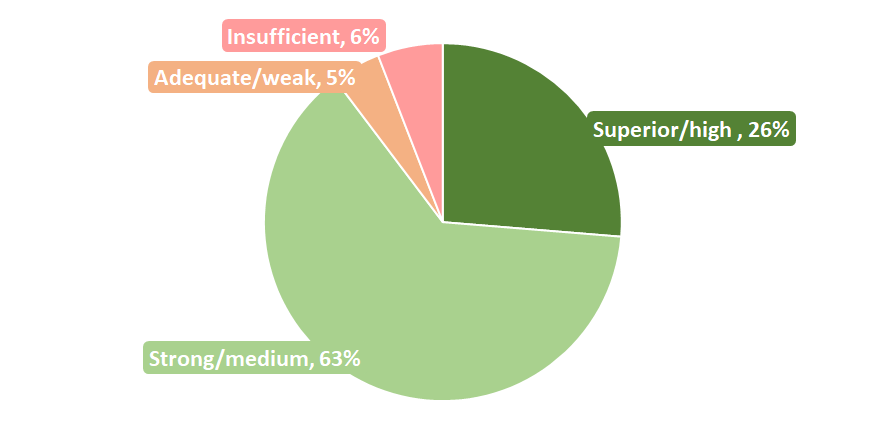

Most of TOP-500 companies got Superior/High or Strong/Medium Solvency index Globas, that points to their ability to repay their debts in time and fully (Picture 11).

Picture 11. Distribution of TOP-500 companies by solvency index Globas

Picture 11. Distribution of TOP-500 companies by solvency index GlobasThus, a comprehensive assessment of enterprises in the field of power supply activity, taking into account the main indices, financial indicators and ratios, points to relatively favorable trends in the industry, as a whole.

Trends in activity of the largest companies of Saint-Petersburg's real economy

Information Agency Credinform has prepared the review of trends in activity of the largest companies of Saint-Petersburg's real economy.

The largest enterprises (TOP-10 and TOP-1000) in terms of annual revenue were selected according to the data from the Statistical Register for the latest available periods (2015 and 2016). The analysis was based on data of the Information and Analytical Globas.

Sales revenue

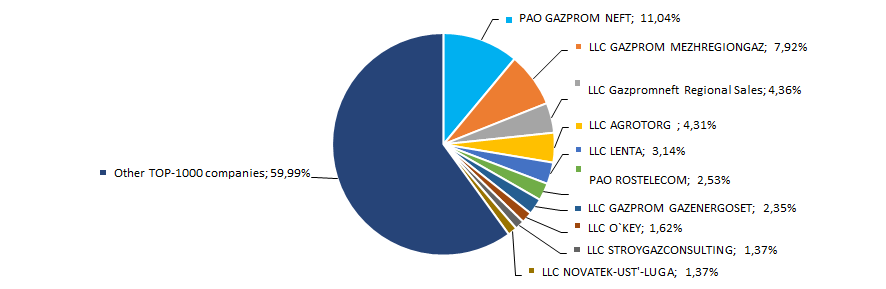

In 2016 total revenue of 10 largest companies amounted to 40% from TOP-1000 total revenue. In 2016, the largest company by total revenue is PAO GAZPROM NEFT – vertically integrated oil company, engaged in oil and gas fields exploration and development, oil refining, production and sale of petroleum products (Picture 1).

Picture 1. Shares of TOP-10 companies in TOP-1000 total revenue for 2016

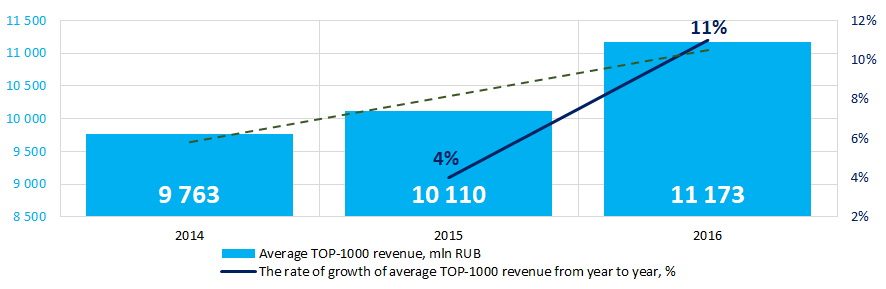

Picture 1. Shares of TOP-10 companies in TOP-1000 total revenue for 2016For the three-year period, the best results by revenue in TOP-1000 were achieved in 2016. In general, the increase in sales revenue is observed (Picture 2).

Picture 2. Change in average revenue of the largest companies of Saint-Petersburg's real economy in 2014 – 2016

Picture 2. Change in average revenue of the largest companies of Saint-Petersburg's real economy in 2014 – 2016Profit and loss

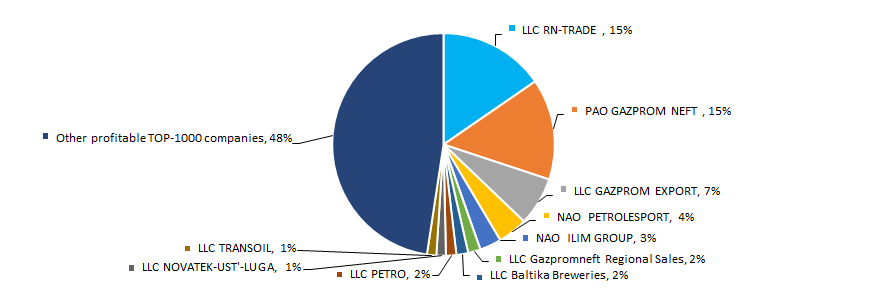

In 2016, profit of 10 largest companies amounted to 52% from TOP-1000 total profit. In 2016, the leading positions by profit take LLC RN-TRADE – the subsidiary of PAO ROSNEFT OIL COMPANY, engaged in retail sale of motor fuels through the filling station chain and to small wholesale consumers, and PAO GAZPROM NEFT (Picture 3).

Picture 3. Shares of TOP-10 companies in TOP-1000 total profit for 2016

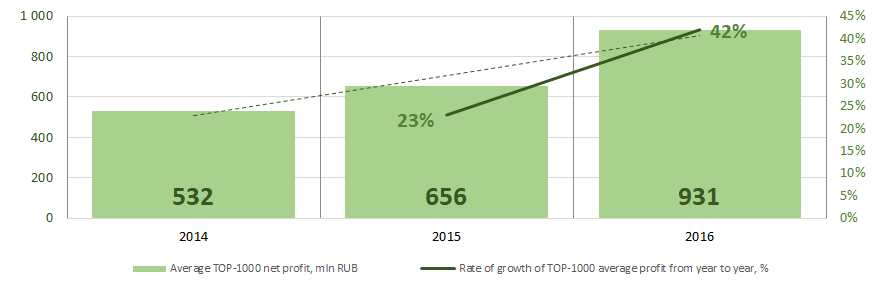

Picture 3. Shares of TOP-10 companies in TOP-1000 total profit for 2016For the three-year period, the average revenue values of TOP-1000 companies show the growing tendency (Picture 4).

Рисунок 4. Picture 4. Change in average profit of the largest companies of Saint-Petersburg's real economy in 2014 – 2016

Рисунок 4. Picture 4. Change in average profit of the largest companies of Saint-Petersburg's real economy in 2014 – 2016Main financial indicators

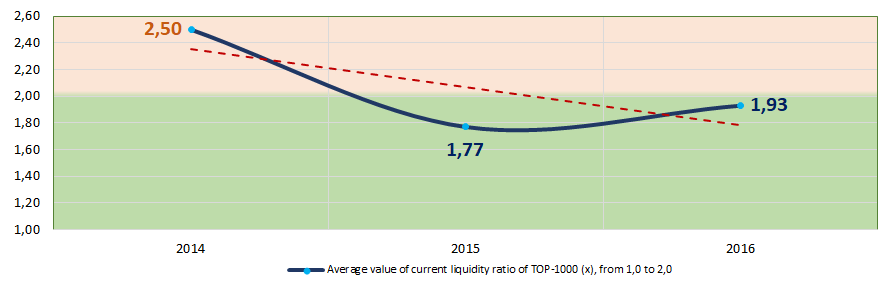

For 2014 – 2016 period the average values of current liquidity ratio of TOP-1000 were higher or within the recommended values – from 1,0 to 2,0 (Picture 5).

Current liquidity ratio (ratio of total working capital to short-term liabilities) shows the sufficiency of company’s assets to meet short-term obligations.

Picture 5. Change in average values of current liquidity ratio of the largest companies of Saint-Petersburg's real economy in 2014 – 2016

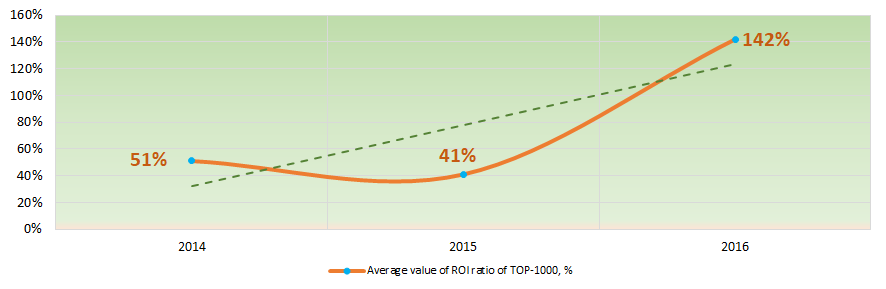

Picture 5. Change in average values of current liquidity ratio of the largest companies of Saint-Petersburg's real economy in 2014 – 2016For the three-year period, the instability of ROI ratio with increasing tendency was observed (Picture 6). The ROI ratio is calculated as a ratio of net profit to sum of stockholder equity and long-term liabilities and shows the return from equity involved in commercial activities and long-term borrowed funds.

Picture 6. Change in average values of ROI ratio of the largest companies of Saint-Petersburg's real economy in 2014 – 2016

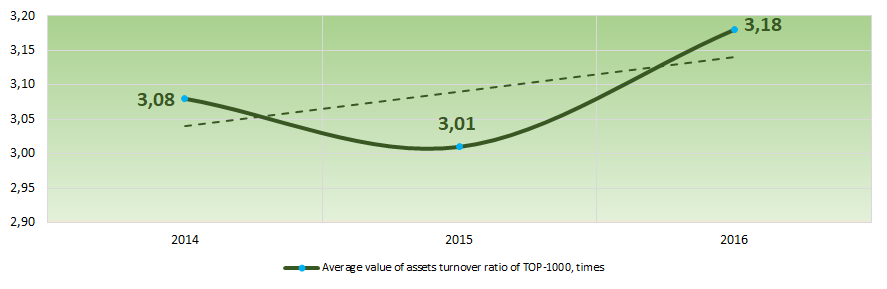

Picture 6. Change in average values of ROI ratio of the largest companies of Saint-Petersburg's real economy in 2014 – 2016Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

For the three-year period, this business activity ratio in general demonstrated the upward trend (Picture 7).

Picture 7. Change in average values of business activity ratio of the largest companies of Saint-Petersburg's real economy in 2014 – 2016

Picture 7. Change in average values of business activity ratio of the largest companies of Saint-Petersburg's real economy in 2014 – 2016Production and services structure

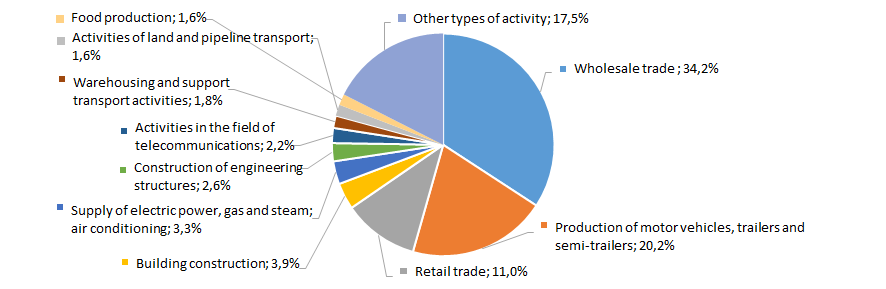

The largest share in TOP-1000 total revenue take companies engaged in wholesale trade and production of motor vehicles (Picture 8).

Picture 8. Distribution of activities in TOP-1000 total revenue, %

Picture 8. Distribution of activities in TOP-1000 total revenue, %Main regions of initial registration

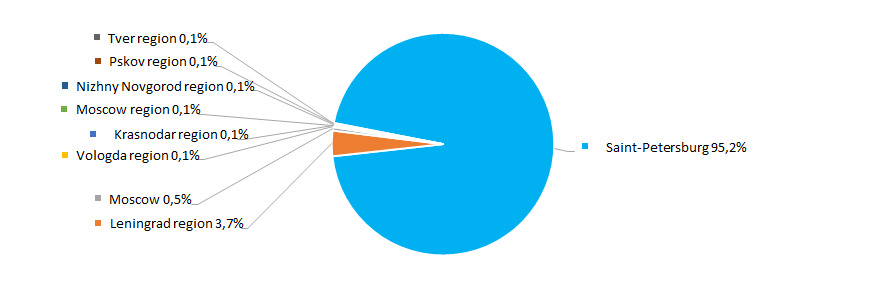

The majority of companies with initial registration outside Saint-Petersburg was founded in Leningrad region (Picture 9).

Picture 9. Distribution of TOP-1000 companies by initial registration regions

Picture 9. Distribution of TOP-1000 companies by initial registration regionsFinancial position score

The assessment of company’s financial position shows that more than a half of companies have above average financial position (Picture 10).

Picture 10. Distribution of TOP-1000 companies by financial position score

Picture 10. Distribution of TOP-1000 companies by financial position scoreLiquidity index

44% of TOP-1000 companies demonstrate rather low level of bankruptcy risk in the short-term period and more than one third have average level of bankruptcy risk (Picture 11).

Picture 11. Distribution of TOP-1000 companies by liquidity index

Picture 11. Distribution of TOP-1000 companies by liquidity indexSolvency index Globas

The majority of TOP-1000 companies have superior/high or strong/medium solvency index Globas, this fact shows the ability of the companies to meet their obligations in time and fully (Picture 12).

Picture 12. Distribution of TOP-1000 companies by solvency index Globas

Picture 12. Distribution of TOP-1000 companies by solvency index GlobasHereby, the complex assessment of the largest companies of Saint-Petersburg's real economy, taking into account main indexes, financial ratios and indicators, demonstrates the denomination of favorable trends.