The structure of the russian economy is changing

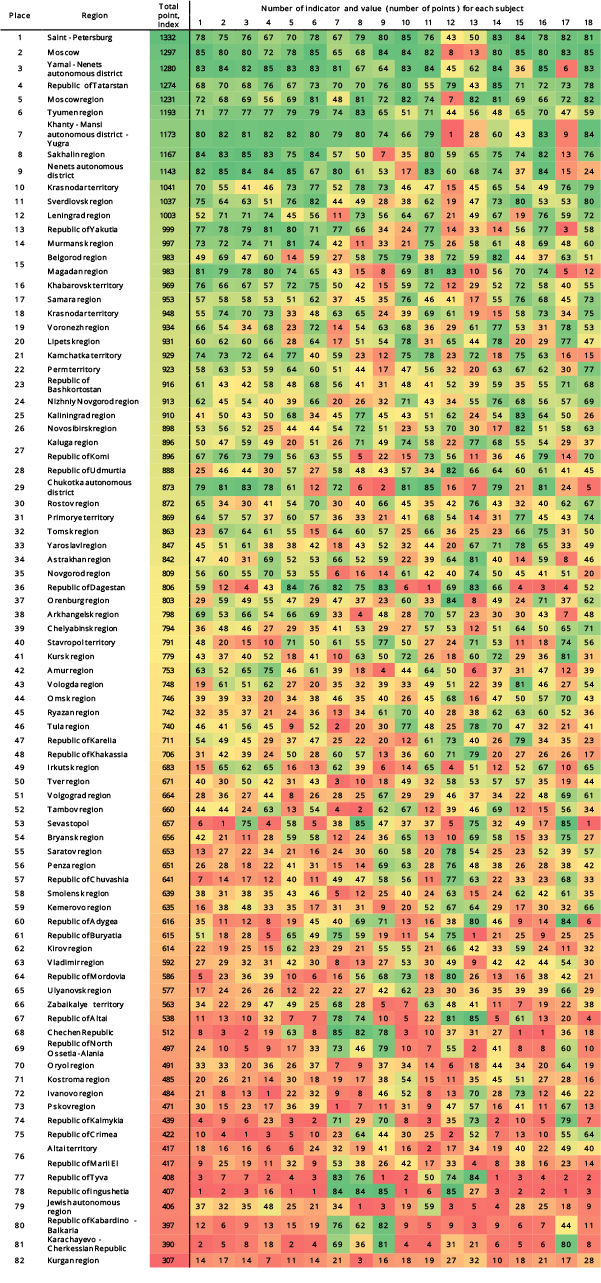

The Russian companies continue to increase turnover despite of all difficulties in business process. According to the latest financial accounts, total revenue net of VAT, excises and other liabilities exceeds 207 trln RUB (see Picture 1). In the context of absolute values, this figure can be considered as a historical maximum. At the same time, the growth rate of total revenue (year to year) can indicate the efficiency of development and demand model, as well as prices increase, or inflation in other words.

Total revenue of enterprises shows the situation in economy of the state in general. For example, decrease in demand follows the prices increase, and resulted in reduction in revenue that leads to reduction of the GDP. The alike situation was observed at the crisis of 2008-2009 during which gross sales of companies decreased for the first time for several years. Russia overcomes this economic instability more easy than it was expected. It became possible due to floating rate of the national currency caused rouble devaluation that has led to negative import dynamics and improvement of competitive ability of domestic goods.

Picture 1. Dynamics of revenue from sale of goods, works and services according to the financial accounts, trln RUB

Picture 1. Dynamics of revenue from sale of goods, works and services according to the financial accounts, trln RUBDistribution of companies by business size

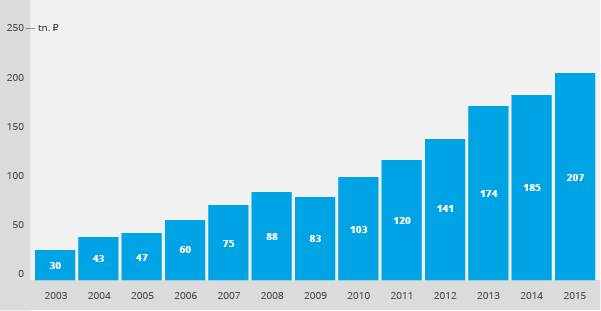

The Russian corporate sector is a field mainly for large business. Corporations holding a monopoly in their industries or segments accumulate about 71% of total revenue. The rest 24% fall for small and micro enterprises and only 5% for medium-sized companies (see Picture 2).

Criteria of classification as a micro-, small- and medium-sized business are established by the orders of the Russian Government. These categories have considerable support from the state: for example, they are statutory privileged participants of procurement procedures. Currently, micro-sized company is an organization with annual revenue up to 120 mln RUB and total stuffing not exceeding 15 employees; small-sized companies have up to 800 mln RUB of revenue and 100 employees, and up to 2 bln RUB of revenue and 250 employees are for medium companies. Other structures are classified as large business.

Picture 2. Distribution of total revenue by business size criterion in 2015, %

Picture 2. Distribution of total revenue by business size criterion in 2015, %Distribution of companies by sectors (sectoral structure of the economy)

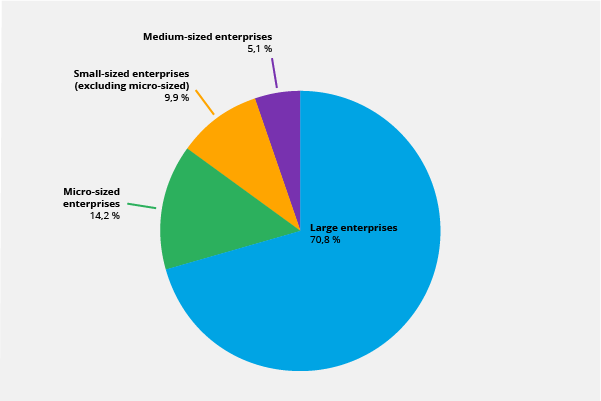

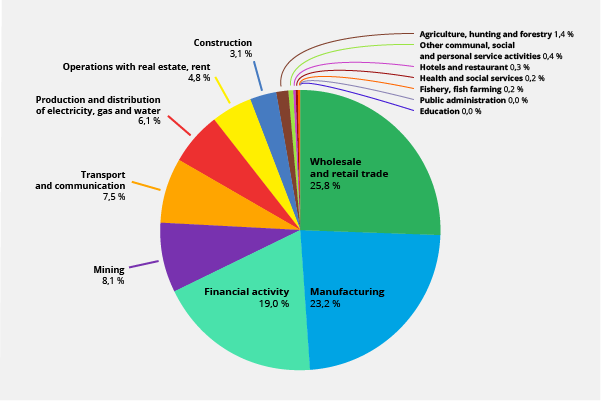

By reference to analyses of all funds virtually received on settlement or cash account, inference should be drawn that for the past 10 years the structure of domestic economy has underwent significant changes. Nowadays financial activity generates 19% of total earnings on companies’ accounts, when in 2007 the share of this sector not exceeded 0,1%. Speaking about senile industries such as manufacturing, transport and mining, their share is reducing (see pictures 3.1 and 3.2). That is to say Russia is on the way of developed countries where the significant part of the GDP is formed by financial services.

Picture 3.1. Sectoral structure of the economy as of January 1, 2007, %

Picture 3.1. Sectoral structure of the economy as of January 1, 2007, % Picture 3.2 Sectoral structure of the economy as of January 1, 2017, %

Picture 3.2 Sectoral structure of the economy as of January 1, 2017, %Distribution of companies by regions

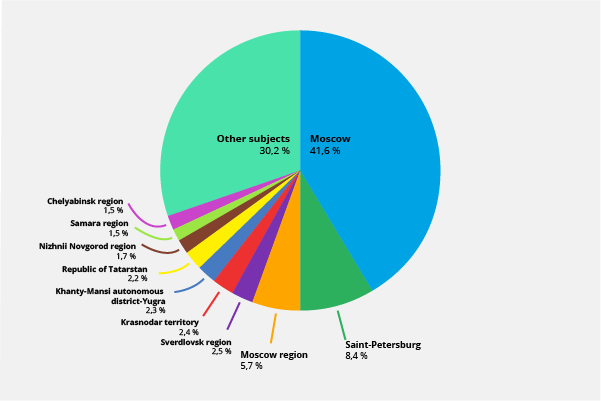

More than 40% of total revenue of all companies is generated in Moscow. Then follows Saint-Petersburg with 8,4% and Moscow region with 5,7% (see Picture 4). Economical imbalance becomes more obvious: almost all large business is registered in Moscow. At the same time its production sites and operating activity are located beyond perimeter of the agglomeration.

Picture 4. Regional distribution of total revenue of companies in 2015, %

Picture 4. Regional distribution of total revenue of companies in 2015, %In current conditions the Russian companies face the challenges hardly to be preliminary modeled and forecasted in term of plans and strategies of development. The current 2017 is expected to be as difficult as 2016. Despite of stabilization of world prices for resources and energy products, complicated geopolitical climate and higher volatility on financial and exchange markets still take place.

With a lack of significant growth, the development of certain enterprises can be provided due to competitors’ market shares only. Under current conditions it is going to have to put up with a lack of high profit rate. Also it is necessary to shift the emphasis towards business optimization and increase in labor productivity to keep reliability under conditions of demand stagnation.

Rating of socio-economic development of the regions

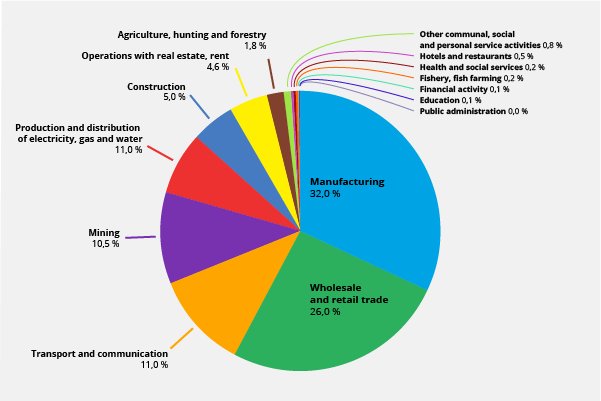

In the April Credinform Newsletter the rating of the Russian regions by socio-economic development is presented.

Development disparity of the Russian regions is long-standing and remains to be one of the key problems for the government and population. Increase in diversity among regions results in disturbance of social equilibrium of the country in general, as well as in differentiation of subject on leaders (minority) with large migration flows directed in, and territories in state of permanent crisis.

First of all, dissimilarity of figures is caused by availability or lack of mineral resources, development of industry and service sector, concentration of economic activity human and financial flows as a result, and climate conditions at a low-grade. As a rule, economic well-being of a region is a key to its good social development level, but there are exemptions: for example, the Republic of Ingushetia is behind by almost all economic indicators, but leads by the average expected lifespan. At the same time, Chukotka autonomous district with very high fiscal revenues, gross regional product and wage level has very low life span (second to last countrywide). In Yamal-Nenets autonomous district, similar to Chukotka by severe climate and economic situation, the life span is considerably higher and increase in population takes place there.

18 figures, the full list of which is presented in Table 1, were used to make a rating. The region can get from 1 to 85 points for each indicator: 85 points go for the best value and 1 for the worst. In summary, the maximum total point (index) is 1530 and the minimal is 18.

The set of indicators shows the development of economic and social potential of every region of the country quite full.

| № | Indicator |

| 1 | Actual final consumption of household per capita by the RF subjects |

| 2 | Gross regional product per capita |

| 3 | Fiscal revenue of the RF subject net of uncompensated receipts per capita |

| 4 | Fixed investment per capita in actual established price |

| 5 | Public catering turnover per capita |

| 6 | Retail sales per capita |

| 7 | Total rate of natural increase per annum |

| 8 | Relative population increase per annum |

| 9 | Life expectancy at birth, both sexes, population at large |

| 10 | Unemployment level, yearly average |

| 11 | Average nominal wage paid |

| 12 | Consumer price index - inflation |

| 13 | Industrial production index |

| 14 | Population with cash income lower than level of the cost of living, as percentage of total population |

| 15 | Number of legal entities per 1000 people of population |

| 16 | Return of taxes and duties to the budget system of the RF by major economic sectors, RUB per 1 resident |

| 17 | Share of old and condemned buildings in the total volume of the housing stock of the RF subject |

| 18 | Fixed assets value at the year-end, by gross book value |

Top three in the rating (see Table 2) consists of Saint-Petersburg with 1332, Moscow (1297) and the Yamal-Nenets autonomous district (1280). Moscow failed to have a lead because of higher annual inflation and lower point for industrial production dynamics. Speaking about relative figures, the capital had decrease in production sector by 3,5% in the past year, and Saint-Petersburg demonstrated increase by 3,9%. However, Moscow got maximum values by the following indicators: actual final consumption of household per capita, number of legal entities per 1000 people of population and fixed assets value. As of St. Petersburg, the level of yearly unemployment is the lowest countrywide, that is why the city got 85 of 85 points. The Yamal-Nenets autonomous district got the highest point for fixed investment per capita and return on taxes and duties to the budget system of the RF per 1 resident.

Sevastopol is the 53rd due to the best indicator of relative population increase (by means of migration) and low percent of condemned buildings. However, the region is at the end by gross regional product per 1 resident and fixed assets value. The Republic of Crimea is the 75th due to poor data on budget income (net of subsidies of the federal center) and fixed investment per capita, as well as high inflation level.

Kurgan region with total index of 307 closes the rating being behind Saint-Petersburg in 4,3 times. The region got high values by none of 18 indicators. Situation both in economic and social sphere is rather bad.

At such a strong level of regional varieties, the state continues to pursue a policy of fiscal equalization redistributing income from “rich” to “poor” that is reasonable under fiscal centralization.

Fundamental changes in the rating should not be expected in a short-term: metropolitan agglomeration and a small group of donor regions concentrating the main resource and industrial potential of the country will keep the leadership in the top ten. In 2017 Moscow stands a good chance to get a leadership in case of local production industry will approach a positive trend.

Speaking about other RF subjects, only the Republic of Crimea is able for significant stabilization due to the range of investment and social programs implemented by the government.

Table 2. Rating of socio-economic development of the regions (Dark green shading – maximum point, dark red shading – minimal point)