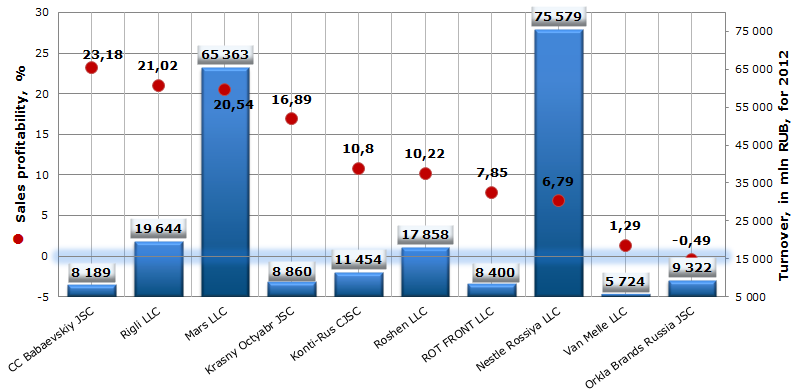

Return on sales of chocolate and sugar confectionery manufacturers

Information agency Credinform prepared a ranking of return on sales of chocolate and sugar confectionery manufacturers in the RF. The companies with highest turnover in this branch were selected for this research according to data from the Statistical Register for the latest available period (for the year 2012). Then, the first 10 enterprises selected by turnover were ranked by decrease in return on sales value.

Return on sales presents the share of operating income in sales volume of a company and is calculated as the ratio of profit on sales to sales revenue. There is no recommended and specified value prescribed for profitability ratios, because they vary strongly depending on industry characteristics and other operational aspects of an enterprise. Therefore, a company should be assessed first of all relying on industry-average indicators. At the same time return on sales shows if the enterprise activity is profitable or loss-making, but doesn’t give any decisive answer to the question how much is a company attractive for investments and business cooperation.

| № | Legal form of organization Name INN | Region | Turnover for 2012, mln RUB | Return on sales, % | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | Confectionary Concern Babaevskiy JSC INN 7708029391 |

Moscow | 8 189 | 23,18 | 146 (the highest) |

| 2 | Rigli LLC INN 7705008210 |

Moscow | 19 644 | 21,02 | 217 (high) |

| 3 | Mars LLC INN 5045016560 |

Moscow region | 65 363 | 20,54 | 181 (the highest) |

| 4 | Moscow confectionary factory Krasny Octyabr JSC INN 7706043263 |

Moscow | 8 860 | 16,89 | 144 (the highest) |

| 5 | Konti-Rus CJSC INN 4629046141 |

Kursk region | 11 454 | 10,8 | 212 (high) |

| 6 | Roshen LLC INN 4824033114 |

Lipetsk region | 17 858 | 10,22 | 189 (the highest) |

| 7 | RotFront CJSC INN 7705033216 |

Moscow | 8 400 | 7,85 | 177 (the highest) |

| 8 | Nestle Rossiya LLC INN 7705739450 |

Moscow | 75 579 | 6,79 | 245 (high) |

| 9 | Van Melle LLC INN 7719697104 |

Moscow | 5 724 | 1,29 | 305 (satisfactory) |

| 10 | Orkla Brands Russia JSC INN 7830000190 |

Saint-Petersburg | 9 322 | -0,49 | 272 (high) |

Return on sales of chocolate and sugar confectionery manufacturers, TOP-10

In spite of an active promotion of healthy lifestyle and healthy eating, popular majority is unable to go back on chocolate, candies and other confectionery delicacies. According to experts, the production volume of chocolate and sugar confectionery went up by 4,75% for the first half of the year 2013.

The top three companies in the raking list are represented by following enterprises: Confectionary Concern Babaevskiy JSC, Rigli LLC (TM Orbit, Juicy Fruit, Hubba Bubba etc.) and Mars LLC (TM Milky Way, Bounty, Mars, Twix, Snickers etc.). The return on sales value of all top three companies is more than 20%, therefore, more than 20% of sales revenue is accounted for by profit on sales of the mentioned enterprises, that may be considered as a good result. Mars LLC is also the second company with highest turnover in the branch at year-end 2012. Moreover all companies got high and the highest solvency index GLOBAS-i®, which characterizes them as financially stable.

The leading company with highest turnover in the branch Nestle Rossiya LLC (TM NESQUIK, Rodnye Prostory, Savinov, Rossiya etc.) is located only on the 7th place of the ranking with the return on sales 6,79%, that could be related to high production cost, as well as to high selling and administrative costs. Although, the company got high solvency index GLOBAS-i®, that characterizes it as financially stable and attractive for business cooperation.

The company Orkla Brands Russia JSC (TM SladKo, Fluide, Pekar, Factory named after N.K. Krupskaya) closes the ranking with the return on sales (-0,49)%, that is less than 0. Similar result can be explained by negative value of sales profit. However, the company got high solvency index GLOBAS-i®, which characterizes it as financially stable with low risk of insolvency in the nearest 12 months. Similar conclusion confirms once again the rule that for overall assessment of a company it is necessary to take comprehensive approach with using of various financial and non-financial indicators.

Offshores will be fought a decisive battle?

It's no surprise that the one of ultimate purposes of any enterprise is profit earning. And sometimes the national tax legislation lays enough material tax rates on its residents and many companies, for purposes of the reduction of payments to the budget, register their business in offshore states which attract them with favorable terms of taxation.

As the result the treasury of the country, where fixed assets, production capacities and management are concentrated, receives much less amounts. Russian economy suffers from it probably more than any other large state of the world. Cyprus, Cayman Islands, Gibraltar, Andorra – it’s just not the whole list of traditional offshores chosen for the registration by many domestic companies.

The problem is long overdue and demands the legislative regulation. The Ministry of Finance is drafting a number of bills which, may be said, are of revolutionary character. First of all it is planning to introduce the concept of «tax resident» relative to legal entities. Today we have the definition of foreign and domestic company and of resident-natural person. Now therefore, company formally registered abroad, but having all production capacities and management in the RF, doesn’t fall within our tax regulation. It’s submitted that the resident-legal entity will mean even that business which assets’ country of origin will be Russia. After introduction of such norm these companies will pay income tax by their place of work then.

Moreover, the question on offshore daughter companies is being worked out. The point is that if the profit earned abroad isn’t transferred to Russia, the tax authorities will be able to attribute it to the parent company and impose a tax. But for realization of such operation in the practice there should be established full-fledged information exchange between the tax authorities of the countries, which sometimes depends on political relationship between countries. This should help the ratification of the OECD Convention on mutual assistance in collection of taxes, signed a year and a half ago, but still not ratified by the State Duma.

Anyway, either with the introduction of the concept of tax resident for legal entities, or as to the taxation of controlled from Russia offshore companies it will be necessary to work out the law substantially, that should close any possible loopholes. Availability of what share of assets in the country will identify a legal entity as Russian resident? Wouldn’t be foreign companies affected thereby? How to avoid double taxation? Questions remain open and, as informed the Deputy Head of the Ministry of Finance Sergey Shatalov, suggested initiatives will be realized not earlier than in 2015.