Fly-by-night companies will be checked with post

It's not a secret that fly-by-night companies are legally registered at one address, virtually carry on "business" at another place, other than the registered address.

In order to curb such practices, the Federal Law № 134-FZ from 28.06.2013 amends to Section 31 of the Tax Code, according to which only legal address noted at the registration in the Unified State Register of Legal Entities (USRLE), will be allowed to send the documents by the tax authorities discharging their powers . Thus, all justification of legal entities that the tax authority sends the wrong correspondence will not be noted, including with any litigation. This innovation comes into force on 30 July 2013.

It must also be noted that the mentioned Federal law also amends the Section 51 of the Civil Code, which will oblige the registration authority to verify the authenticity of information included in the USRLE. Moreover, the designated state agency obliges now to inform interested parties in advance of the upcoming state registration of amendments in the statute of an entity and of the forthcoming inclusion of the data in the Unified State Register of Legal Entities.

Information agency Credinform plans to enter an independent Reliability index for assessing the degree of approximation of the analyzed company to unreliable organizations, called "fly-by-night companies ".More than 30 different factors selected from the group of registration and financial data are used in arriving at the Credinform Reliability index.

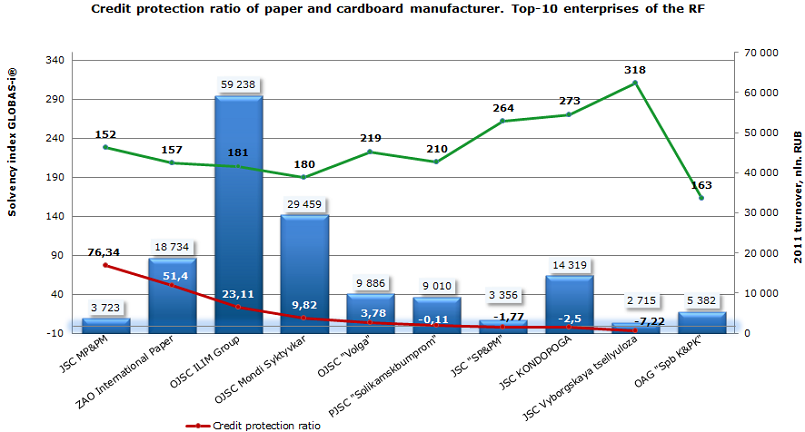

Credit protection of paper and cardboard manufacturers in Russia

Information agency Credinform prepared the ranking for credit protection of paper and cardboard manufacturers in Russia. The ranking list includes industry’s 10 largest Russian companies with mentioned activity type and is based on revenue as stated in the Statistics register, with the reference period of 2011. The selected companies were ranked first in terms of turnover, and then at a rate of credit protection.

Credit protection index is rated as the ratio of earnings before tax and interest on loans to the amount of interest due. This financial indicator shows the possible reduce level of borrower’s operating profit, in which he is able to pay interests. The recommended ratio value is more than 1.

| № | Name, INN | Region | Turnover 2011, mln. RUB | Credit protection ratio, % | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | JSC Mariiskii Pulp and Paper Mill,INN 1216010765 | Mari El Republic | 3 723 | 76,34 | 152 (top) |

| 2 | ZAO International Paper,НН 4704012472 | Leningrad region | 18 734 | 51,4 | 157 (top) |

| 3 | Open Joint-Stock Company ILIM Group,ИНН 7840346335 | Saint-Petersburg | 59 238 | 23,11 | 181 (top) |

| 4 | Open Joint Stock Company Mondi Syktyvkar,ИНН 1121003135 | The Komi Republic | 29 459 | 9,82 | 180 (top) |

| 5 | Open Joint Stock Company "Volga",ИНН 5244009279 | The Nizhni Novgorod region | 9 886 | 3,78 | 219 (high) |

| 6 | Public Joint Stock Company "Solikamskbumprom",ИНН 5919470121 | The Perm Territory | 9 010 | -0,11 | 210 (high) |

| 7 | Joint Stock Company "Syassky Pulp and Paper Mill",ИНН 4718011856 | Leningrad region | 3 356 | -1,77 | 264 (high) |

| 8 | JOINT STOCK COMPANY KONDOPOGA,ИНН 1003000650 | The Republic of Karelia | 14 319 | -2,5 | 273 (high) |

| 9 | JSC Vyborgskaya tsellyuloza,ИНН 7825481883 | Leningrad region | 2 715 | -7,22 | 318 (medium) |

| 10 | Joint Stock Company "Saint-Petersburg Cardboard and polygraphic Plant",ИНН 4719003640 | Leningrad region | 5 382 | — | 163 (top) |

The first line of the ranking is JSC Mariiskii Pulp and Paper Mill with 76.34% loans protection, which is significantly higher than 1. This means that the company makes a sufficient flow of operating profit for the timely interest repayment. Positive result is confirmed by the top solvency index GLOBAS-i ®, which also characterizes the company as financially stable. Next in the ranking are ZAO International Paper and Open Joint-Stock Company ILIM Group with 51.4% and 23.11% ratio of loans protection respectively, which corresponds to the recommended values.

At the same time Open Joint-Stock Company ILIM Group has the highest sales figures in 2011. Both companies were also assigned the highest solvency index GLOBAS-i ®.

Four of top-10 companies in terms of revenue in 2011 have values of loans protection below the recommended figure. But despite the deviation from the recommended values, 3 companies (Public Joint Stock Company "Solikamskbumprom", Joint Stock Company "Syassky Pulp and Paper Mill" and JOINT STOCK COMPANY KONDOPOGA) were assigned a high solvency index GLOBAS-I ®. This shows the financial strength and uncritical deviation from the standard meaning. JSC Vyborgskaya tsellyuloza was given a satisfactory solvency index GLOBAS-i ®, due to the loss in a balance sheet figures, as well as variance of liquidity ratio and financial stability to the standard values. Credit protection ratio was not rated for Joint Stock Company "Saint-Petersburg Cardboard and polygraphic Plant ", as the company’s interest due was 0 in 2011.

In general, the critical value for the industry could be the level of credit protection ratio less than (-2.5). But it should be noted that integrated approach, including examining of liquidity and profitability ratios, should be used for an objective assessment of the company's solvency.