7 important facts about Russian companies

According to the Information and Analytical system Globas, there are 3,1 million operating legal entities in Russia as of August 1, 2021.

We bring to your attention a few of the most important facts that will help you compose an overview of Russian companies.

1. General structure

The majority of the operating legal entities counts for commercial organizations - 2.5 million or 81%. The most common legal form is a limited liability company. The number of registered LLC is 2.4 million. Joint stock companies are a less spread legal form. 48.7 thousand joint-stock companies are registered in Russia, including 41.6 thousand non-public and 6.5 thousand public joint-stock companies. In 2019, there were 67 thousand joint-stock companies in the Russian Federation, since this year the number of joint-stock companies has been constantly decreasing.

The shareholders of operating companies with a controlling stake in the authorized capital of 50% or more are mainly Russian citizens. There are 2,1 million such kind of companies. Citizens of other countries with a share in the capital of more than 50% have established 50 thousand organizations.

2. Region of registration

Moscow remains the leader in terms of the number of registered legal entities. As of August 1, 2021, over 520 thousand legal entities were registered in the capital of our country, St. Petersburg is in the second place with 208 thousand registered companies, Moscow region closes the top with 178 thousand companies. The share of the three regions of the total number of operating companies exceeds 29%.

3. Activity types

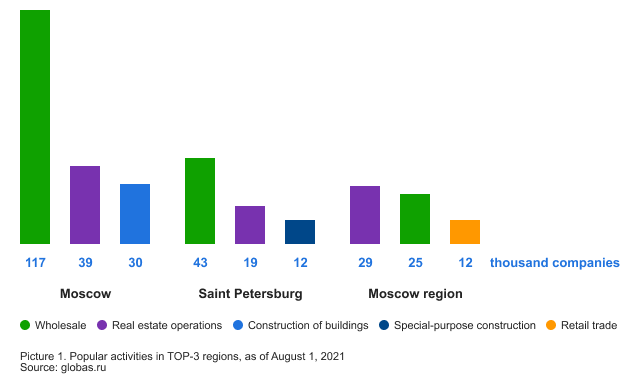

Most of the companies are engaged in wholesale and real estate transactions. These sectors are the most popular in Moscow, St. Petersburg and Moscow region (Picture1). The largest number of construction and development companies is registered in St. Petersburg and Moscow too.

4. Companies’ duration

The significant part of operating companies have passed the formation period: 67% of organizations were founded more than 5 years ago (Picture 2). The share of newly established companies from 1 to 3 years is 13%. In 2020, a large number of new companies could not survive the decline in the level of business activity: 110 thousand legal entities with duration from 1 to 3 years ceased their activities.

5. Business categories

2.1 million operating companies refer to small and medium-sized businesses, and 1,9 million companies are micro-enterprises.

6. Result of activity

Most of the companies in Russia show positive financial result: in 2020, the share of profitable companies was 75%. The share of unprofitable ones is 25%.

7. Globas index

According to Globas, 30% of operating companies have Superior / High and Strong / Medium solvency index, 47% have Adequate / Weak solvency index, and 11% have Unsatisfactory / Poor solvency index.

7 conclusions from 7 facts

|

Metalworking companies in Yekaterinburg

Information agency Credinform has prepared a ranking of metalworking enterprises in Yekaterinburg. Companies engaged in manufacture of fabricated metal products (TOP-10) in terms of annual revenue were selected according to the data from the Statistical Register and the Federal Tax Service for the available periods (2018 - 2020). Then the companies were ranged by product profitability ratio (Table 1). The selection and analysis of companies were based on the data from the Information and Analytical system Globas.

Product profitability (%) is calculated as the ratio of sales profit to expenses for ordinary activities.

Profitability reflects the economic efficiency of production. Analysis of the product profitability provides us with the feasibility of goods production. There are no recommended values for indicators of this group, as they vary greatly depending on the industry.

In order to get the most comprehensive and fair picture of the financial standing of an enterprise, it is necessary to pay attention to all the combination of financial indicators and company’s ratios.

| Name, INN, type of activity | Revenue, million RUB | Net profit (loss), million RUB | Product profitability, % | Solvency index Globas | |||

| 2019 | 2020 | 2019 | 2020 | 2019 | 2020 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| JSC URAL SIBERIAN INDUSTRIAL COMPANY INN 6673128630 manufacture of other fabricated metal products n.e.c. |

1 057,5 1 057,5 |

4 629,6 4 629,6 |

-37,5 -37,5 |

889,9 889,9 |

3,28 3,28 |

33,98 33,98 |

233 Strong |

| JSC VIZ INN 6658019241 manufacture of sinks, wash basins, baths and other sanitary ware and their components from ferrous metals, copper or aluminum |

1 632,0 1 632,0 |

1 707,1 1 707,1 |

396,6 396,6 |

369,2 369,2 |

23,20 23,20 |

29,18 29,18 |

209 Strong |

| AO UMECON INN 6660000590 manufacture of metal structures and products of their parts |

2 338,8 2 338,8 |

2 392,1 2 392,1 |

102,0 102,0 |

309,2 309,2 |

6,79 6,79 |

19,41 19,41 |

192 High |

| NAO URALCHERMET INN 6672333153 treatment and coating of metals |

2 184,7 2 184,7 |

1 880,4 1 880,4 |

40,1 40,1 |

58,3 58,3 |

7,65 7,65 |

9,46 9,46 |

242 Strong |

| OOO NPO LEGION INN 6686020432 manufacture of constructional metal products |

843,2 843,2 |

939,0 939,0 |

9,8 9,8 |

27,5 27,5 |

6,58 6,58 |

8,08 8,08 |

269 Medium |

| AO PK TT INN 7422035050 manufacture of steel bars and solid sections of steel by cold drawing |

722,6 722,6 |

944,2 944,2 |

10,5 10,5 |

23,8 23,8 |

4,01 4,01 |

7,87 7,87 |

222 Strong |

| OOO PERVAYA KROVELNAYA INN 6671330135 machining |

738,2 738,2 |

1 085,8 1 085,8 |

11,5 11,5 |

24,5 24,5 |

2,46 2,46 |

3,45 3,45 |

222 Strong |

| OOO STALTRANS INN 6672159201 manufacture of wire products and springs |

1 927,5 1 927,5 |

1 823,0 1 823,0 |

4,3 4,3 |

3,7 3,7 |

1,82 1,82 |

2,30 2,30 |

258 Medium |

| NAO NIZMK INN 6664003916 manufacture of other metal products |

1 130,7 1 130,7 |

1 185,9 1 185,9 |

11,9 11,9 |

33,4 33,4 |

0,50 0,50 |

-0,52 -0,52 |

232 Strong |

| OOO TPK INN 6673240159 treatment and coating of metals |

1 838,9 1 838,9 |

1 785,0 1 785,0 |

105,4 105,4 |

9,8 9,8 |

14,38 14,38 |

-1,29 -1,29 |

219 Strong |

| Average value for TOP-10 companies |  1 441,4 1 441,4 |

1 837,2 1 837,2 |

65,5 65,5 |

174,9 174,9 |

7,07 7,07 |

11,19 11,19 |

|

| Average value for TOP-100 companies |  455,1 455,1 |

489,3 489,3 |

18,1 18,1 |

24,2 24,2 |

7,12 7,12 |

5,20 5,20 |

|

| Average industry value |  76,2 76,2 |

85,0 85,0 |

6,2 6,2 |

5,5 5,5 |

7,26 7,26 |

9,40 9,40 |

|

improvement compared to prior period,

improvement compared to prior period,  decline compared to prior period

decline compared to prior period

The average values of the product profitability ratio of TOP-10 are above and of TOP-100 - below the average industry value in 2020. Two companies of TOP-10 decreased their values in 2020, comparing to the previous period, whereas in 2019 the decrease was recorded for six companies.

At the same time, in 2020 seven companies increased the revenue and / or net profit. The average revenue in TOP-10 increased by 27%, in TOP-100 – almost by 8%, average industry value increased almost by 12%. The average profit in TOP-10 increased almost by factor of 2,7, in TOP-100 – by 34%, but the average industry value decreased by 11%.

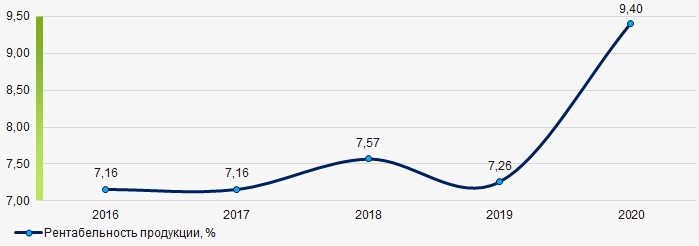

In general, during last 5 years, the average industry values of the product profitability ratio were increasing during two periods. The best value was registered in 2020, the worst - in 2016 and 2017 (Picture 1).

Picture 1. Change in average industry values of product profitability of metalworking enterprises in Yekaterinburg in 2016 – 2020

Picture 1. Change in average industry values of product profitability of metalworking enterprises in Yekaterinburg in 2016 – 2020