Return on equity of Russian airline companies

Information agency Credinform prepared a ranking of Russian airline companies.

The companies with the highest volume of revenue were selected for this ranking according to the data from the Statistical Register for the latest available period (for the year 2012). These enterprises were ranked by decrease in return on equity.

Return on equity (%) is the relation of company’s net profit to its equity capital. It shows how many monetary units of net profit were earned by each unit invested by company owners. It allows to assess the effectiveness of use of the capital invested by the owners. If the ratio is negative, it means that the enterprise has net loss.

There are no recommended or specified values prescribed for the mentioned ratio, because it varies strongly depending on the branch, where each concrete enterprise conducts business, that is why it should be assessed relying on industry-average indicator of the sector, where it operates, as well as on indexes of other enterprises of the same industry.

| № | Name | Region | Turnover,in mln RUB, for 2012 | Passenger traffic, ths. of people, for 2013 | Return on equity, % | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|---|

| 1 | ORENBURGSKIEAVIALINIIOJSC INN: 5638057840 |

Orenburg region | 17 602,8 | 3 141,0 | 73,6 | 226 high |

| 2 | Aviatsionnaya kompaniya TRANSAERO OJSC INN: 5701000985 |

Saint-Petersburg | 97 610,1 | 12 500,0 | 48,5 | 221 high |

| 3 | AVIAKOMPANIYAROSSIYAOJSC INN: 7810814522 |

Saint-Petersburg | 27 969,2 | 4 590,1 | 47,4 | 275 high |

| 4 | Aviakompaniya Sibir (S7) OJSC INN: 5448100656 |

Novosibirsk region | 55 863,8 | 7 084,6 | 26,2 | 203 high |

| 5 | GLOBUS LLC INN: 5448451904 |

Novosibirsk region | 11 307,9 | 2 154,3 | 24,3 | 249 high |

| 6 | AVIAKOMPANIYA VOLGA-DNEPR LLC INN: 7328510118 |

Ulyanovsk region | 12 067,9 | Cargo carriage | 19,5 | 269 high |

| 7 | AVIAKOMPANIYA URALSKIE AVIALINII OJSC INN: 6608003013 |

Sverdlovsk region | 23 101,9 | 4 419,2 | 17,2 | 198 the highest |

| 8 | AVIAKOMPANIYAYUTEIROJSC INN: 7204002873 |

Khanty-Mansijsk autonomous district - Yugra | 72 500,6 | 8 182,1 | 13,5 | 217 high |

| 9 | AEROFLOT-ROSSIYSKIE AVIALINII OJSC INN: 7712040126 |

Moscow | 177 906,2 | 20 902,4 | 9,6 | 196 the highest |

| 10 | AVIAKOMPANIYAYAKUTIYAOJSC INN: 1435149030 |

Republic of Sakha (Yakutia) | 11 960,8 | 1 098,9 | 1,9 | 248 high |

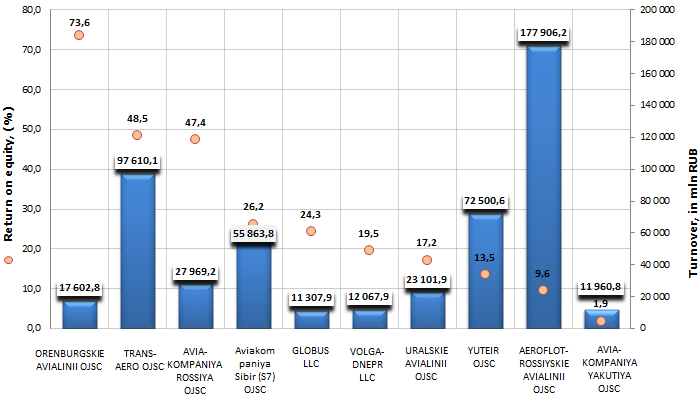

Picture 1. Net profit, return on equity of the largest Russian airline companies (TOP-10)

Three leaders on the highest return on equity ratio among the leaders of air transportations in Russia are as follows: ORENBURGSKIE AVIALINII (ORENAIR) OJSC - 73,6%, Aviatsionnaya kompaniya TRANSAERO OJSC - 48,5% and AVIAKOMPANIYA ROSSIYA OJSC - 47,4%.

Airline company ORENBURGSKIE AVIALINII traces its history back to the year 1932 and is one of the oldest airline companies in Russia, it carries out air transportations throughout Russia, international charter flights to the countries of Europe, Asia and Africa.

Transaero OJSC is Russia's first-ever private airline company, founded in 1991 and rapidly catching up Aeroflot – Rossiyskie avialinii OJSC on the amount of passenger traffic, which traditionally leads on this indicator.

AVIAKOMPANIYA ROSSIYA OJSC is the leading air carrier in the North-Western region of the country, is based in Saint-Petersburg and carries out about 40% of all air transportations from Pulkovo airport. It traces its history back to the year 1934, being the successor of the aviation enterprise «Pulkovo». Since 2011 it is a part of the group of companies «Aeroflot».

Other participants of TOP-10 showed lower return on equity, but not going beyond positive values, what testifies to the profitability of their business.

This is confirmed by the independent estimation of solvency, developed by the Information agency Credinform: all TOP-10 enterprises got a high and the highest solvency index GLOBAS-i®, what guarantees that they can pay off their loan liabilities in time and fully. Risk of default in the nearest time is highly improbable; organizations are attractive objects for investment, especially considering high potential of the Russian market, where, in spite of tough economic situation of last years, air transportations are growing at the remarkable tempo.

Ministry of Economic Development of the Russian Federation reduced inflation predicted values

According to calculation of the Ministry of Economic Development of the Russian Federation till the end of the year the inflation in Russia will amount to 6-6,5%. According to the head of the department Alexey Ulykaev, domestic economic entered the path of gradual decline in inflation. Such optimistic Ulykaev’s projections are explained by ruble stabilization, seasonal decline in food prices and also by reduction of regulated tariffs and prices indexation.

It is also possible to make a positive forecast of inflationary changes, basing on the situation in agriculture. Reportedly to Ministry of Agriculture, 97-98 million tons of crop is expected in the current year, which is quite good result. We will remind that in the Russian basket by a consumer price index, the share of foodstuff - is 38%.

According to the Central Bank (CB) assessment, the contribution of unforeseen factors to annual inflation is 1,5%. According to statement of CB representatives, the change of a monetary policy orientation allowed to avoid significant deviations from target values of inflation in medium-term prospect. However, mega-regulator preserves the intention of the transition to a floating rate of ruble. After decrease in threats of financial stability the Central Bank reduced the intervention volume on 100 million dollars.

Except the correction of inflation expected values, the Ministry of Economic Development of the Russian Federation announced a preliminary estimate of GDP growth in the second quarter 2014. Thus, according to the preliminary estimate of the department, it is possible to expect the growth to 1,2%.

By the results of first half of the year, the growth of industrial production by 1,8% is noted. Moreover, quarterly growth is also observed: 1,1% by the results of first quarter and 2,5% - by the results of the second. Herein processing production grows better than mining.

Talking about positive dynamics of industry development, should be noted a role of currency fluctuations, which have led to reduction of expenses for domestic manufacturers. Reduction of expenses, in turn, significantly increased the competitiveness of the Russian manufacturers, both on domestic and foreign markets.