Foreign name brands

Have you ever guessed many brands, describing themselves on Russian market as products with European or American history, are virtually Russian? It’s most likely that you are even the proud owner of such article, being unsuspicious of it.

As it happens, Russian consumers are seriously susceptible to foreign sonorous names, especially if they are supported by a beautiful legend. This was set up as far back as during USSR-times, when imported goods were a big shortage and available not for many people. Imported article built a certain public image for its owner. That is why after the dissolution of the USSR, the consumers swept away from shelves everything that even remotely resembled the foreign born. Therewith, foreign goods had always higher price in comparison with domestic products.

Domestic manufacturers decided to avail themselves of consumer's love of all foreign and make a pretty penny out of it. Only a couple of details: foreign sonorous name, beautiful legend, rememberable slogan (Italy style, Germany quality, English traditions etc.) and the consumer is ready by himself to pay much more.

All foreign name brands can be divided into two groups. To the first one belong companies which don't conceal its Russian origin, but herewith have foreign sonorous name. Production of such enterprises has usually adequate price-quality relationship. Companies of the second group are more sophisticated, with the purpose to earn larger profit they disseminate active the myths and legends of the foreign born of their products. In both cases most of goods are manufactured in China, where specialized factories exist which produce absolutely identical goods made-to-order by manufacturers, but with different labels and packages. It is fair to say that not many articles manufactured in China are of low quality, in most cases goods are produced in large plants, with observance of all standards. Certainly there are examples of low-quality goods, but, as a rule, these brands don’t exist for a long time.

Here is far from being the whole list of brands, describing themselves as foreign, but virtually being Russian:

| Brand | Company - brand owner | Products | ТМ |

|---|---|---|---|

| Vitek | GOLDER-ELEKTRONIKS LLC | Household appliances |  |

| Scarlett | Arima Holding Corp (joint Russian-Chinese enterprise, registered in offshore area of British Overseas Territories) | Household appliances |  |

| Bork | BORK Electronic Gmbh (single shareholder is from Russia - Biryulin Maksim Vasilevich) | Premium Household appliances |  |

| Greenfield, Tess, Jardin | Orimi Treid LLC | Tea, coffee |    |

| Carlo Pazolini | Carlo Pazolini Group, registered in Italy, CEO – Iliya Reznik | Medium-medium high footwear |  |

| Ralf Ringer | Ralf Ringer CJSC | Footwear |  |

| Tervolina | TERVOLINA LLC | Footwear |  |

| Mascotte | Moskot-Shuz LLC | Footwear |  |

| befree, ZARINA, LOVE REPUBLIC | MalonFashnGrupJSC | Clothing |    |

| Erich Krause | Ofis Premier CJSC | Office goods |  |

| Savage, People, Lawine | Savazh LLC | Clothing |   |

With the help of the information and analytical system GLOBAS-i®, developed by the Information Agency Credinform, you will find all information on any Russian company you are interested in, as well as you will be able to check it for due diligence and solvency by using of independent indexes, worked out by the company's analytics.

Net profit ratio of grape wine manufacturers

Information agency Credinform prepared a ranking of enterprises manufacturing grape wines, based on net profit ratio.

The companies with highest volume of revenue were selected for this ranking according to data from the Statistical Register for the latest available period (for the year 2012). These enterprises were ranked by decrease in net profit ratio.

Net profit ratio (%) is the ratio of net profit (loss) to net sales. It shows how profitable were sales of a company.

There is no specified value, that is why it is recommended to compare companies of the same branch or ratio's change with time in one specific organization. It is clear that a negative value means that company has net loss. The higher is the net profit ratio the more effective is finally company’s activity.

| № | Name | Region | Turnover for 2012, mln RUB | Net profit ratio | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | Abrau-Dyurso CJSC INN 2315092440 |

Krasnodar Territory | 2 474,9 | 19,6 | 201(high) |

| 2 | Stavropolskii vinno-konyachnyi zavod CJSC INN 2634045238 |

Stavropol Territory | 3 873,8 | 17,8 | 210(high) |

| 3 | Igristye Vina CJSC ИНН 7830001010 |

Saint-Petersburg | 4 537,2 | 8,2 | 200(high) |

| 4 | Agropromyshlennaya firma Fanagoriya CJSC INN 2352002170 |

Krasnodar Territory | 2 207,5 | 7,5 | 207(high) |

| 5 | Derbentskii zavod igristyh vin JSC INN 542001269 |

The Republic of Daghestan | 1 725,0 | 5,2 | 270(high) |

| 6 | Kuban-Vino LLC INN 2352034598 |

Krasnodar Territory | 1 565,1 | 3,2 | 256(high) |

| 7 | Kombinat shampanskih vin LLC INN 4702012163 |

Leningrad region | 1 393,6 | 0,7 | 299(high) |

| 8 | Moskovskii kombinat shampanskih vin JSC INN 7729007350 |

Moscow | 2 560,1 | 0,6 | 256(high) |

| 9 | Vinzavod Mayskii LLC INN 703006292 |

Moscow | 1 769,8 | 0,3 | 269(high) |

| 10 | Detchinskii zavod CJSC INN 4011006869 |

Kaluga region | 1 562,6 | 0,3 | 262(high) |

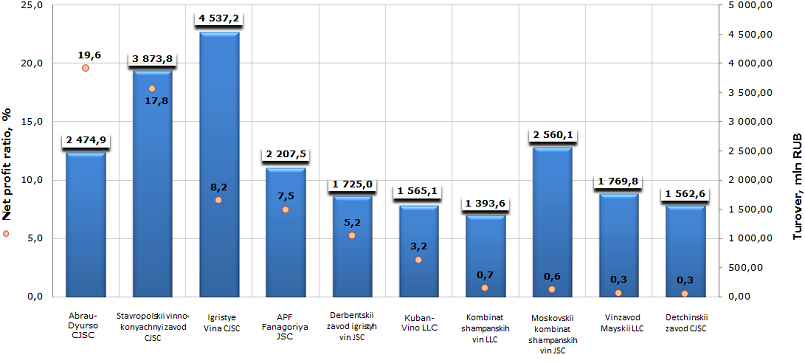

Picture 1. Net profit ratio and turnover of the largest producers of grape wines

Cumulative turnover of TOP-10 the largest grape wine manufacturers at year-end 2012 reached 23 669,6 mln RUB, went up by 13,7% per annum. The average value of net profit ratio is 6,3%. Cumulative net profit of TOP-10 enterprises of the mentioned branch is fixed at the level 1887,6 mln RUB, besides its increment was 9,4% in comparison with the previous year.

It can be stated that the situation in the field of grape wine producing is favorable enough. This can be explained mainly by the growing demand on wine products, including of domestic manufacture.

Abrau-Dyurso CJSC (19,6%) holds the biggest value of net profit ratio, the company with proud history located in Krasnodar Territory, producing sparkling grape wine – champagne under its own recognizable brand name. Also following organizations hold a higher-than-average ratio: Stavropolskii vinno-konyachnyi zavod CJSC (17,8%), Igristye Vina CJSC (8,2%), Agropromyshlennaya firma Fanagoriya CJSC (7,5%).

Igristye Vina CJSC (Saint-Petersburg) is besides the largest enterprise of the branch with the turnover 4537,2 mln RUB, it manufactures table grape wines, champagne, cognac.

Other participants of TOP-10 showed although positive, but low enough net profit ratios, that can point to high costs of production.

At the same time, according to the independent estimation of solvency developed by the Agency Credinform, all market leaders have a high solvency index GLOBAS-i®, that can be considered as a guarantee they will pay off their debts, while risk of default is minimal or below average. From investment point of view the business cooperation with participants of the rating looks attractive.