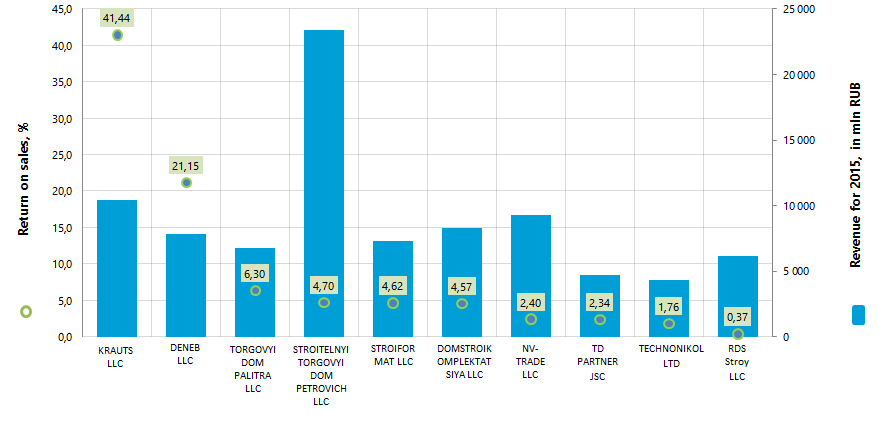

Return on sales of the largest Russian companies engaged in the building materials trade

Information agency Credinform offers the ranking on the return on sales of the largest Russian companies engaged in the building materials trade.

The largest Russian enterprises (TOP-10), working it the market of building materials trade, were selected on the volume of revenue for the ranking, according to the data from the Statistical Register for the latest available period - for 2015. Then they were ranked by decrease in return on sales ratio.

Return on sales (%) is calculated as the share of operating profit in the company's sales volume. The return on sales ratio characterizes the efficiency of industrial and commercial activity of an enterprise and shows how much money remains by an enterprise in the result of the sale of products after covering its costs, payment of taxes and loans interest’s expense.

Return on sales is an indicator of the efficiency of company’s pricing policy and its ability to control costs. The differences in competitive strategies and product lines cause significant variety of return on sales values in companies of the same industry. That is why it should be noted that at equal values of revenues, operating expenses and pre-tax profit in two different organizations the return on sales can vary greatly under the influence of the volume of interest payments on the net profit margin.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention to all available combination of ratios, financial and other indicators.

| Name, INN, region | Net profit for 2015, mln RUB | Revenue for 2015, mln RUB | Revenue for 2015 by 2014, (growth/ reduction), % | Return on sales, % | Solvency index Globas-i |

|---|---|---|---|---|---|

| KRAUTS LLC INN 7728865059 Moscow |

4 310,9 | 10 404,1 | 150,0 | 41,44 | 196 The highest |

| DENEB LLC INN 5047103554 Moscow region |

552,9 | 7 858,1 | -7,7 | 21,15 | 229 High |

| TORGOVYI DOM PALITRA LLC INN 5012022008 Moscow region |

271,0 | 6 785,3 | 28,4 | 6,30 | 180 The highest |

| STROITELNYI TORGOVYI DOM PETROVICH LLC INN 7802348846 Saint-Petersburg |

1 093,5 | 23 394,3 | 17,2 | 4,70 | 190 The highest |

| STROIFORMAT LLC INN 7810024468 Leningrad region |

39,6 | 7 270,2 | - (*) | 4,62 | 550 Unsatisfactory |

| DOMSTROIKOMPLEKTATSIYA LLC INN 7714916151 Moscow |

210,2 | 8 323,4 | 36,6 | 4,57 | 234 High |

| NV-TRADE LLC INN 2315171300 Moscow |

21,8 | 9 240,1 | 13,8 | 2,40 | 264 High |

| TD PARTNER JSC INN 7704602692 Moscow |

27,1 | 4 670,7 | -11,2 | 2,34 | 246 High |

| TECHNONIKOL LTD INN 3811066336 Irkutsk region |

47,1 | 4 323,2 | -35,2 | 1,76 | 261 High |

| RDS Stroy LLC INN 7710452533 Moscow |

13,9 | 6 157,8 | 3,0 | 0,37 | 252 High |

(*) – calculation of the relation of revenue of STROIFORMAT LLC for 2014 – 2015 is not given due to the lack of company’s financial statement for 2014 in the state statistics authorities

The average value of the return on sales ratio in the group of TOP-10 companies amounted to 8,97 in 2015. The same indicator in the group of the TOP-100 companies was 4,7, by the industry average value of 5,09.

Nine companies from the TOP-10 got the highest and high solvency index Globas-i, that points to their ability to repay their debts in time and fully.

STROIFORMAT LLC got unsatisfactory solvency index Globas-i, due to the claim for recognition of the company bankrupt submitted in June 2016 and for the participation as a defendant in arbitration court proceedings in terms of debt collection.

The total revenue of the TOP-10 enterprises amounted to 88,4 bln RUB in 2015, that is by 16% more than in 2014 on the comparable range of companies. At the same time, the total net profit in the same group increased more than 3 times. Three organizations from the TOP-10 (highlighted in red in Table 1) allowed a decrease in the value of net profit and (or) in revenue in 2015 compared with the previous period.

In the group of the TOP-100 enterprises an increase in the total revenue for the same period amounted to 41% on the comparable range of companies, by an increase in total net income by 13%.

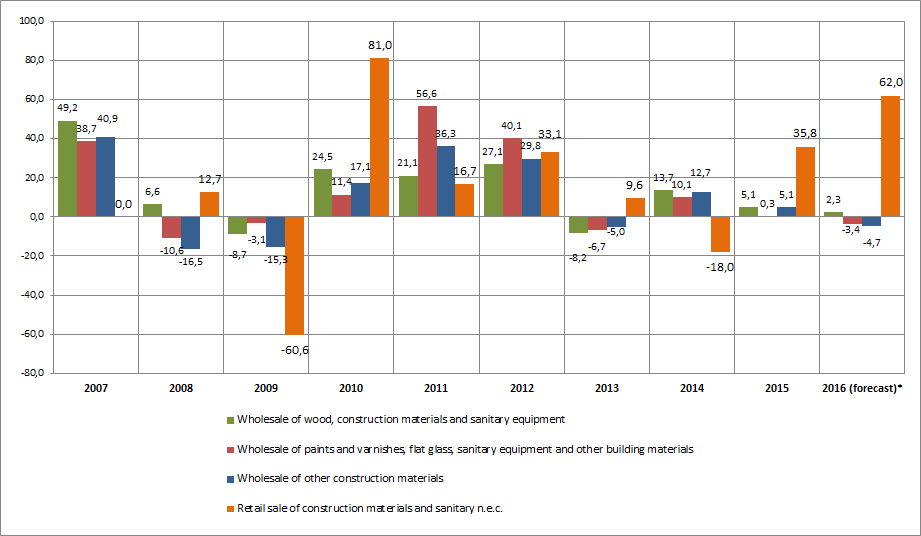

There are positive values of the return on sales ratio observed by all TOP-10 companies, as well as in industry in general. It points to a relatively high efficiency of work of the industry. However, there has been a trend towards a slowdown in growth in the industry in recent years, as evidenced by the calculated figures (Picture 2) on the basis of the data of the Federal State Statistics Service.

(*) forecast for 2016 is calculated based on the average rate of growth (decline) for 2014-2015 and for 6 months 2015-2016

As the graph shows, the sales proceeds in the given types of trade are largely dependent on the macroeconomic environment. At the same time, according to the same data of Rosstat, there is a significant increase in sales proceeds observed from 2006 till 2015. Thus, Thus, in the wholesale of wood, construction materials and sanitary equipment, paints and varnishes, flat glass and other building materials - the growth rate is 3 times. In the wholesale of other construction materials - an increase of 2,3 times, and in the retail trade with building materials - an increase of 1,5 times.

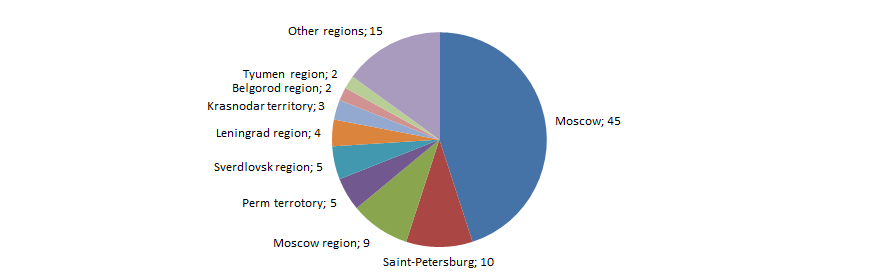

Companies engaged in the building materials trade largely tend to the major cities - Moscow and Saint-Petersburg. This is confirmed by the Information and analytical system Globas-i, according to which 100 the largest enterprises engaged in the building materials in terms of revenue for 2015 are concentrated in 23 regions of Russia.

Economic plans for 2017-2019 budget

On October 28, 2016 the State Duma received the draft budget for 2017-2019. The key priorities of the budget are: assistance in economic growth, financial support of priority projects and complete fulfillment of the social obligations. Another important factor is the budget balance. While forming the budgetary framework, the Government used the conservative basis with the worldwide average oil price of 40 USD per barrel. It is expected, that till the end of the year the project «On Federal Budget for 2017 and the Planning Period of 2018 and 2019» will acquire the status of the Federal Law. The main budget indicators, submitted by the Government of the Russian Federation, are represented in Table 1.

| Indicator | 2017 | 2018 | 2019 |

|---|---|---|---|

| Exchange rate, ruble for dollar | 67,5 | 68,7 | 71,1 |

| Average oil price, USD per barrel | 40 | 40 | 40 |

| Inflation, % | 4 | 4 | 4 |

| GDP, trn RUB | 86,806 | 92,296 | 98,860 |

| Growth, % | 0,6 | 1,7 | 2,1 |

| Income, trn RUB | 13,487 | 14,028 | 14,844 |

| Expenses, trn RUB | 16,240 | 16,039 | 15,987 |

| Deficit, trn RUB | 2,753 | 2,011 | 1,142 |

According to the forecast, the main budget income will form on the base of non-oil and gas revenues. Their share will be 62,6%, the other part will be filled by oil and gas revenues. Main non-oil and gas revenues are nominally represented by three groups: domestic production, import and others. The income from domestic production includes: VAT (77,8% in the group), excises (21,7%), income tax (16,1%). The income from import is formed by VAT (79,6% in group), excises (2,5%) and entry fees (21,0%).

Within expenses the largest part is intended for social policy - 5,08 trn RUB (31,3% of total expenses), 2,83 trn RUB (17,5%) for defense, 2,32 trn RUB (14,3%) for national economy, 1,94 trn RUB (12,0%) for national security and law enforcement activities, 1,20 trn RUB (7,4%) for national issues. Other articles take from 5% - 1% or less of total expenses. For public and municipal debt management is planned to allocate more than 728 bln RUB - 4,5% of total expenses. The deficit between income and expenses is planned to cover by the Reserve Fund, the National Wealth Fund, borrowings and other sources.

Within the budget expenses can be divided on 5 directions:

- New living standards (13 government programs) - 3,2 trn RUB are planned,

- Innovative development and modernization of the economy (18 programs) - 1,99 trn RUB,

- National security protection (1 program) – 1,7 trn RUB,

- Balanced regional development (6 programs) – 0,99 trn RUB,

- Effective State (4 programs) – 1,58 trn RUB

The budget expenses also include financial support for the development of certain industries within the government programs. Among such industries are: aviation industry, shipbuilding, electronic and radio-electronic industry, pharmaceutical and medical industry, agriculture, the development of fishery industry and others. It is also planned to support the export in the following industries: car industry, aviation industry, agricultural engineering industry and railway machinery.

The next three years are expected to be complicated. Economy will continue to be under the influence of internal and external negative factors; its significant restructuring and capacity increase are not expected. The previous economy model, based on export of raw materials and stimulating of consumption, has reached its limits. It is expected, that potential increase in economy growth is possible only after structural measures, the effect from which appears after a certain time; that was taken into account while budget planning.