List of documents necessary for safe execution of a contract with counterparty

The lack of due diligence on the part of a taxpayer by choosing of counterparties can be followed by submission of claims on the side of tax authorities in execution of contracts with fly-by-night company. And, as a consequence - additional charge of tax and holding liable for a tax offence.

Following features of fly-by-night companies are singled out:

- registration at «mass» address,

- mass» founder or executive,

- lack of information on a company in open data sources,

- communication through representatives and refusal on the part of potential partner in the establishment of contacts with the management.

However, not always the presence of those or other listed criteria points to a fly-by-night company. But if there is a combination of features, then it is a serious pause for thought about the due diligence of potential counterparty.

The criteria, upon which tax authorities rely by planning of field tax audits, are presented in the order of the Federal Tax Service from 30.05.2007 № MM-3-06/333 «On approval of the concept of planning system of field tax audits».

In order to make ourselves and your business safe from possible claims on the side of taxation bodies, there are a lot of ways to make certain of trustworthiness of potential counterparty. First of all, it is required to request a number of documents by the contractor before closing of a deal. The standard minimum includes certificates of state registration, of registration with tax authorities and articles of incorporation. Besides, an extract from EGRUL (the Uniform State Register of legal entities) should be requested, as well as certificate of no arrears in tax payments. The term between getting of the extract and the moment of its presentation to a taxpayer is not prescribed by the law, but the less is the term, the better.

Also it wouldn't go amiss to test the counterparty for license for business activity (if its availability is obligatory) and its status, to be acquainted with annual accounting reports of the contractor, with the existence of arbitration cases, where he/she/it is a defendant, and to test if company is listed in the register of bad-faith suppliers.

It is considered also as a discretion, when it is got more specific information about the staff size of counterparty, his/her/its property status, about composition and value of fixed assets, reputation on the market and work experience in that or another industry.

As practice shows, verification and collection of data, confirming the trustworthiness of a potential contractor, require efforts of an interested party, as companies also provide such information to potential partners not always willingly. Information and analytical system Globas-I, in online mode, can help to get necessary information on a counterparty (registration data, availability of licenses, court proceedings, information about composition of the management), and Reliability index will easy help to find out a fly-by-night company.

See also: How to check the counterparty before signing the contract

Return on investment of enterprises manufacturing flour, grain and starch

Information agency Credinform prepared a ranking of flour milling companies and enterprises producing grain and starch.

The companies with the highest volume of revenue were selected for this ranking according to the data from the Statistical Register for the latest available period (for the year 2012). These enterprises were ranked by decrease in return on investment ratio.

Return on investment (%) is the ratio of company’s net profit (loss) to its net asset value. It shows how many monetary units were earned by each unit of net profit. It characterizes the effectiveness of use of resources by a company.

There are no recommended or specified values prescribed for the mentioned ratio, because it varies strongly depending on the branch, where each concrete organization conducts business, that is why the company should be assessed relying on industry-average indicator of the sector, as well as on indexes of other enterprises of the same industry. The higher is the ratio value, the more efficient are the investments. If the ratio is in negative zone, it points to that an enterprise has net loss in the period under review.

Agro-industrial complex represents an important unit of gross domestic product of Russia and joins in itself several branches of economy focused on manufacture and processing of agricultural raw materials and getting of products from it, reaching an ultimate consumer. Two main sectors of agro-industrial complex can be distinguished – crop growing and animal breeding and separate sector of food processing industry, as well as the sphere of production of agricultural and other related equipment and developments of chemical industry (fertilizers, pesticides). All mentioned spheres are closely related and bound together.

In 90th the economic slowdown didn’t keep away also from agrarians. The area of farming land was reduced, as well as production of basic crops, material and technical facilities got old, shelves of stores were full of imported, sometimes defective products.

Today the situation begins to change gradually for the better. Production, turnover, net profit of enterprises increase. What has, finally, an impact on substitution of import for domestic products. The branch becomes attractive for investments.

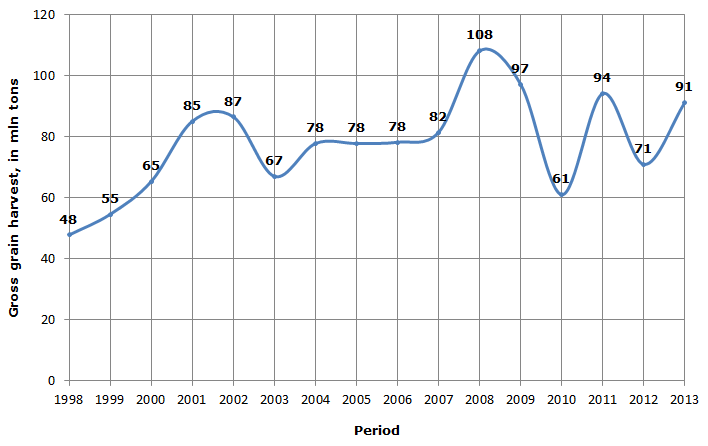

Picture 1. Gross grain harvest, in mln tons

For last years the gross grain harvest has a trend to gradual increase of storage volume. Certainly, the climatic factor can have a significant impact on the aging process of crops till up to the present, as it was in the period of heat wave of 2010 or moist summer of 2012, but, under otherwise equal conditions, if in 1998 agrarians succeeded to gather «only» 48 mln tons, then at year-end 2013 already 91 mln tons - the gain by 89,5%. Russia became again one of the largest exporters of crops on the world market, it supplied 23 mln tons in the previous year.

Flour-and-cereals industry, its investment attractiveness and competitive ability depend directly on quantity and quality of gathered grain.

| № | Name | Region | Turnover,in mln RUB, for 2012 | Turnover gain by the year 2011, % | Return on investments, % | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|---|

| 1 | Peterburgsky melnichny kombinat OJSC INN: 7810229592 |

Saint-Petersburg | 2 863,3 | 16,7 | 36,4 | 216 high |

| 2 | MAGNITOGORSKY KOMBINAT KHLEBOPRODUKTOV–SITNOCJSC INN: 7414001724 |

Chelabinsk region | 3 376,8 | 13,7 | 32,5 | 212 high |

| 3 | LENINGRADSKY KOMBINAT KHLEBOPRODUKTOV IM. S. M. KIROVA OJSC INN: 7830002303 |

Saint-Petersburg | 4 923,2 | -0,4 | 29,5 | 223 high |

| 4 | ResursLLC INN: 7440007056 |

Chelabinsk region | 2 781,8 | -13,0 | 27,9 | 220 high |

| 5 | KAZANZERNOPRODUKTOJSC INN: 1658001372 |

Republic of Tatarstan | 2 782,9 | -6,9 | 18,0 | 232 high |

| 6 | KOMBINAT KHLEBOPRODUKTOV STAROOSKOLSKY CJSC INN: 3128033189 |

Belgorod region | 4 038,5 | 14,6 | 10,9 | 246 high |

| 7 | MELKOMBINATOJSC INN: 6903001493 |

Tver region | 4 199,7 | 9,3 | 8,9 | 233 high |

| 8 | KARGILL LLC INN: 7113502396 |

Tula region | 18 559,7 | 9,6 | 8,5 | 245 high |

| 9 | ALEISKZERNOPRODUKT IMENI S.N.STAROVOITOVA CJSC INN: 2201000766 |

Altai territory | 5 131,7 | 4,9 | 5,9 | 211 high |

| 10 | MELNIKOJSC INN: 2209006093 |

Altai territory | 4 289,9 | 26,1 | 3,3 | 239 high |

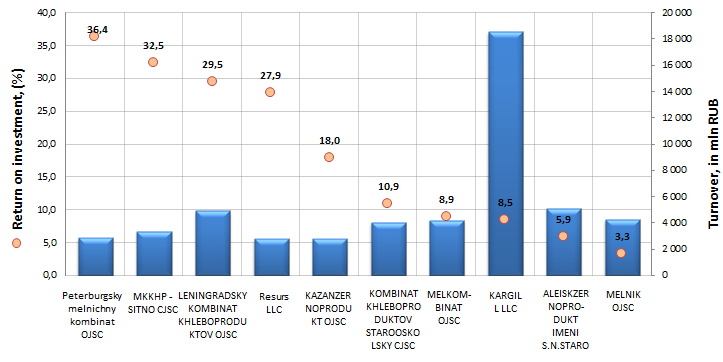

Picture 2. Return on investments, turnover of the largest enterprises manufacturing flour, grain and starch (TOP-10)

Turnover of the largest enterprises manufacturing flour, grain and starch (TOP-10) reached 52,9 bln RUB, went up by 7,8% per annum. The leaders accumulate up to 30% of sales revenue of all companies in the industry. The average return on investment of the TOP-10 list made 18,2%.

Following companies in the ranking showed the return on investment ratio above TOP-10 average: Peterburgsky melnichny kombinat OJSC (36,4%) and LENINGRADSKY KOMBINAT KHLEBOPRODUKTOV IM. S. M. KIROVA OJSC (29,5%) from Saint-Petersburg, as well as MAGNITOGORSKY KOMBINAT KHLEBOPRODUKTOV – SITNO CJSC (32,5%) and Resurs LLC (27,9%) from Chelyabinsk region. Now therefore, investors will receive more benefit from investments in these enterprises.

Peterburgsky melnichny kombinat OJSC and LENINGRADSKY KOMBINAT KHLEBOPRODUKTOV IM. S. M. KIROVA OJSC are the leaders of flour-and-cereals industry of the North-West of Russia. The production under TM «Aladushkin», «Yasno Solnyshko», «Muka Predportovaya», «Gornitsa» etc. takes up to 70% of the retail market of flour and more than 60% of the market of cereal crops of Saint-Petersburg and Leningrad region. Besides, the companies satisfy about 25% of demand of the market of productive consumption of flour in Saint-Petersburg and region.

MAGNITOGORSKY KOMBINAT KHLEBOPRODUKTOV – SITNO CJSC is the main supplier of bakery, creamy, flour and confectionary products in Magnitogorsk and outside it. The plant produces 180 names of bakery products and more than 200 names of pies, cakes, spice cakes, biscuits, muffins, tartlets, wafers, cracknels and dry bread crumbs.

Resurs LLC produces cereals, including boil-in-the-bags under TM «Uvelka», which have won popularity by consumers not only in the Urals, but also in the rest of Russia.

All enterprises from TOP-10 got a high solvency index GLOBAS-i®, what points to sound enough financial standing of the branch.

See also: Return on investment of oil and gas companies in Russia