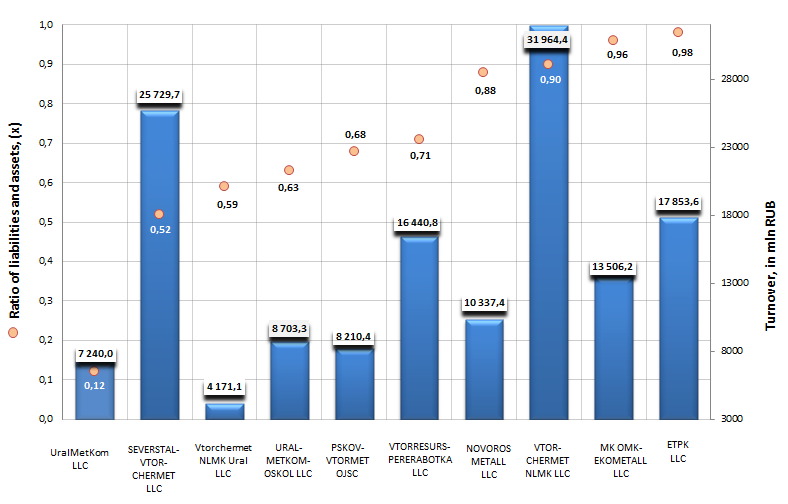

Ratio of liabilities and assets of enterprises engaged in recycling of raw materials

Information agency Credinform offers to get acquainted with the ranking of Russian companies engaged in recycling of raw materials. The companies with the highest volume of revenue involved in this activity were selected by the experts according to the data from the Statistical Register for the latest available period (for the year 2012). Then, the first 10 enterprises selected by turnover were ranked by increase of the ratio of liabilities and assets.

The mentioned ratio refers to a group of indexes of financial stability and is calculated as the relation of long-term and short-term borrowings to total assets. This ratio presents what share of assets of an enterprise is funded with loans. The recommended value of the analyzed ratio is from 0,2 up to 0,5.

| № | Name, INN | Region | Turnover,2012, mln RUB | Ratio of liabilities and assets, (х) | Solvency index GLOBAS-i |

|---|---|---|---|---|---|

| 1 | Uralskaya metallolomnaya kompaniya LLC INN 5607019072 |

Orenburg region | 7 240 | 0,12 | 210 (high) |

| 2 | SEVERSTAL-VTORCHERMET LLC INN 3528165743 |

Vologda region | 25 730 | 0,52 | 332 (satisfactory) |

| 3 | Vtorchermet NLMK Ural LLC INN 6674342481 |

Sverdlovsk region | 4 171 | 0,59 | 320 (satisfactory) |

| 4 | URALMETKOM-OSKOLLLC INN 5607021177 |

Belgorod region | 8 703 | 0,63 | 220 (high) |

| 5 | PSKOVVTORMET OJSCINN 6027007501 | Pskov region | 8 210 | 0,68 | 219 (high) |

| 6 | VTORRESURS-PERERABOTKALLC INN 4217126359 |

Kemerovo region | 16 441 | 0,71 | 248 (high) |

| 7 | NOVOROSMETALL LLC INN 2315057727 |

Krasnodar territory | 10 337 | 0,88 | 248 (high) |

| 8 | VTORCHERMETNLMKLLC INN 7705741770 |

Sverdlovsk region | 31 964 | 0,90 | 301 (satisfactory) |

| 9 | METALLOLOMNAYA KOMPANIYA OMK-EKOMETALL LLC INN 7705937571 |

Moscow | 13 506 | 0,96 | 289 (high) |

| 10 | Ekaterinburgskaya torgovo-promyshlennaya kompaniya LLC INN 6670025354 |

Sverdlovsk region | 17 854 | 0,98 | 275 (high) |

The first place of the ranking belongs to Uralskaya metallolomnaya kompaniya LLC with the ratio value 0,12, what points to that company’s management tries not to misappropriate borrowed funds. Herewith the enterprise got a high solvency index GLOBAS-i®, what points to a quite good solvency level and low credit risk.

SEVERSTAL-VTORCHERMET LLC is the only one company from the list, which ratio of liabilities and assets is within normal range (from 0,2 up to 0,5). However, based on the combination of financial and non-financial indicators, the enterprise got a satisfactory solvency index GLOBAS-i®, what testifies to a low probability of financial inability in the nearest 12 months.

Ratio of liabilities and assets of enterprises engaged in recycling of raw materials in Russia, TOP-10

The enterprises Vtorchermet NLMK Ural LLC (0,59), URALMETKOM-OSKOL LLC (0,63), PSKOVVTORMET OJSC (0,68) and VTORRESURS-PERERABOTKA LLC (0,71) have the value of the ratio of liabilities and assets being a little higher than recommended values. But only Vtorchermet NLMK Ural LLC got a satisfactory solvency index GLOBAS-i®, because there are losses in the structure of company’s balance sheet ratios. Other organizations got a high solvency index GLOBAS-i®, what points to stable financial standing of the enterprises.

TOP-10 companies, which took the places from 7 to 10 in the ranking, showed the value of the ratio of liabilities and assets close to 1. Such results point to that the sum of loans, credits and accounts payable is almost equal to all assets of the enterprises, what can impair financial stability of companies in the future. However, based on the combination of financial and non-financial indicators, only VTORCHERMET NLMK LLC got a satisfactory solvency index GLOBAS-i®, because there are losses in the structure of company’s balance sheet ratios. The rest enterprises got a high solvency index GLOBAS-i®.

In summary it’s important to note, that executives should follow closely the ratio of assets and all their loans and credits, because a substantial surplus of liabilities can dent the financial stability of an enterprise.

See also: Net profit of enterprises engaged in secondary processing of raw materials

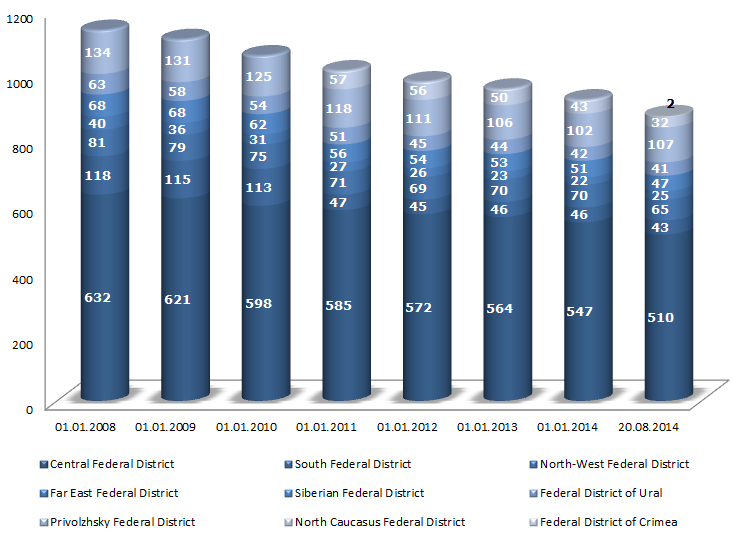

How many banks are there in Russia?

According to the Central Bank of the Russian Federation on August 20, 2014 the number of commercial banks and non-banking organizations with a valid license amounted 872 units. In this case, 418 (47.9%) of these units can be called as large organizations.

The number of banks operating in Russia declines annually. These trends are especially measurable in the current year. After the recall of license of Master Bank in November 2013 such news has become more regular. So, over a period from January 1 until August 20 of this year the number of credit organizations with a valid license reduced by 51 units. Such policy of the main regulator proves the experts’ opinion that near the future there will be at about 500-600 banks in Russia. Thus, currently only 418 banks have the nominal capital that conform to requirements of the Central Bank.

According to the article 11 of the Federal Act ‘Concerning Banks and Banking Activities’ the nominal capital of the bank must be not less than 300 mln rubles as from the date of registration.

| № | Name | INN | Region | Authorized capital, mln RUB |

|---|---|---|---|---|

| 1 | VTB BANK OPEN JOINT-STOCK COMPANY | 7702070139 | Saint-Petersburg | 343 643,4 |

| 2 | RUSSIAN AGRICULTURAL BANK OPEN JOINT-STOCK COMPANY | 7725114488 | Moscow | 248 048,0 |

| 3 | BANK VTB 24 CLOSED JOINT-STOCK COMPANY | 7710353606 | Moscow | 91 564,9 |

| 4 | GAZPROMBANK JOINT-STOCK COMPANY | 7744001497 | Moscow | 64 486,3 |

| 5 | JOINT-STOCK COMPANY ALFA-BANK | 7728168971 | Moscow | 59 587,6 |

| 6 | JOINT-STOCK COMPANY UniCredit Bank | 7710030411 | Moscow | 40 438,3 |

| 7 | JOINT-STOCK COMPANY Raiffeisenbank | 7744000302 | Moscow | 36 711,3 |

| 8 | JOINT-STOCK COMPANY BANK URALSIB | 0274062111 | Moscow | 29 824,0 |

| 9 | INTERREGIONAL BANK FOR SETTLEMENTS OF THE TELECOMMUNICATIONS AND POSTAL SERVICES | 7710301140 | Moscow | 29 025,7 |

| 10 | JOINT-STOCK COMMERCIAL BANK AK BARS | 1653001805 | the Republic of Tatarstan | 28 211,7 |

It should be noted that amid the trend of credit organizations reduction, the Bank of Russia gave the licenses for banking transactions realizations to Sevastopolskiy Morskoy Bank and Chernomorskiy Bank of Development and Reconstruction on August 13. These banks are registered in new constituent entities of the Russian Federation, in the City of Sevastopol and the Republic of Crimea.

Concerning the regional structure it should be pointed out that more than half of banks are registered in the Central Federal District: 510 credit organizations (58%). Thus, the great majority is registered in Moscow, 454 organizations in total: 425 banks and non-banking credit organizations.

Banks and non-banking organizations trend in Russia among federal districts

The reduction of banks goes on various scenarios. Due to the raising of the minimum amount of the nominal capital by the Bank of Russia the number of procedures related to the taking over of small banks by the large ones, the consolidation of capital and self-liquidation and liquidation under the court decision has grown essentially. Cases of banks liquidation because of the law violation are also frequent.

According to analysts, the reduction of active banks in Russia that started in the period of the financial crisis is going to continue. Many experts are expecting of the essential reduction of active banks. At the same time it is early to give perfect forecasts about its total amount and the influence of such processes on economy.

The global experience demonstrates that if the bank has found and taken its special position for banking service, the size of this bank plays no role, as the ability of carrying out its obligations and acting on the legal structure is much more important. For instance, both small and large banks coexist peacefully in Switzerland. In addition to this, the section of finance services in these banks is one of the most advanced all over the world.