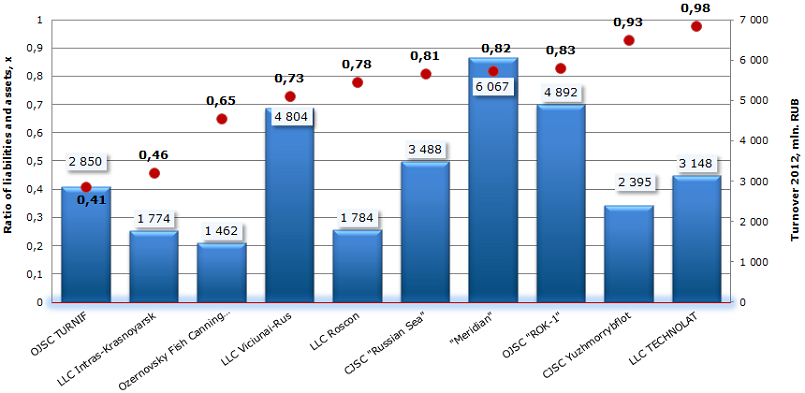

The ratio of liabilities and assets of the Russian enterprises engaged in processing and preserving of fish and seafood

Information agency Credinform prepared ranking of Russian enterprises engaged in processing and preserving of fish and seafood by the liabilities and assets ratio. Companies with this activity, largest in terms of turnover for the latest available in the Statistical Register period (2012), were selected for the ranking. The selected enterprises were ranked first in terms of turnover, and then 10 largest were sorted in an investigated factor ascending order.

The liabilities and assets ratio shows the share of borrowings in the enterprise‘s assets and is calculated as the ratio of long-term and short-term debt to total assets. This ratio refers to a group of indexes of financial stability. Its recommended value ranges from 0.2 to 0.5.

| № | Name, INN | Region | Ratio of liabilities and assets, х | Turnover 2012, mln. RUB | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | OJSC "Pacific department of fish survey and research fleet",INN 2536053382 | Primorski Krai | 0,41 | 2 850 | 184 (top) |

| 2 | LLC Intras-Krasnoyarsk,INN 2466056838 | Krasnoyarsk Territory | 0,46 | 1 774 | 241 (high) |

| 3 | Ozernovsky Fish Canning Plant 55, JSC,INN 4108003484 | Kamchatka Krai | 0,65 | 1 462 | 208 (high) |

| 4 | LLC Viciunai-Rus,INN 3911008930 | Kaliningrad region | 0,73 | 4 804 | 237 (high) |

| 5 | LLC Roscon,INN 3904067043 | Kaliningrad region | 0,78 | 1 784 | 222 (high) |

| 6 | CJSC "Russian Sea",INN 5031033020 | Moscow region | 0,81 | 3 488 | 277 (high) |

| 7 | "Meridian",INN 7713016180 | Moscow | 0,82 | 6 067 | 173 (top) |

| 8 | OJSC "ROK-1",INN 7805024462 | St. Petersburg | 0,83 | 4 892 | 221 (high) |

| 9 | CJSC Yuzhmorrybflot,INN 2508098600 | Primorski Krai | 0,93 | 2 395 | 288 (high) |

| 10 | LLC TECHNOLAT,INN 3906145113 | Kaliningrad region | 0,98 | 3 148 | 242 (high) |

Among 10 companies in the ranking, only two can boast of liabilities and assets ratio with the relevant normative values. Both companies are at the head of the ranking.

The first line is taken by OJSC "Pacific department of fish survey and research fleet" (OJSC TURNIF) with the ratio of 0.41, which corresponds to the recommended values. Additionally, the company has got the highest solvency index GLOBAS -i ®, which characterizes it as financially stable. The second line is for LLC Intras-Krasnoyarsk with the value of 0.46, which also conforms to standards. The company was given a high solvency index GLOBAS -i ®. This indicates that the balanced financial policy exists in both companies. They are able to make their financial liabilities on time.

The ratio of liabilities and assets of the Russian enterprises engaged in processing and preserving of fish and seafood. Top-10

Ozernovsky Fish Canning Plant 55, JSC and LLC Viciunai-Rus, located on the third and fourth lines, have values of 0.65 and 0.73 respectively, which is slightly deviated from the norm. This shows a trend towards the gradual equalization of borrowings and assets of the companies.

The ratio of borrowings and equity capital of the remaining enterprises is significantly higher than normative values and approaches to 1, which characterizes these enterprises as financially sensitive. However, there are leaders in terms of turnover among these companies. Moreover, all companies has got high and the highest solvency index GLOBAS -i ®, and this indicates a good solvency margin and low credit risk, in spite of the deviations of researched ratio from the norm.

Thus, the companies’ management should control the ratio of borrowings and equity capital in order to avoid financial instability. At the same time, it should be remembered that it is necessary to consider a set of financial indicators for an objective solvency assessment.

Russia is eager to become one of European leaders by volume of GDP

In the course of the forum “Russia is calling”, arranged by VTB Capital, the President of Russian Federation Vladimir Putin stated that Russia comes to grips to become the first economy in Europe and the fifth in the world by the volume of GDP.

According to OECD (Organization for Economic Cooperation and Development), in 2012 volume of GDP in Russia at parity of purchasing power amounted to 3,373 trillion dollars, whereas GDP in Germany amounted to 3,378 trillion dollars. Russia’s GDP per capita and size of consumption are comparable with the results of euro-zone countries, but in the eyes of the head of the State, there is other good news. Economy of the State is more than two times inferior to western European countries in labor efficiency. The President considers such disjuncture between consumption level and economic efficiency unsafe.

According to Vladimir Putin, present pace of economic growth doesn’t reduce underrun from leaders, but indicates temporary shutdown in economy, its one-sided structure and resource-based nature. And in order to improve efficiency, it is necessary to have the growth twice as much than present – at the level of 5-6%. It is possible only on condition of economy commitment to create qualitative jobs.

The President also noticed that one of the economic growth factors is liberalization of infrastructure. Today, in his opinion, expenses of infrastructure are insufficiently controlled. This happens not only owing to value detraction, but also as a result of bad primary calculation. The President recalled that the state is going to invest in infrastructure projects on a repayable and remuneration bases.

The most important key to growth of economic efficiency is improvement of business climate, continued Vladimir Putin. Unfortunately, not all the departments hold it as a priority. However, all the measures are to be implemented during two years. The country’s leader set a task to increase the total volume of investments in economy of the country till 25% of GDP in the near future, and by 2018 - till 27%. Moreover, he urged to develop non-primary export and assured that independently from external conditions and objective difficulties all the contemplated reforms would be implemented and prescribed vector to create strong economy would be saved.