Principles of taxation of business won’t be changed, but new levies will be introduced

The Government of the RF is not about to make amendments in principles of taxation of business. This was announced by the Prime Minister of the RF Dmitry Medvedev in the course of its speech at the forum of the organization «Opora Rossii», dedicated to small business. The Prime Minister stated that in spite of external-economic difficulties and tight budget, the government doesn’t plan to introduce changes in principles of taxation of business.

As a reminder, earlier the government refused the increase of VAT, PIT and move towards progressive taxation scale. Also they refused the introduction of sales tax, against which were: the Ministry of Finance, Ministry for Economic Development (MED), as well as the Deputy prime-minister Igor Shuvalov. According to the opinion of most experts, the introduction of new taxes in the current economic situation, when it is necessary to stimulate the development of small and medium business, will have a negative impact on economic and investment climate of the country.

Along with this in the course of International investment forum «Sochi-2014» Dmitry Medvedev informed about government’s intention to support regional budgets, which incur a deficit of funds, on account of the introduction of additional tax levies. Note that at year-end 2013 the amount of total consolidated debt of constituent entities of the Federation owed to the budget increased by 26,9% and as of the 1st of January of the current year made 2 trn 26 bln RUB. The most part of borrowings goes toward discharge of the budget deficit, which increases annually. Along with this the debt of municipal entities also increases. So that as of today the debt of local self-government authorities reaches 288,9 bln RUB.

The Prime Minister offered to allow regions to introduce additional taxes on trading rights, on food service, as well as tourist and visitor’s tax by themselves. Note that earlier tourist regions of the country (Krasnodar territory, Moscow and Saint-Petersburg) advanced the initiative to introduce the tourist tax.

According to preliminary estimates of the Ministry of Finance, due to new levies regions will be able to replenish the budget by 50-70 bln RUB annually. By that an effect from the introduction of sales tax is estimated at 200 bln RUB.

New levies can be introduced already since next year, but their amount isn’t determined yet. The right to impose taxes will be transferred most likely to regions, and at the federal level it will be set just the upper limit.

The experts note that suggested levies won’t help solve a problem of budget deficit of outlying regions, but will come upon small traders and taxi drivers, i.e. upon representatives of small business and individual entrepreneurs. The introduction of levy for trading rights can be considered generally as an additional administrative barrier for entrance to the market. Finally, all tax «innovations» will be paid by consumer, because the increase of tax burden will automatically have an impact on price.

As a reminder, the current Tax Code allows to collect one-time charges for providing of government services. Besides that one-time charges are collected for hunt and fishing.

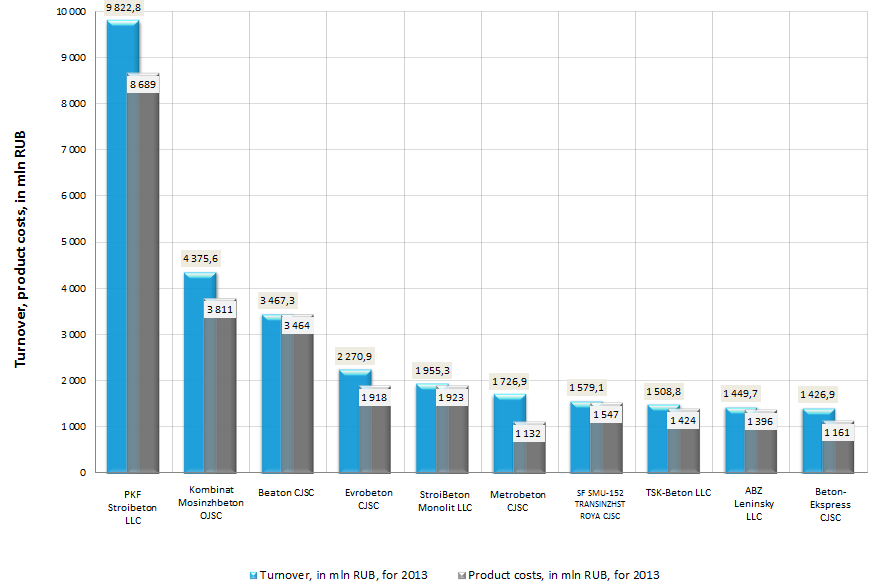

Product costs of manufacturers of concrete

Information agency Credinform prepared a ranking of Russian enterprises - manufacturers of concrete.

The companies with the highest volume of revenue were selected for this ranking according to the data from the Statistical Register for the latest available period (for the year 2013). These enterprises were ranked by decrease in cumulative annual turnover.

Product costs (in RUB) are expenses of an enterprise for manufacture and realization of products, represented in monetary form.

Product costs belong to the most important qualitative indicators, which collectively show all sides of company’s business activity. The level of product costs is connected with volume and quality of production, use of labor time, raw and other materials, equipment, expenditure of payroll budget etc. Product costs, on their turn, are the basis of determination of prices for production. The lower are product costs, the higher is profit and level of profitability. To reduce product costs, it needs to know their composition, structure and factors of their dynamics.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention not only to product costs, but also to all available combination of review data.

| № | Name | Region | Turnover, in mln RUB, for 2013 | Product costs, in mln RUB, for 2013 | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | PKF Stroibeton LLC INN 5018059580 |

Moscow region | 9 823 | 8 689 | 223 (high) |

| 2 | Kombinat Mosinzhbeton OJSC INN7724208292 |

Moscow | 4 376 | 3 811 | 275 (high) |

| 3 | Beaton CJSC INN 7825367884 |

Saint-Petersburg | 3 467 | 3 464 | 197 (the highest) |

| 4 | Evrobeton CJSC INN 7734536888 |

Moscow | 2 271 | 1 918 | 285 (high) |

| 5 | StroiBetonMonolit LLC INN 5047050341 |

Moscow region | 1 955 | 1 923 | 172 (the highest) |

| 6 | Metrobeton CJSC INN 7803033447 |

Saint-Petersburg | 1 727 | 1 132 | 257 (high) |

| 7 | SF SMU-152 TRANSINZHSTROYA CJSC INN 7701145790 |

Moscow | 1 579 | 1 547 | 237 (high) |

| 8 | TSK-Beton LLC INN 7811470024 |

Saint-Petersburg | 1 509 | 1 424 | 364 (satisfactory) |

| 9 | ABZ Leninsky LLC INN 7727785467 |

Moscow | 1 450 | 1 396 | 253 (high) |

| 10 | Beton-Ekspress CJSC INN 6673143733 |

Sverdlovsk region | 1 427 | 1 161 | 262 (high) |

Picture. Turnover and product costs of the largest manufacturers of concrete (TOP-10)

The turnover of the largest companies – manufacturers of concrete in the RF (TOP-10) made 29 583 bln RUB, according to the latest published annual financial statement (for the year 2013), and cumulative product costs – 26 464 bln RUB. Now therefore, total expenses of enterprises of this branch are high enough, it is necessary to cut costs, otherwise the probability to get a negative result of net profit increases.

Among industry leaders the main manufacturers of concrete are concentrated in Moscow agglomeration and Saint-Petersburg, what is explained by large volume of construction and new housing supply in these regions.

PKF Stroibeton LLC (Moscow region) is the firm engaged in the manufacture of ready-mixed concrete, mortar, curb stone, asphalt concrete, as well as dry building mixes and concrete products.

Kombinat Mosinzhbeton OJSC (Moscow) is one of the largest Moscow enterprises on manufacture of concrete, concrete products and asphalt concrete. The assortment of goods manufactured by the plant includes more than 70 types of high-quality concrete mixes (from road to extra-strong and hydrotechnical) and 120 types of concrete products.

Beaton CJSC (Saint-Petersburg) has gathered experience in manufacture of road concrete mixes and concretes of different marks and classes: for road construction, for housing and industrial construction, for building and construction of bridge and tunnel structures, as well as concretes for works with built-in-place piles.

According to the independent estimation of the Information agency Credinform, all organizations of the TOP-10 (except TSK-Beton LLC) got a high and the highest solvency index, what can signal to potential investors, that the largest market players can pay off their debts in time and fully in the moment of their incurrence.

The standing of the branch will be determined to a large extent by speed of housing construction: for 9 months of 2014 the volume of new housing supply countrywide has increased by 24,6% to the relevant period of 2013 – up to 48,2 mln sq. m.

However, the increased value of credit and mortgage programs, as well as unstable macroeconomic situation, could have a negative impact on the dynamics of building sector next year.