Debt/equity ratio of companies engaged in software development and consulting in this field

Information agency Credinform prepared a ranking «Debt/equity ratio of companies engaged in software development and consulting in this field». The companies with highest volume of revenue were selected for this ranking according to data from the Statistical Register for the latest available period (for the year 2012). Then, the first 10 enterprises selected by turnover were ranked by increase in debt/equity ratio.

Mentioned indicator – debt/equity ratio – belongs to the group of financial stability indexes. Indicators of this group are interesting first of all for long-term credits, because they characterize the firm's ability to satisfy its long-term obligations. So that, the debt/equity ratio is calculated as the relation of total borrowed funds to amount of internal capital and shows how many units of borrowed funds were added by an enterprise to each unit of its own funding sources.

Recommended value of the considered indicator is less than 1. At the same time, the debt/equity ratio cannot be negative, that’s why its value within the interval from 0 to 1 is one of indicators of high ability of a company to repay its liabilities.

| № | Name, INN | Region | Turnover for 2012 in mln RUB | Debt/equity ratio, (х) | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | SAP SNG LLC INN 7705058323 |

Moscow | 16 315 | 1,23 | 230 (high) |

| 2 | Inform LLC INN 7725624249 |

Moscow | 10 062 | 1,84 | 232 (high) |

| 3 | EDVANSED TRANSFORMEISHN KONSALTING LLC INN 7715744096 |

Moscow | 5886 | 2,17 | 212 (high) |

| 4 | Maikrosoft Rus LLC INN 7743528989 |

Moscow | 8915 | 3,21 | 227 (high) |

| 5 | KROK INKORPOREITED CJSC INN 7701004101 |

Moscow | 29 187 | 3,76 | 207 (high) |

| 6 | OTKRYTYE TEHNOLOGII 98 CJSC INN 7729376075 |

Moscow | 6252 | 5,2 | 197 (the highest) |

| 7 | OTRASLEVOI TSENTR VNEDRENIYA NOVOI TEHNIKI I TEHNOLOGY CJSC INN 7717130165 |

Moscow | 10 318 | 8,09 | 180 (the highest) |

| 8 | ABSoft LLC INN 7610085752 |

Yaroslavl region | 57 975 | 22,97 | 276 (high) |

| 9 | MONT LLC INN 7703313144 |

Moscow | 11 376 | 55,44 | 200 (high) |

| 10 | GAZPROM INFORM LLC INN 7727696104 |

Moscow | 8312 | 96,99 | 270 (high) |

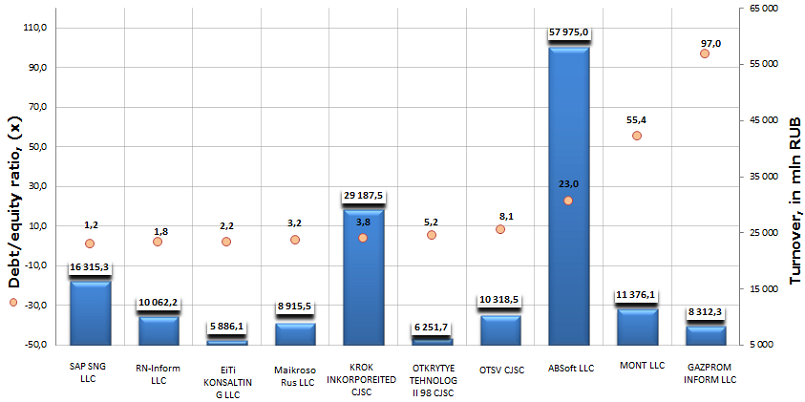

Analysis of results of 10 the largest software engineers showed that none of companies doesn’t meet recommended standards on the debt/equity ratio, because the indicator value is above 1, what testifies that companies misappropriate borrowed funds. Although all companies got a high and the highest solvency index GLOBAS-i®, that characterizes them as financially stable.

Debt/equity ratio of the largest on turnover companies engaged in software development and consulting in this field, TOP-10

The best result was presented by the company SAP SNG LLC, having the lowest deviation from recommended values. Moreover, the enterprise is the 3rd in the branch on the turnover. In support of good results the company got a high solvency index GLOBAS-i®.

The enterprise with the highest turnover in the branch at year-end 2012 – KROK INKORPOREITED CJSC – is only on the 5th place in the ranking list, with the value of the debt/equity ratio being three times over the upper limit of the standard. Such result testifies to significant exceedence of credit resources over own capital of organization. However, the company got a high solvency index GLOBAS-i®.

In summary, it should be noted, that for the objective assessment of a company it should be considered not only recommended values of those or other indicators, but also of industry-average indicators. So that, the activity in the sphere of information technologies (IT) is science-intensive and requires significant material costs, this particular explains such high values of the debt/equity ratio by the analyzed enterprises.

The manufacturing industry in Russia resumed the growth

According to recent reported data, the industrial construction increased on 2,1% in the February, 2014 in comparison with corresponding period of the previous year. Against the background of tense situation in Ukraine and West countries’ threats to impose economic sanctions on Russia this fact encouraged optimism into the expert community.

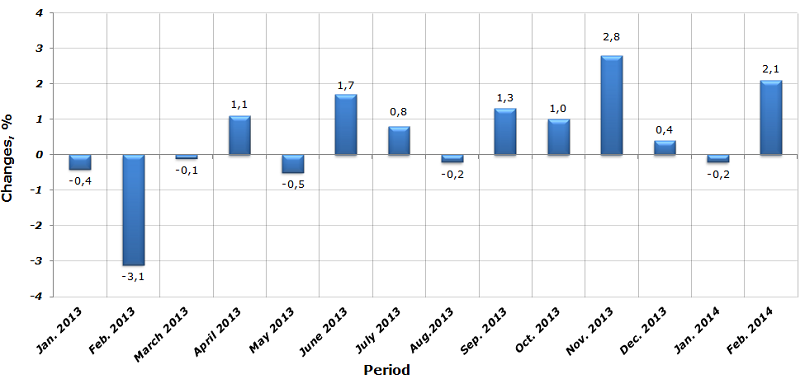

Fig. Increase of industrial construction, % (to corresponding period of the previous year)

The February indicator became the second best value of the industrial construction for the last 14 months. It reached its peak in November 2013 – 2,8%, whereas in February 2013 there was a decline on 3,1% in comparison with the rate in February 2012.

Last year many analysts came to a conclusion that the country has plunged into long-standing stagnation, the increase of industrial construction amounted to symbolic 0,4%. The figures of the January 2014 are not by much but however more than the figures of similar period of 2013. It is indicative that the main contribution into positive dynamic was made by processing industry in the February of the current year. This industry has showed the increase on 3,4%, the extraction of mineral resources – 0,7% and production and distribution of electric power, gas and water has decreased on 0,3%.

Taking into consideration the deep integration of Russia into the world economy, on the main markets of which the rally of investment activity and the consumer’s demand are being noted recently, there are reasons to believe that the observing processes of recovery of the domestic industry will have system nature. And the external situation with joining of the Crimea and Sevastopol won’t have significant impact on mutual trade and collaboration with main foreign trade partner – the European Union. Several forecasts have already been made concerning the fact that the infrastructural investments into new territories will provide a spark to the GDP, and political sanctions of the West countries will summon the part of the capital back to the country.