The Government will reduce inspections of small business

In governmental authorities they talk constantly about the development of small business, but sometimes good ideas bump up against the practice of frequent inspections by all sorts of regulatory bodies, when it becomes difficult to conduct business due to the high bureaucratization.

Today, when country’s economy is not in the best condition, the problem of lifting of excess restrictions gained a new actuality. In particular, at a meeting with the First Deputy PM Igor Shuvalov in March, the Federal Antimonopoly Service (FAS) was tasked to establish immunity for enterprises with annual revenues being below 400 mln RUB and reduce the number of inspections of small business for a period of not less than three years.

The idea seems to be quite reasonable and should give a new impulse to the development of the business environment.

Own funds flexibility ratio of pharmaceutical companies

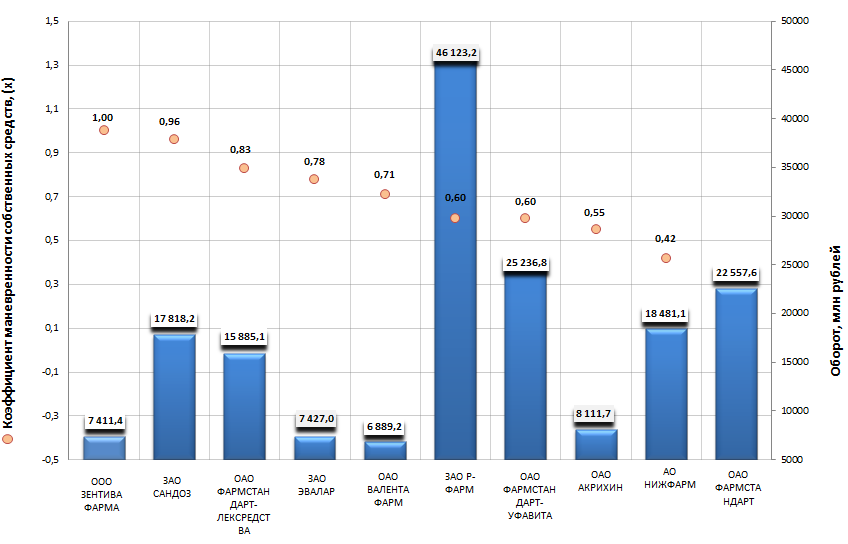

Information Agency Credinform has prepared the ranking of pharmaceutical companies by own funds flexibility ratio. The largest enterprises engaged in this activity in terms of turnover were selected according to the data from the Statistical Register for the latest available period (for the year 2013). Then, the first ten companies by turnover were ranged by decrease in own funds flexibility ratio.

Own funds flexibility ratio (х) shows the ability of the company to support the level of own working capital and to replenish current assets from its own sources in case of need. It is calculated as a ratio of current assets to total equity. The recommended value is from 0,2 to 0,5.

The decrease of the indicator shows possible delay in collection of receivables or toughening of terms of trade credit granting by suppliers and contractors. The increase shows the growing ability to repay the current liabilities.

| № | Name, INN | Region | Turnover 2013, mln. RUB. | Own funds flexibility ratio, (х) | Solvency index Globas-i® |

|---|---|---|---|---|---|

| 1 | LLC ZENTIVA PHARMA INN 7704510025 |

Moscow | 7411 | 1 | 212 (high) |

| 2 | CJSC SANDOZ INN 7717011640 |

Moscow | 17 818 | 0,96 | 277 (high) |

| 3 | JSC PHS-LEKSREDSTVA INN 4631002737 |

Kursk Region | 15 885 | 0,83 | 159 (the highest) |

| 4 | CJSC Evalar INN 2227000087 |

Altai Region | 7427 | 0,78 | 159 (the highest) |

| 5 | JSC Valenta Pharm INN 5050008117 |

Moscow Region | 6889 | 0,71 | 192 (the highest) |

| 6 | CJSC Company R-Pharm INN 7726311464 |

Moscow | 46 123 | 0,6 | 222 (high) |

| 7 | PJSC PHARMSTANDARD-UFIMSKIY VITAMIN PLANT INN 274036993 |

Republic Of Bashkortostan | 25 237 | 0,6 | 187 (the highest) |

| 8 | OJSC CHEMICO-PHARMACEUTICAL WORKS AKRIKHIN INN 5031013320 |

Moscow Region | 8112 | 0,55 | 168 (the highest) |

| 9 | OJSC Nizhpharm INN 5260900010 |

Nizhny Novgorod Region | 18 481 | 0,42 | 182 (the highest) |

| 10 | OJSC PHARMSTANDARD INN 274110679 |

Moscow Region | 22 558 | -0,46 | 220 (high) |

The first place of the ranking takes LLC ZENTIVA PHARMA with ratio value equal 1, that means the circulation of almost 100% of own working capital, it also shows the high efficiency of resources use. The company has the high solvency index Globas-i®, that shows the company’s stable financial condition.

Picture. Own funds flexibility ratio of the largest pharmaceutical companies in Russia, Top-10

The industry leader by turnover CJSC Company R-Pharm takes the sixth place of the ranking with ratio value 0,6, that corresponds to the generally accepted standards. The company also has the high solvency index Globas-i®.

OJSC PHARMSTANDARD is the only company with the negative ratio value, that means the capitalization of the most part of own working capital. This may lead to delay in collection of receivables. However according to total financial and non-financial indicators, the high solvency index Globas-i® was assigned to the company.

In general, all companies of TOP-10 showed rather high level of own funds flexibility ratio, that shows the ability of the vast majority of leaders of the Russian pharmaceutical market to provide flexibility in use of own funds.