Russian economy: we're preparing for the worst, but hoping for the best

According to the Minister of Economic Development Aleksei Ulyukaev Russian economy could show a little bit better result by the end of the year, than for all last months, when the economic performances were just worsening. In light of the fact that industrial production has declined (for the first time since the beginning of the year) by 0,1% in January-November, the statement of the Minister looks very optimistic in this context.

GDP (Gross domestic product) has increased by 1,4% for 10 months of the current year, and in October – by 1,8%. Most probably it wouldn't succeed to reach the planned performance by 1,8% at year-end anymore and the domestic product would show positive dynamics by 1,5%. Now therefore, some recovery of the economy is expected in October-December, though weak, but at least. There are some reasons for it.

First of all, pleasant situation in the agricultural sector: after rains at the beginning of autumn, which hindered harvesting operations, agricultural industry showed double-digit growth in October - 26,3% on an annualized basis, that in itself is an excellent result.

Moreover, it is observed the improvement of investment demand in last months of the year, in which the investment program of Gazprom has no small share.

On top of that, it is observed the retail trade recovery: in October the turnover growth was speeded up to 3,5% on an annualized basis against 3% in September. And in view of coming traditional Pre-New Year clearance sales, the analysts of the Agency Credinform forecast if not bigger, but surely attained level of dynamics in the retail field.

All mentioned positive signals will help domestic economy to finish the year on an up note, but they are short-term. It must be stated, that general position of affairs is not so bright.

First of all, the decline of capital investments is speeding up – in October it was -1,9% on an annualized basis, while in September the figure was -1,6%.

The unemployment is continuing to rise, in October it reached 5,5%. In view of the decrease in industrial production this fact is not surprising.

And, perhaps, the main determinant, which could play a low-down trick with us in the long-term outlook, is the growth of bank crediting of natural persons, that reached on an annualized basis 30% in October. Surely, loan proceeds can spur the consumption now, but along with this the risk of loan default grows up, that will have an impact on the banking sector in some or other way. On the back of economic stagnation, similar practice of credit institutions seems to be highly risky.

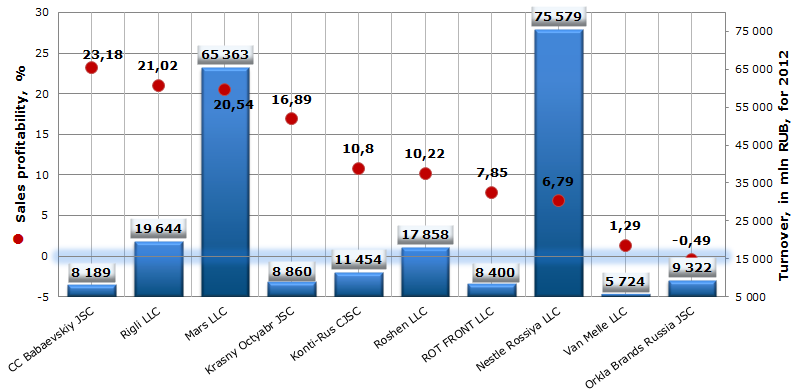

Return on sales of chocolate and sugar confectionery manufacturers

Information agency Credinform prepared a ranking of return on sales of chocolate and sugar confectionery manufacturers in the RF. The companies with highest turnover in this branch were selected for this research according to data from the Statistical Register for the latest available period (for the year 2012). Then, the first 10 enterprises selected by turnover were ranked by decrease in return on sales value.

Return on sales presents the share of operating income in sales volume of a company and is calculated as the ratio of profit on sales to sales revenue. There is no recommended and specified value prescribed for profitability ratios, because they vary strongly depending on industry characteristics and other operational aspects of an enterprise. Therefore, a company should be assessed first of all relying on industry-average indicators. At the same time return on sales shows if the enterprise activity is profitable or loss-making, but doesn’t give any decisive answer to the question how much is a company attractive for investments and business cooperation.

| № | Legal form of organization Name INN | Region | Turnover for 2012, mln RUB | Return on sales, % | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | Confectionary Concern Babaevskiy JSC INN 7708029391 |

Moscow | 8 189 | 23,18 | 146 (the highest) |

| 2 | Rigli LLC INN 7705008210 |

Moscow | 19 644 | 21,02 | 217 (high) |

| 3 | Mars LLC INN 5045016560 |

Moscow region | 65 363 | 20,54 | 181 (the highest) |

| 4 | Moscow confectionary factory Krasny Octyabr JSC INN 7706043263 |

Moscow | 8 860 | 16,89 | 144 (the highest) |

| 5 | Konti-Rus CJSC INN 4629046141 |

Kursk region | 11 454 | 10,8 | 212 (high) |

| 6 | Roshen LLC INN 4824033114 |

Lipetsk region | 17 858 | 10,22 | 189 (the highest) |

| 7 | RotFront CJSC INN 7705033216 |

Moscow | 8 400 | 7,85 | 177 (the highest) |

| 8 | Nestle Rossiya LLC INN 7705739450 |

Moscow | 75 579 | 6,79 | 245 (high) |

| 9 | Van Melle LLC INN 7719697104 |

Moscow | 5 724 | 1,29 | 305 (satisfactory) |

| 10 | Orkla Brands Russia JSC INN 7830000190 |

Saint-Petersburg | 9 322 | -0,49 | 272 (high) |

Return on sales of chocolate and sugar confectionery manufacturers, TOP-10

In spite of an active promotion of healthy lifestyle and healthy eating, popular majority is unable to go back on chocolate, candies and other confectionery delicacies. According to experts, the production volume of chocolate and sugar confectionery went up by 4,75% for the first half of the year 2013.

The top three companies in the raking list are represented by following enterprises: Confectionary Concern Babaevskiy JSC, Rigli LLC (TM Orbit, Juicy Fruit, Hubba Bubba etc.) and Mars LLC (TM Milky Way, Bounty, Mars, Twix, Snickers etc.). The return on sales value of all top three companies is more than 20%, therefore, more than 20% of sales revenue is accounted for by profit on sales of the mentioned enterprises, that may be considered as a good result. Mars LLC is also the second company with highest turnover in the branch at year-end 2012. Moreover all companies got high and the highest solvency index GLOBAS-i®, which characterizes them as financially stable.

The leading company with highest turnover in the branch Nestle Rossiya LLC (TM NESQUIK, Rodnye Prostory, Savinov, Rossiya etc.) is located only on the 7th place of the ranking with the return on sales 6,79%, that could be related to high production cost, as well as to high selling and administrative costs. Although, the company got high solvency index GLOBAS-i®, that characterizes it as financially stable and attractive for business cooperation.

The company Orkla Brands Russia JSC (TM SladKo, Fluide, Pekar, Factory named after N.K. Krupskaya) closes the ranking with the return on sales (-0,49)%, that is less than 0. Similar result can be explained by negative value of sales profit. However, the company got high solvency index GLOBAS-i®, which characterizes it as financially stable with low risk of insolvency in the nearest 12 months. Similar conclusion confirms once again the rule that for overall assessment of a company it is necessary to take comprehensive approach with using of various financial and non-financial indicators.