Trends in bus transportation

Information Agency Credinform presents a review of activity trends of the largest bus transportation companies. Passenger transportation companies with the largest annual revenue (TOP-10 and TOP-1000) have been selected for the analysis, according to the data from the Statistical Register for the latest available accounting periods (2015 — 2017). The analysis was based on the data from the Information and Analytical system Globas .

Net assets indicate fair value of corporate assets that is calculated annually as assets on balance less company’s liabilities. Net assets value is negative (insufficiency of property) if liabilities are larger than the property value.

| № | Name, INN, region | Net assets value, million RUB | Solvency index Globas | ||

| 2015 | 2016 | 2017 | |||

| 1 | 2 | 3 | 4 | 5 | 6 |

| 1 | State unitary enterprise of Moscow region MOSTRANSAVTO INN 5000000017 Moscow region |

20913,2 |  21399.6 21399.6 |

19511,9 19511,9 |

258 Medium |

| 2 | State unitary enterprise of Saint Petersburg PASSAZHIRAVTOTRANS INN 7830001758 Saint Petersburg |

5684,9 |  8924,4 8924,4 |

12113,0 12113,0 |

202 Strong |

| 3 | Municipal transportation company ROSTOVPASSAZHIRTRANS INN 6163050739 Rostov region |

503,6 |  365,4 365,4 |

1355,4 1355,4 |

276 Medium |

| 4 | Municipal unitary enterprise Transportation Company of Municipal district of Yuzhno-Sakhalinsk INN 6501238799 Sakhalin region |

117,7 |  1348,2 1348,2 |

1194,9 1194,9 |

299 Medium |

| 5 | JSC Third Park INN 7814010096 Saint Petersburg |

527,8 |  585,5 585,5 |

602,4 602,4 |

210 Strong |

| 996 | Municipal enterprise SAMARA PASSAZHIRAVTOTRANS INN 6318163505 Samara region |

405,9 |  131,9 131,9 |

-169,5 -169,5 |

322 Adequate |

| 997 | Municipal enterprise Khabarovsk Passenger Road transportation enterprise No. 1 INN 2724018687 Khabarovsk territory Process of being wound up, since 18.08.2016 |

7,2 |  -119,9 -119,9 |

-248,4 -248,4 |

600 Insufficient |

| 998 | Municipal enterprise Passenger Transportation of Penza INN 5834030883 Penza region Process of being wound up, since 31.10.2014 |

-447,9 |  -481,3 -481,3 |

-471,3 -471,3 |

600 Insufficient |

| 999 | Municipal enterprise Chelyabinsk Bus Transport INN 7453222396 Chelyabinsk region Process of being wound up since 05.12.2016, signs of premeditated bankruptcy are detected |

40,7 |  -164,8 -164,8 |

-621,1 -621,1 |

600 Insufficient |

| 1000 | Municipal enterprise of Nizhnii Novgorod Nizhegorodskii Passenger Road Transport INN 5260000192 Nizhnii Novgorod region |

-393,2 |  -573,3 -573,3 |

-710,1 -710,1 |

291 Medium |

— growth compared to prior period,

— growth compared to prior period,  — decline compared to prior period.

— decline compared to prior period.

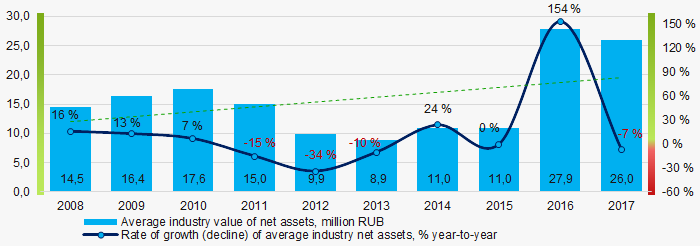

Average net assets of TOP-1000 companies tended to increase during the last decade (Picture 1).

Picture 1. Change in average net assets of bus transportation companies in 2008 — 2017

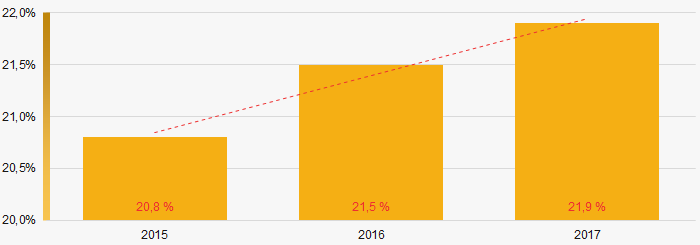

Picture 1. Change in average net assets of bus transportation companies in 2008 — 2017The share of TOP-1000 companies with insufficiency of property is significant and tends to increase within the last 3 years (Picture 2).

Picture 2. Share of TOP-1000 companies with negative value of net assets in 2015-2017

Picture 2. Share of TOP-1000 companies with negative value of net assets in 2015-2017Sales revenue

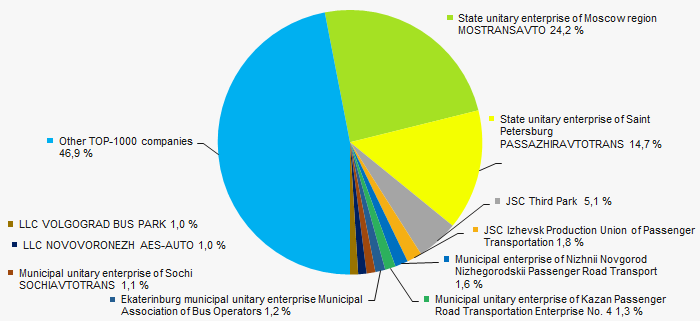

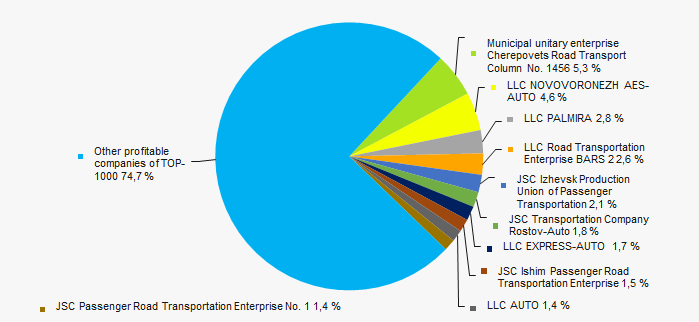

In 2017 sales revenue of 10 leaders amounted to 53% of total revenue of TOP-1000 companies (Picture 3). This is an indicator of a high level of monopolization within the industry.

Picture 3. TOP-10 companies by their share in 2017 total revenue of TOP-1000 companies

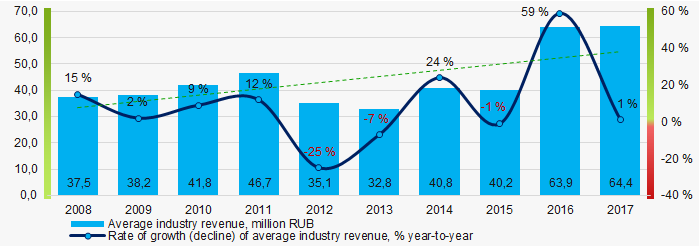

Picture 3. TOP-10 companies by their share in 2017 total revenue of TOP-1000 companiesIn general, revenue tends to increase during the decade (Picture 4).

Picture 4. Change in average revenue of bus transportation companies in 2008 — 2017

Picture 4. Change in average revenue of bus transportation companies in 2008 — 2017Profit and loss

In 2017 profit of 10 industry leaders amounted to 25% of total profit of TOP-1000 companies (Picture 5).

Picture 5. TOP-10 companies by their share in 2017 total profit"

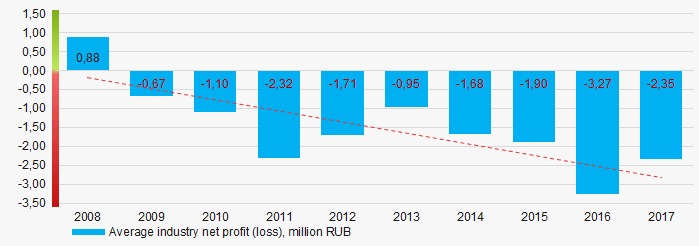

Picture 5. TOP-10 companies by their share in 2017 total profit"Average net profit has mostly negative values, with a trend of the loss to increase (Picture 6).

Picture 6. Change in average net profit (loss) of bus transportation companies in 2008 — 2017

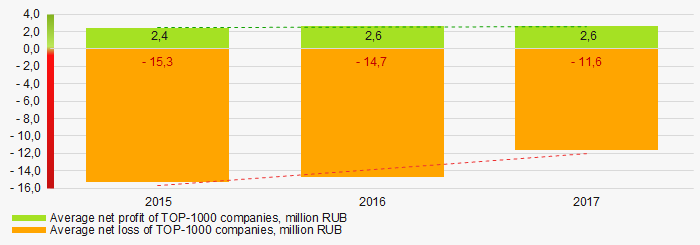

Picture 6. Change in average net profit (loss) of bus transportation companies in 2008 — 2017Average net profit values of TOP-1000 companies within the last 3 years tend to increase slightly, and the average loss value decreases (Picture 6).

Picture 7. Change in average net profit and loss of TOP-1000 companies in 2015 — 2017

Picture 7. Change in average net profit and loss of TOP-1000 companies in 2015 — 2017Key financial ratios

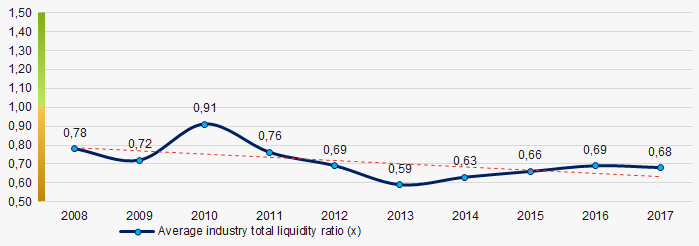

During the last decade average values of total liquidity ratio were below the recommended value — from 1,0 to 2,0, tending to decrease (Picture 8).

Total liquidity ratio (a ratio of current assets to current liabilities) reveals the sufficiency of a company’s funds for meeting its short-term liabilities.

Picture 8. Change in average values of total liquidity ratio of bus transportation companies in 2008 — 2017

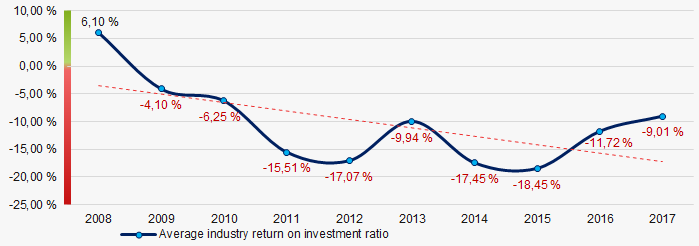

Picture 8. Change in average values of total liquidity ratio of bus transportation companies in 2008 — 2017During the last decade, average values of return on investment ratio were in the negative area and tended to decrease (Picture 9).

It is a ratio of net profit to total equity and noncurrent liabilities, and it demonstrates benefit from equity engaged in business activity and long-term raised funds of the company.

Picture 9. Change in average values of return on investment ratio of bus transportation companies in 2008 — 2017

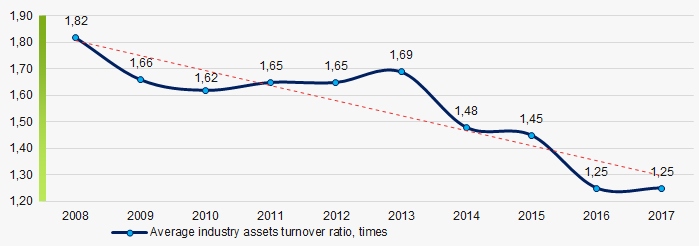

Picture 9. Change in average values of return on investment ratio of bus transportation companies in 2008 — 2017Assets turnover ratio is a ratio of sales revenue to average total assets for the period, and it measures resource efficiency regardless of the sources. The ratio indicates the number of profit-bearing complete production and distribution cycles per annum.

During the last decade, this activity ratio tended to decrease (Picture 10).

Picture 10. Change in average values of assets turnover ratio of bus transportation companies in 2008 — 2017

Picture 10. Change in average values of assets turnover ratio of bus transportation companies in 2008 — 2017Structure of services

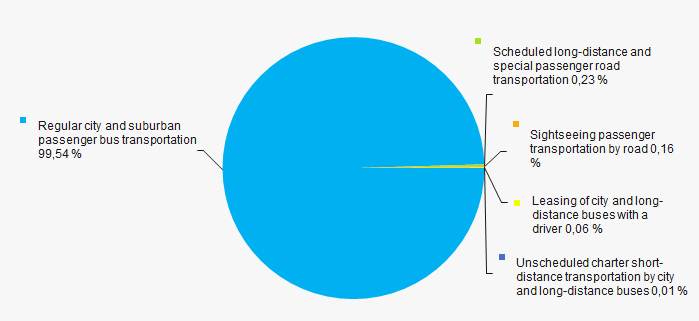

City and suburban passenger transportation companies have the largest share within the revenue of TOP-1000 (Picture 11).

Picture 11. Types of activity by their share in total revenue of TOP-1000 companies

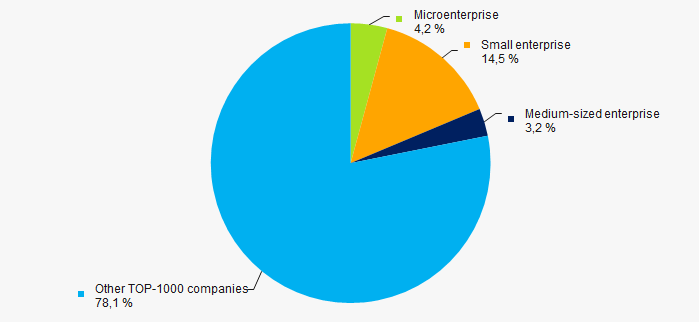

Picture 11. Types of activity by their share in total revenue of TOP-1000 companies74% of TOP-1000 companies are included in the register of small and medium-sized businesses of the Federal Tax Service of the Russian Federation. In general, their share in total revenue of TOP-1000 in 2017 amounted to 22% (Picture 12).

Picture 12. Shares of small and medium-sized enterprises in TOP-1000 companies' revenue, %

Picture 12. Shares of small and medium-sized enterprises in TOP-1000 companies' revenue, %Key regions of activity

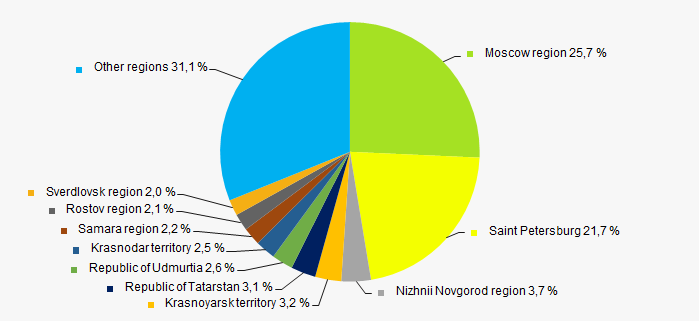

TOP-1000 companies are unevenly located throughout Russian territory, and are registered in 79 regions. Companies with the largest revenue are concentrated in the Moscow region and in Saint Petersburg (Picture 13).

Picture 13. Revenue of TOP-1000 companies by Russian regions

Picture 13. Revenue of TOP-1000 companies by Russian regionsFinancial position score

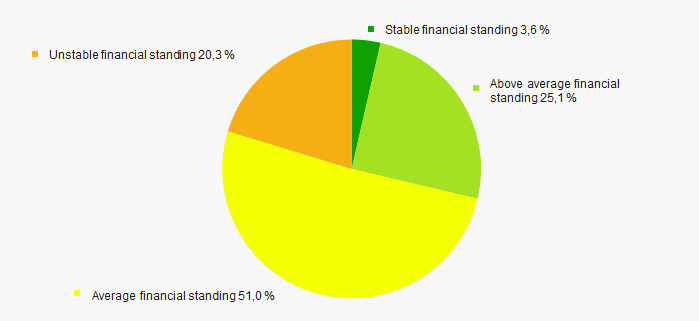

Assessment of financial state of TOP-1000 companies indicates that over a half of the companies have an average financial standing (Picture 14).

Picture 14. TOP-1000 companies by their financial position score

Picture 14. TOP-1000 companies by their financial position scoreSolvency index Globas

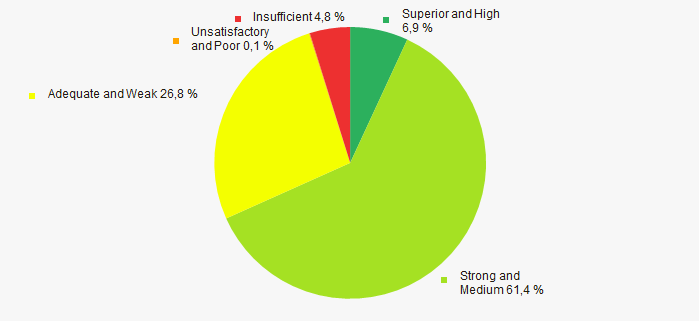

The majority of TOP-1000 companies have got a superior, high, strong or medium Solvency index Globas, that indicates their capability to meet liabilities timely and in full (Picture 15).

Picture 15. TOP-1000 companies by Solvency index Globas

Picture 15. TOP-1000 companies by Solvency index GlobasConclusion

A comprehensive assessment of the largest bus transportation companies, that considers key indexes, financial figures and ratios, is indicative of predominance of negative trends within the sector (Table 2).

| Trends and assessment factors | Relative share of the factor, % |

| Rate of growth (decline) of average industry net assets |  10 10 |

| Increase/ Decrease of share of companies with negative net assets |  -10 -10 |

| Rate of growth (decline) of average industry revenue |  10 10 |

| Level of competition / monopolization |  -10 -10 |

| Rate of growth (decline) of average industry net profit (loss) |  -10 -10 |

| Increase/ Decrease of average industry net profit of TOP-1000 companies |  10 10 |

| Increase/ Decrease of average industry net loss of TOP-1000 companies |  10 10 |

| Increase/ Decrease of average industry total liquidity ratio |  -10 -10 |

| Increase/ Decrease of average industry return on investment ratio |  -10 -10 |

| Increase/ Decrease of average industry assets turnover ratio, times |  -10 -10 |

| Share of small and medium-sized business within the industry by revenue over 30% |  -10 -10 |

| Regional concentration |  -10 -10 |

| Financial standing (majority share) |  5 5 |

| Solvency index Glogas (majority share) |  10 10 |

| Average factors' value |  -2 -2 |

— positive trend (factor),

— positive trend (factor),  — negative trend (factor).

— negative trend (factor).

Shadow-fighting

Under its Transparent Business project, the Federal Tax Service has disclosed information about 2.5 million out of 4.2 million active legal entities. This data was formerly considered a tax secrecy.

Almost 40% of Russian companies stayed in the shadow.

Since August 2018, the Federal Tax Service has started to publish data that is not a tax secrecy anymore. This information is available only concerning legal entities, excluding major taxpayers, defense and strategic enterprises. Data concerning the latter are to be disclosed in 2020.

Information disclosed is relevant as of December 31, 2017.

Average number of employees

Companies are to give an account of their last year’s average number of employees to tax authorities (Paragraph 3 Article 80 of the Tax Code of the Russian Federation). This information is to be provided by all enterprises whether or not they perform actual activity or in fact have employees.

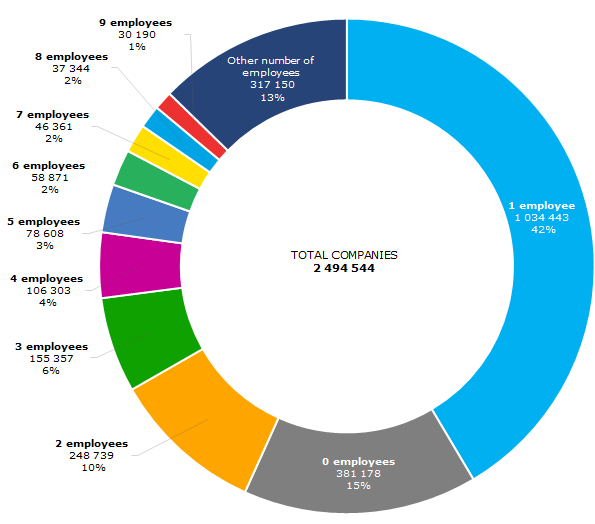

42% (or over one million) of companies that provided reports, have only one employee, and 15% of enterprises do not have staff at all (see Picture 1).

Absence of staff or a number that is obviously insufficient for activity increases the risk of the company to turn out to be a shell company or an abandoned business. However, there are other reasons:

- Aspects of record keeping: only full-time employees are included in the data of the Federal Tax Service, whereas a significant part of Russian companies has contractor or secondary employment agreements with their employees. In addition, the employees on maternity or educational leave are not included in the data.

- Tax minimization: wage bill has the burden of social security contributions, so the employers do not get full-time employees.

- Nature of activities: these days a company can be competitive and even successful without a large number of employees. Tasks are transferred to subcontractors, and the company’s director just coordinates the work.

- Errors: disclosed information is provided by legal persons themselves. The Federal Tax Service recommends that they “provide error-correcting reports with valid data without delay”. An example is EXPRESS LLC. On August 1, 2018 when the data was published, the company had 698,000 employees. For comparison, Russian Railways, the largest Russian employer, employs 737,000 people.

Picture 1. Companies by average number of employees according to the Federal Tax Service, as of 31.12.2017

Picture 1. Companies by average number of employees according to the Federal Tax Service, as of 31.12.2017Total income and expenditure

Data concerning total income and expenditure is provided from financial accounts. 2.5 million companies provided this information to the Federal Taxation Service.

Total income = revenue + income from participation in other companies + interest receivable + other income.

Total expenditure = cost of sales + selling and marketing expenses + administrative expenses + interest payable + other expenses.

In case of lack of balance sheet, this data gives an overview of size of business, and if the financial account is available – it can be used for additional comparison and check of figures from official sources, as they sometimes contain errors.

In particular, financials of ADAM-S LLC: a1b99439d89e raise doubts: this company from Ingushetia reported the Federal Taxation Service to have revenue of 122 trillion rubles, at the same time a revenue of 121 million rubles is stated in the balance sheet.

Paid taxes and fees

Total taxes and fees paid by the company during the calendar year, excluding total taxes and fees paid for import to the customs territory of the Eurasian Economic Union (EEU), are to be included.

2.1 million companies disclosed this information. Minimum taxes paid indicate that the company does not perform business activity. For example, DIAMANT LLC .36 ruble of taxes to all budgets in 2017

See the statistics of types of paid taxes and their regional distribution below.

2.2 trillion rubles or 39% of all taxes paid by companies is VAT. Insurance contributions for compulsory pension insurance are ranked second with 1.3 trillion rubles, and the next one is profit tax – 1 trillion rubles (see Table 1).

Table 1. Total taxes paid by companies in 2017, by tax types

| Rank | Tax | Total paid taxes, billion rubles | Share of the tax in paid taxes, % |

| 1 | VAT | 2238 | 39 |

| 2 | Insurance and other contributions for compulsory pension insurance | 1316 | 23 |

| 3 | Profit tax | 958 | 17 |

| 4 | Insurance contributions for compulsory health insurance | 314 | 6 |

| 5 | Corporate property tax | 195 | 3 |

| - | Other taxes | 685 | 12 |

| Total | 5679 | 100 |

Moscow companies accumulate 35% of all paid taxes. Other regions are far behind the capital city. The ranking is to change after the disclosure of major taxpayers, especially in the regions in which fuel and energy companies are registered.

Table 2. Total taxes paid by companies in 2017, by regions

| Rank | Region | Total paid taxes, billion rubles | Share of the region in paid taxes, % |

| 1 | Moscow | 2002 | 35 |

| 2 | Saint Petersburg | 437 | 8 |

| 3 | Moscow region | 397 | 7 |

| 4 | Krasnodar territory | 198 | 3 |

| 5 | Republic of Tatarstan | 138 | 2 |

| - | Other regions | 2507 | 45 |

| Total | 5679 | 100 |

Special tax regimes

Special tax regime is set based on activity type, number of employees and company’s revenue. Legislation allows simultaneous application of several special tax regimes, and combination of some of them with general taxation system.

The Federal Tax Service published information concerning 1.9 million companies that apply special tax regime. Almost 90% of companies use Simplified Tax System (STS). 5% of companies combine STS with Unified Tax on Imputed Income (UTII) (see Table 3).

Table 3. Main types of special tax treatment used by companies in 2017.

| Unified Agricultural Tax | STS | UTII | Number of companies | Share of total number of companies that provided information about using special tax regime, % |

| + | 1734746 | 90 | ||

| + | + | 103802 | 5 | |

| + | 83923 | 4 | ||

| + | 14776 | 1 | ||

| Production sharing agreement and other combinations of tax treatment | 1329 | <0 | ||

Consolidated group of taxpayers

Consolidated group of taxpayers (CGT) is a voluntary alliance of companies created for payment of profit tax for total financial result of all group.

The group can be created if one company is a direct or indirect shareholder of others (share in each of them is not less than 90%).

Member of CGT is a company that is a party of an active agreement of creation of a consolidated group of taxpayers.

Responsible member of CGT is the member that, according to the agreement of creation of a consolidated group, has the duty to charge and pay profit tax of all companies of the group.

The Federal Tax Service disclosed data concerning 88 companies that are members of consolidated groups.

Summary

- Having disclosed this data about companies, the tax service has received a point in the dispute concerning its right to charge additional tax. In case of a tax dispute with a taxpayer the Federal Tax Service may appeal to availability of information concerning counterparties.

- Business community has received a new source of information about companies’ activities.

- Released data is an auxiliary tool, as an overall assessment of a company includes many other, no less important information, as well as a comprehensive analysis that is possible only by means of a professional Information and Analytical system.

On December 1, 2018 the Federal Tax Service plans to publish information about arrears, companies’ tax debts and data concerning tax violations. This information will help Globas users to assess a company’s tax burden and to avoid the risk of cooperation with an abusive taxpayer.