Equity in fish processing

Information agency Credinform represents a ranking of the largest Russian enterprises engaged in processing and preserving fish and seafood. The companies with the largest volume of annual revenue (TOP-10) were selected for the ranking, according to the data from the Statistical Register for the latest available periods (2015 - 2017). They were ranked by equity turnover ratio (Table 1). The analysis was based on the data of the Information and Analytical System Globas.

Equity turnover (times) is revenue to the annual average total equity. It reflects the efficiency of the company’s equity management.

The ratio indicates the rate of equity turnover. High value speaks about effective equity management, and the low one is indicative of some equity idleness.

The experts of the Information agency Credinform, taking into account the actual situation both in the economy as a whole and in the sectors, has developed and implemented in the Information and Analytical system Globas the calculation of practical values of financial ratios that can be recognized as normal for a particular industry. For fish processing companies, the practical value of equity turnover ratio is from 3,74 times in 2017.

For the most complete and objective view of the financial condition of the enterprise, it is necessary to pay attention to the complex of indicators and financial ratios of the company.

| Name, INN, region | Revenue, million RUB | Net profit (loss), million RUB | Equity turnover, times | Solvency index Globas | |||

| 2016 | 2017 | 2016 | 2017 | 2016 | 2017 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| TORGOVY DOM BALTIISKIY BEREG COMPANY LIMITED INN 7804500052 Saint Petersburg |

1253 1253 |

6185 6185 |

38 38 |

-13 -13 |

36,45 36,45 |

207,56 207,56 |

312 Adequate |

| LLC RUSSIAN FISH WORLD INN 5074018058 Moscow |

1981 1981 |

2296 2296 |

17 17 |

94 94 |

54,17 54,17 |

27,76 27,76 |

191 High |

| JSC OKEANRYBFLOT INN 4100000530 Kamchatka territory In process of reorganization by spin-off since 11.06.2019 |

15351 15351 |

14464 14464 |

3735 3735 |

1602 1602 |

5,42 5,42 |

8,17 8,17 |

194 High |

| JSC FISH PROCESSING PLANT №1 INN 7805024462 Saint Petersburg |

5842 5842 |

6359 6359 |

80 80 |

145 145 |

7,64 7,64 |

7,25 7,25 |

201 Strong |

| LLC VICHUNAI RUS INN 3911008930 Kaliningrad region |

8716 8716 |

9998 9998 |

244 244 |

311 311 |

6,23 6,23 |

7,23 7,23 |

198 High |

| JSC INDUSTRIAL AND BUSINESS ENTERPRISE MERIDIAN INN 7713016180 Moscow |

7635 7635 |

7493 7493 |

323 323 |

654 654 |

6,25 6,25 |

5,99 5,99 |

212 Strong |

| FGUP ARKHANGELSKOE AT THE FEDERAL PENITENTIARY SERVICE INN 3621005430 Saint Petersburg In process of reorganization in the form of transformation since 21.05.2018 |

3343 3343 |

3429 3429 |

235 235 |

304 304 |

8,37 8,37 |

5,47 5,47 |

198 High |

| LLC USTKAMCHATRYBA INN 4109002780 Kamchatka territory |

2132 2132 |

2654 2654 |

987 987 |

1294 1294 |

1,13 1,13 |

1,00 1,00 |

171 Superior |

| JSC OZERNOVSKY FISH CANNING PLANT №55 INN 4108003484 Kamchatka territory |

3532 3532 |

3170 3170 |

1400 1400 |

1047 1047 |

1,26 1,26 |

0,80 0,80 |

174 Superior |

| JSC RUSSIAN SEA INN 5031033020 Moscow region |

8801 8801 |

10088 10088 |

1467 1467 |

99 99 |

-6,83 -6,83 |

-18,65 -18,65 |

233 Strong |

| Total for TOP-10 companies |  58587 58587 |

66136 66136 |

8526 8526 |

5537 5537 |

|||

| Average value for TOP-10 companies |  5859 5859 |

6614 6614 |

853 853 |

554 554 |

12,01 12,01 |

25,26 25,26 |

|

| Industry average value |  127 127 |

129 129 |

14 14 |

12 12 |

6,43 6,43 |

3,74 3,74 |

|

— growth of indicator to the previous period,

— growth of indicator to the previous period,  — decrease of indicator to the previous period.

— decrease of indicator to the previous period.

The average indicator of equity turnover ratio of TOP-10 companies is above the industry average and practical values. In 2017, three companies of TOP-10 increased their figures.

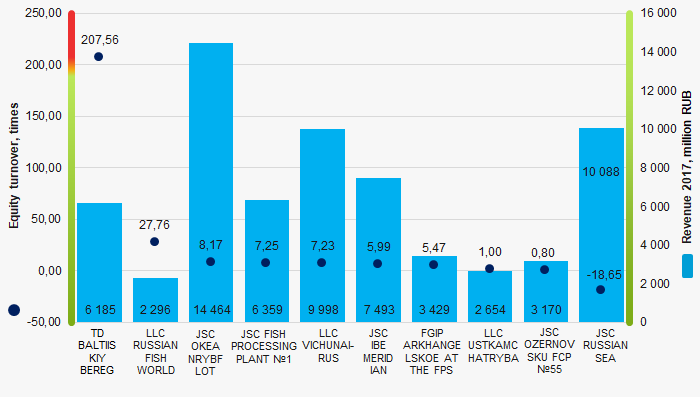

Picture 1. Equity turnover ratio and revenue of the largest Russian enterprises engaged in processing and preserving of fish and seafood (TOP-10)

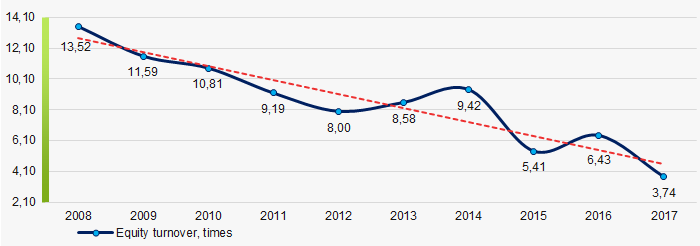

Picture 1. Equity turnover ratio and revenue of the largest Russian enterprises engaged in processing and preserving of fish and seafood (TOP-10)Over the past 10 years, the values of equity turnover ratio have a trend to decrease (Picture 2).

Picture 2. Change in the industry average values of equity turnover ratio of the largest Russian enterprises engaged in processing and preserving of fish and seafood in 2008 – 2017

Picture 2. Change in the industry average values of equity turnover ratio of the largest Russian enterprises engaged in processing and preserving of fish and seafood in 2008 – 2017Trends in activity of companies of Belgorod region

Information agency Credinform has prepared a review of activity trends of the largest companies of the real economy sector in Belgorod region.

The largest companies of Belgorod region (ТОP-1000) in terms of annual revenue were selected according to the data from the Statistical Register for the latest available periods (2012 - 2017). The analysis was based on data of the Information and Analytical system Globas.

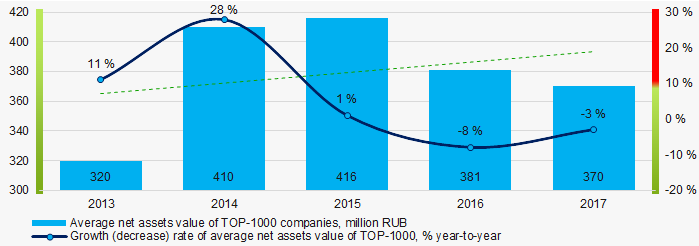

Net assets is a ratio reflecting the real value of company's property. It is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The ratio is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

The largest company in terms of net assets is JSC STOILENSKY GOK. In 2017 net assets of the company amounted to more than 74 billion RUB. The smallest size of net assets in TOP-1000 had LLC METALL-GROUP, which is in process of being wound up since 22.03.2018. The lack of property of the company was expressed in negative terms - 7,4 billion RUB.

For the last five years, the average values of TOP-1000 net assets showed the growing tendency (Picture 1).

Picture 1. Change in average net assets value of ТОP-1000 companies in 2013 – 2017

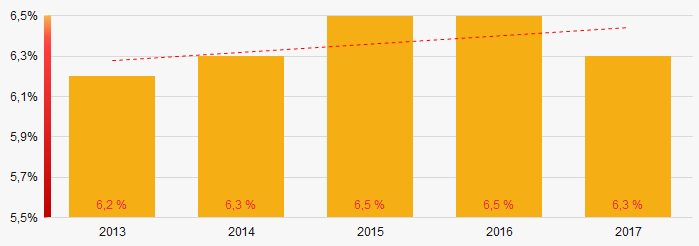

Picture 1. Change in average net assets value of ТОP-1000 companies in 2013 – 2017For the last five years, the share of ТОP-1000 enterprises with lack of property is growing (Picture 2).

Picture 2. The share of enterprises with negative net assets value in ТОP-1000

Picture 2. The share of enterprises with negative net assets value in ТОP-1000Sales revenue

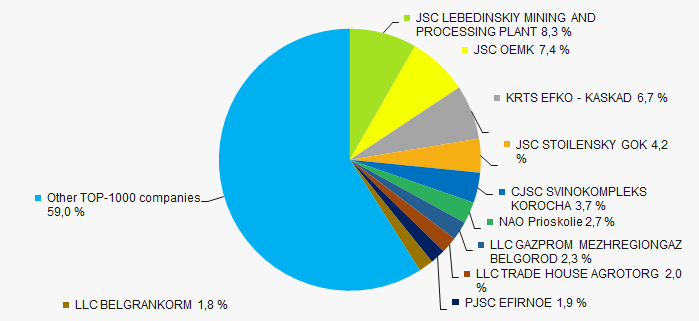

In 2017, the total revenue of 10 largest companies amounted to 41% from ТОP-1000 total revenue (Picture 3). This fact testifies the high level of industrial concentration in Belgorod region.

Picture 3. Shares of TOP-10 in TOP-1000 total revenue for 2017

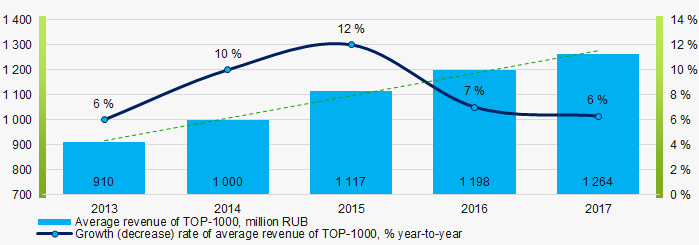

Picture 3. Shares of TOP-10 in TOP-1000 total revenue for 2017In general, the growing trend in sales revenue is observed (Picture 4).

Picture 4. Change in average revenue of TOP-1000 in 2013 – 2017

Picture 4. Change in average revenue of TOP-1000 in 2013 – 2017Profit and loss

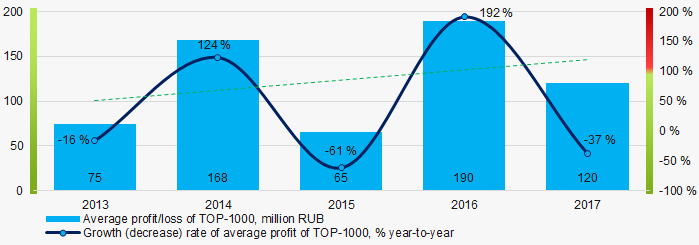

The largest company in terms of net profit is JSC LEBEDINSKIY MINING AND PROCESSING PLANT. In 2017 the company’s profit amounted to 104,5 billion RUB

For the last five years, the average profit values of TOP-1000 show the growing tendency (Picture 5).

Picture 5. Change in average profit of TOP-1000 in 2013 – 2017

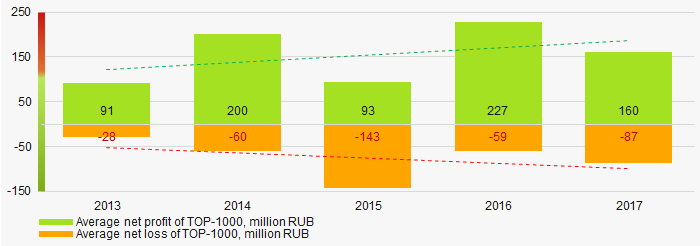

Picture 5. Change in average profit of TOP-1000 in 2013 – 2017Over a five-year period, the average net profit values of ТОP-1000 show the growing tendency, along with this the average net loss is also growing (Picture 6).

Picture 6. Change in average net profit/loss of ТОP-1000 companies in 2013 – 2017

Picture 6. Change in average net profit/loss of ТОP-1000 companies in 2013 – 2017Main financial ratios

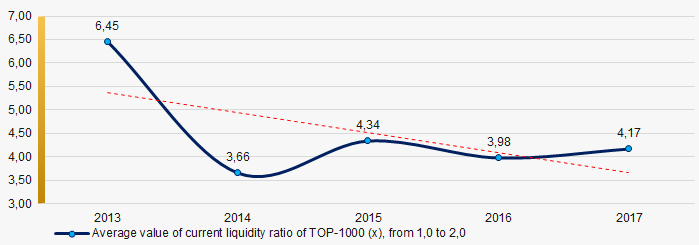

For the last five years, the average values of the current liquidity ratio were higher than the recommended values - from 1,0 to 2,0, with downward trend (Picture 7).

The current liquidity ratio (ratio of total working capital to short-term liabilities) shows the sufficiency of company’s assets to meet short-term obligations.

Picture 7. Change in average values of current liquidity ratio of TOP-1000 companies in 2013 – 2017

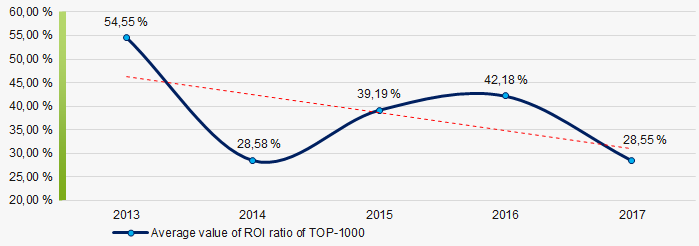

Picture 7. Change in average values of current liquidity ratio of TOP-1000 companies in 2013 – 2017For the last five years, the high level of the average values of ROI ratio with downward trend is observed (Picture 8).

The ROI ratio is calculated as a ratio of net profit to sum of stockholder equity and long-term liabilities and shows the return from equity involved in commercial activities and long-term borrowed funds.

Picture 8. Change in average values of ROI ratio in 2013 – 2017

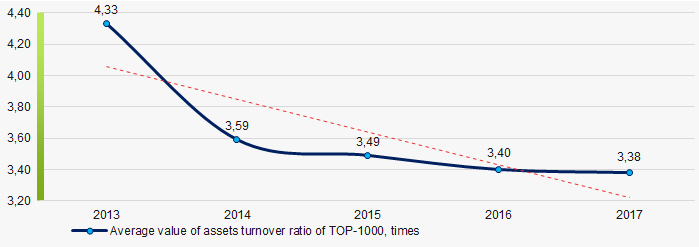

Picture 8. Change in average values of ROI ratio in 2013 – 2017Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

For the last five years, this business activity ratio demonstrated the downward trend (Picture 9).

Picture 9. Change in average values of assets turnover ratio of TOP-1000 companies in 2013 – 2017

Picture 9. Change in average values of assets turnover ratio of TOP-1000 companies in 2013 – 2017Small businesses

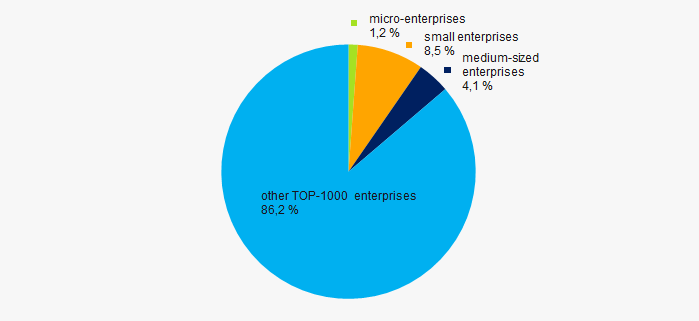

70% of ТОP-1000 companies are registered in the Unified register of small and medium-sized enterprises of the Russian Federal Tax Service. Herein, their share in TOP-1000 total revenue amounted to 14% that is lower than the national average value (Picture 10).

Picture 10. Shares of small and medium-sized enterprises in ТОP-1000

Picture 10. Shares of small and medium-sized enterprises in ТОP-1000Main regions of activity

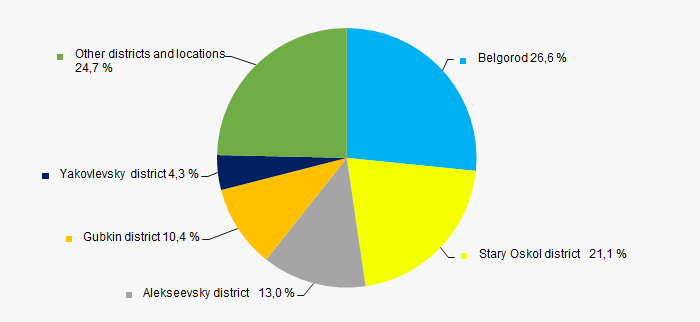

ТОP-1000 companies are unequally located across the country and registered in 22 regions of Russia. Almost 71% of the largest enterprises in terms of revenue are located in Belgorod, Stary Oskol, Alekseevsky and Gubkin districts (Picture 11).

Picture 11. Distribution of TOP-1000 revenue by the districts of Belgorod region

Picture 11. Distribution of TOP-1000 revenue by the districts of Belgorod regionFinancial position score

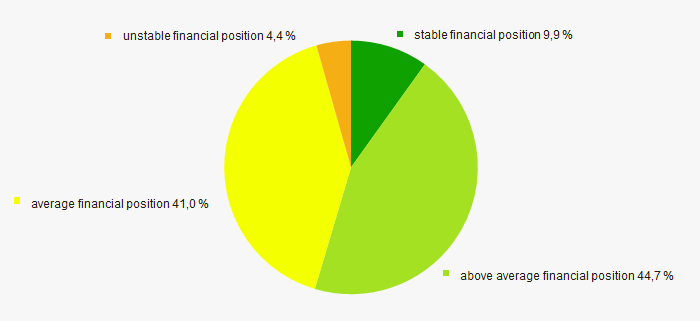

An assessment of the financial position of TOP-1000 companies shows that more than a half of them have stable or above average financial position (Picture 12).

Picture 12. Distribution of TOP-1000 companies by financial position score

Picture 12. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

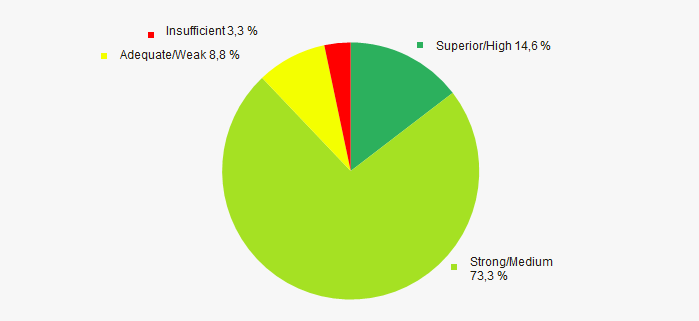

Most of TOP-1000 companies got superior/high or strong/medium Solvency index Globas, this fact shows the ability of the companies to meet their obligations in time and fully (Picture 13).

Picture 13. Distribution of TOP-1000 companies by Solvency index Globas

Picture 13. Distribution of TOP-1000 companies by Solvency index GlobasIndustrial production index

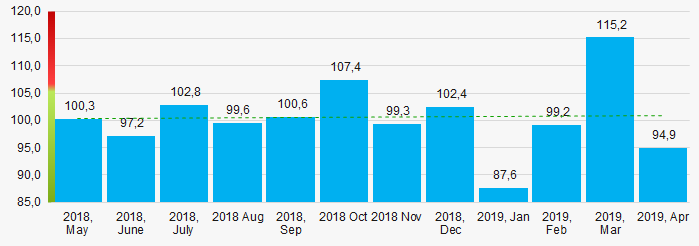

According to the Federal Service of State Statistics, there is an increasing trend in the industrial production index in Belgorod region during 12 months of 2018-2019 (Picture 14). Herewith the average index from month to month amounted to 100,5%.

Picture 14. Industrial production index in Belgorod region in 2018-2019, month by month (%)

Picture 14. Industrial production index in Belgorod region in 2018-2019, month by month (%)According to the same data, the share of enterprises of Belgorod region in the amount of revenue from the sale of goods, works, services made 0,85% countrywide in 2018.

Conclusion

A complex assessment of activity of the largest companies of Belgorod region real economy, taking into account the main indexes, financial ratios and indicators, demonstrates the presence of positive trends (Table 1).

| Trends and assessment factors | Relative share, % |

| Growth/drawdown rate of average net assets value |  10 10 |

| Increase / decrease in the share of enterprises with negative net assets |  -10 -10 |

| The level of capital concentration |  -10 -10 |

| Growth/drawdown rate of average revenue |  10 10 |

| Growth/drawdown rate of average net profit (loss) |  10 10 |

| Increase / decrease in average net profit of companies |  10 10 |

| Increase / decrease in average net loss of companies |  -10 -10 |

| Increase / decrease in average values of current liquidity ratio |  -10 -10 |

| Increase / decrease in average values of ROI ratio |  -10 -10 |

| Increase / decrease in average values of assets turnover ratio, times |  -10 -10 |

| Share of small and medium-sized businesses by revenue more than 22% |  -10 -10 |

| Regional concentration |  10 10 |

| Financial position (the largest share) |  10 10 |

| Solvency index Globas (the largest share) |  10 10 |

| Industrial production index |  10 10 |

| Average value of factors |  0,7 0,7 |

favorable trend (factor),

favorable trend (factor),  unfavorable trend (factor)

unfavorable trend (factor)