Anti-crisis measures in 2016

Preliminary results on a set of macroeconomic indicators for 2015 are appearing in mass media. In general, speaking about economic development, the leading experts suppose the past year to have been quite difficult. The country was under unrelenting external political and economic pressure. According to preliminary results of 2015, the GDP has reduced by 3,9% and inflation has reached 12,9%. Net capital outflow amounted to 57 bln USD. Industrial manufacture in January-November 2015 decreased by 3,3% in accordance with the relevant period of the previous year; retail trade turnover reduced by 9,3%.

In order to reduce negative trends in economy, the government of Russia has implemented the plan of high priority measures in 2015 aimed at the economy stable development and social stability; the plan was also considered as anti-crisis. Summing up the results, the following were implemented:

- efforts were concentrated on supporting the economy’s most critical areas,

- activities on implementation of import-substituting projects has started,

- companies continue financial investment in innovative developments,

- increase of banks’ authorized capital was supported,

- ;the agriculture, provided 3% growth in the sector, received financial support,

- funding a set of subsectors, as well as lending promotion, confirmed the effectiveness of these measures.

According to 2015 expected results, food, coke, oil and chemical industries have shown the positive dynamics. Achievements of other manufacture sectors reported by the Federal State Statistics Service (Rosstat) are presented in the table below.

Table 1. Indexes of production for main types of industrial manufacture

| November 2015 in % to | January-November 2015 in % to January-November 2014 | ||

|---|---|---|---|

| November 2014 | October 2015 | ||

| Manufacturing1) | 94,7 | 100,2 | 94,7 |

| manufacture of food products, beverages and tobacco | 102,4 | 96,0 | 101,9 |

| textile and clothing industry | 96,2 | 95,3 | 88,0 |

| manufacture of leather, leather products and footwear | 95,3 | 89,7 | 87,8 |

| wood working and production of wood products | 94,9 | 93,5 | 96,6 |

| pulp and paper industry; publishing and printing | 97,0 | 96,6 | 93,3 |

| manufacture of coke and petroleum products | 98,2 | 105,2 | 100,1 |

| chemical manufacturing | 105,7 | 96,9 | 106,8 |

| manufacture of rubber and plastic products | 94,6 | 90,8 | 96,4 |

| manufacture of other non-metallic mineral products | 88,0 | 84,4 | 92,6 |

| metallurgical manufacturing and manufacture of finished metal products | 93,5 | 93,7 | 94,1 |

| machinery and equipment manufacturing | 94,2 | 102,3 | 88,8 |

| manufacture of electrical, electronic and optical equipment | 98,4 | 111,9 | 92,1 |

| manufacture of transport vehicles and equipment | 91,9 | 117,0 | 88,3 |

| other manufacturing | 100,2 | 97,6 | 92,9 |

Opinion leaders of the government economic bloc suppose auto industry, transport machine building, light industry and housing construction to have high potential. That is why it is planned in 2016 to update the relevant development programs, finalize the funding issue in order to give these sectors a special priority.

The beginning of 2016 has sprung new surprises: world oil price has dropped below 30 USD per barrel; stock markets of the world have daily crashed on the background of panic moods; official exchange rate of ruble against the American currency has increased to 80 rubles per 1 USD.

According to the analysts, world oil price will after all get out of speculators and panic moods’ hands, and may reach 50 USD per barrel to the midyear. However, the government economic bloc has already started to develop estimated figures taking into account the average oil price of 40, 30 and 20 USD. Thus, the recommendation “on improving the efficiency of business” emerges even fuller blown.

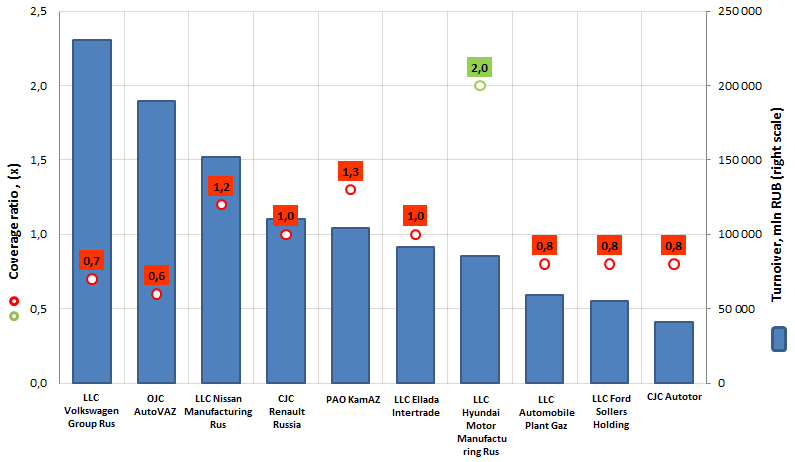

Coverage ratio of the largest car manufacturers in Russia

Information agency Credinform has prepared a ranking of the largest Russian car manufacturers.

The TOP-10 list of enterprises was drawn up for the ranking in terms of revenue, according to the data from the Statistical Register for the latest available period (for the year 2014). Revenue trend data relative to previous period and coverage ratio are also represented (see table 1).

Coverage ratio (х) is the proportion of the company`s current assets to short-term liabilities. It shows funds adequacy of enterprise for repayment of short-term liabilities.

Recommended value: from 2,0 to 3,0. If index is less than 1, that demonstrates that short-term liabilities excess current assets.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention not only to the average figures in the industry, but also to all presented combination of financial indicators and company’s ratios.

| № | Name | Region | Turnover, mlnRUB, 2014 | Turnovergrowthto 2013, % | Coverage ratio, (х) | Solvency index of GLOBAS-i® |

|---|---|---|---|---|---|---|

| 1 | LLC Volkswagen Group Rus INN 5042059767 |

Kaluga Oblast | 230 583 | -4,4 | 0,7 | 282 high |

| 2 | OJC AutoVAZ INN 6320002223 |

Samara Oblast | 189 370 | 8,1 | 0,6 | 295 high |

| 3 | LLC Nissan Manufacturing Rus INN 7842337791 |

Saint-Petersburg | 152 033 | 21,8 | 1,2 | 269 high |

| 4 | CJC Renault Russia INN 7709259743 |

Moscow | 110 592 | 4,4 | 1,0 | 223 high |

| 5 | PAO KamAZ INN 1650032058 |

Republic of Tatarstan | 104 389 | -2,6 | 1,3 | 252 high |

| 6 | LLC Ellada Intertrade INN 3906072056 |

Kaliningrad Oblast | 91 640 | 15,8 | 1,0 | 228 high |

| 7 | LLC Hyundai Motor Manufacturing Rus INN 7801463902 |

Saint-Petersburg | 85 392 | 7,1 | 2,0 | 219 high |

| 8 | LLC Automobile Plant Gaz INN 5250018433 |

Nizhny Novgorod Oblast | 59 278 | -13,9 | 0,8 | 302 satisfying |

| 9 | LLC Ford Sollers Holding INN 1646021952 |

Republic of Tatarstan | 54 888 | -34,7 | 0,8 | 327 satisfying |

| 10 | CJC Autotor INN 3905011678 |

Kaliningrad Oblast | 40 967 | -4,4 | 0,8 | 290 high |