ТОP-10 of betting companies

Significant tax deductions aimed at the development of domestic sport are directed from the bookmakers to the budget. However, in 2020 the average return on costs of the TOP 10 bookmakers shows a decrease in income per ruble spent. At the same time, revenue and net profit demonstrated the growth.

Information agency Credinform has prepared a ranking of the betting companies. The largest enterprises (TOP-10) in terms of annual revenue were selected according to the data from the Statistical Register and the Federal Tax Service for the available periods (2018-2020). Then the companies were ranged by return on costs ratio (Table 1). The selection and analysis were based on the data from the Information and Analytical system Globas.

Our article dated 11.09.2019 will help to compare the current and 2018 results.

Return on costs (%) is the share of earnings before tax and the sum of production and sales costs. The ratio shows the income per ruble spent.

For the most full and fair opinion about the company’s financial position, the whole set of financial indicators and ratios of the company should be taken into account.

| Name, INN, region | Revenue, million RUB | Net profit (loss), million RUB | Return on costs, % | Solvency index Globas | |||

| 2019 | 2020 | 2019 | 2020 | 2019 | 2020 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| LLC F.O.N. INN 9715010229 Moscow |

38 064 38 064 |

52 188 52 188 |

19 396 19 396 |

23 298 23 298 |

52,33 52,33 |

47,25 47,25 |

156 Superior |

| LLC RUS-TELETOT INN 7714156454 Moscow |

467 467 |

459 459 |

9 9 |

66 66 |

16,28 16,28 |

28,28 28,28 |

176 High |

| LLC FIRMA STOM INN 7705005321 Moscow |

20 154 20 154 |

19 328 19 328 |

480 480 |

1 195 1 195 |

5,68 5,68 |

10,94 10,94 |

163 Superior |

| LLC PYATIGORSKII IPPODROM INN 7705252264 Stavropol region |

560 560 |

182 182 |

50 50 |

-21 -21 |

13,16 13,16 |

6,91 6,91 |

241 Strong |

| LLC BK MARAFON INN 7701180668 Moscow |

2 671 2 671 |

4 062 4 062 |

41 41 |

177 177 |

2,54 2,54 |

5,49 5,49 |

165 Superior |

| LLC FORTUNA INN 6164205110 Rostov region |

15 813 15 813 |

14 603 14 603 |

859 859 |

123 123 |

7,97 7,97 |

4,90 4,90 |

212 Strong |

| JSC SPORTBET INN 7710310850 Moscow |

4 986 4 986 |

2 244 2 244 |

-126 -126 |

-189 -189 |

-0,08 -0,08 |

0,20 0,20 |

281 Medium |

| LLC 23BET.RU INN 5018092611 Moscow |

983 983 |

911 911 |

-63 -63 |

19 19 |

-2,78 -2,78 |

-0,58 -0,58 |

243 Strong |

| LLC ATLANTIK-M INN 7709424267 Moscow |

9 9 |

86 86 |

6 6 |

-28 -28 |

29,42 29,42 |

-44,09 -44,09 |

298 Medium |

| LLC KINOMANIYA INN 5836674770 Penza region |

4 4 |

2 2 |

0 0 |

-3 -3 |

-6,80 -6,80 |

-156,29 -156,29 |

390 Weak |

| Average value for TOP-10 companies |  8 371 8 371 |

9 407 9 407 |

2 065 2 065 |

2 464 2 464 |

11,77 11,77 |

-9,70 -9,70 |

|

| Average industry value |  1 580 1 580 |

1 786 1 786 |

223 223 |

232 232 |

18,25 18,25 |

16,46 16,46 |

|

growth of indicator in comparison with prior period,

growth of indicator in comparison with prior period,  decline of indicator in comparison with prior period

decline of indicator in comparison with prior period

In 2020, the average values of return on costs for TOP-10 companies are negative and lower than the industry average values. In 2020, five companies demonstrated the decline in indicators, in 2019 there were four companies like this.

At the same time, three companies showed the increase in revenue and five companies demonstrated the increase in net profit in 2020.

The TOP-10 average revenue increased by 12%, the industry average value increased by 13%.

The TOP-10 average profit increased by 19%, the industry average value - by 4%.

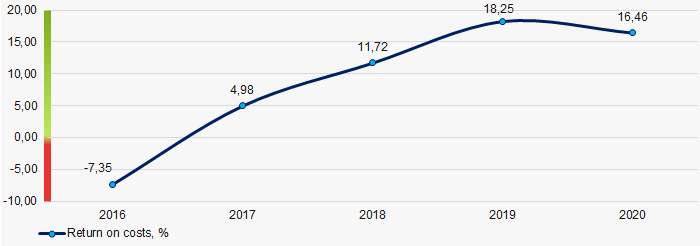

In general, during the last 5 years, the growth of average industry indicators of return on costs ratio was observed 3 times. The ratio reached its highest values in 2019, and the worst result is shown in 2016 (Picture 1).

Picture 1. Change in average industry values of return on costs of the betting companies in 2016 – 2020

Picture 1. Change in average industry values of return on costs of the betting companies in 2016 – 2020TOP 10 software developers

The global software market is constantly growing, driven by companies' intention to invest in their digital sustainability and development. The Russian software market is no exception, where more than 84 thousand development companies are employed, 65% of which are small businesses. The average return on investment of the largest of them in 2020 shows a growing return on equity and long-term borrowed funds. At the same time, revenue and net profit also increased.

Information agency Credinform has selected for this ranking in Globas the largest companies listed in the Unified Register of Small and Medium Enterprises and engaged in the development, modernization, testing and support of software with the highest annual revenue (TOP 10 and TOP 100), according to the data from the Statistical Register and the Federal Tax Service for the latest available periods (2018 – 2020). They were ranked by the return on investment ratio (Table 1).

Return on investment is calculated as the ratio of net profit to the amount of equity capital and long-term liabilities and demonstrates the return on the equity capital involved in commercial activities and the long-term attracted funds of the organization.

For the most complete and objective view of the financial condition of the enterprise, it is necessary to pay attention to the complex of indicators and financial ratios of the company.

| Name, INN, region | Revenue, million RUB | Net profit (loss), million RUB | Return on investment, % | Solvency index Globas | |||

| 2019 | 2020 | 2019 | 2020 | 2019 | 2020 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| LLC SILIZ INN 7813348809 Saint Petersburg |

1 049,0 1 049,0 |

1 504,2 1 504,2 |

623,5 623,5 |

862,4 862,4 |

187,19 187,19 |

341,72 341,72 |

152 Superior |

| LLC DOMAIN NAME REGISTER REG.RU INN 7733568767 Moscow |

1 049,0 1 049,0 |

1 786,5 1 786,5 |

85,5 85,5 |

292,3 292,3 |

43,94 43,94 |

137,92 137,92 |

191 High |

| LLC VS LABORATORY INN 7810840970 Saint Petersburg |

1 296,5 1 296,5 |

1 490,2 1 490,2 |

16,5 16,5 |

40,1 40,1 |

23,70 23,70 |

36,58 36,58 |

223 Strong |

| LLC SPECIAL TECHNOLOGIES INN 7714343013 Moscow region |

1 287,2 1 287,2 |

1 533,7 1 533,7 |

341,5 341,5 |

326,3 326,3 |

43,36 43,36 |

29,29 29,29 |

236 Strong |

| LLC PRIME FACTORING INN 7705922670 Moscow |

6 791,0 6 791,0 |

6 851,1 6 851,1 |

247,9 247,9 |

75,3 75,3 |

99,58 99,58 |

28,93 28,93 |

237 Strong |

| LLC ADV CONSULTING INN 7706127570 Moscow |

1 805,2 1 805,2 |

2 195,0 2 195,0 |

125,8 125,8 |

194,4 194,4 |

13,10 13,10 |

27,88 27,88 |

216 Strong |

| LLC SCIENTIFIC AND TECHNICAL CENTER PROTEI INN 7825483961 Saint Petersburg |

1 641,8 1 641,8 |

1 583,7 1 583,7 |

72,3 72,3 |

97,0 97,0 |

21,20 21,20 |

137,92 137,92 |

187 High |

| LLC SATEL INN 7731232881 Moscow |

1 589,0 1 589,0 |

1 459,8 1 459,8 |

8,0 8,0 |

75,5 75,5 |

1,44 1,44 |

11,97 11,97 |

208 Strong |

| JSC ELVIS-PLUS INN 7735003794 Moscow |

545,4 545,4 |

1 584,7 1 584,7 |

13,4 13,4 |

26,7 26,7 |

6,28 6,28 |

11,12 11,12 |

181 High |

| LLC NORBIT INN 7702314674 Moscow |

778,8 778,8 |

1 532,8 1 532,8 |

2,2 2,2 |

107,3 107,3 |

-0,81 -0,81 |

-65,73 -65,73 |

239 Strong |

| Average value for TOP 10 |  1 821,0 1 821,0 |

2 152,2 2 152,2 |

153,7 153,7 |

209,7 209,7 |

43,24 43,24 |

58,09 58,09 |

|

| Average value for TOP 100 |  878,6 878,6 |

951,8 951,8 |

107,4 107,4 |

144,2 144,2 |

55,18 55,18 |

59,41 59,41 |

|

| Average industry value |  57,8 57,8 |

65,3 65,3 |

5,3 5,3 |

7,5 7,5 |

9,19 9,19 |

30,45 30,45 |

|

growth of indicator to the previous period,

growth of indicator to the previous period,  fall of indicator to the previous period

fall of indicator to the previous period

The average 2020 value of return on investment ratio of TOP 10 is lower than of TOP 100 and the industry average one. In 2020, the decrease of figures was recorded for three companies of TOP 10. In 2019, the fall was observed in seven companies. The best result was demonstrated by LLC SILIZ engaged in developing and controlling games for social networks.

At the same time, eight companies gained revenue and seven companies gained net profit in 2020.

The increase in revenue was 18% and 8% for TOP 10 and TOP 100 respectively, while the industry average value climbed almost 13%.

The average profit of TOP 10 have increased 36%, TOP 100’s one jumped 34%, and on average in the industry, almost 42% growth was recorded.

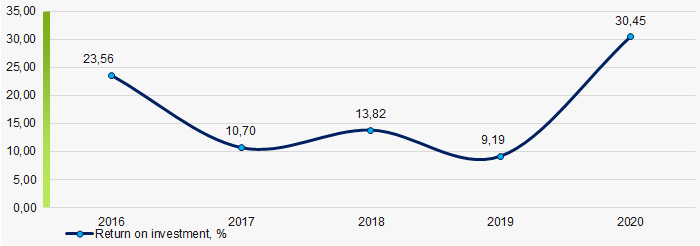

In general, the industry average return on investment values have raised for two periods during the past 5 years. The highest value was recorded in 2020 and the lowest one was in 2019 (Picture 1).

Picture 1. Change in the average return on investment values of software developers in 2016 - 2020

Picture 1. Change in the average return on investment values of software developers in 2016 - 2020