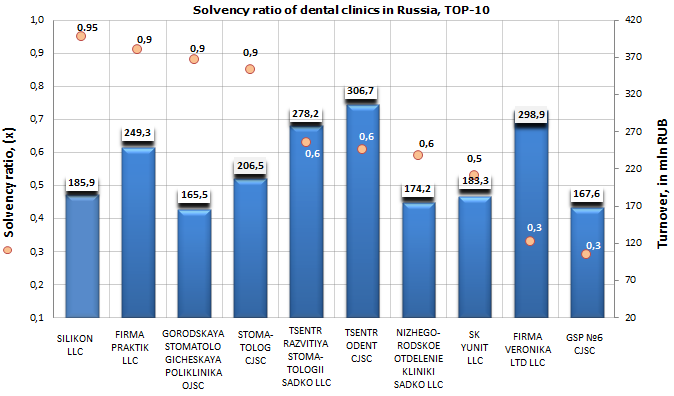

Solvency ratio of dental clinics

Information agency Credinform prepared a ranking of dental clinics on solvency ratio. The companies with highest volume of revenue were selected for this ranking according to the data from the Statistical Register for the latest available period (for the year 2012). Then, the first 10 enterprises selected by turnover were ranked by decrease in solvency ratio.

Solvency ratio is calculated as the relation of own capital to the balance sum. This indicator reflects that part of activity, which is funded through own resources. Recommended value of the ratio: > 0,5.

| № | Legal form Name INN | Region | Turnover for 2012, in mln RUB | Solvency ratio, (х) | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | SILIKON LLC INN 7731016390 |

Moscow | 186 | 0,95 | 163 (the highest) |

| 2 | FIRMA PRAKTIK LLC INN 6451115277 |

Saratov region | 249 | 0,91 | 249 (high) |

| 3 | GORODSKAYA STOMATOLOGICHESKAYA POLIKLINIKA OJSC INN 3801024930 |

Irkutsk region | 165 | 0,88 | 173 (the highest) |

| 4 | Tulskaya stomatologicheskaya poliklinika im. S. A. Zlotnikova CJSC INN 7104002478 |

Tula region | 207 | 0,85 | 192 (the highest) |

| 5 | TSENTR RAZVITIYA STOMATOLOGII SADKO LLC INN 5262146310 |

Nizhny Novgorod region | 278 | 0,63 | 213 (high) |

| 6 | TSENTRODENT CJSC INN 3904002705 |

Kaliningrad region | 307 | 0,61 | 170 (the highest) |

| 7 | NIZHEGORODSKOE OTDELENIE KLINIKI SADKO LLC INN 5260159627 |

Nizhny Novgorod region | 174 | 0,59 | 181 (the highest) |

| 8 | SK YUNIT LLC INN 5904011848 |

Perm territory | 183 | 0,53 | 171 (the highest) |

| 9 | FIRMA VERONIKA LTD LLC INN 7814015070 |

Saint-Petersburg | 299 | 0,33 | 181 (the highest) |

| 10 | Gorodskaya stomatologicheskaya poliklinika №6 CJSC INN 5407115727 |

Novosibirsk region | 168 | 0,29 | 216 (high) |

According to the data of the Ministry of Healthcare and Social Development, about 14% of population undergoes preventive dental examination in state health care facilities annually. However, this figure does not include the amount of those, who visits private clinics, which become more and more popular among people. According to experts' estimates, the volume of Russian dental market made 260 bln RUB at year-end 2012. Therewith the cumulative annual turnover of the first 10 largest Russian dental clinics increased by 33% at year-end 2012 and made 2216 mln RUB.

Eight among the largest ten Russian dental clinics showed the solvency ratio, matching the recommended values.

The first place of the ranking belongs to SILIKON LLC with the value of solvency ratio 0,95, what matches the standard values and testifies that the company funds 95% of its activity through own resources. However, for improvement of the material and technical base and enhancement of the quality of provided services it can be recommended the organization to resort to external borrowings.

The companies FIRMA VERONIKA LTD LLC and Gorodskaya stomatologicheskaya poliklinika №6 CJSC have the value of solvency ratio less than recommended one, what can testify to high enough share of borrowed funds in the capital structure.

Although all enterprises of the ranking got a high and the highest solvency index GLOBAS-i®, what characterizes them as financially stable and attractive for business cooperation.

Extension of terms of foreign exchange control will replenish the budget

The Ministry of Finance of the RF has put forward an initiative to extend the term of limitation for currency offense from 1 up to 3 years. If the norm will be accepted at the legislative level, it will allow to replenish the budget by more than 220 bln RUB annually at the cost of imposed penal sanctions (about 1,6% of revenue side of the budget as of the year 2014).

Today the penalties for illegal exchange transactions make approximately 75-100% of their size. However, taking into account that it is possible to hold somebody accountable for breaching the legislation only during one year from the moment of its committing, the budget doesn’t receive an essential part of compensation. Whole proceeding procedure is longstanding on its own: it is necessary to inform a violator about place and time of hearing of a case, serve a summons, join him/her to the case etc. As the result, in 2012 the violators shirked responsibilities because of the extension of the term of limitation almost in every second case.

The majority of detected violations in monetary terms is connected with fraudulent import. Parties transfer funds to non-residents using fraudulent documents, in most cases - false delivery notes, executed in the states-members of Customs Union.

The violation can occur also through contractor’s fault, for example, a buyer delays cash transfer, and for placing of currency gain out-of-time a resident faces a penalty. The extension of the term of limitation should relieve this problem partially, because to delay payment for 3 years seems to be improbable. And in case such episodes will happen, then the reputational component as an unreliable partner will play the defining role for the market. Beyond that, an extended term will allow to conduct deeper investigations and find out the ultimate beneficiaries in a transaction.