Legislative changes

The State Duma of the Federal Assembly of the Russian Federation of the eighth convocation has been working since October 12, 2021. During the past period, five Federal laws have been adopted and signed by the President of the Russian Federation, 3 laws have been sent to the Federation Council for approval, 73 bills have been sent for feedback and 22 for amendments. We offer an overview of the draft laws in the economic field currently under consideration in the State Duma.

By the second reading, draft Federal Law №1258306-7 mitigated previously planned deoffshorization measures. In order to limit the possibility of obtaining state support in the form of subsidies and budget investments by companies whose owners are registered in offshore zones, it is proposed to reduce the possibility of direct or indirect, i.e. through third parties, offshore ownership in the authorized capital of these legal entities from 50% to 25%. In addition, when determining the share owned by offshore owners, it is proposed not to take into account shares traded at organized auctions.

The draft Federal Law №1159731-7 on amendments to the law "On Accounting", which is under consideration in the second reading, proposes:

- to limit the range of organizations exempt from reporting to the State Information Resource of Financial Accounts (GIRBO);

- to empower the Government of the Russian Federation to determine cases in which access to information from GIRBO may be temporarily or permanently restricted for certain categories of users;

- to establish a single deadline for submitting corrected reports to GIRBO;

- to clarify the composition of the information to be placed by organizations in the Unified Federal Register of Legally Significant Information about activities of Legal Entities, individual entrepreneurs and other subjects of economic activity.

In the first reading, draft laws are being reviewed providing for:

- preparation by the Government of the Russian Federation of proposals on the formation of a list of strategically important organizations of the military-industrial complex, which are submitted to the President of the Russian Federation for approval. It is supposed to establish special requirements for the possibility of alienation or transfer to trust management of shares or shares in the authorized capital of organizations that have strategic importance for the military-industrial complex and the security of the country;

- elimination of the main legal conflicts and obstacles for joint-stock companies of employees (people's enterprises) to operate normally;

- mitigating restrictions on obtaining support by small and medium-sized enterprises that have committed minor violations of the procedure and conditions for providing support;

- elimination of a number of administrative barriers in the form of obtaining mandatory approvals for transactions aimed at restoring the previously lost control of the beneficial owner over a foreign company in the event of its registration as an international company in the special administrative regions of Russia.

Draft Federal Law №1256483-7 "On Financial groups and financial holdings" is under preliminary consideration. The Law is supposed to introduce the concepts of a financial group, a financial holding company and the conditions under which associations of legal entities are recognized as financial groups or holdings. Thus, as a general rule, a financial group may be recognized as an association of legal entities under the control or significant influence of a financial organization, and a financial holding is an association of legal entities under the control of a non-financial organization, one of the participants of which is a financial organization, and the share of financial activities which is at least 40%.

Shipbuilding enterprises of Saint Petersburg

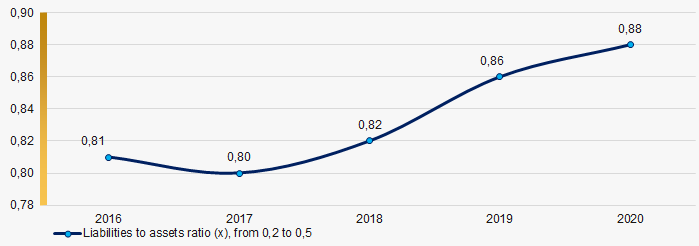

Saint Petersburg is one of the largest shipbuilding centers in Russia, where more than 50 ships and vessels were built in October 2021. By 2025, 4 submarines, 22 ships and vessels for military purposes, 3 nuclear icebreakers, 1 scientific and 2 passenger ships will be delivered to customers. However, the analysis of liabilities to assets ratio of the largest shipbuilding enterprises of the city indicates their excessive debt load in 2019-2020.

Information agency Credinform has selected for this ranking in Globas the largest enterprises of Saint Petersburg engaged in construction of ships, vessels, floating structures, pleasure and sports boats. Companies with the largest volume of annual revenue (TOP 10) were selected for the ranking, according to the data from the Statistical Register and the Federal Tax Service for the latest available periods (2018 - 2020). They were ranked by liabilities to assets ratio (Table 1).

Liabilities to assets ratio shows the proportion of assets financed by the company through loans. The standard value for this indicator is from 0.2 to 0.5.

Sales revenue and net income show the scale and efficiency of a company’s business and liabilities to assets ratio indicates the risk of insolvency.

Exceeding the upper standard value indicates excessive debt load, which can stimulate development, but negatively affects the stability of the financial position. The value of the indicator below the standard one may indicate a conservative strategy of financial management and excessive caution in attracting new borrowed funds.

For the most complete and objective view of the financial condition of the enterprise, it is necessary to pay attention to the complex of indicators and financial ratios of the company.

| Name, INN | Revenue, million RUB | Net profit (loss), million RUB | Liabilities to assets ratio.(x), from 0,2 to 0,5 | Solvency index Globas | |||

| 2019 | 2020 | 2019 | 2020 | 2019 | 2020 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| JSC ELEKTRORADIOAVTOMATIKA INN 7812018283 |

3 594,1 3 594,1 |

3 574,6 3 574,6 |

157,1 157,1 |

181,2 181,2 |

0,45 0,45 |

0,60 0,60 |

168 Superior |

| JSC UNITED SHIPBUILDING CORPORATION INN 7838395215 |

68 832,0 68 832,0 |

85 665,0 85 665,0 |

509,7 509,7 |

1 501,2 1 501,2 |

0,74 0,74 |

0,74 0,74 |

223 Strong |

| JSC ADMIRALTY SHIPYARDS INN 7839395419 |

35 011,1 35 011,1 |

39 156,6 39 156,6 |

1 774,0 1 774,0 |

3 494,6 3 494,6 |

0,70 0,70 |

0,754 0,754 |

204 Strong |

| LLC MARINE COMPLEX SYSTEMS INN 7801304758 |

723,1 723,1 |

1 009,4 1 009,4 |

52,0 52,0 |

4,5 4,5 |

0,87 0,87 |

0,87 0,87 |

273 Medium |

| JSC SREDNE-NEVSKY SHIPYARD INN 7817315385 |

10 459,0 10 459,0 |

11 137,5 11 137,5 |

952,4 952,4 |

189,3 189,3 |

0,86 0,86 |

0,89 0,89 |

189 High |

| JSC ALMAZ SHIPBUILDING COMPANY INN 7813046950 |

6 536,3 6 536,3 |

6 366,7 6 366,7 |

2,7 2,7 |

262,0 262,0 |

0,87 0,87 |

0,91 0,91 |

204 Strong |

| LLC PLANT SPORTSUDPROM INN 7802567252 |

261,2 261,2 |

682,5 682,5 |

7,9 7,9 |

1,3 1,3 |

0,96 0,96 |

0,95 0,95 |

292 Medium |

| LLC SK SEVERNAYA GAVAN INN 7728859070 |

927,8 927,8 |

674,4 674,4 |

155,6 155,6 |

27,0 27,0 |

0,69 0,69 |

0,95 0,95 |

270 Medium |

| JSC SEVERNAYA SHIPYARD INN 7805034277 |

20 736,6 20 736,6 |

14 929,5 14 929,5 |

-534,5 -534,5 |

173,4 173,4 |

0,99 0,99 |

0,99 0,99 |

240 Strong |

| JSC BALTIC PLANT INN 7830001910 |

20 654,3 20 654,3 |

18 929,8 18 929,8 |

-6 444,2 -6 444,2 |

-7 878,8 -7 878,8 |

1,03 1,03 |

1,09 1,09 |

293 Medium |

| Average value for TOP 10 |  16 773,6 16 773,6 |

18 212,6 18 212,6 |

-336,7 -336,7 |

-204,4 -204,4 |

0,82 0,82 |

0,87 0,87 |

|

| Average value for TOP 100 in Saint Petersburg |  1 737,9 1 737,9 |

1 889,0 1 889,0 |

-31,2 -31,2 |

-18,2 -18,2 |

0,76 0,76 |

0,75 0,75 |

|

| Industry average value |  386,6 386,6 |

427,1 427,1 |

-10,2 -10,2 |

-9,4 -9,4 |

0,86 0,86 |

0,88 0,88 |

|

growth of indicator to the previous period,

growth of indicator to the previous period,  fall of indicator to the previous period

fall of indicator to the previous period

The average 2020 value of liabilities to assets ratio of TOP 10 and TOP 100 was above the standard one. Six of TOP 10 companies had decrease in 2020, while in 2019 the decrease was recorded for four companies.

Five of ten companies gained revenue and/or net profit in 2020. At the same time, the increase in the average revenue of TOP 10 and TOP 100 amounted to almost 9% each; the industry average value grew by more than 10%. The average loss of TOP 10 decreased by 39%, and by 42% for TOP 100. On average in the industry, the loss was reduced by almost 8%.

The decrease in average revenue was 10%, and there was 33% fall of the industry average value.

The average profit of TOP 10 have increased almost 9%. However, on average in the industry, the decrease was recorded by almost 26%.

The industry average values of liabilities to assets ratio have raised ones during the past 5 years. The highest value was recorded in 2017 and the lowest one was in 2020 (Picture 1).

Picture 1. Change in the average values of liabilities to assets ratio in shipbuilding in 2016 - 2020

Picture 1. Change in the average values of liabilities to assets ratio in shipbuilding in 2016 - 2020