Activity trends in shipbuilding

Information agency Credinform has observed trends in the activity of the largest Russian shipbuilding companies.

Enterprises with the largest volume of annual revenue (TOP-10 and TOP-100), were selected for the analysis, according to the data from the Statistical Register for the latest available periods (for 2015-2017). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Net assets is an indicator, reflecting the real value of company's property, is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The indicator of net assets is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

The largest company in terms of net assets amount is JSC UNITED SHIPBUILDING CORPORATION. In 2018 net assets of the company amounted to almost 250 billion RUB.

JSC VYBORG SHIPYARD had the smallest amount of net assets in the TOP-100 group. Insufficiency of property of the company in 2018 was expressed in negative value -511 million RUB.

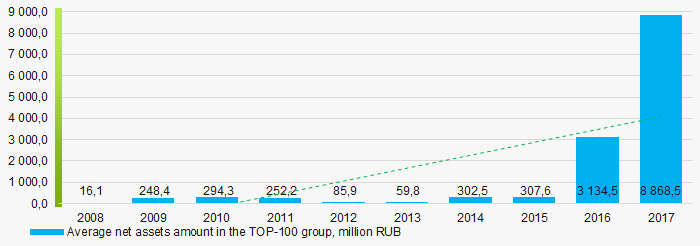

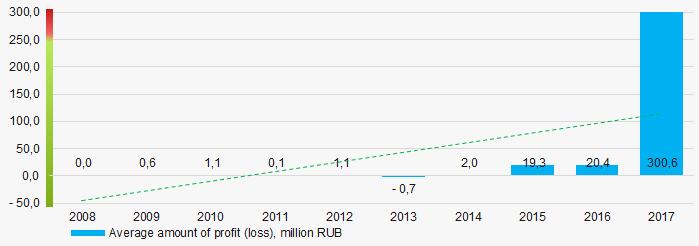

For a ten-year period average amount of net assets of TOP-100 companies has increasing tendency (Picture 1).

Picture 1. Change in average indicators of the net asset amount of shipbuilding companies in 2008 – 2017

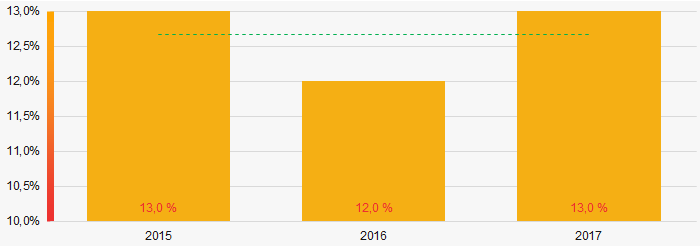

Picture 1. Change in average indicators of the net asset amount of shipbuilding companies in 2008 – 2017Share of companies with insufficiency of property in the TOP-100 demonstrate stable standing on relatively high level for the last three years (Picture 2).

Picture 2. Shares of companies with negative values of net assets in TOP-100 companies in в 2015 – 2017

Picture 2. Shares of companies with negative values of net assets in TOP-100 companies in в 2015 – 2017 Sales revenue

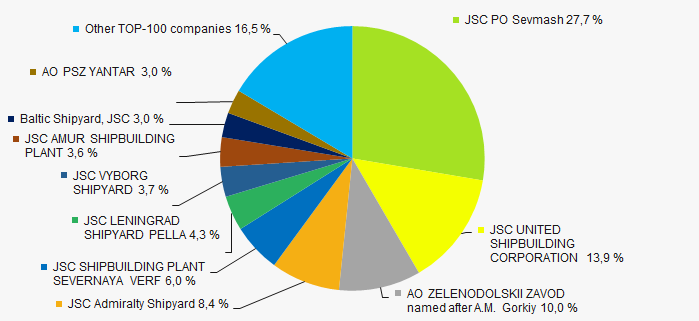

The revenue volume of 10 leaders of the industry made 84% of the total revenue of TOP-100 companies in 2017(Picture 3). It demonstrates high level of monopolization in the industry.

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-100 companies for 2017

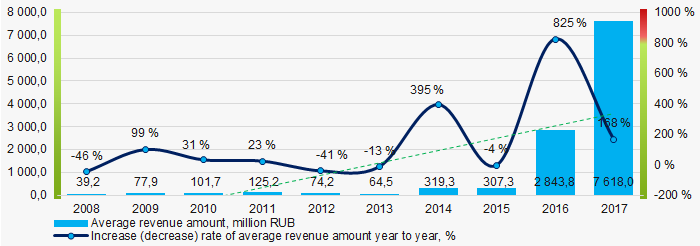

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-100 companies for 2017In general, over a ten-year period an increasing tendency in revenue volume is observed (Picture 4).

Picture 4. Change in the average revenue of shipbuilding companies in 2008 – 2017

Picture 4. Change in the average revenue of shipbuilding companies in 2008 – 2017Profit and losses

The largest company in terms of net profit amount is JSC PO Sevmash. Net profit of the company amounted to 6,6 billion RUB for 2018.

For the last ten years average industrial indicators of net profit have an increasing tendency (Picture 5).

Picture 5. Change in the average indicators of net profit of shipbuilding companies in 2008 – 2017

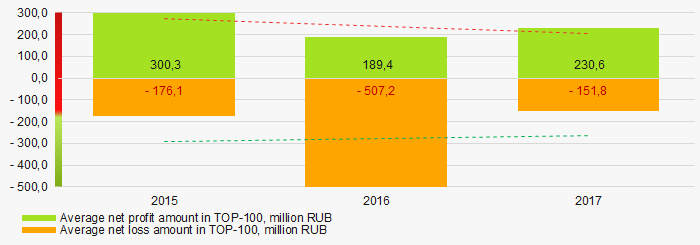

Picture 5. Change in the average indicators of net profit of shipbuilding companies in 2008 – 2017Over a three-year period, the average values of net profit indicators of TOP-100 companies tend to decrease. Besides, the average value of net loss decreases (Picture 6).

Picture 6. Change in the average indicators of net profit of shipbuilding companies in 2008 – 2017

Picture 6. Change in the average indicators of net profit of shipbuilding companies in 2008 – 2017Key financial ratios

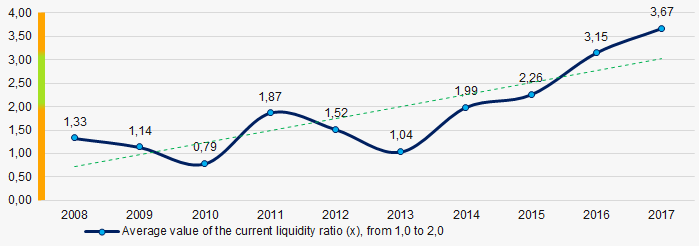

Over the ten-year period the average indicators of the current liquidity ratio most often were above the range of recommended values – from 1,0 up to 2,0 with increasing tendency (Picture 7).

The current liquidity ratio (the relation of the amount of current assets to short-term liabilities) shows the sufficiency of company’s funds for repayment of its short-term liabilities.

Picture 7. Change in the average values of the current liquidity ratio of shipbuilding companies in 2008 – 2017

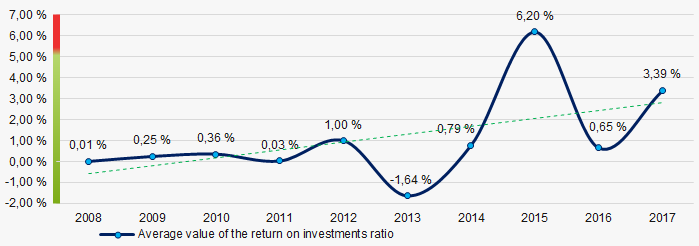

Picture 7. Change in the average values of the current liquidity ratio of shipbuilding companies in 2008 – 2017Sufficiently low level of average values of the indicators of the return on investment ratio with increasing tendency has been observed for ten years (Picture 8).

The ratio is calculated as the relation of net profit to the sum of own capital and long-term liabilities and demonstrates the return on the equity involved in the commercial activity of own capital and the long-term borrowed funds of an organization.

Picture 8. Change in the average values of the return on investment ratio of shipbuilding companies in 2008 – 2017

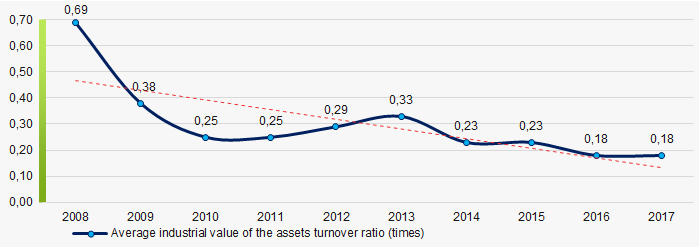

Picture 8. Change in the average values of the return on investment ratio of shipbuilding companies in 2008 – 2017Asset turnover ratio is calculated as the relation of sales revenue to the average value of total assets for a period and characterizes the efficiency of use of all available resources, regardless of the sources of their attraction. The ratio shows how many times a year a complete cycle of production and circulation is made, yielding profit.

This business activity ratio showed a tendency to decrease for a ten-year period (Picture 9).

Picture 9. Change in the average values of the assets turnover ratio of shipbuilding companies in 2008 – 2017

Picture 9. Change in the average values of the assets turnover ratio of shipbuilding companies in 2008 – 2017Small business

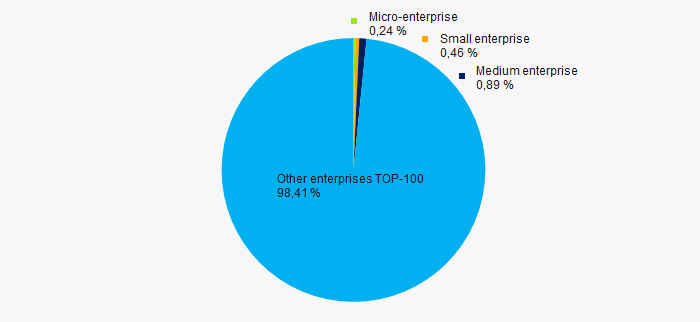

65% of the TOP-100 companies are registered in the Register of small and medium enterprises of the Federal Tax Service of the RF. Besides, share of revenue in the total volume in 2017 is more than 1,5%, that is lower than the average indicator countrywide (Picture 10).

Picture 10. Shares of small and medium enterprises in TOP-100 companies

Picture 10. Shares of small and medium enterprises in TOP-100 companiesMain regions of activity

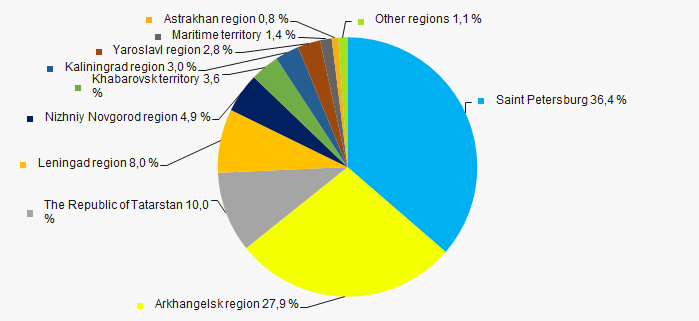

TOP-100 enterprises are unequally distributed along the territory of Russia with consideration to geographical position and registered in 29 regions. More than 74% of revenue volume is concentrated in Saint Petersburg, Arkhangelsk region and the Republic of Tatarstan (Picture 11).

Picture 11. Distribution of TOP-100 companies by regions of Russia

Picture 11. Distribution of TOP-100 companies by regions of RussiaFinancial position score

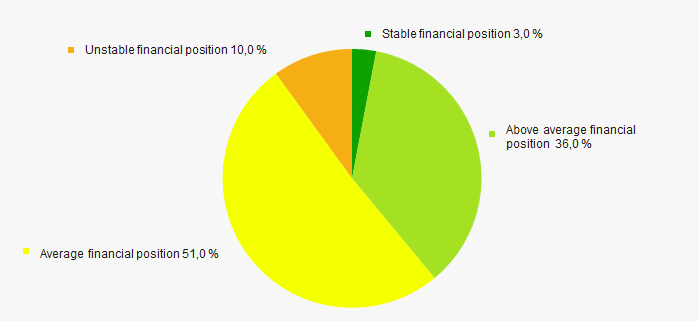

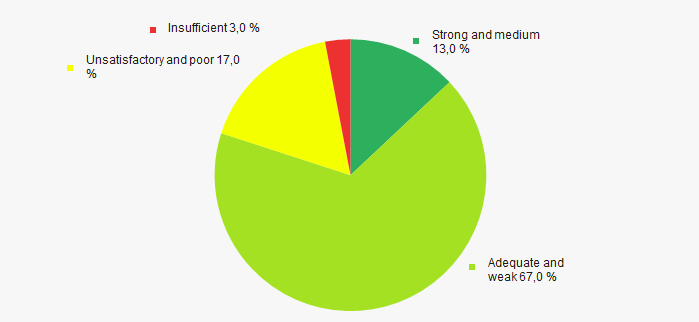

An assessment of the financial position of TOP-100 companies shows that the largest number is in average financial position. (Picture 12).

Picture 12. Distribution of TOP-100 companies by financial position score

Picture 12. Distribution of TOP-100 companies by financial position scoreSolvency index Globas

Most of TOP-1000 companies have got from Medium to Superior Solvency index Globas, that points to their ability to repay their debts in time and fully (Picture 13).

Picture 13. Distribution of TOP-100 companies by solvency index Globas

Picture 13. Distribution of TOP-100 companies by solvency index GlobasConclusion

Comprehensive assessment of the activity of largest Russian shipbuilding enterprises, taking into account the main indexes, financial indicators and ratios, demonstrates the presence of favorable trends (Table 1)

| Trends and assessment factors | Share of factor, % |

| Rate of increase (decrease) of average amount of net assets |  10 10 |

| Increase / decrease of share of companies with negative values of net assets |  5 5 |

| Increase (decrease) rate of average revenue amount |  10 10 |

| Level of competition |  -10 -10 |

| Increase (decrease) rate of average net profit (loss) amount |  10 10 |

| Increase / decrease of average net profit amount of TOP-1000 companies |  -10 -10 |

| Increase / decrease of average net loss amount of TOP-1000 companies |  10 10 |

| Increase / decrease of average industrial values of the current liquidity ratio |  5 5 |

| Increase / decrease of average industrial values of the return on investments ratio |  5 5 |

| Increase / decrease of average industrial values of the assets turnover ratio, times |  -10 -10 |

| Share of small and medium enterprises in the industry in terms of revenue volume more than 22% |  -10 -10 |

| Regional concentration |  -10 -10 |

| Financial position (major share) |  5 5 |

| Solvency index Globas (major share) |  10 10 |

| Average value of factors |  1,4 1,4 |

positive trend (factor),

positive trend (factor),  negative trend (factor).

negative trend (factor).

Loan security in the shipbuilding industry

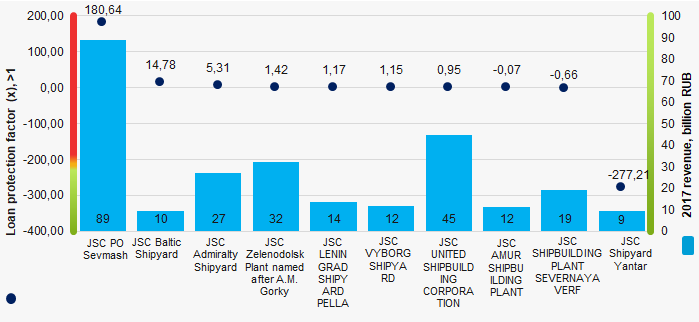

Information agency Credinform has prepared a ranking of the largest Russian shipbuilding enterprises. The largest enterprises (TOP-10) in terms of annual revenue were selected according to the data from the Statistical Register for the available periods (2015-2017). Then the companies were ranged by loan protection factor (Table 1). The analysis was based on the data from the Information and Analytical system Globas.

Loan protection factor (x) is the ratio of pre-tax earnings and loan interest to the sum of interest payable. It characterizes the security level of creditors from non-payment of interest for the granted loan and shows how many times during the reporting period the company earned means to pay the interest on loans.

The recommended value is >1. No indicator value indicates that the company does not have borrowed funds, therefore, no interest payable to creditors. However, it may not alsways be the evidence of general well-being as credit resources are necessary for successful business growth.

For the most full and fair opinion about the company’s financial position the whole set of financial indicators and ratios should be taken into account.

| Name, INN, region | Revenue, million RUB | Net profit (loss), million RUB | Loan protection factor (x), >1 | Solvency index Globas | ||||||

| 2016 | 2017 | 2018 | 2016 | 2017 | 2018 | 2016 | 2017 | 2018 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 |

| JSC PO Sevmash INN 2902059091 Arkhangelsk region |

74274 74274 |

88787 88787 |

107392 107392 |

5720 5720 |

8892 8892 |

6616 6616 |

2,37 2,37 |

180,64 180,64 |

101,71 101,71 |

193 High |

| Baltic Shipyard JSC INN 7830001910 Saint Petersburg |

328 328 |

9666 9666 |

25584 25584 |

-130 -130 |

2676 2676 |

-1032 -1032 |

-0,92 -0,92 |

14,78 14,78 |

0,12 0,12 |

262 Medium |

| JSC Admiralty Shipyard INN 7839395419 Saint Petersburg |

44926 44926 |

27084 27084 |

41023 41023 |

5194 5194 |

2712 2712 |

2952 2952 |

9,36 9,36 |

5,31 5,31 |

5,01 5,01 |

195 High |

| JSC Zelenodolsk Plant named after A.M. Gorky INN 1648013442 Republic of Tatarstan |

12690 12690 |

32135 32135 |

25007 25007 |

8 8 |

91 91 |

15 15 |

0,95 0,95 |

1,42 1,42 |

0,98 0,98 |

231 Strong |

| JSC LENINGRAD SHIPYARD PELLA INN 4706000296 Leningrad region |

4327 4327 |

13701 13701 |

12653 12653 |

-626 -626 |

240 240 |

348 348 |

0,12 0,12 |

1,17 1,17 |

1,37 1,37 |

194 High |

| JSC VYBORG SHIPYARD INN 4704012874 Leningrad region |

5392 5392 |

11766 11766 |

7947 7947 |

-1089 -1089 |

12 12 |

-546 -546 |

-4,38 -4,38 |

1,15 1,15 |

-0,86 -0,86 |

254 Medium |

| JSC UNITED SHIPBUILDING CORPORATION INN 7838395215 Saint Petersburg |

48613 48613 |

44758 44758 |

61996 61996 |

585 585 |

207 207 |

295 295 |

1,12 1,12 |

0,95 0,95 |

0,85 0,85 |

242 Strong |

| JSC AMUR SHIPBUILDING PLANT INN 2703000015 Khabarovsk region |

5421 5421 |

11539 11539 |

11383 11383 |

-8008 -8008 |

-1633 -1633 |

-3681 -3681 |

-8,88 -8,88 |

-0,07 -0,07 |

-2,48 -2,48 |

279 Medium |

| JSC SHIPBUILDING PLANT SEVERNAYA VERF INN 7805034277 Saint Petersburg |

13601 13601 |

19177 19177 |

17700 17700 |

-1835 -1835 |

-1651 -1651 |

-3200 -3200 |

0,31 0,31 |

-0,66 -0,66 |

-7,81 -7,81 |

255 Medium |

| JSC Shipyard Yantar INN 3900000111 Kaliningrad region |

12182 12182 |

9478 9478 |

14266 14266 |

403 403 |

422 422 |

83 83 |

2,49 2,49 |

-277,21 -277,21 |

7,96 7,96 |

243 Strong |

| Total for TOP-10 companies |  221754 221754 |

268091 268091 |

324951 324951 |

222 222 |

11968 11968 |

1850 1850 |

||||

| Average value for TOP-10 companies |  22175 22175 |

26809 26809 |

32495 32495 |

22 22 |

1197 1197 |

185 185 |

0,26 0,26 |

-7,25 -7,25 |

10,09 10,09 |

|

| Average industry value |  2844 2844 |

7618 7618 |

20 20 |

301 301 |

1,21 1,21 |

2,00 2,00 |

||||

(*) 2018 data is for the reference

growth of indicator in comparison with prior period,

growth of indicator in comparison with prior period,  decline of indicator in comparison with prior period.

decline of indicator in comparison with prior period.

Average value of loan protection factor for TOP-10 companies is lower than 2017 average industry value. In 2018 only one company improved the result.

Picture 1. Loan protection factor and revenue of the largest Russian shipbuilding enterprises (ТОP-10)

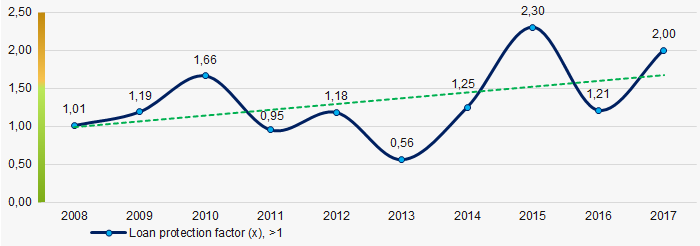

Picture 1. Loan protection factor and revenue of the largest Russian shipbuilding enterprises (ТОP-10)Within 10 years, the average industry indicators of the loan protection factor showed the growing tendency. (Picture 2).

Picture 2. Change in average industry values of the loan protection factor of the Russian shipbuilding enterprises in 2008 – 2017

Picture 2. Change in average industry values of the loan protection factor of the Russian shipbuilding enterprises in 2008 – 2017