Legislative changes

Federal Law No. 236-FZ dated 01.07.2021 establishes the procedure and conditions for foreign persons to operate on the Internet in Russia using information resources with an audience of more than 500 thousand Russian users per day.

In accordance with the law, the owners of such information resources, which are mainly large foreign IT companies, are obliged to create branches, representative offices or register Russian legal entities that will be able to fully represent interests of parent organizations and interact with Russian supervisory authorities. Such obligations also apply to hosting providers, operators of advertising systems and organizers of information dissemination on the Internet.

The Federal Service for Supervision of Communications, Information Technology and Mass Media (Roskomnadzor) has been instructed to implement measures to encourage the above-mentioned foreign companies to comply with the requirements of Russian laws. Among these measures are:

- informing users of information resources about violations of Russian legislation;

- prohibition of advertising such information resource internally and externally of the resource;

- restrictions on transactions to such internet resources;

- banning search results;

- prohibition of collection and cross-border transfer of personal data;

- partial restriction or complete termination of access to such information resources.

The law came into force on July 1, 2021.

According to the Information and Analytical system Globas there are over 4 thousand branches and 9,800 representative offices of foreign companies operating in Russia. In addition, there are over 14 thousand legal entities with 100% ownership by foreign companies. Here you can find our review devoted to their activities dated 09.06.2021.

TOP 10 brokerage companies

Information agency Credinform represents a ranking of the largest Russian brokerage companies engaged in securities financing transactions. Companies with the largest volume of annual revenue (TOP 10 and TOP 100) operating in financial markets with stock values and commodity contracts on behalf of others markets with were selected for the ranking, according to the data from the Statistical Register and the Federal Tax Service for the latest available periods (2018 - 2020). They were ranked by the return on the authorized capital (Table 1). The selection and analysis were based on the data of the Information and Analytical system Globas.

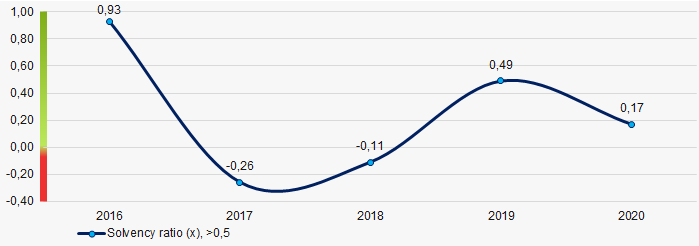

Solvency ratio (х) is the ratio of equity to total assets. It shows the dependence of the company on external loans. The reccommended value is >0,5.

The ratio below the minimum value is idicative of a strong dependence on external sources of funds. If the market conditions deteriorate, this can lead to a liquidity crisis and an unstable financial position of the company.

For the most complete and objective view of the financial condition of the enterprise, it is necessary to pay attention to the complex of indicators and financial ratios of the company.

| Name, INN, region, activity type | Revenue, million RUB | Net profit (loss), million RUB | Solvency ratio (x), >0,5 | Solvency index Globas | |||

| 2019 | 2020 | 2019 | 2020 | 2019 | 2020 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| JSC ROST.S INN 0814089015 Moscow emission activity |

465 465 |

852 852 |

2 140 2 140 |

-1 634 -1 634 |

1,00 1,00 |

0,80 0,80 |

293 Medium |

| LLC TORGOVAYA KOMPANIYA INN 7715655456 Moscow securities management |

566 566 |

625 625 |

13 13 |

19 19 |

0,53 0,53 |

0,62 0,62 |

214 Strong |

| JSC ABR MANAGEMENT INN 7842467053 Saint Petersburg securities management |

879 879 |

886 886 |

-39 -39 |

6 6 |

0,57 0,57 |

0,53 0,53 |

248 Strong |

| Branch of DEGA RETAIL HOLDING LIMITED INN 9909460763 Moscow securities management |

1 874 1 874 |

1 009 1 009 |

-718 -718 |

978 978 |

0,13 0,13 |

0,50 0,50 |

306 Adequate |

| LLC BN-BROKER INN 7733862470 Moscow activities of exchange intermediaries and stock brokers performing commodity futures and options transactions in exchange trading |

848 848 |

2 314 2 314 |

-13 -13 |

47 47 |

0,88 0,88 |

0,48 0,48 |

323 Adequate |

| LLC CITI BROKER INN 7736524278 Moscow activities of exchange intermediaries and stock brokers performing commodity futures and options transactions in exchange trading |

73 73 |

770 770 |

5 5 |

7 7 |

0,50 0,50 |

0,46 0,46 |

258 Medium |

| LLC ITI COMMODITIES INN 7703434420 Moscow activities of exchange intermediaries and stock brokers performing commodity futures and options transactions in exchange trading |

1 032 1 032 |

1 445 1 445 |

12 12 |

2 2 |

0,01 0,01 |

0,01 0,01 |

312 Adequate |

| LLC KTZH FINANS INN 7704391000 Moscow emission activity |

1 525 1 525 |

1 482 1 482 |

43 43 |

-6 -6 |

0,01 0,01 |

0,01 0,01 |

333 Adequate |

| JSC AVTOBAN-FINANS INN 7708813750 Moscow securities management |

1 075 1 075 |

1 261 1 261 |

15 15 |

46 46 |

0,00 0,00 |

0,01 0,01 |

264 Medium |

| LLC SVYAZINVESTNEFTEKHIM-FINANS INN 1655380771 Republic of Tatarstan emission activity |

1 798 1 798 |

1 803 1 803 |

2 2 |

2 2 |

0,00 0,00 |

0,00 0,00 |

317 Adequate |

| Average value for TOP 10 |  1 013 1 013 |

1 244 1 244 |

146 146 |

-53 -53 |

0,36 0,36 |

0,34 0,34 |

|

| Average value for TOP 100 |  208 208 |

169 169 |

36 36 |

1 1 |

0,29 0,29 |

0,46 0,46 |

|

| Average industry value |  55 55 |

29 29 |

-11 -11 |

-14 -14 |

0,49 0,49 |

0,17 0,17 |

|

growth of indicator to the previous period,

growth of indicator to the previous period,  fall of indicator to the previous period

fall of indicator to the previous period

In 2020, the average values of the solvency ratio of the TOP 10 and TOP 100 companies were below the recommended one. Four companies of TOP 10 reduced their figures in 2020. In 2019, the fall was recorded for two companies.

In 2020, nine companies gained revenue and six legal entities gained net profit.

The average revenue of TOP 10 climbed 22%, and a 19% decrease was recorded in TOP 100. There was a 47% increase in the industry average indicator.

There was an almost 4 and 36 times fall in profit of TOP 10 and TOP 100 respectively. The industry average profit fell 27%.

Over the past five years, the industry average values of the solvency ratio were negative over two periods. The increase was recorded over two periods. The highest value was recorded in 2016 and the lowest one was in 2017 (Picture 1).

Picture 1. Change in the industry average values of the solvency ratio of the brokerage companies engaged in securities financing transactions in 2016 - 2020

Picture 1. Change in the industry average values of the solvency ratio of the brokerage companies engaged in securities financing transactions in 2016 - 2020