Federal Antimonopoly Service prepared amendments to the Competition Law

Federal Antimonopoly Service (FAS) brought up the amendments to the Competition Law for discussion of the expert community. The cases specified in the article 14 of the current law are particularized in the proposed bill. It will help in future to shorten the time and to simplify the proof of antitrust infringement. Today the contradictions of the law interpretation lead to ambiguous judicial practice.

In fact, the article 14 of the current law was written over by the drafters. The following examples are given as a case of unethical competition: discredit of another economic entity, misinformation of consumers, inaccurate comparison, using of the results of intellectual property, using of business reputation of another entrepreneur and others. Herewith Yana Sklyarova, the head of department for protection against unfair competition, laid emphasis on the fact that the new version of the law would be maximally close to the corresponding statutory acts of the European countries.

Several articles of the new bill partly coincide with the advertising legislation and intellectual property legislation. This may lead to temptation on the part of the judicial authorities to apply softer article to the lawbreaker at considering cases. In order to avoid situations of this kind, the new bill expects the amending to Administrative Offences Code, which eliminates the responsibility of the infringers.

On the whole, the bill has generated the approval of the experts, except for the articles related to the using of the intellectual property. Thus, many manufacturers disagree with the introduction of “prior use” notion. In other words, it means that those who started producing the item earlier become the owners of the trademark. Ivan Bliznets, the chairman of Intellectual Property Committee of the Chamber of Commerce and Industry of the Russian Federation, showed solidarity concerning this question. He explained that the Civil Code of the Russian Federation doesn’t contain such a notion and this legislative instrument is of the higher level.

Before coming into force, the bill will be marked up considering all the notes.

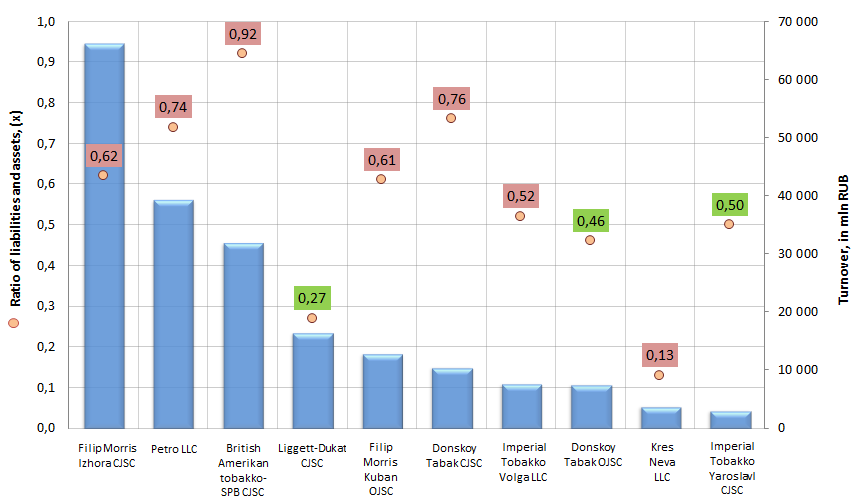

Ratio of liabilities and assets of tobacco manufacturers

Information agency Credinform prepared a ranking of companies of tobacco industry.

The companies with the highest volume of revenue were selected for this ranking according to the data from the Statistical Register for the latest available period (for the year 2013). These enterprises were ranked by increase in the value of consolidated revenues per annum. The ratio of liabilities and assets was calculated for each company.

The ratio of liabilities and assets (х) is the relation of long-term and short-term borrowings to total assets. It shows what share of assets of an enterprise is funded through borrowings.

Recommended value: from 0,2 to 0,5.

If the ratio value is above 0,5, then it testifies that an organization is strongly dependent on borrowings. The risk of liquidity crisis and debt load occurs.

And if the ratio is below 0,2, then it can be drawn the conclusion about company’s development policy due to own sources, that makes sense not always and let maintain a certain market share.

It should be understood, that recommended values can differ essentially as well for enterprises of different branches, as for organizations of the same industry, consequently, these values are exclusively of informational character.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention not only to average values of profit, but also to all available combination of financial data.

| № | Name | Region | Turnover, in mln RUB, for 2013 | Changeby 2012, % | Ratio of liabilities and assets, (х) | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|---|

| 1 | Filip Morris Izhora CJSC INN: 4720007247 |

Leningrad region | 66 229 | 11,7 | 0,62 | 174 the highest |

| 2 | Petro LLC INN: 7834005168 |

Saint-Petersburg | 39 306 | -3,1 | 0,74 | 230 high |

| 3 | British Amerikan tobakko-SPB CJSC INN: 7809008119 |

Saint-Petersburg | 31 948 | 0,0 | 0,92 | 195 the highest |

| 4 | Liggett-DukatCJSC INN: 7710064121 |

Moscow | 16 449 | -11,1 | 0,27 | 223 high |

| 5 | Filip Morris Kuban OJSC INN: 2311010485 |

Krasnodar territory | 12 851 | 29,7 | 0,61 | 206 high |

| 6 | DonskoyTabakCJSC INN: 6162063051 |

Rostov region | 10 542 | 242,4 | 0,76 | 239 high |

| 7 | Imperial Tobakko Volga LLC INN: 3443033593 |

Volgogradregion | 7 690 | -4,0 | 0,52 | 241 high |

| 8 | DonskoyTabakOJSC INN: 6163012571 |

Rostov region | 7 528 | -15,7 | 0,46 | 218 high |

| 9 | Kres Neva LLC INN: 4720011412 |

Leningrad region | 3 815 | -1,8 | 0,13 | 192 the highest |

| 10 | Imperial Tobakko Yaroslavl CJSC INN: 7601000015 |

Yaroslavlregion | 3 059 | -5,6 | 0,50 | 234 high |

Picture 1. Ratio of liabilities and assets, turnover of the largest tobacco companies of Russia (TOP-10)

The turnover of the largest tobacco manufacturers (TOP-10) made 199,4 bln RUB according to the last published annual financial statement, what gives 95,2% from the revenues of all enterprises of the market. Now therefore, there is a sufficiently strong monopolization of the industry.

In spite of a number of anti-tobacco measures taken at the legislative level consolidated revenues of all Russian tobacco companies increased by 8,3% up tо 209,4 bln RUB following the results of the previous year.

Only three participants of TOP-10 list showed the analyzed ratio being within recommended value: Liggett-Dukat CJSC (0,27), Donskoy tabak OJSC (0,46) and Imperial Tobakko Yaroslavl CJSC (0,5).

These organizations strike rationally a balance between loan and own funds. The occurrence of the risk of liquidity crisis by such relation is below average.

Kres Neva LLC conducts moderate policy and develops mostly due to own resources.

The rest participants of the ranking attract extensively borrowed capital, what increases the risk of loss of their financial stability amid the crisis, but at the same time it let them grow rapidly and maintain their market share.

According to the independent estimation of the Information agency Credinform the organizations of the TOP-10 list got a high and the highest solvency index, what can signal to potential investors, that the largest market players can pay off their debts in time and fully, while risk of default is minimal.