Individual bankruptcy – new reality for the Russian economy

The Supreme Court on September 29, 2015 has discussed the plenary meeting act on operation of the Law of December 29, 2014 that was put in force on October 1st № 476-FL «On Amendments to the Federal Law “On Insolvency (Bankruptcy)” and Certain Legislative Acts of the Russian Federation to Regulate Rehabilitation Procedures for Individual Debtors».

The aim of the plenum – to give an explanation and legal objectives to the Arbitral tribunals for making fewer errors in the law enforcement practice.

According to the Supreme Court and National Association of Professional Recovery Agencies, about 200 thousand people can apply to the court for bankruptcy for the first six months of operation of the Law.

The Supreme Court clarified that courts must receive petitions on individual bankruptcy and on debts appeared before operation of the Law that is on obligations before October 1, 2015.

While in the absence of finances for bankruptcy procedure and remuneration payment to the supervisor, case may be dismissed by the court at any stage.

The question of amount of minimum required sum for financing of individual bankruptcy procedure stays open. In this case there different explanations may appear, most often not in favor of debtor. Moreover, both in the Law on Bankruptcy and in the Supreme Court clarifications, it stays unclear, how to divide, in case of bankruptcy, co-property of spouses, in repayment of this debt.

In the plenum act of the Supreme Court it`s noted that only one bankruptcy case against individual entrepreneur is permitted – physical person cannot be bankrupt as individual and as sole entrepreneur at the same time. Cases on individuals insolvency by the Arbitral tribunals are heard according to the place of the debt`s residence, that is defined by registration documents or extract of the Unified State Register of Sole Entrepreneurs. If the place of individual`s residence is unknown or is located outside Russia, such bankruptcy cases are heard by the court according to the last place of debtor`s residence in the RF.

Court costs of case on debtor`s bankruptcy and costs on payment for supervisor are paid on count of debtor`s property. If individual himself applies to the court for bankruptcy, he pays an amount (10 th RUB) into court`s deposit, also supplies with evidential document proving existence of property for repayment on the bankruptcy case. If bankruptcy is initiated by creditor, he pays recompense to financial manager, but spent money can be repaid in case of finding debtor`s property, notes the Supreme Court.

Restructuring of the debt plan must be approved on the first creditors` meeting but the court can confirm it without such approval if gets debtor`s agreement. As an exception court can do without debtor`s agreement if the debtor abuses his rights, for example, having high salary and insisting on the fastest discharge of bankruptcy. It is noted in the Supreme Court paper that court cannot confirm restructuring of the debt plan, if it is beforehand unenforceable or does not stipulate for financing for living of debtor and his family at the lesser of living wage. The plan cannot be also approved if on completing the realization period debtor is not able to settle with prospective creditors (due date to those does not come about yet). Maximum term of the plan realization is three years.

Thus,absolute majority of individuals bankruptcy procedures will become property realization procedures while payment in full discharge on the part of individuals who were not able to pay debts before that, seems to be unlikely; moreover under conditions of high interest rate (key rate of the Central Bank of the RF), preventing from refinancing of the financial obligations under more profitable conditions.

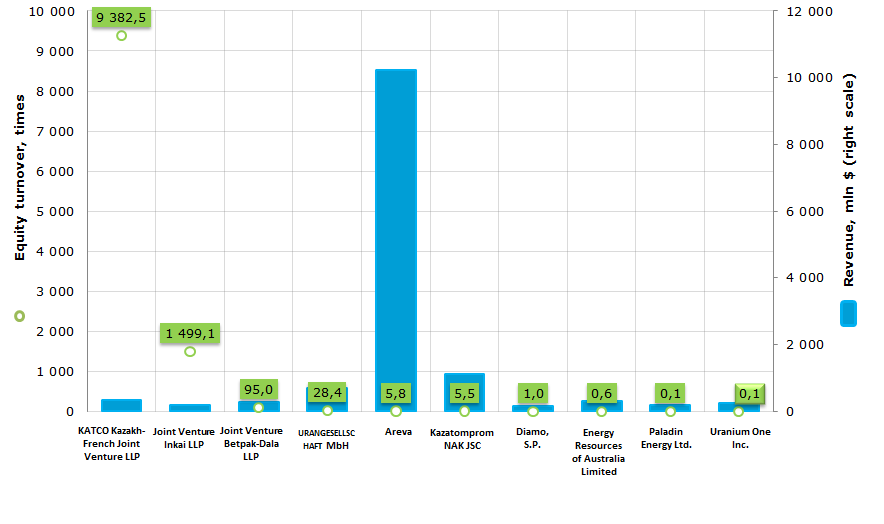

Equity turnover of the key global uranium producers (Top-10)

Information agency Credinform prepared a ranking based on equity turnover ratio of key global companies engaged in mining and enrichment of uranium. Companies with the highest volume of revenue for 2014 were selected for this ranking. The enterprises were ranked by Equity turnover number per year.

Equity turnover (times) is a ratio of revenue to the year average amount of equity capital. This ratio indicates the intensity of use of total available assets by the organization.

Equity turnover shows the rate of equity capital turnover. For the joint-stock companies this means the activity of funds being at the risk of the enterprise’s owners. The low ratio indicates inactivity of the part of equity capital. Increase in turnover shows that equity is implemented and serves the corporate proposes.

| № | Name | Country | Revenue, mln $ 2014 | Equity turnover, times |

|---|---|---|---|---|

| 1 | KATCO Kazakh-French Joint Venture LLP | Kazakhstan | 343,7 | 9382,5 |

| 2 | Joint Venture Inkai LLP | Kazakhstan | 180,0 | 1499,1 |

| 3 | Joint Venture Betpak-Dala LLP | Kazakhstan | 289,8 | 95,0 |

| 4 | URANGESELLSCHAFT MbH | Germany | 689,5 | 28,4 |

| 5 | Areva | France | 10 220,3 | 5,8 |

| 6 | Kazatomprom NAK JSC | Kazakhstan | 1 109,5 | 5,5 |

| 7 | Diamo, S.P. | Czech Republic | 174,55 | 1,0 |

| 8 | Energy Resources of Australia Limited | Australia | 318,7 | 0,6 |

| 9 | Paladin Energy Ltd. | Australia | 198,6* | 0,1* |

| 10 | Uranium One Inc. | Canada | 260,9 | 0,1 |

* Indicators are given following the financial accounts as of 30.06.2015 being a financial year and accounting period end.

Equity turnover of the global key players in the uranium market (Top-10) varies form 0,1 (Uranium One Inc.) to 9383 (KATCO Kazakh-French Joint Venture LLP) times. Areva with turnover of 6 times per period is a leader in the industry.

Picture 1. Equity turnover and revenue of key global uranium ore producers (top-10)

Uranium is the main energy supplier in the nuclear power engineering; about 20% of electric power accrues to this source. Uranium industry covers all stages of the uranium production, including exploration, development and enrichment of ore.

In 2014 more than 41% of uranium mining accounted for Kazakhstan.

| № | Country | U, tons | %, of world production |

|---|---|---|---|

| 1 | Kazakhstan | 23 127 | 41,1 |

| 2 | Canada | 9 134 | 16,2 |

| 3 | Australia | 5 001 | 8,9 |

| 4 | Niger | 4 057 | 7,2 |

| 5 | Namibia | 3 255 | 5,8 |

| 6 | Russia | 2 990 | 5,3 |

| 7 | Uzbekistan (estimated) | 2 400 | 4,3 |

| 8 | USA | 1 919 | 3,4 |

| 9 | PRC (estimated) | 1 500 | 2,7 |

| 10 | Ukraine | 926 | 1,6 |

| Total for the world | 56 217 |

Kazatomprom NAK JSC in Kazakhstan accumulates 25% of the global uranium production.

| № | Company | U, tons | %, of world production |

|---|---|---|---|

| 1 | Kazatomprom NAK JSC | 13 801 | 24,5 |

| 2 | Cameco | 8 956 | 15,9 |

| 3 | ARMZ - Uranium One | 6 944 | 12,4 |

| 4 | Areva | 6 496 | 11,6 |

| Total for top-4 | 36 197 | 64,4 | |

| Total | 56 217 | 100% |

KATCO Kazakh-French Joint Venture LLP with the turnover of 9382,5 is the leader of the ranking. The enterprise was established in 1996. Founders are NAC Kazatomprom JSC and AREVA (France). JV Katco LLP carries out uranium mining by in-situ leaching method at Moiynkum deposit located in the South-Kazakhstan oblast.

Joint Venture Inkai LLP’s turnover is 1499,1 times. Joint Venture Inkai, established in March 1996, is owned by Canadian company Cameco Corporation and by National Atomic Company Kazatomprom JSC. The enterprise carries out uranium mining by in-situ leaching method at Inkai deposit in South-Kazakhstan region.

Quite high values of these indicators of the ranking leaders indicate the active use of enterprises’ equity.

Joint Venture Betpak-Dala LLP with turnover of 95 times was established on the base of Dala mine on February 20, 2004 for industrial production and the continuation of work on the further exploration of mineral resources. In September 2005, the company received uranium mining, exploration and production rights in South Inkai mine. The founders of the enterprise are NAC Kazatomprom JSC and “Astana” Kazakhstan Investment Group LLP.

URANGESELLSCHAFT MbH (28,4 times) is engaged in the exploration and development of uranium and thorium deposits, operation of mines and processing plants, trade with uranium and thorium in the form of ores. The enterprise is 100% subsidiary of AREVA.

Areva (5,8 times) is a French enterprise for development and production of equipment for atomic energy industry and production of electric power of alternative sources. Areva is the only company engaged in all activity types connected with nuclear power production only.

Kazatomprom NAK JSC (5,5 times) is the national operator of the Republic of Kazakhstan, for import and export of uranium, rare metals, nuclear fuel for power plants, special equipment technologies and dual-purpose materials. Today, the Company has more than 27,000 employees. The Sole Shareholder of the Company is «Samruk-Kazyna» JSC.

Strategic goals of «NAC «Kazatomprom» JSC are focused on holding key positions in the world nuclear power market, maximum diversification of the Company’s activity into the front end nuclear fuel cycle (NFC) through participation in foreign assets of NFC (in stages of conversion, uranium isotope separation, nuclear fuel fabrication, power plants construction), as well as diversification into the allied high technological areas with the development and use of scientific and technical potential of the Company.

Diamo, S.P. (1 time) is Czech state-owned company responsible for the development of uranium deposits in Rožnov. Uranium mining in the Czech Republic, the volume of which once amounted to more than 2,500 tons per year, was sharply reduced after the collapse of the communist government in 1990. In 1994 the production fell to 600 tons of uranium per year and gradually decreased over the past decade to 228 tons in 2012. The last underground mine is a mine Rožná in Dolní Rožínka, located 50 kilometers northwest of the city of Brno. In 2003 the mine was going to be closed, but due to the increase in the uranium price it was not happened. In 2014 the mine was significantly exhausted, and the government announced its intention to close the mine in 2017. Diamo has completed a feasibility study on the revival of the Brzkov mine of the 1980s near Jihlava, which contains 3000-4000 tons of uranium at a depth of 300 m. Diamo plans that commissioning the mine will take about 6-7 years.

Energy Resources of Australia Limited (0,6 times) is a publicly listed company on the Australian Stock Exchange. Rio Tinto, a diversified resources group, owns 68,39% of ERA shares. The company is one of the largest uranium producers in the world, operating the Ranger uranium mine in the Northern Territory.

Paladin Energy Ltd. (0,1 times) is a uranium production company with projects currently in Australia and two mines in Africa located in Western Australia. The company’s shares are listed in the Australian Securities Exchange (ASX) and Toronto Securities Exchange (TSX). Since 1998, during a period of sustained downturn in global uranium markets, Paladin accumulated a quality portfolio of advanced uranium projects each having production potential. The Langer Heinrich Mine in Namibia is Paladin’s flagship project. The Kayelekera Mine in Malawi, the Company’s second mine, provided an excellent follow-up to Langer Heinrich. A Development Agreement with the Government of Malawi was executed in February 2007, which provides fiscal stability for the project for ten years. Unfortunately, despite improvements to both processing recoveries and costs, the extended downturn in uranium price has resulted in Kayelekera Mine being placed on 'care and maintenance' until there is a significant improvement in the uranium price outlook. Regional exploration is currently focused on identifying additional resources to extend the expected life of the project when processing at the Kayelekera Mine resumes.

Uranium One Inc. (0,1 time) is one of the world’s largest uranium producers with a globally diversified portfolio of assets located in Kazakhstan, the United States, Australia and Tanzania. ROSATOM State Atomic Energy Corporation, through its affiliates, owns 100% of the outstanding common shares of Uranium One.

Today 50% of total extracted uranium in the world account for Australia, Kazakhstan and Russia.

| Country | U, tons | %, of global reserves |

|---|---|---|

| Australia | 1 706 100 | 28,9 |

| Kazakhstan | 679 300 | 11,5 |

| Russia | 505 900 | 8,6 |

| Canada | 493 900 | 8,4 |

| Niger | 404 900 | 6,9 |

| Namibia | 382 800 | 6,5 |

| SAR | 338 100 | 5,7 |

| Brazil | 276 100 | 4,7 |

| USA | 207 400 | 3,5 |

| PRC | 199 100 | 3,4 |

| Mongolia | 141 500 | 2,4 |

| Ukraine | 117 700 | 2,0 |

| Uzbekistan | 91 300 | 1,5 |

| Botswana | 68 800 | 1,2 |

| Tanzania | 58 500 | 1,0 |

| Jordan | 40 000 | 0,7 |

| Other countries | 191 500 | 3,2 |

| Total in the world | 5 902 900 |

Capital turnover has a direct impact on the solvency of the company. In addition, the increase in the capital turnover rate ceteris paribus indicates an increase in production and technical capacity of the organization.