Trends in the field of hydropower industry

Information Agency Credinform has prepared the review of trends in the field of hydropower industry.

The largest enterprises (TOP-5 and TOP-25) in terms of annual revenue were selected according to the data from the Statistical Register for the latest available periods (2015 and 2016). The analysis was based on data of the Information and Analytical system Globas.

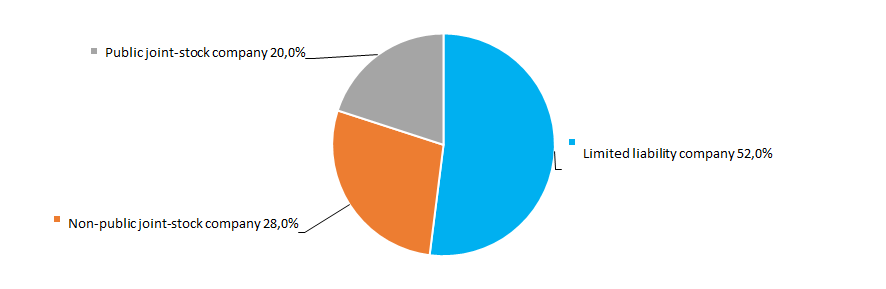

Legal forms

The most popular legal form among companies in the field of hydropower industry is Limited Liability Company. A significant place also take public and non-public joint stock companies (Picture 1).

Picture 1. Distribution of TOP-25 companies by legal forms

Picture 1. Distribution of TOP-25 companies by legal formsSales revenue

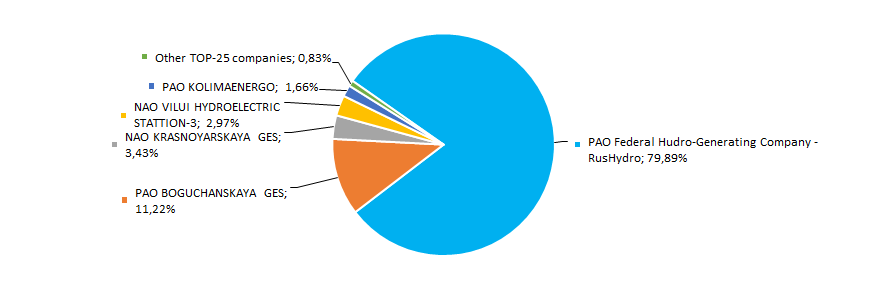

In 2016 total revenue of 5 largest companies amounted to 99,2% from TOP-25 total revenue. This fact testifies high level of monopolization within the industry. In 2016, the largest company by total revenue is PAO Federal Hydro-Generating Company – RusHydro (Picture 2).

Picture 2. The shares of TOP-5 companies in TOP-25 total revenue for 2016, %

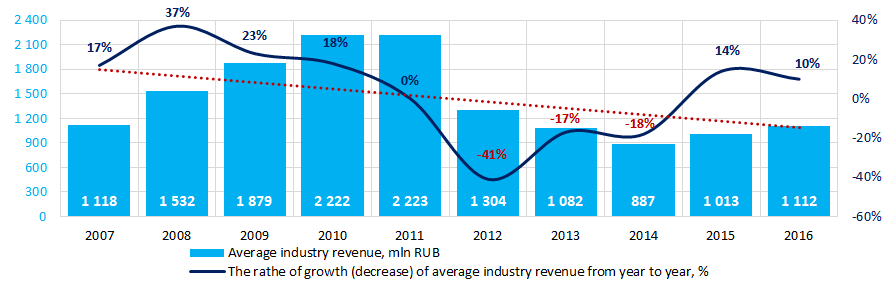

Picture 2. The shares of TOP-5 companies in TOP-25 total revenue for 2016, %The best results by revenue among the industry for the ten-year period were achieved in 2011. In general, the decrease in average industry indicators was observed within this period (Picture 3).

Picture 3. The change of average industry revenue of the companies in the field of hydropower industry in 2007-2016

Picture 3. The change of average industry revenue of the companies in the field of hydropower industry in 2007-2016Profit and loss

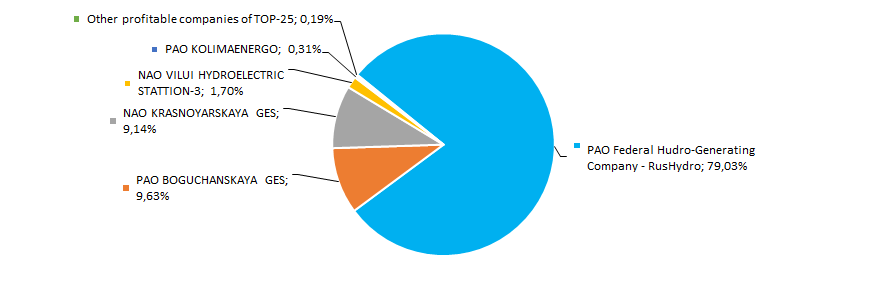

In 2016 profit of 5 largest companies amounted to 99,8% from TOP- 25 total profit. In 2016, the leading position by amount of profit takes PAO Federal Hydro-Generating Company – RusHydro (Picture 4).

Picture 4. The shares of TOP-5 companies in TOP-25 total profit for 2016, %

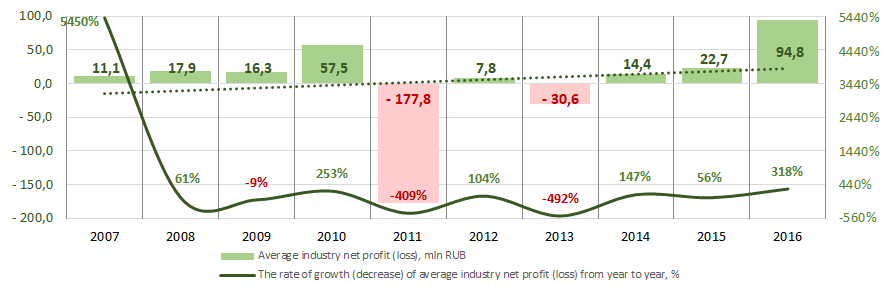

Picture 4. The shares of TOP-5 companies in TOP-25 total profit for 2016, %For the ten-year period, the average industry revenue values of companies in the field of hydropower industry are not stable and in general demonstrates increasing tendency. The negative values were observed in 2011 and 2013 against the background of crisis phenomena in the economy. In recent years the significant growth of indicators is observed. The best results of the industry were in 2016 (Picture 5).

Picture 5. The change of average industry profit of the companies in the field of hydropower industry in 2007-2016

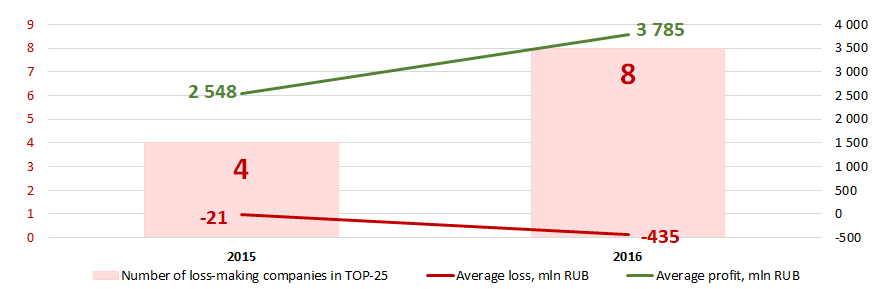

Picture 5. The change of average industry profit of the companies in the field of hydropower industry in 2007-2016In 2015, the TOP-25 list included 4 loss-making companies. In 2016 the number of loss-making companies doubled increased up to 8. Meanwhile, their average loss increased by 20 times. The average profit of other companies from TOP-25 list increased by 49% for the same period (Picture 6).

Picture 6. The number of loss-making companies, average loss and profit within TOP-25 companies in 2015 – 2016

Picture 6. The number of loss-making companies, average loss and profit within TOP-25 companies in 2015 – 2016Main financial indicators

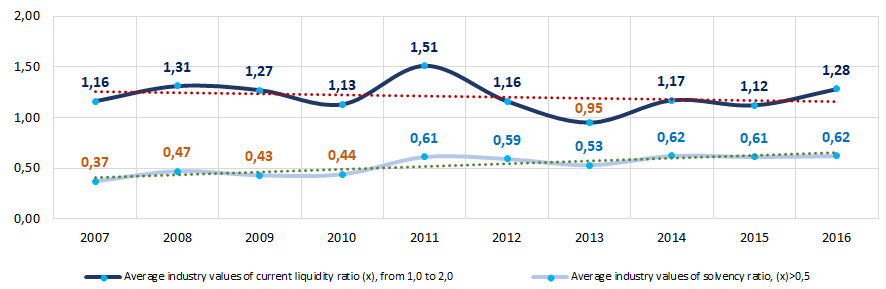

For the ten-year period, only in 2013 the average industry values of current liquidity ratio were lower than recommended values - from 1,0 to 2,0. (yellow color on Picture 7). In general, the downtrend of indicators is observed. Current liquidity ratio (ratio of total working capital to short-term liabilities) shows the sufficiency of company’s assets to meet short-term obligations.

Current liquidity ratio (ratio of total working capital to short-term liabilities) shows the sufficiency of company’s assets to meet short-term obligations.

Solvency ratio (ratio of equity capital to total balance) shows the company’s dependence from external borrowings. The recommended value of the ratio is >0,5. The ratio value less than minimum limit signifies about strong dependence from external sources of funds. The calculation of practical values of financial indicators, which might be considered as normal for a certain industry, has been developed and implemented in the Information and Analytical system Globas by the experts of Information Agency Credinform, taking into account the actual situation of the economy as a whole and the industries. In 2016 the practical value of solvency ratio for electrical power generation, distribution and transmission companies is from 0,02 to 0,84.

For the ten-year period, the average industry values of the ratio were lower than recommended values from 2007 to 2010 and within practical values (Picture 7).

Picture 7. Changes of average industry values of current liquidity ratio and solvency ratio of companies in the field of hydropower industry in 2007 – 2016

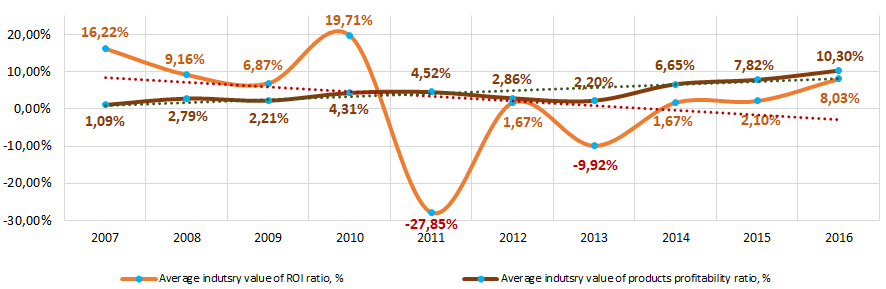

Picture 7. Changes of average industry values of current liquidity ratio and solvency ratio of companies in the field of hydropower industry in 2007 – 2016For the last ten years, the instability of ROI ratio with downtrend was observed. In the periods of crisis phenomena in the economy (2011 and 2013) the ratios decreased to negative values (Picture 8). The ROI ratio is calculated as a ratio of net profit to sum of stockholder equity and long-term liabilities and shows the return from equity involved in commercial activities and long-term borrowed funds.

Within the same period, the products profitability ratio demonstrated the increasing tendency (Picture 8). The greatest growth of indicators was observed after 2014. Product profitability ratio is a ratio of sales profit to general expenses. In general, the profitability characterizes the production efficiency.

Picture 8. Changes of average industry values of ROI ratio and products profitability ratio of companies in the field of hydropower industry in 2007 – 2016

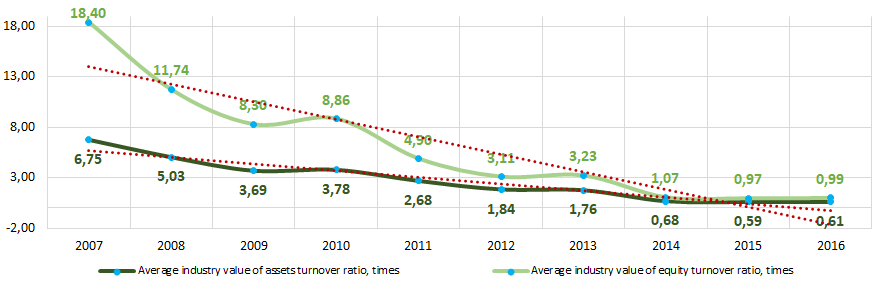

Picture 8. Changes of average industry values of ROI ratio and products profitability ratio of companies in the field of hydropower industry in 2007 – 2016For the ten-year period, the values of activity ratios demonstrate downtrend (Picture 9).

Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

Equity turnover ratio is calculated as a ratio of revenue to yearly average sum of equity and demonstrates the company’s usage rate of total assets.

Picture 9. Changes of average industry values of activity ratios of companies in the field of hydropower industry in 2007 – 2016

Picture 9. Changes of average industry values of activity ratios of companies in the field of hydropower industry in 2007 – 2016Main regions of activity

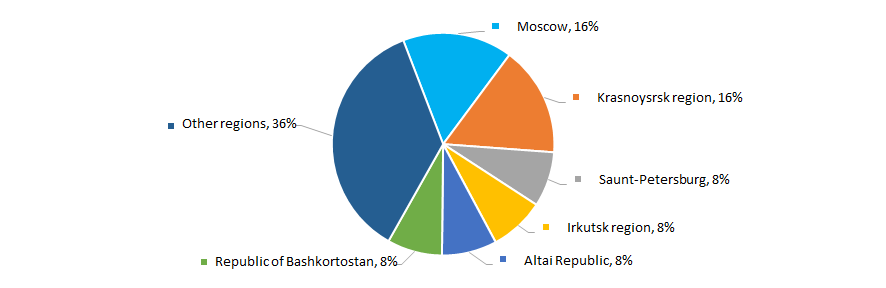

Companies in the field of hydropower industry are unequally distributed across the country. Most of them are registered in Moscow and Krasnoyarsk region (Picture 10). On the one hand, this could be related to the registration of head offices in the largest financial center. On the other hand, Krasnoyarsk region is the region with the maximum potential of renewable resources for electricity generation.

TOP-25 companies are registered only in 15 regions of the Russian Federation.

Picture 10. Distribution of TOP-25 companies by Russian regions

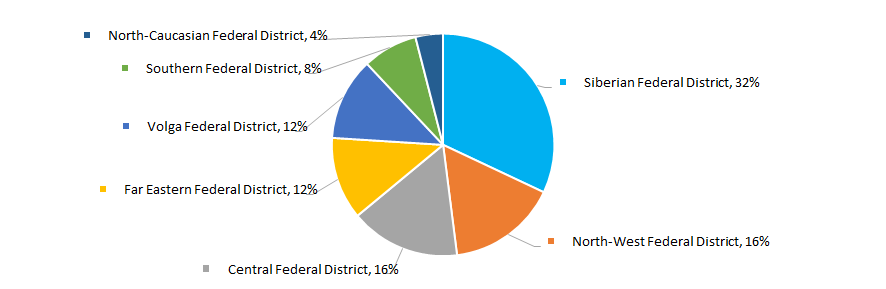

Picture 10. Distribution of TOP-25 companies by Russian regionsMost of the companies of the industry are concentrated in the Central Federal District (Picture 11).

Picture 11. Distribution of TOP-25 companies by federal districts of Russia

Picture 11. Distribution of TOP-25 companies by federal districts of RussiaThe share of companies from TOP-25 list with branches or representative offices amounted to 20%.

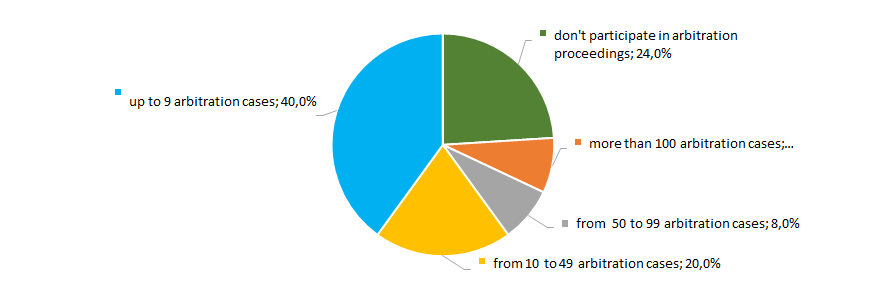

Participation in arbitration proceedings

The better half of industry companies don’t participate in arbitration proceedings or participate inactively (Picture 12).

Picture 12. Distribution of TOP-25 companies by participation in arbitration proceedings

Picture 12. Distribution of TOP-25 companies by participation in arbitration proceedingsReliability index

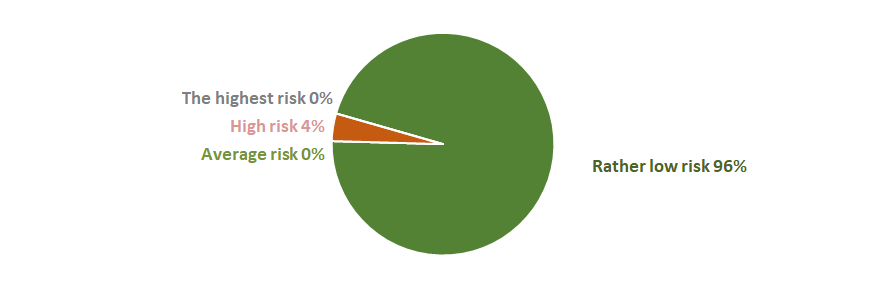

From the point of flight-by-night features or unreliable companies, the vast majority of industry companies show rather low level of cooperation (Picture 13).

Picture 13. Distribution of TOP-25 companies by reliability index

Picture 13. Distribution of TOP-25 companies by reliability indexFinancial position score

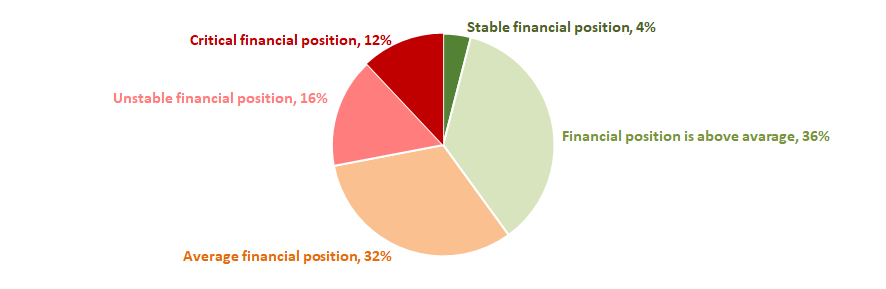

The assessment of company’s financial position shows that more than a quarter of companies are in unstable and critical financial position and more than a third of companies have average financial position (Picture 14).

Picture 14. Distribution of TOP-25 companies by financial position score

Picture 14. Distribution of TOP-25 companies by financial position scoreLiquidity index

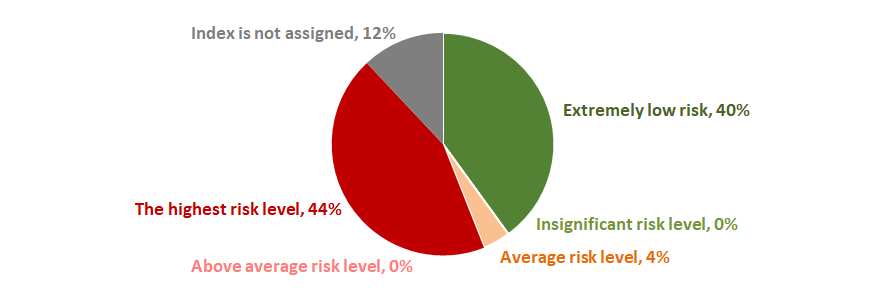

Almost more than a half of industry companies have the highest or average level of bankruptcy risk in the short-term period (Picture 15).

Picture 15. Distribution of TOP-25 companies by liquidity index

Picture 15. Distribution of TOP-25 companies by liquidity indexSolvency index Globas

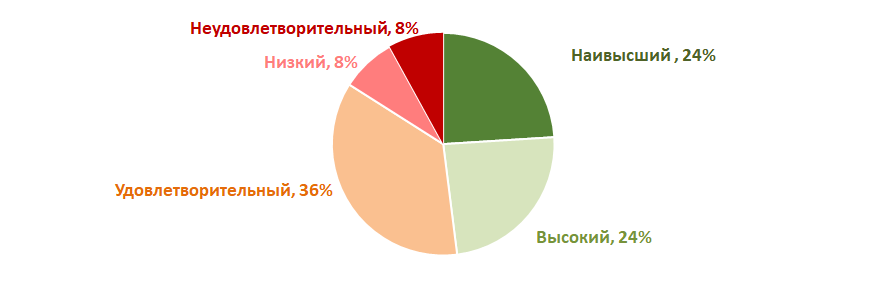

More than a third of TOP-25 companies have adequate and weak solvency index Globas. Thus, almost more than a half of companies have superior, high or strong, medium solvency index Globas (Picture 16).

Picture 16. Distribution of TOP-500 companies by solvency index Globas

Picture 16. Distribution of TOP-500 companies by solvency index GlobasHereby, the complex assessment of hydropower industry companies, taking into account main indexes, financial ratios and indicators, shows negative trends in this field of activity from 2009 to 2014. However, in recent years, the situation changed for the better.

Asset turnover of the largest Russian hydropower enterprises

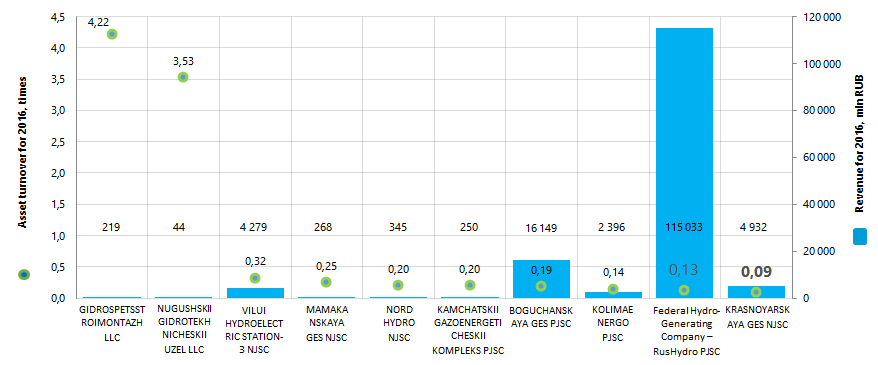

Information agency Credinform offers a ranking of the largest Russian hydropower enterprises. The companies with the largest volume of annual revenue (TOP-10) were selected for the ranking, according to the data from the Statistical Register for the latest available periods (for 2015 and 2016). Then they were ranked by asset turnover ratio in 2016 (Table 1). The analysis is based on data of the Information and Analytical system Globas.

Asset turnover is calculated as a relation of sales proceeds to the average value of company's total assets for a period. The indicator refers to the group of activity ratios and characterizes the efficiency of use by a company of all available resources, apart from sources of their attraction. The ratio shows how many times a year the full cycle of production and circulation completes, which yields profit.

The experts of the Information agency Credinform, taking into account the actual situation both in the economy as a whole and in sectors, has developed and implemented in the Information and Analytical system Globas the calculation of practical values of financial ratios that can be recognized as normal for a particular industry. For companies on production, transmission and distribution of electrical power the practical value of the asset turnover ratio was from 0,61 in 2016.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention to all combination of indicators and financial ratios.

| Name, INN, region | Revenue, mln RUB | Net profit, mln RUB | Asset turnover, times | Solvency index Globas | |||

| 2015 | 2016 | 2015 | 2016 | 2015 | 2016 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| GIDROSPETSSTROIMONTAZH LLC INN 6143079313 Rostov region |

575,9 | 218,5 | 14,3 | 2,2 | 3,08 | 4,22 | 308 Adequate |

| NUGUSHSKII GIDROTEKHNICHESKII UZEL LLC INN 0263015092 Republic of Bashkortostan |

42,2 | 44,2 | 0,1 | 1 797,0 | 3,98 | 3,532 | 258 Medium |

| VILUI HYDROELECTRIC STATION-3 NJSC INN 1433015048 Republic of Sakha ( Yakutia) |

2 364,0 | 4 279,2 | 770,1 | 898,3 | 0,17 | 0,32 | 175 High |

| MAMAKANSKAYA GES NJSC INN 3802010707 Irkutsk region |

263,0 | 267,7 | 90,8 | 82,8 | 0,26 | 0,25 | 196 High |

| NORD HYDRO NJSC INN 7801435581 Republic of Karelia |

330,8 | 345,0 | 9,5 | -3,3 | 0,22 | 0,20 | 311 Adequate |

| KAMCHATSKII GAZOENERGETICHESKII KOMPLEKS PJSC INN 4101047002 Kamchatka territory |

280,0 | 250,1 | 0,7 | -32,8 | 0,21 | 0,20 | 221 Strong |

| BOGUCHANSKAYA GES PJSC INN 2420002597 Krasnoyarsk territory |

14 653,7 | 16 149,1 | 4 678,3 | 5 104,6 | 0,18 | 0,19 | 186 High |

| KOLIMAENERGO PJSC INN 4908000718 Magadan region |

2 057,9 | 2 395,5 | 16,8 | 163,6 | 0,12 | 0,14 | 238 Strong |

| Federal Hydro-Generating Company – RusHydro PJSC INN 2460066195 Krasnoyarsk territory |

107 099,0 | 115 033,0 | 30 022,0 | 41 877,0 | 0,12 | 0,13 | 162 Superior |

| KRASNOYARSKAYA GES NJSC INN 2446000322 Krasnoyarsk territory |

18 597,0 | 4 931,6 | 10 243,0 | 4 843,3 | 0,40 | 0,09 | 187 High |

| Total by TOP-10 companies | 146 263,5 | 143 914,0 | 45 845,5 | 54 732,7 | |||

| Total by TOP-10 companies | 14 626,3 | 14 391,4 | 4 584,6 | 5 473,3 | 0,87 | 0,92 | |

| Industry average value | 1 012,8 | 1 110,5 | 22,7 | 94,5 | 0,59 | 0,61 | |

The average indicator of the asset turnover ratio of TOP-10 companies in 2016 is above the practical value. Two from TOP-10 enterprises have the ratio value above the practical one and eight enterprises - below. Five from the TOP-10 companies reduced revenue or net profit indicators in 2016 in comparison with the previous period or have a loss (are marked with red filling in columns 3 and 5 in Table 1).

Picture 1. Asset turnover ratio and revenue of the largest Russian hydropower enterprises (TOP-10)

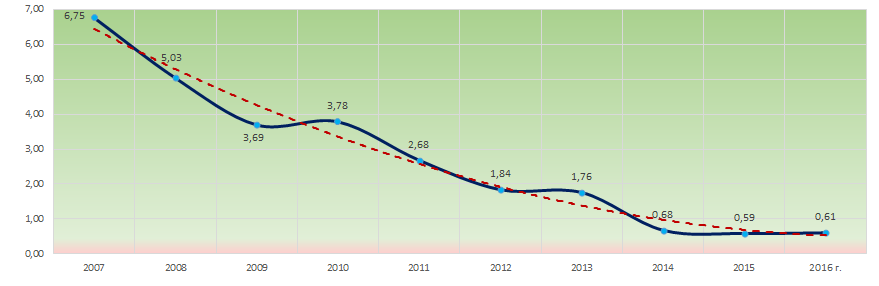

Picture 1. Asset turnover ratio and revenue of the largest Russian hydropower enterprises (TOP-10)The industry average values of the asset turnover ratio tend to decline over the past ten years. It can point to a gradual fall of companies’ business in this field of activity (Picture 2).

Picture 2. Change in the average industry values of the asset turnover ratio of the Russian companies on the production, transmission and distribution of electrical power in 2007 – 2016

Picture 2. Change in the average industry values of the asset turnover ratio of the Russian companies on the production, transmission and distribution of electrical power in 2007 – 2016 Eight from TOP-10 companies got the Superior and High or Strong and Medium solvency index Globas , that testifies to their ability to repay their debt obligations timely and fully.

GIDROSPETSSTROIMONTAZH LLC and NORD HYDRO NJSC got Adequate solvency index Globas, due to the information on their participation as defendants in arbitration cases. The forecast for the development of indices is stable.