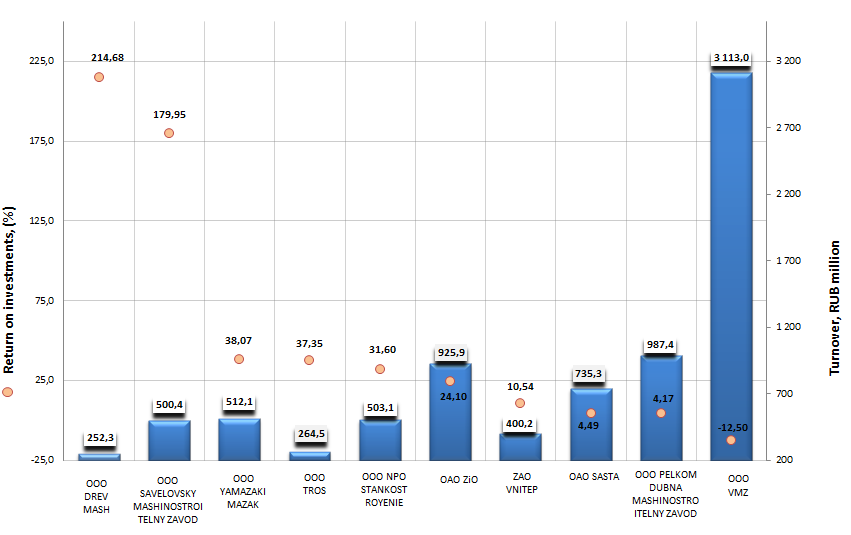

Return on investments of machine tools manufacturers

Information agency Credinform prepared the ranking of Russian manufacturers of machine tools on return on investment ratio. The largest companies in terms of turnover for the last available period in the Statistical register (2013) of this industry were taken for the investigation. Further the top-10 enterprises were ranked in descending order of return on investment ratio.

Return on investment is an output indicator of the involved into the business activity shareholder’s equity and long-term borrowed money. It is calculated as a ratio of net profit to sum of shareholder’s equity and long-term liabilities.

The standard values for the profitability index are not provided, as they grossly change depending on the sector, in which the company carries out its activity. Due to this, each company should be considered in comparison with the sectoral index.

| № | Name, tax number | Region | Turnover 2013, RUB million | Return on investments, % | Solvency indexGlobas-i® |

|---|---|---|---|---|---|

| 1 | ООО Drevmash TAX NUMBER 3525249949 |

Vologda region | 252 | 214,68 | 318 (satisfactory) |

| 2 | ООО Savelovsky Mashinostroitelny zavod TAX NUMBER 7704802518 |

Tver region | 500 | 179,95 | 369 (satisfactory) |

| 3 | ООО Yamazaki Mazak TAX NUMBER 7726556880 |

Moscow | 512 | 38,07 | 227 (high) |

| 4 | ООО Teknologiya razvitykh system TAX NUMBER 7706818288 |

Moscow | 265 | 37,35 | 228 (high) |

| 5 | ООО Nauchno-Proizvodstvennoye Obyedinenie Stankostroyenie TAX NUMBER 268061504 |

Republic of Bashkortostan | 503 | 31,6 | 278 (high) |

| 6 | ОАО Moskovsky Stankostroitelny Zavod imeni Sergo Ordzhonikidze (ZIO) TAX NUMBER 7725008666 |

Moscow | 926 | 24,1 | 166 (prime) |

| 7 | ZAO Vnitep TAX NUMBER 7705151026 |

Moscow | 400 | 10,54 | 195 (prime) |

| 8 | ОАО Sasta TAX NUMBER 6232000019 |

Ryazan region | 735 | 4,49 | 248 (high) |

| 9 | ООО Pelkom Dubna Mashinostroitelny zavod TAX NUMBER 5010025437 |

Moscow region | 987 | 4,17 | 273 (high) |

| 10 | ООО Volzhsky Mashinostroitelny zavod TAX NUMBER 6321276844 |

Samara region | 3 113 | -12,5 | 333 (satisfactory) |

The first spots in the ranking are taken by OOO Drevmash and OOO Savelovsky Mashinostroitelny Zavod with the values of return on investments 214,68% и 179,95% correspondingly. However, in spite of the fact that companies showed such high values of the return on investment ratio, they were given the satisfactory solvency index Globas-i® per totality of financial and non-financial indicators. This scoring bears evidence to the fact that the solvency margin doesn’t undertake the full and timely meeting of debt obligations.

Return on investments of the largest manufacturers of machine tools in Russia, Top-10

The ultimate leader of the market by the turnover Volzhsky Mashinostroitelny zavod is placed on the tenth spot of the ranking, having shown the negative value of return on investments. At the same time the company bears losses for the reviewed period. Thus the company was given the satisfactory solvency index per totality of financial and non-financial indicators.

The importance of the return on investments indicator lies not only in the fact that it shows the output from the invested assets, but also the fact that the usefulness of borrowing funds at a certain interest may be estimated on its basis. The company should take the credits where the interest rate is lower than the return on invested capital.

Payback for a tiny text

Many people came across the situation when the main eye-catching offer of the advertisement of the credit organizations’ financial services is followed by the tiny text. Usually, this text carries the special terms of the provision of services and other limitations. As a rule, nobody reads this information, though it hides the important legal meaning. As a result, the different cases take place to the disfavour of the customer, leading to additional scarcely voidable financial expenses.

In order to avoid such confusions, the State Duma of the Russian Federation passed in the first reading a bill concerning strengthening of responsibility in this field: the bank employers will pay up to RUB 1 million fee for the breach of requirements to advertisement of financial services.

Many credit organizations lure the clients using forbidden methods. They invite the famous people to act in promotional video, saying nothing about the additional services. At the same time, the borrowers don’t get the full and reliable information. The tiny blind text on the billboards hiding the most important credit terms and the indicating in the advertisement only the minimum interest rate without reffering to other terms, which leads to significant expenses of the borrower, are among the violations.

The goal of the new law is to provide the citizens with the completeness of information, while advertising particular financial products in order to make people be informed about its final cost.

Up to date the maximum penalty for banks for the breaching of the advertisement amounts to RUB 300 thousand. According to law draftsmen, the law is not obeyed in the current form due to the fact that it doesn’t cause difficulties for the violators.